by Calculated Risk on 1/08/2016 09:39:00 AM

Friday, January 08, 2016

Comments: Another Strong Employment Report

This was a strong employment report with 292,000 jobs added, and employment gains for October and November were revised up.

However wages were mostly unchanged, from the BLS: "In December, average hourly earnings for all employees on private nonfarm payrolls, at $25.24, changed little (-1 cent), following an increase of 5 cents in November. Over the year, average hourly earnings have risen by 2.5 percent."

Earlier: December Employment Report: 292,000 Jobs, 5.0% Unemployment Rate

Note: The warm weather might have had a positive impact on this report. As an example, very few people reported they had a full time job, but worked part time due to bad weather (an indicator of the impact of weather).

A few more numbers: Total employment is now 4.9 million above the previous peak. Total employment is up 13.6 million from the employment recession low.

Private payroll employment increased 275,000 in December, and private employment is now 5.3 million above the previous peak. Private employment is up 14.1 million from the recession low.

In December, the year-over-year change was 2.65 million jobs.

Seasonal Retail Hiring

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 746 thousand workers (NSA) net in October, November and December. Note: this is NSA (Not Seasonally Adjusted).

This is slightly below the number last year, and suggests retailers were reasonably optimistic about sales.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in October to 80.9%, and the 25 to 54 employment population ratio was unchanged at 77.4%. The participation rate for this group might increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in December - and although the series is noisy - it does appear wage growth is trending up.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 6.0 million in December but was down by 764,000 over the year. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons was little changed in December. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 9.9% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.08 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 2.05 million in November.

This is generally trending down, but is still high.

State and Local Government

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.) In December 2015, state and local governments added 13 thousand jobs. State and local government employment is now up 209,000 from the bottom, but still 549,000 below the peak.

State and local employment is now increasing. And Federal government layoffs appear to have ended and, with the recent budget deal, Federal employment will probably increase in 2016. (Federal payrolls increased by 4,000 in December, and Federal employment was up 17,000 in 2015).

Overall this was another strong employment report.

December Employment Report: 292,000 Jobs, 5.0% Unemployment Rate

by Calculated Risk on 1/08/2016 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 292,000 in December, and the unemployment rate was unchanged at 5.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in several industries, led by professional and business services, construction, health care, and food services and drinking places. Mining employment continued to decline.

...

The change in total nonfarm payroll employment for October was revised from +298,000 to +307,000, and the change for November was revised from +211,000 to +252,000. With these revisions, employment gains in October and November combined were 50,000 higher than previously reported.

...

In December, average hourly earnings for all employees on private nonfarm payrolls, at $25.24, changed little (-1 cent), following an increase of 5 cents in November. Over the year, average hourly earnings have risen by 2.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 292 thousand in December (private payrolls increased 275 thousand).

Payrolls for October and November were revised up by a combined 50 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.65 million jobs.

This was the 2nd best year since the '90s.

1) 2014: 3.116 million jobs added

2) 2015: 2.650 million

3) 2005: 2.506 million

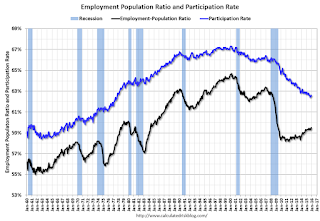

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in December to 62,6%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased to 59.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in December at 5.0%.

This was above expectations of 200,000 jobs, and revisions were up ... a strong report.

I'll have much more later ...

Thursday, January 07, 2016

Friday: Employment Report

by Calculated Risk on 1/07/2016 08:09:00 PM

An employment report preview from Goldman Sachs economists Elad Pashtan and Daan Struyven:

We expect a 215k gain in nonfarm payroll employment in December, slightly above expectations of 200k. ... The unemployment rate is likely to remain unchanged at 5.0%. Average hourly earnings are likely to rise a relatively soft 0.1% month-over-month due to calendar effects. However, we expect the year-over-year rate to rise to a new cyclical high of 2.6%, boosted by favorable base effects.Friday:

• At 8:30 AM, Employment Report for December. The consensus is for an increase of 200,000 non-farm payroll jobs added in December, down from the 211,000 non-farm payroll jobs added in November. The consensus is for the unemployment rate to be unchanged at 5.0%.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a no change in inventories.

• At 3:00 PM, Consumer Credit for November from the Federal Reserve. The consensus is for an increase of $19 billion in credit.

Reis: Mall Vacancy Rate Declined in Q4

by Calculated Risk on 1/07/2016 04:11:00 PM

Reis reported that the vacancy rate for regional malls declined to 7.8% in Q4 2015, down from 7.9% in Q3. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined to 10.0% in Q4 2015, down from 10.1% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

The national vacancy rate for neighborhood and community shopping centers declined by 10 basis points during the fourth quarter to 10.0%. Although both net absorption and construction remain at weak levels, net absorption is slowly starting to pull ahead of construction and push the vacancy rate down again. The vacancy rate for malls also declined by 10 basis points to 7.8%, also demonstrating a bit of resurgence. Malls have had a better recovery than neighborhood and community centers up to this juncture, but neither has had a strong recovery on a widespread basis.

...

Asking and effective rents once again grew by 0.5% during the fourth quarter. There has not been much change in the rental growth rates for neighborhood and community centers over the last five quarters. Given such an elevated vacancy rate these results are in line with expectations. Over the last 12 months asking and effective rents grew by 2.0% and 2.2%, respectively, which is a bit of an improvement from the 1.8% and 2.0% that they respectively increased during 2014. This was the best calendar-year performance for rent growth since 2007, before the recession.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

Preview: Employment Report for December

by Calculated Risk on 1/07/2016 12:37:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus, according to Bloomberg, is for an increase of 200,000 non-farm payroll jobs in December (with a range of estimates between 170,000 to 249,000), and for the unemployment rate to be unchanged at 5.0%.

The BLS reported 211,000 jobs added in November.

Here is a summary of recent data:

• The ADP employment report showed an increase of 257,000 private sector payroll jobs in December. This was above expectations of 190,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in December to 48.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 30,000 in December. The ADP report indicated a 2,000 increase for manufacturing jobs.

The ISM non-manufacturing employment index increased in December to 55.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 230,000 in December.

Combined, the ISM indexes suggests employment gains of 200,000. This suggests employment growth close to expectations.

• Initial weekly unemployment claims averaged close to 275,000 in December, up from 270,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 271,000, down slightly from 272,000 during the reference week in November.

The slight decrease during the reference suggests about the same level of layoffs in December as in November.

• The final December University of Michigan consumer sentiment index increased to 92.6 from the November reading of 91.3. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like lower gasoline prices.

• Trim Tabs reported that the U.S. economy added between 120,000 to 150,000 jobs in December, down from their estimate of 168,000 jobs in November. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. Based on these indicators, it appears job gains should be around 200 thousand again in December.

Las Vegas Real Estate in December: Sales Increased 20% YoY, Inventory Down

by Calculated Risk on 1/07/2016 10:31:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR Reports Local Home Prices and Sales End 2015 Up From 2014

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in December 2015 was 3,290, up from 2,734 in December 2014. Compared to the previous year, 20.4 percent more homes and 20.0 percent more condos and townhomes sold in December 2015.1) Overall sales were up sharply year-over-year. Sales in the previous month (November) were probably impacted by the new TILA-RESPA Integrated Disclosure (TRID). In early October, this new disclosure rule pushed down mortgage applications sharply, however applications have since bounced back. Note: TILA: Truth in Lending Act, and RESPA: the Real Estate Settlement Procedures Act of 1974.

...

By the end of December, GLVAR reported 7,224 single-family homes listed without any sort of offer. That’s down 11.2 percent from one year ago. [CR NOTE: GLVAR Corrected the percent change for listings] For condos and townhomes, the 2,091 properties listed without offers in December represented a 9.4 percent decrease from one year ago.

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That continued in December, when 6.8 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10 percent of all sales one year ago. Another 6.9 percent of all December sales were bank-owned, down from 8 percent one year ago.

emphasis added

2) Conventional (equity, not distressed) sales were up 27% year-over-year. In Dec 2014, 82.0% of all sales were conventional equity. In Dec 2015, 86.3% were standard equity sales.

3) The percent of cash sales decreased year-over-year from 31.9% in Dec 2014 to 33.2% in Dec 2015. This has been trending down.

4) Non-contingent inventory is down 11.2% year-over-year. This was the fourth month in a row with a YoY decline in inventory. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is over.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

| Jun-15 | 4.3% |

| Jul-15 | 5.1% |

| Aug-15 | 3.5% |

| Sep-15 | -0.8% |

| Oct-15 | -7.1% |

| Nov-15 | -5.2% |

| Dec-15 | -11.2% |

Weekly Initial Unemployment Claims decrease to 277,000

by Calculated Risk on 1/07/2016 08:33:00 AM

The DOL reported:

In the week ending January 2, the advance figure for seasonally adjusted initial claims was 277,000, a decrease of 10,000 from the previous week's unrevised level of 287,000. The 4-week moving average was 275,750, a decrease of 1,250 from the previous week's unrevised average of 277,000.The previous week was unrevised at 287,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 275,750.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, January 06, 2016

Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

by Calculated Risk on 1/06/2016 04:36:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

5) Monetary Policy: The Fed raised rates in December, and now the question is how much will the Fed raise rates in 2016? The market is pricing in two 25 bps rate hikes in 2016, and most analysts expect three to four hikes in 2016. However, some analysts think the Fed is finished, the so-called "one and done" view. Will the Fed raise rates in 2016, and if so, by how much?

For years I made fun of those predicting an imminent Fed Funds rate increase. Based on high unemployment and low inflation, I argued it would be a "long time" before the first rate hike. A long time passed ... and last year I finally argued a rate hike was likely (although I thought we'd see more than one). Now it seems likely the Fed will raise rates further in 2016.

Tim Duy at Fed Watch expects four rate hikes in 2016:

The Federal Reserve will continue to hike rates, slowly. I expect that economic conditions will be sufficient for the Federal Reserve to justify 100bp of rate hikes in 2016. Although the Fed will not want to appear mechanical in its normalization process, they will likely find themselves hiking every other meeting beginning in March. They will be slow to begin the process of "normalizing" the balance sheet, although I expect that they will be fully engaged in that conversation by the middle of the year. That conversation will take on more urgency if they have difficulty controlling short rates with their new tools.And Fed Vice Chairman Stanley Fischer thinks four hikes is "in the ballpark", from Bloomberg: Fed's Fischer Says Four Rate Hikes in 2016 ‘in the Ballpark’

Federal Reserve Vice Chairman Stanley Fischer said policy makers’ forecasts predicting four interest-rate increases in 2016 were “in the ballpark,” though China’s slowing economy and other sources of uncertainty make it difficult to predict the path of policy.Of course the Fed will be data dependent and inflation is the key to the number of rate hikes in 2015. From the December FOMC minutes:

“The reason we meet eight times a year is because things happen, and as they happen you want to adjust your policy,” Fischer said in an interview Wednesday on CNBC.

In determining the size and timing of further adjustments to monetary policy, some members emphasized the importance of confirming that inflation would rise as projected and of maintaining the credibility of the Committee's inflation objective.If inflation picks up, then four rate hikes is probably "in the ballpark". If inflation stays low, then we will see fewer rate hikes.

I've seen several people arguing the Fed will be cutting rates by the end of 2016 - I think that is unlikely. Instead I think the Fed will be cautious - and they will not want to reverse course. Right now I think something around three rate hikes in 2016 is likely.

As an aside, the old saying on Wall Street with regards to rate hikes is "3 steps and a stumble" meaning three hikes and the stock market stumbles. I don't think there is an validity to the saying, but I expect to hear it on CNBC in 2016!

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

FOMC Minutes: "some members said that their decision to raise the target range was a close call"

by Calculated Risk on 1/06/2016 02:11:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 15-16. Excerpts:

After assessing the outlook for economic activity, the labor market, and inflation and weighing the uncertainties associated with the outlook, members agreed to raise the target range for the federal funds rate to 1/4 to 1/2 percent at this meeting. A number of members commented that it was appropriate to begin policy normalization in response to the substantial progress in the labor market toward achieving the Committee's objective of maximum employment and their reasonable confidence that inflation would move to 2 percent over the medium term. Members agreed that the postmeeting statement should report that the Committee's decision reflected both the economic outlook and the time it takes for policy actions to affect future economic outcomes. If the Committee waited to begin removing accommodation until it was closer to achieving its dual-mandate objectives, it might need to tighten policy abruptly, which could risk disrupting economic activity. Members observed that after this initial increase in the federal funds rate, the stance of monetary policy would remain accommodative. However, some members said that their decision to raise the target range was a close call, particularly given the uncertainty about inflation dynamics, and emphasized the need to monitor the progress of inflation closely.

Members also discussed their expectations for the size and timing of adjustments in the target range for the federal funds rate going forward. Based on their current forecasts for economic activity, the labor market, and inflation, as well as their expectation that the neutral short-term real interest rate will rise slowly over the next few years, members expected economic conditions would evolve in a manner that would warrant only gradual increases in the federal funds rate. However, they also recognized that the appropriate path for the federal funds rate would depend on the economic outlook as informed by incoming data. Members stressed the potential need to accelerate or slow the pace of normalization as the economic outlook evolved. In the current situation, because of their significant concern about still-low readings on actual inflation and the uncertainty and risks present in the inflation outlook, they agreed to indicate that the Committee would carefully monitor actual and expected progress toward its inflation goal. In determining the size and timing of further adjustments to monetary policy, some members emphasized the importance of confirming that inflation would rise as projected and of maintaining the credibility of the Committee's inflation objective. Based on their current economic outlook, they continued to anticipate that the federal funds rate was likely to remain, for some time, below levels that the Committee expected to prevail in the longer run.

emphasis added

Reis: Apartment Vacancy Rate increased in Q4 to 4.4%

by Calculated Risk on 1/06/2016 11:57:00 AM

Reis reported that the apartment vacancy rate increased in Q4 2015 to 4.4%, up from 4.3% in Q3, and up from 4.3% in Q4 2014. The vacancy rate peaked at 8.0% at the end of 2009, and appears to have bottomed at 4.2%.

A few comments from Reis Senior Economist and Director of Research Ryan Severino:

Fourth quarter data provides yet more evidence that the national vacancy rate has already bottomed out and is set to keep increasing. As we noted last quarter, vacancy technically started rising during the second quarter of 2014, but had fallen back before bottoming out again during the second quarter of 2015. However, the national vacancy rate has now increased for two consecutive quarters. This marks is the first time that has happened since the fourth quarter of 2009 and truly represents a turning point in the apartment market. With construction outpacing demand the national vacancy rate should slowly drift higher over the coming years.

Vacancy once again increased by 10 basis points to 4.4% during the quarter with construction slightly outpacing net absorption. While demand and supply had been largely in balance between mid-2013 and mid-2015, that has started to change over the last two quarters. Gradually, construction is overtaking net absorption by a wider margin, putting increasing upward pressure on vacancy. During the second quarter construction exceed demand by 3,471 units. During the third quarter that difference had risen to 12,350 units and during the fourth quarter it registered 15,263 units. With construction continuing to increase and net absorption generally stabilizing, this rift should continue to widen over time putting further upward pressure on the national vacancy rate.

Asking and effective rents both grew by 0.8% during the fourth quarter. This was a bit slower than the scorching performance during the last two quarters, but still represents an annualized rate in excess of 3%, well ahead of even core inflation. This slight pullback is not entirely unexpected due to the seasonality typically observed in the apartment market - apartment rent growth tends to be strongest during the two middle quarters of the calendar year when people have a propensity to move while the weather is more conducive and children are out of school. The slight pullback in rent growth during the fourth quarter is more of a testament to how strong rent growth was during those two middle quarters than any weakness exhibited during the fourth quarter....

On a calendar-year basis, rent growth continues to accelerate. Asking and effective rents grew by 4.5% and 4.6%, respectively, during 2015.This is greater than 2014's growth rates of 3.7% and 3.9% for asking and effective rents and is the strongest performance during a calendar year since 2007 before the recession. The low vacancy rate, improving economy, tightening labor market and gradually rising income growth is providing all of the fodder for continued rent growth, even in the face of rising construction.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. Now that completions are catching up with starts, the vacancy rate has started to increase.

Apartment vacancy data courtesy of Reis.