by Calculated Risk on 12/15/2015 11:42:00 AM

Tuesday, December 15, 2015

Key Measures Show Inflation close to 2% in November

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in November. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.4% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for November here. Motor fuel was down 26% annualized in November.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was unchanged (0.3% annualized rate) in November. The CPI less food and energy rose 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy also rose 2.0%. Core PCE is for October and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.4% annualized, and core CPI was at 2.2% annualized.

On a year-over-year basis, two of these measures suggest inflation remains below the Fed's target of 2% (core CPI as at 2% and median CPI is above 2%).

Using these measures, inflation has been moving up and is closer to the Fed's target.

NAHB: Builder Confidence declines to 61 in December

by Calculated Risk on 12/15/2015 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 61 in December, down from 62 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Edges Down One Point in December

Builder confidence in the market for newly constructed single-family homes remained relatively flat in December, dropping one point to 61 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Overall, builders are optimistic about the housing market, although they are reporting concerns with the high price of lots and labor,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“For the past seven months, builder confidence levels have averaged in the low 60s, which is in line with a gradual, consistent recovery,” said NAHB Chief Economist David Crowe. “With job creation, economic growth and growing household formations, we anticipate the housing market to continue to pick up traction as we head into 2016.”

...

All three HMI components posted modest losses in December. The index measuring sales expectations in the next six months fell two points to 67, the component gauging current sales conditions decreased one point to 66, and the index charting buyer traffic dropped two points to 46.

Looking at the three-month moving averages for regional HMI scores, the West increased three points to 76 while the Northeast rose a single point to 50. Meanwhile the Midwest dropped two points to 58 and the South fell one point to 64.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 63, but still a strong reading.

CoreLogic: "Number of Mortgaged Properties with Negative Equity Down 20.7% Year Over Year"

by Calculated Risk on 12/15/2015 08:58:00 AM

From CoreLogic: CoreLogic Reports 256,000 US Properties Regained Equity in the Third Quarter of 2015

CoreLogic ... today released a new analysis showing 256,000 properties regained equity in the third quarter of 2015, bringing the total number of mortgaged residential properties with equity at the end of Q3 2015 to approximately 46.3 million, or 92.0 percent of all homes with an outstanding mortgage. Nationwide, borrower equity increased year over year by $741 billion in Q3 2015.On states:

The total number of mortgaged residential properties with negative equity stood at 4.1 million, or 8.1 percent, in Q3 2015. That was down 4.7 percent quarter over quarter from 4.3 million homes, or 8.7 percent, compared with Q2 2015 and down 20.7 percent year over year from 5.2 million homes, or 10.4 percent, compared with Q3 2014. ...

For the homes in negative equity status, the national aggregate value of negative equity was $301 billion at the end of Q3 2015, declining approximately $8.1 billion from $309.1 billion in Q2 2015, a decrease of 2.6 percent. On a year-over-year basis, the value of negative equity declined overall from $341 billion in Q3 2014, representing a decrease of 11.8 percent in 12 months.

Of the more than 50 million residential properties with a mortgage, approximately 8.9 million, or 17.6 percent, have less than 20 percent equity (referred to as “under-equitied”) and 1.1 million, or 2.2 percent, have less than 5 percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” may have a difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near-negative equity are considered at risk of moving into negative equity if home prices fall.

“Home price growth continued to lift borrower equity positions and increase the number of borrowers with sufficient equity to participate in the mortgage market," said Frank Nothaft, chief economist for CoreLogic. "In Q3 2015 there were 37.5 million borrowers with at least 20 percent equity, up 7 percent from 35 million in Q3 2014. In the last three years, borrowers with at least 20 percent equity have increased by 11 million, a substantial uptick that is driving rapid growth in home equity originations.”

emphasis added

"Nevada had the highest percentage of mortgaged residential properties in negative equity at 19.0 percent, followed by Florida (17.8 percent), Arizona (14.6 percent), Rhode Island (12.3 percent) and Maryland (12.1 percent). Combined, these five states account for 29.3 percent of negative equity in the U.S. "Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago.

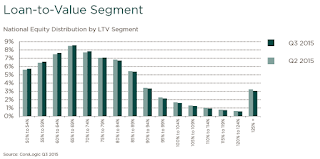

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q3 2015 compared to Q2 2015. In Q3, 3.0% of residential properties have 25% or more negative equity, down from 3.2% in Q2 2015.

For reference, three years ago, in Q3 2012, 9.6% of residential properties had 25% or more negative equity.

A year ago, in Q3 2014, there were 5.2 million properties with negative equity - now there are 4.1 million. A significant change.

CPI unchanged in November, Core CPI up 2.0% YoY

by Calculated Risk on 12/15/2015 08:35:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 0.5 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of no change for CPI, and also at the forecast of a 0.2% increase in core CPI.

The indexes for energy and food declined in November, offsetting an increase in the index for all items less food and energy and resulting in the seasonally adjusted all items index being unchanged. The energy index fell 1.3 percent, with all of the major component indexes declining except electricity. ...

The index for all items less food and energy rose 0.2 percent in November, the same increase as in September and October. ... The index for all items less food and energy rose 2.0 percent, its largest 12-month increase since the 12 months ending May 2014.

emphasis added

Monday, December 14, 2015

Tuesday: CPI, NY Fed Mfg, Homebuilder Survey

by Calculated Risk on 12/14/2015 09:25:00 PM

From the WSJ: Junk Bonds Resume Sharp Selloff

The U.S. junk-bond rout deepened Monday, with the bonds of dozens of low-rated companies falling anew and the shares of some large fund-management firms tumbling as well.CR Note: It is called "junk" for a reason! A large portion of the concern is related to debt of energy companies.

The declines reflected gathering concerns about risky companies’ access to financing, traders’ capacity to sell bonds without causing prices to fall, and ripple effects from the closure of a junk-bond mutual fund.

Tuesday:

• At 8:30 AM ET, the Consumer Price Index for November from the BLS. The consensus is for no changed in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, the NY Fed Empire State Manufacturing Survey for December. The consensus is for a reading of -7.0, up from -10.7.

• At 10:00 AM, the December NAHB homebuilder survey. The consensus is for a reading of 63, up from 62 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

Hotel Occupancy: Heading for a Record Year

by Calculated Risk on 12/14/2015 02:41:00 PM

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 5 December

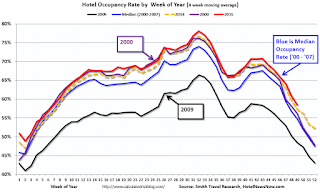

The U.S. hotel industry recorded positive results in two of the three key performance measurements during the week of 29 November through 5 December 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are currently in the weakest part of the year; December and January.

In year-over-year measurements, the industry’s occupancy decreased 0.4% to 57.0%. However, average daily rate for the week was up 1.8% to US$116.51, and revenue per available room increased 1.5% to US$66.37.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.For 2015, the 4-week average of the occupancy rate is above 2000 (best year for hotels), and 2015 will be the best year ever for hotels.

Occupancy Rate Year-to-date:

1) 2015 66.9%

2) 2000 66.1%

3) 2014 64.8%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Merrill Lynch: "Home Sweet Home"

by Calculated Risk on 12/14/2015 11:59:00 AM

A few excerpts from a piece by Michelle Meyer at Merrill Lynch: Home sweet home

We expect continued improvement in homebuilding and sales in 2016 and 2017, but still far from a V-shaped trajectory. Here are our baseline forecasts:

• Housing starts to average 1.275 million in 2016 and 1.4 million in 2017 on the way to a return to the historical average of 1.5 million by the end of 2017.

[CR NOTE: For reference, housing starts will probably be just over 1.1 million in 2015].

• Existing home sales to increase 5% in 2016 and 3% in 2017. We look for more robust growth in new home sales with a gain of 10% and about 14% over the next two years, respectively.

[CR Note: New Home sales will probably be just over 500 thousand in 2015]

• Home price appreciation should slow with prices up only 1.8% in 2016. The forecast for 2017 becomes more controversial as our baseline forecast is for a decline of 1.5%, as our model looks for home prices to converge to income.

[CR Note: A decline in nominal prices seems unlikely in 2017. However a decline in real prices (nominal price increases less than inflation) is possible].

When considering the forecasts for the next two years, we have to ask two critical questions: what is a “normal” rate of activity, and, after years of below-normal activity, could the sector overshoot?

In our view, a reasonable estimate of “normal” is the pre-crisis average of about 1.5 million. The math is simple: household formation of 1.2 million + demolitions of 300K + some number of second home purchases. There is a risk that household formation is on a slightly slower pace given persistently high rates of doubling up among young adults.

Starting in the early 2000s, and accelerating post crisis, there is a rising share of “grown-up” children who live with their parents. While this is partly due to the Great Recession and slow recovery, there could also be some secular changes related to delayed marriage. This could imply a somewhat lower equilibrium pace of housing starts.

That said, in the medium term, the risk is that we overshoot this new-normal level given pent-up household formation. Although we are skeptical about the quality of the data, the recent statistics from the Housing Vacancy Survey show a surge in household formation, implying formation of about 1.5 million this year. While the data will probably be revised lower, there is an improving trend. Provided the overall economy continues to heal as we are expecting, with 2.5% growth in 2016 and an unemployment rate of 4.5% by year-end, we will see further growth in households.

Indeed, there is a risk that housing demand continues to overshoot supply, as we believe it has this year. Homebuilders have been complaining that a shortage of labor has been a major impediment to production. According to the NAHB, 52% of homebuilders report labor shortages, back to 2000 levels and up notably from 21% just three years ago. The challenge is that many skilled workers left the construction industry after the housing bubble burst and have not come back This could continue to extend delivery times and slow production.

Duy: "Makes You Wonder What The Fed Is Thinking"

by Calculated Risk on 12/14/2015 09:21:00 AM

A few excerpts from an article by Tim Duy: Makes You Wonder What The Fed Is Thinking

The Fed is poised to raise the target range on the federal funds rate this week. More on that decision tomorrow. My interest tonight is a pair of Wall Street Journal articles that together call into question the wisdom of the Fed's expected decision. The first is on inflation, or lack thereof, by Josh Zumbrun:

Central bank officials predict inflation will approach their target in 2016. The trouble is they have made the same prediction for the past four years. If the Fed is again fooled, it may find it raised rates too soon, risking recession.A key reason for the Federal Reserve to raise interest rates is to be ahead of the curve on inflation. But given their poor inflation forecasting record, not to mention that of other central banks ... why are they so sure that they must act now to head off inflationary pressures? One would expect waning confidence in their inflation forecasts to pull the center more toward the views of Chicago Federal Reserve President Charles Evans and Board Governors Lael Brainard and Daniel Tarullo and thus defer tighter policy until next year.

Now combine the inflation forecast uncertainty with the growing consensus among economists that the Fed faces the zero bound again in less than five years. This one's from Jon Hilsenrath:

Among 65 economists surveyed by The Wall Street Journal this month, not all of whom responded, more than half said it was somewhat or very likely the Fed’s benchmark federal-funds rate would be back near zero within the next five years. Ten said the Fed might even push rates into negative territory, as the European Central Bank and others in Europe have done—meaning financial institutions have to pay to park their money with the central banks...Not a surprising conclusion given that Fed officials expect the terminal fed funds rate in the 3.3-3.8 percent range (central tendency) while the 2001-03 easing was 5.5 percentage points and the 1990-92 easing was 5.0 percentage points. You see of course how the math works.

...

Bottom Line: Given that the Fed likely only gets one chance to lift-off from the zero bound on a sustained basis, it is reasonable to think they would wait until they were absolutely sure inflation was coming. Even more so given the poor performance of their inflation forecasts. But the Fed thinks there is now more danger in waiting than moving. And so into the darkness we go.

Sunday, December 13, 2015

Sunday Night Futures

by Calculated Risk on 12/13/2015 07:47:00 PM

From Jon Hilsenrath at the WSJ: Fed Officials Worry Interest Rates Will Go Up, Only to Come Back Down

Federal Reserve officials are likely to raise their benchmark short-term interest rate from near zero Wednesday, expecting to slowly ratchet it higher to above 3% in three years.Weekend:

But that’s if all goes as planned. Their big worry is they’ll end up right back at zero.

• Schedule for Week of December 13th

• FOMC Preview and Review of Projections

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are unchanged and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $35.62 per barrel and Brent at $37.93 per barrel. A year ago, WTI was at $58, and Brent was at $61 - so prices are down almost 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.01 per gallon (down about $0.55 per gallon from a year ago). Prices should fall under $2.00 per gallon soon.

FOMC Preview and Review of Projections

by Calculated Risk on 12/13/2015 12:08:00 PM

Almost all analysts are expecting the FOMC to raise the Fed Funds rate this week. Most analysts think the federal funds rate will be increased from a target range of "0 to 1/4 percent" to a range of "1/4 to 1/2 percent".

The current effective rate is 0.14 percent, close to the middle of the current range.

For review, here are the key paragraph in the October FOMC statement:

"In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. "Since that statement, the economy added 298 thousand jobs in October and 211 thousand jobs in November. The unemployment rate declined further from 5.1% in September to 5.0% in November. This is the "some further improvement" in the labor market that the FOMC mentioned in the October statement.

emphasis added

Also, based on recent comments, it seems several key members of the FOMC are reasonably confident inflation will move back towards the 2% target. Of course headline inflation will take another dip due to the recent decline in oil prices.

Here are the September FOMC projections. Since the release of those projections, Q2 GDP was revised up from 3.7% annualized to +3.9% annualized. And Q2 GDP was reported at 2.1%. It appears GDP will be up around 2.2% for this year - in the September forecast range.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 2.0 to 2.3 | 2.2 to 2.6 | 2.0 to 2.4 | |

| Jun 2015 | 1.8 to 2.0 | 2.4 to 2.7 | 2.1 to 2.5 | |

The unemployment rate was at 5.0% in October and November, so the unemployment rate projection for Q4 2015 will probably be changed to 5.0% (at the lower end of Sept projection).

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | |

| Sept 2015 | 5.0 to 5.1 | 4.7 to 4.9 | 4.7 to 4.9 | |

| Jun 2015 | 5.2 to 5.3 | 4.9 to 5.1 | 4.9 to 5.1 | |

As of October, PCE inflation was up only 0.2% from October 2014. Since oil prices have declined further since September, headline PCE inflation could move down some more in November and December. Overall PCE inflation projections will probably be revised down for 2015, and will be well below the FOMC's 2% target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 0.3 to 0.5 | 1.5 to 1.8 | 1.8 to 2.0 | |

| Jun 2015 | 0.6 to 0.8 | 1.6 to 1.9 | 1.9 to 2.0 | |

PCE core inflation was up only 1.3% in October year-over-year. It appears PCE inflation will be in the September forecast range, and will be mostly unrevised.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 1.3 to 1.4 | 1.5 to 1.8 | 1.8 to 2.0 | |

| Jun 2015 | 1.3 to 1.4 | 1.6 to 1.9 | 1.9 to 2.0 | |

Overall, it appears the labor market has improved, and the economy is growing about as expected - although inflation is still low.