by Calculated Risk on 5/10/2016 10:09:00 AM

Tuesday, May 10, 2016

BLS: Jobs Openings increased in March

From the BLS: Job Openings and Labor Turnover Summary

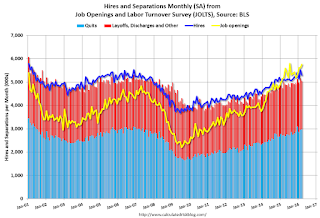

The number of job openings was little changed at 5.8 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Hires edged down to 5.3 million while separations were little changed at 5.0 million. Within separations, the quits rate was 2.1 percent, and the layoffs and discharges rate was 1.2 percent....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was little changed in March at 3.0 million.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in March to 5.757 million from 5.608 million in February.

The number of job openings (yellow) are up 11% year-over-year compared to March 2015.

Quits are up 9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another strong report, and job openings are just below the record high set in July 2015.

NFIB: Small Business Optimism Index increased in April

by Calculated Risk on 5/10/2016 08:54:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Increases One Point in April

The Index of Small Business Optimism rose 1 point in April to 93.6 ... according to the National Federation of Independent Business’ (NFIB) monthly economic survey released today. ...

Fifty-three percent reported hiring or trying to hire (up 5 points), but 46 percent reported few or no qualified applicants for the positions they were trying to fill. Hiring activity increased substantially ... Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 4 points, revisiting the highest level for this expansion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 93.6 in April.

Monday, May 09, 2016

"Mortgage Rates Steady Near 3-Year Lows"

by Calculated Risk on 5/09/2016 08:18:00 PM

Tuesday:

• At 9:00 AM, NFIB Small Business Optimism Index for April.

• At 10:00 AM, Job Openings and Labor Turnover Survey for March from the BLS. Job openings decreased in February to 5.445 million from 5.604 million in January. The number of job openings were up 6% year-over-year, and Quits were up 9% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.3% increase in inventories.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady Near 3-Year Lows

Mortgage rates moved sideways today, taking them one step closer to officially claiming the title of "3 year lows." Tomorrow marks the three year anniversary of the Wall Street Journal article that began the early days of the 'taper tantrum'--the jarring move higher in rates that resulted from markets coming to terms with the end of the Fed's asset purchases.

While rates aren't as low today as they had been before the taper tantrum, the current rate environment is excellent in its own right. Apart from being fairly close to the all-time lows seen in 2012-2013, today's low rates exist without any Fed asset purchases and without any risk that the Fed will surprise the world with a shift toward stricter monetary policy. In fact, if there's any risk for financial markets, it's that the Fed will continue to back away from their rate-hike campaign that began with the first and only hike in nearly a decade this past December.

Most lenders are right in line with rates seen on Friday. The most prevalent conventional 30yr fixed quote continues hovering around 3.625% with more than a few lenders already back down to 3.5%.

emphasis added

Phoenix Real Estate in April: Sales up 1%, Inventory up YoY

by Calculated Risk on 5/09/2016 02:53:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up year-over-year in April. This is the second consecutive months with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were up 0.8% year-over-year.

2) Cash Sales (frequently investors) were down to 23.8% of total sales.

3) Active inventory is now up 4.9% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow.

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | --- | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 75.7% | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 8.1% | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 0.7% | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | -9.5% | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3.6% | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | -12.4% | 2,469 | 32.2% | 29,889 | 48.8% |

| Apr-15 | 8,368 | 9.3% | 2,120 | 25.3% | 25,950 | -13.2% |

| Apr-16 | 8,437 | 0.8% | 2,008 | 23.8% | 27,232 | 4.9% |

| 1 April 2008 does not include manufactured homes, ~100 more | ||||||

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 5/09/2016 12:19:00 PM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• April Employment Report: 160,000 Jobs, 5.0% Unemployment Rate

• Comments: A Decent Employment Report

• Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

• Update: "Scariest jobs chart ever"

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend has been down for all categories, and the "less than 5 weeks", "6 to 14 weeks" and "15 to 26 weeks" are all close to normal levels.

The long term unemployed is below 1.3% of the labor force, however the number (and percent) of long term unemployed remains elevated.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and all four groups were generally trending down - although the rate has somewhat flattened out recently.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 1.24 million.

Construction employment is still below the bubble peak, but close to the level in the late '90s.

The BLS diffusion index for total private employment was at 56.3 in April, down from 58.6 in March.

The BLS diffusion index for total private employment was at 56.3 in April, down from 58.6 in March.For manufacturing, the diffusion index was at 47.5, up from 36.7 in March.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall private job growth was somewhat widespread in April, but manufacturing employment is struggling.

Update: "Scariest jobs chart ever"

by Calculated Risk on 5/09/2016 09:01:00 AM

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever".

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I was asked if I could post an update to the graph, and here it is through the May 2016 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 4.0% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Sunday, May 08, 2016

Sunday Night Futures

by Calculated Risk on 5/08/2016 07:31:00 PM

From the WSJ: Greece Passes Austerity Measures As Creditors Remain Deadlocked Over Bailout Terms

The legislation that Greek lawmakers passed late on Sunday covers the bulk of a package of austerity measures worth around €5.4 billion ($6.16 billion), or 3% of gross domestic product, that creditors have requested.The beatings will continue until morale improves.

...

Greece’s most influential creditors, Germany and the International Monetary Fund, remain deadlocked over the terms of Greece’s bailout plan, which the IMF thinks is badly flawed but Germany says can’t be changed.

Weekend:

• Schedule for Week of May 8, 2016

Monday:

• At 10:00 AM ET, the Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: S&P are up 11 and DOW futures are up 120 (fair value).

Oil prices were up over the last week with WTI futures at $45.79 per barrel and Brent at $45.37 per barrel. A year ago, WTI was at $59, and Brent was at $64 - so prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon (down about $0.40 per gallon from a year ago).

Merrill on Fed: "See you in September"

by Calculated Risk on 5/08/2016 09:28:00 AM

A few excerpts from a research piece by Michael Hanson at Merrill Lynch: See you in September

Earlier this year we had expected that the Fed would shift away from risk management toward a more straight-forward data-dependent policy stance, and that the US macro data would improve enough to support a rate hike this summer. Following the soft April jobs report we have reassessed both parts of that view. Despite some Fed officials making the case for a “live” June FOMC meeting, we have been struck since early this year by Fed Chair Yellen’s strongly dovish tone. ... Thus we now expect the Fed will hike one more time this year, in September. This very gradual hiking pace continues in our view with two hikes for 2017, in March and September.CR Note: I think a June rate hike is still possible, and that the main focus will be on inflation - not employment.

Notably, we still see a greater chance for a hike at the June or July meeting than current market pricing. ... We don’t think the threshold for another 25bp hike is nearly as high as market pricing implies, but the Fed does need to see signs that continued progress is being made toward its dual mandate objectives. ... While September is now most likely in our view, the probability distribution for the timing of hikes remains fairly flat overall.

emphasis added

Saturday, May 07, 2016

Schedule for Week of May 8, 2016

by Calculated Risk on 5/07/2016 05:31:00 AM

The key economic report this week is April retail sales on Friday.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

9:00 AM ET: NFIB Small Business Optimism Index for April.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in February to 5.445 million from 5.604 million in January.

The number of job openings (yellow) were up 6% year-over-year, and Quits were up 9% year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.3% increase in inventories.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: The Monthly Treasury Budget Statement for April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 267 thousand initial claims, down from 274 thousand the previous week.

8:30 AM ET: Retail sales for April will be released. The consensus is for retail sales to increase 0.9% in April.

8:30 AM ET: Retail sales for April will be released. The consensus is for retail sales to increase 0.9% in April.This graph shows retail sales since 1992 through March 2016. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were down 0.3% from February to March (seasonally adjusted), and sales were up 1.7% from March 2015.

8:30 AM: The Producer Price Index for April from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.2% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 89.7, up from 89.0 in April.

Friday, May 06, 2016

Lawler: Q1 Home Builder Results

by Calculated Risk on 5/06/2016 06:03:00 PM

From housing economist Tom Lawler:

Below is a table showing some selected operating statistics from large, publicly-traded home builders for the quarter ending March 31, 2016.

Here a few (of what could be many) points.

1. In terms of units, 27% of D.R. Horton’s net orders last quarter were from its “entry level” Express brand, up from 18% in the first quarter of last year. Express comprised 23% of Horton’s deliveries last quarter, up from 8% a year earlier.

2. Both Meritage Homes and MDC Holdings said that they either had or were to planning to increase production of lower priced homes (“entry-level-plus” in Mertigage’s case, and their “new, more affordable product line” in MDC’s case.

3. Meritage Homes said that its margins were in “a handful” of communities in Southern California and Arizona that it acquired in 2013 were adversely impacted by the reduction in FHA loan limits in those markets effective at the beginning of 2014. Specifically, the company said that “(w)hen those loan limits were reduced, we weren’t able to get the prices we were expecting ...”

| Net Orders | Settlements | Average Closing Price ($000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/16 | 3/15 | % Chg | 3/16 | 3/15 | % Chg | 3/16 | 3/15 | % Chg |

| D.R. Horton | 12,292 | 11,135 | 10.4% | 9,262 | 8,243 | 12.4% | 290 | 281 | 3.1% |

| Pulte Group | 5,652 | 5,139 | 10.0% | 3,945 | 3,365 | 17.2% | 353 | 323 | 9.3% |

| NVR | 4,137 | 3,926 | 5.4% | 3,006 | 2,534 | 18.6% | 369 | 371 | -0.4% |

| Cal Atlantic | 4,135 | 3,960 | 4.4% | 2,727 | 2,435 | 12.0% | 432 | 398 | 8.5% |

| Beazer Homes | 1,538 | 1,698 | -9.4% | 1,150 | 936 | 22.9% | 328 | 306 | 7.3% |

| Meritage Homes | 1,987 | 1,979 | 0.4% | 1,488 | 1,335 | 11.5% | 400 | 387 | 3.4% |

| MDC Holdings | 1,646 | 1,593 | 3.3% | 907 | 909 | -0.2% | 435 | 420 | 3.6% |

| M/I Homes | 1,314 | 1,108 | 18.6% | 876 | 717 | 22.2% | 353 | 325 | 8.6% |

| Sub Total | 32,701 | 30,538 | 7.1% | 23,361 | 20,474 | 14.1% | 344 | 329 | 4.7% |

| LGI Homes | 844 | 671 | 25.8% | ||||||

| Total | 32,701 | 30,538 | 7.1% | 24,205 | 21,145 | 14.5% | 332 | 318 | 4.4% |