by Calculated Risk on 4/17/2016 10:38:00 AM

Sunday, April 17, 2016

Hotels: Occupancy Rate Tracking close to Record Year

From HotelNewsNow.com: STR: US hotel results for week ending 9 April

The U.S. hotel industry recorded mostly positive results in the three key performance metrics during the week of 3-9 April 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should mostly move sideways for the next couple of months, and then increase further during the Summer travel period.

In year-over-year comparisons, the industry’s occupancy remained flat at 68.2%. Average daily rate for the week was up 3.9% to US$122.90, and revenue per available room increased 3.9% to US$83.83.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking close to 2015.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, April 16, 2016

Schedule for Week of April 17, 2016

by Calculated Risk on 4/16/2016 08:21:00 AM

The key economic reports this week are March housing starts on Tuesday, and March Existing Home Sales on Wednesday.

From manufacturing, the April Philly Fed manufacturing survey will be released this week.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 59, up from 58 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for March.

8:30 AM: Housing Starts for March. Total housing starts decreased to 1.178 million (SAAR) in February. Single family starts increased to 822 thousand SAAR in February.

The consensus for 1.167 million, down from the February rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.27 million SAAR, up from 5.08 million in February.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.27 million SAAR, up from 5.08 million in February.During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 253 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 9.0, down from 12.4.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

9:00 AM: FHFA House Price Index for February 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

No economic releases scheduled.

Friday, April 15, 2016

FNC: Residential Property Values increased 5.7% year-over-year in February

by Calculated Risk on 4/15/2016 03:21:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their February 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.1% from January to February (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.1% (NSA), the 20-MSA RPI increased 0.2%, and the 30-MSA RPI increased 0.2% in February. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

From FNC: FNC Index: February Home Prices Up 0.1%

The latest FNC Residential Price Index™ (RPI) indicated U.S. home prices moved slightly higher in February after dropping unexpectedly in January. Not adjusting for seasonality, February home prices were up 0.1%. On a yearover-year basis, prices continue to climb at a moderate pace, up 5.7% from a year ago.Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 14.2% from the peak in 2006 (not inflation adjusted).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change based on the FNC index (four composites) through February 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The February Case-Shiller index will be released on Tuesday, April 26th.

Earlier: Preliminary April Consumer Sentiment decreases to 89.7

by Calculated Risk on 4/15/2016 01:29:00 PM

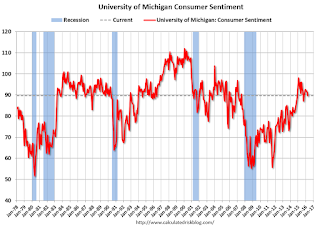

The preliminary University of Michigan consumer sentiment index for April was at 89.7, down from 91.0 in March:

Consumer confidence continued its slow overall decline in early April, marking the fourth consecutive monthly decline. To be sure, the sizes of the recent losses have been quite small, with the Sentiment Index falling just 2.9 Index-points since December 2015, although it was down 6.2 Index-points from a year ago and 8.4 points below the peak in January 2015. None of these declines indicate an impending recession, although concerns have risen about the resilience of consumers in the months ahead. Consumers reported a slowdown in expected wage gains, weakening inflation-adjusted income expectations, and growing concerns that slowing economic growth would reduce the pace of job creation. These apprehensions should ease as the economy rebounds from its dismal start in the first quarter of 2016.This was below the consensus forecast of 91.8.

emphasis added

Click on graph for larger image.

BLS: Unemployment Rate decreased in 21 States in March

by Calculated Risk on 4/15/2016 11:08:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

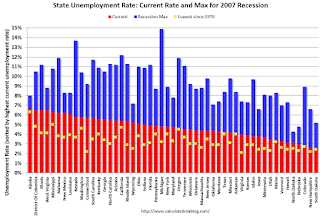

Regional and state unemployment rates were little changed in March. Twenty-one states had unemployment rate decreases from February, 15 states had increases, and 14 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

South Dakota and New Hampshire had the lowest jobless rates in March, 2.5 percent and 2.6 percent, respectively, followed by Colorado, 2.9 percent. The rates in both Arkansas (4.0 percent) and Oregon (4.5 percent) set new series lows. (All region, division, and state series begin in 1976.) Alaska had the highest rate, 6.6 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.6%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only seven states and D.C are at or above 6% (dark blue).

Fed: Industrial Production decreased 0.6% in March

by Calculated Risk on 4/15/2016 09:28:00 AM

From the Fed: Industrial production and Capacity Utilization

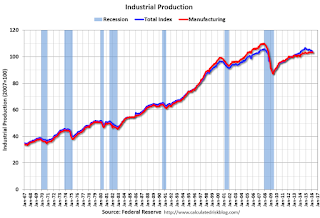

Industrial production decreased 0.6 percent in March for a second month in a row. For the first quarter as a whole, industrial production fell at an annual rate of 2.2 percent. A substantial portion of the overall decrease in March resulted from declines in the indexes for mining and utilities, which fell 2.9 percent and 1.2 percent, respectively; in addition, manufacturing output fell 0.3 percent. The sizable decrease in mining production continued the industry's recent downward trajectory; the index has fallen in each of the past seven months, at an average pace of 1.6 percent per month. At 103.4 percent of its 2012 average, total industrial production in March was 2.0 percent below its year-earlier level. Capacity utilization for the industrial sector decreased 0.5 percentage point in March to 74.8 percent, a rate that is 5.2 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.8% is 5.2% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.6% in March to 103.4. This is 18.3% above the recession low, and 2.0% below the pre-recession peak.

This was below expectations of a 0.1% decrease. The decline was most related to mining and utilities.

NY Fed: April "General business conditions climbed nine points, highest in more than a year"

by Calculated Risk on 4/15/2016 08:35:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity expanded for New York manufacturing firms for the first time in over a year, according to the April 2016 survey. After remaining in negative territory for seven months, the general business conditions index rose to a reading slightly above zero last month, and climbed nine more points to reach 9.6 in April.This was above the consensus forecast of 3.0, and indicates manufacturing expanded in the NY region in April.

...

The index for number of employees edged up to 2.0, indicating that employment levels remained fairly steady, and the average workweek index was unchanged at 2.0, a sign that hours worked remained largely the same.

...

Indexes for the six-month outlook indicated that conditions were expected to improve in the months ahead. The index for future business conditions moved up four points to 29.4—its third consecutive rise. The index for future new orders remained elevated at 36.6, and the index for future shipments climbed to 37.2. Future employment indexes conveyed an expectation that employment levels and the average workweek would rise modestly over the next six months.

Thursday, April 14, 2016

Friday: Industrial Production, Consumer Sentiment, NY Fed Mfg Survey

by Calculated Risk on 4/14/2016 05:30:00 PM

Friday:

• At 8:30 AM, NY Fed Empire State Manufacturing Survey for April. The consensus is for a reading of 3.0, up from 0.6.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.4%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 91.8, up from 91.0 in March.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for March 2016 from BLS.

LA area Port Traffic Decreased Sharply YoY in March due to Labor Slowdown last Year

by Calculated Risk on 4/14/2016 01:44:00 PM

Note: There were some large swings in LA area port traffic early last year due to labor issues that were settled in late February 2015. Port traffic slowed in January and February last year, and then surged in March 2015 as the waiting ships were unloaded (the trade deficit increased in March too). This has impacted the YoY changes for the first few months of 2016.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 3.1% compared to the rolling 12 months ending in February. Outbound traffic was up 0.4% compared to 12 months ending in February.

The downturn in exports over the last year was probably due to the slowdown in China and the stronger dollar.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down sharply year-over-year in March, but last year imports surged after the labor issues were resolved. So the year-over-year data was negatively impacted.

Key Measures Show Inflation close to 2% in March

by Calculated Risk on 4/14/2016 11:14:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in March. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for March here. Motor fuel was up 29% annualized in March following several months of large declines.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.1% annualized rate) in March. The CPI less food and energy rose 0.1% (0.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy also rose 2.2%. Core PCE is for February and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.5% annualized, and core CPI was at 0.8% annualized.

On a year-over-year basis, three of these measures are at or above 2%.

Using these measures, inflation has been moving up, and most are close to the Fed's target (Core PCE is still below).