by Calculated Risk on 4/12/2016 11:44:00 AM

Tuesday, April 12, 2016

CoreLogic: Foreclosure Inventory Declines 23.9% Year-over-year

CoreLogic released their National Foreclosure Report for February this morning.

CoreLogic reported that the national delinquency rate was at 3.2% in February, the lowest since November 2007.

From CoreLogic:

Approximately 434,000 homes in the United States were in some stage of foreclosure as of February 2016, compared to 571,000 in February 2015, a decrease of 23.9%. This was the 52nd consecutive month with a year-over-year decline. As of February 2016, the foreclosure inventory represented 1.2% of all homes with a mortgage, compared to 1.5% in February 2015.CoreLogic breaks down the foreclosure inventory by judicial vs non-judicial foreclosure states (see page 8 and 9 of the report). The judicial foreclosure states - that are still working through the backlog of foreclosures - have far more foreclosure inventory than the non-judicial foreclosure states.

NFIB: Small Business Optimism Index declined slightly in March

by Calculated Risk on 4/12/2016 09:06:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Drops to a New Two Year Low

The Index of Small Business Optimism fell 0.3 points from February, falling to 92.6. Statistically, no change. Four of the 10 Index components posted a gain, six posted small declines, the biggest gain was in Expected Business Conditions, a 4 point improvement to a still very negative number. ...

Reported job creation improved in March, with the average employment change per firm rising to an average gain in employment of 0.02 workers per firm, not much, but positive. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 92.6 in March.

Monday, April 11, 2016

"Mortgage Rates Holding Near 3-Year Lows"

by Calculated Risk on 4/11/2016 06:05:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Holding Near 3-Year Lows

Mortgage rates were little changed today, keeping them in line with the lowest levels in nearly 3 years. Specifically, there have only been 2-3 days with better rates since May 2013, depending on the lender. That puts the average lender at 3.625% in terms of conventional 30yr fixed rate quotes for top tier scenarios. Some of the more aggressive lenders continue to offer 3.5%. These rates are a mere quarter point higher than the all-time lows seen from late 2011 through early 2013.Here is a table from Mortgage News Daily:

emphasis added

Update: The California Budget Surplus

by Calculated Risk on 4/11/2016 02:59:00 PM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider (now at Bloomberg). One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved significantly since then. Here is the most recent update from California State Controller Betty Yee: CA Controller’s March Cash Report Shows Higher-Than-Expected Revenues

March state revenues surpassed estimates in Gov. Jerry Brown’s proposed 2016-17 budget by $218.6 million, with both the corporation tax and the retail sales and use tax beating expectations, State Controller Betty T. Yee reported today.California is doing much better.

Overall, total revenues of $7.40 billion outstripped projections in the proposed budget released in January by 3 percent. Corporation tax revenues of $1.71 billion were $47.5 million, or 2.9 percent, higher than expected. Sales tax revenues of $1.79 billion beat expectations by $36.0 million, or 2.0 percent. Only the personal income tax, which has normally surpassed projections in the past few years, came up short. Revenues of $3.49 billion were $31.2 million, or 0.9 percent, less than expected.

...

Compared to projections when this year’s budget was signed last summer, revenues for the first nine months of the fiscal year are $2.26 billion higher than expected, with both the corporation tax and the personal income tax exceeding estimates. Compared to the prior fiscal year, revenues to date are higher by $5.20 billion, or 7.1 percent.

emphasis added

Mortgage Rates and Ten Year Yield

by Calculated Risk on 4/11/2016 11:28:00 AM

With the ten year yield falling to 1.73%, there has been some discussion about whether mortgage rates will fall to new lows. Based on an historical relationship, 30-year rates should currently be around 3.7%.

As of Friday, Mortgage News Daily reported: "the average lender continuing to quote conventional 30yr fixed rates of 3.625% on top tier scenarios." Pretty close to expected.

The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

To reach new lows (on the Freddie Mac survey), mortgage rates would have to fall below the 3.35% lows in 2012.

For that to happen, based on the historical relationship, the Ten Year yield would have fall to under 1.5%.

So I don't expect new lows on mortgage rates unless the Ten Year yield falls further.

Report: U.S. Office Vacancy Increased Slightly in Q1 2016

by Calculated Risk on 4/11/2016 09:13:00 AM

From CBRE: U.S. Office Vacancy Inches Up Slightly in Q1 2016

Vacancy in the U.S. office market inched up by 10 basis points (bps) during the first quarter of 2016 (Q1 2016), rising to 13.2%, according to the latest analysis from CBRE Group, Inc. Even with the increase, the national office vacancy rate remains at the lowest level since 2008.CR note: This is another measure of the office vacancy rate (in addition to Reis) that I follow. In general, the office vacancy rate has been declining slowly - and will probably decline further in 2016.

Despite the slight increase, vacancy continued to improve in the majority of U.S. markets, with rates falling in 33 markets, rising in 25, and remaining unchanged in five. Suburban vacancy remained at 14.7% while downtown vacancy increased by 10 bps, to 10.4%. The overall national office vacancy rate has fallen 70 bps over the past four quarters.

...

The slight rise in the national vacancy rate was fueled by significant new supply coming to certain markets including Boston, Washington D.C., Dallas and Orange County. Compounding that issue, Washington had negative absorption and Dallas only modest absorption, trailing this new supply. ...

“We expect the U.S. office market to improve in 2016 as the U.S. economy continues to expand, moving closer to full employment and driving demand for office space,” noted Mr. Havsy. “Office demand is expected to outpace new supply in the next two years, further tightening the vacancy rate and keeping rent growth above inflation in a majority of the U.S. office markets.”

Sunday, April 10, 2016

Sunday Night Futures

by Calculated Risk on 4/10/2016 07:17:00 PM

From Professor Jim Hamilton at Econbrowser: Why no economic boost from lower oil prices?

Many analysts had anticipated that a dramatic drop in oil prices such as we’ve seen since the summer of 2014 could provide a big stimulus to the economy of a net oil importer like the United States. That doesn’t seem to be what we’ve observed in the data.Weekend:

There is no question that lower oil prices have been a big windfall for consumers. Americans today are spending $180 B less each year on energy goods and services than we were in July of 2014, which corresponds to about 1% of GDP. A year and a half ago, energy expenses constituted 5.4% of total consumer spending. Today that share is down to 3.7%.

But we’re not seeing much evidence that consumers are spending those gains on other goods or services. ...

...

For a net oil importer like the United States, the direct dollar gains to consumers exceed the dollar losses to domestic producers. Even so, multiplier effects from displaced workers and capital in the oil sector could end up eating away at some of those net gains. When oil prices collapsed in 1986 we saw no boom in the national U.S. economy, and in fact Texas and other oil-producing states experienced their own recession.

On the other hand, when oil prices spike up rapidly the result is unemployed labor and capital in sectors like autos and their suppliers. Furthermore, in the days before fracking there was a much longer lead time between an increase in oil prices and an increase in spending by oil producers. The result was an unambiguous net negative shock to GDP from a big upward spike in oil prices. The oil price shocks of 1973, 1979, 1980, 1990, and 2007 were all followed by economic recessions. In a recent paper I surveyed a number of academic studies that concluded that while a sharp increase in oil prices can reduce U.S. GDP growth, it’s harder to see evidence of significant net gains for U.S. GDP from a sharp decline in oil prices.

It looks like we’ve just added some more data to support that conclusion.

• Schedule for Week of April 10, 2016

• Energy expenditures as a percentage of PCE at All Time Low

Monday:

• No economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $40.08 per barrel and Brent at $41.94 per barrel. A year ago, WTI was at $52, and Brent was at $56 - so prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.04 per gallon (down about $0.35 per gallon from a year ago).

Energy expenditures as a percentage of PCE at All Time Low

by Calculated Risk on 4/10/2016 11:37:00 AM

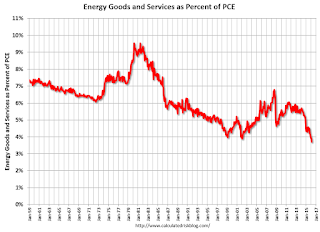

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through February 2016.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In February 2016, with WTI oil prices averaging $30.32 per barrel, energy expenditures as a percent of PCE declined to an all time low of just under 3.7%.

Saturday, April 09, 2016

Schedule for Week of April 10, 2016

by Calculated Risk on 4/09/2016 08:12:00 AM

The key economic report this week is March retail sales on Wednesday.

For prices, PPI and CPI will be released this week.

For manufacturing, March Industrial Production and the April NY Fed manufacturing survey will be released this week.

No economic releases scheduled.

9:00 AM ET: NFIB Small Business Optimism Index for March.

2:00 PM: The Monthly Treasury Budget Statement for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for March will be released. The consensus is for retail sales to increase 0.1% in March.

8:30 AM ET: Retail sales for March will be released. The consensus is for retail sales to increase 0.1% in March.This graph shows retail sales since 1992 through February 2016. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were down 0.1% from January to February (seasonally adjusted), and sales were up 3.1% from February 2015.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.1% decrease in inventories.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for April. The consensus is for a reading of 3.0, up from 0.6.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.4%.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 91.8, up from 91.0 in March.

10:00 AM ET: Regional and State Employment and Unemployment (Monthly) for March 2016 from BLS.

Friday, April 08, 2016

Sacramento Housing in March: Sales up 4.7%, Inventory down 17% YoY

by Calculated Risk on 4/08/2016 08:00:00 PM

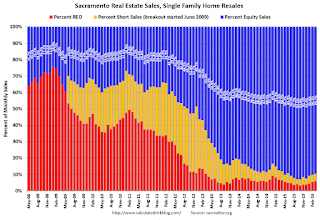

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In March, total sales were up 4.7% from March 2015, and conventional equity sales were up 6.0% compared to the same month last year.

In March, 10.1% of all resales were distressed sales. This was up from 9.7% last month, and down from 12.4% in March 2015.

The percentage of REOs was at 5.8% in March, and the percentage of short sales was 4.3%.

Here are the statistics.

Press Release: Sales volume jumps 33%, days on market decreases further

Sales volume jumped 33.1% from 1,082 to 1,440 for March. This current number is up 4.7% from March last year (1,376 sales).

...

Although the total Active Listing Inventory increased 12.4% from 1,755 to 1,973, the Months of Inventory decreased from 1.6 months to 1.4 months.

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 17.3% year-over-year (YoY) in March. This was the elventh consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 15.3% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying - but limited inventory.