by Calculated Risk on 9/29/2015 05:14:00 PM

Tuesday, September 29, 2015

Zillow Forecast: Expect August Year-over-year Change for Case-Shiller Index Similar to July

The Case-Shiller house price indexes for July were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Forecast: Expect August's Data to Look a Lot Like July's

The July S&P/Case-Shiller (SPCS) data published today showed home prices dipping on a seasonally-adjusted monthly basis, with both the 10- and 20-city indices falling 0.2 percent from June to July.This suggests the year-over-year change for the August Case-Shiller National index will be about the same as in the July report.

On an annual basis, the 10-city index was up 4.5 percent from July 2014, while the 20-city index increased 5 percent over the past year. The U.S. National Index was up 4.7 percent year-over-year. We expect the August SPCS to show a second consecutive monthly decline in the 10-city index, down 0.1 percent from July to August, and the 20-city index to be flat over the same period (seasonally adjusted). The National Index is expected to grow 0.4 percent (seasonally adjusted) in August from July. We expect all three indices to show annual appreciation of less than 5 percent when August data is released next month.

All SPCS forecasts are shown in the table below. These forecasts are based on today’s July SPCS data release and the August 2015 Zillow Home Value Index (ZHVI), released September 21. The SPCS Composite Home Price Indices for July will not be officially released until Tuesday, October 27.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| July Actual YoY | 4.5% | 4.5% | 5.0% | 5.0% | 4.7% | 4.7% |

| August Forecast YoY | 4.5% | 4.5% | 4.9% | 4.9% | 4.8% | 4.8% |

| August Forecast MoM | 0.1% | -0.1% | 0.1% | 0.0% | 0.3% | 0.4% |

Shutdown Update

by Calculated Risk on 9/29/2015 02:14:00 PM

From the LA Times: Congress moves closer to averting government shutdown with Senate vote

With Wednesday's funding deadline looming, the Senate overwhelmingly advanced the government funding bill by a 77-19 vote. More than half the Republicans in the Senate joined Democrats to break the filibuster by conservative Republicans, led by Sen. Ted Cruz of Texas ...If it doesn't pass the House by Wednesday night, the Government will shutdown. It seems likely this will pass.

Final passage in the Senate is likely to come Tuesday. The House is expected to vote Wednesday.

However, there is growing concern about a shutdown later this year - that might include Congress threatening (once again) to not pay the bills.

From Dara Lind at Vox: The next government shutdown fight, explained

The next funding bill is currently working its way through the Senate, and will come to the House sometime Wednesday. Congress was supposed to fund the government for the entire 2016 fiscal year, which begins on October 1. But instead, the Senate bill only funds the government through December 11.The so-called "debt ceiling" will probably be reached in November, so both of these issues will be tied together (the "debt ceiling" is misleading - it sounds fiscally responsible, but it is actually about paying the bills - and not paying the bills would be irresponsible).

John Schoen at CNBC discusses this: How the government shutdown may be averted, for now

The debt issued by the Treasury is used to pay for spending that Congress has already authorized for goods and services the government has already provided. It would be like trying to control your household spending by not paying a credit card charge for a meal you've already eaten.Right now it looks like there won't be a shutdown this week.

Freezing the debt ceiling does nothing to better manage future spending or make government do more with less money.

If anything, forcing the Treasury to default on its debt would only increase government spending because it would raise future borrowing costs. Just as a deadbeat consumer who doesn't pay legitimate credit card charges has to pay higher interest rates, investors in U.S. Treasurys would demand higher returns to offset the risk of Congress pulling this stunt again.

Real Prices and Price-to-Rent Ratio in July

by Calculated Risk on 9/29/2015 11:42:00 AM

Yesterday, San Francisco Fed President John Williams said:

I am starting to see signs of imbalances emerge in the form of high asset prices, especially in real estate, and that trips the alert system. One lesson I have taken from past episodes is that, once the imbalances have grown large, the options to deal with them are limited. I think back to the mid-2000s, when we faced the question of whether the Fed should raise rates and risk pricking the bubble or let things run full steam ahead and deal with the consequences later. What stayed with me were not the relative merits of either case, but the fact that by then, with the housing boom in full swing, it was already too late to avoid bad outcomes. Stopping the fallout would’ve required acting much earlier, when the problems were still manageable. I’m not assigning blame by any means, and economic hindsight is always 20/20. But I am conscious that today, the house price-to-rent ratio is where it was in 2003, and house prices are rapidly rising. I don’t think we’re at a tipping point yet—but I am looking at the path we’re on and looking out for potential potholes.Williams is looking at something like the third graph below. This shows the price-to-rent ratio is elevated, but nothing like during the housing bubble (and there are few signs of speculations).

emphasis added

Here is the earlier post: Case-Shiller: National House Price Index increased 4.7% year-over-year in July

The year-over-year increase in prices is mostly moving sideways now at between 4% and 5%.. In October 2013, the National index was up 10.9% year-over-year (YoY). In July 2015, the index was up 4.7% YoY.

Here is the YoY change since January 2014 for the National Index:

| Month | YoY Change |

|---|---|

| Jan-14 | 10.5% |

| Feb-14 | 10.2% |

| Mar-14 | 8.9% |

| Apr-14 | 7.9% |

| May-14 | 7.0% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.6% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.4% |

| Feb-15 | 4.3% |

| Mar-15 | 4.3% |

| Apr-15 | 4.4% |

| May-15 | 4.5% |

| Jun-15 | 4.5% |

| Jul-15 | 4.7% |

Most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it is good news for housing and the economy.

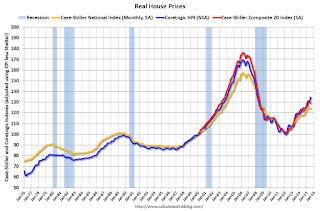

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.0% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to April 2003, and the CoreLogic index back to December 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.2% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to April 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to November 2003.

This is the graph SF President John Williams mentioned yesterday.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

Case-Shiller: National House Price Index increased 4.7% year-over-year in July

by Calculated Risk on 9/29/2015 09:15:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: July Home Price Gains Concentrated in the West According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 4.7% annual increase in July 2015 versus a 4.5% increase in June 2015. The 10-City Composite was virtually unchanged from last month, rising 4.5% year-over-year. The 20-City Composite had higher year-over-year gains, with an increase of 5.0%.

...

Before seasonal adjustment, the National Index posted a gain of 0.7% month-over-month in July. The 10-City Composite and 20-City Composite both reported gains of 0.6% month-over-month. After seasonal adjustment, the National index posted a gain of 0.4%, while the 10-City and 20-City Composites were both down 0.2% month-over-month. All 20 cities reported increases in July before seasonal adjustment; after seasonal adjustment, 10 were down, nine were up, and one was unchanged.

...

“The S&P/Case Shiller National Home Price Index has risen at a 4% or higher annual rate since September 2012, well ahead of inflation. Most of the strength is focused on states west of the Mississippi. The three cities with the largest cumulative price increases since January 2000 are all in California: Los Angeles (138%), San Francisco (116%) and San Diego (115%). The two smallest gains since January 2000 are Detroit (3%) and Cleveland (10%). The Sunbelt cities – Miami, Tampa, Phoenix and Las Vegas – which were the poster children of the housing boom have yet to make new all-time highs. [says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices.]

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.9% from the peak, and down 0.3% in July (SA).

The Composite 20 index is off 13.7% from the peak, and down 0.2% (SA) in July.

The National index is off 7.0% from the peak, and up 0.4% (SA) in July. The National index is up 25.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.6% compared to July 2014.

The Composite 20 SA is up 5.0% year-over-year..

The National index SA is up 4.7% year-over-year.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in July seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 39.5% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 52% above January 2000 (52% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 12% above the change in overall prices due to inflation.

Two cities - Denver (up 67% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston, Charlotte, San Francisco, Portland). Detroit prices are barely above the January 2000 level.

I'll have more on house prices later.

Monday, September 28, 2015

Today in Fed Speak

by Calculated Risk on 9/28/2015 06:59:00 PM

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices. The consensus is for a 5.3% year-over-year increase in the Comp 20 index for July. The Zillow forecast is for the National Index to increase 4.6% year-over-year in July.

Today in Fed speak: This year, this year, and "middle of next year".

From NY Fed President William Dudley: Fed’s Dudley: Still Likely on Track for 2015 Rate Rise

“If the economy continues on the same trajectory it’s on…and everything else suggests that’s likely to continue…then there is a pretty strong case for lifting off” before 2015 ends, he said in a Wall Street Journal interview.From SF Fed President John Williams: The Economic Outlook: Live Long and Prosper

emphasis added

Looking forward, I expect that we’ll reach our maximum employment mandate in the near future and inflation will gradually move back to our 2 percent goal. In that context, it will make sense to gradually move away from the extraordinary stimulus that got us here. We already took a step in that direction when we ended QE3. And given the progress we’ve made and continue to make on our goals, I view the next appropriate step as gradually raising interest rates, most likely starting sometime later this year. Of course, that view is not immutable and will respond to economic developments over time.From Chicago Fed President Charles Evans: Thoughts on Leadership and Monetary Policy

Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment. I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation. After liftoff, I think it would be appropriate to raise the target interest rate very gradually. This would give us sufficient time to assess how the economy is adjusting to higher rates and the progress we are making toward our policy goals

ATA Trucking Index decreased 0.9% in August

by Calculated Risk on 9/28/2015 05:08:00 PM

From the ATA: ATA Truck Tonnage Index Fell 0.9% in August

AAmerican Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index declined 0.9% in August, following a revised increase of 3.1% during July. In August, the index equaled 134.2 (2000=100), down from 135.3 in July. The all-time high of 135.8 was reached in January 2015.

Compared with August 2014, the SA index increased 2.1%, which was below the 4% gain in July. Year-to-date through August, compared with the same period last year, tonnage was up 3.3%.

...

After such a robust July, it is not too surprising that tonnage took a breather in August,” said ATA Chief Economist Bob Costello. “The dip after a strong gain goes with the up and down pattern we’ve seen this year.”

Costello said a few factors hurt August’s reading, including soft housing starts and falling factory output.

“As I said last month, I remain concerned about the high level of inventories throughout the supply chain. This could have a negative impact on truck freight volumes over the next few months,” he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 2.1% year-over-year.

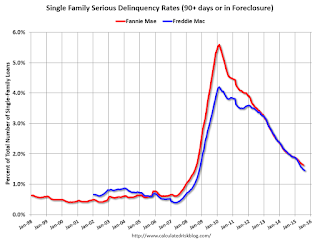

Freddie Mac: Mortgage Serious Delinquency rate declined in August, Lowest since October 2008

by Calculated Risk on 9/28/2015 12:55:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 1.45%, down from 1.48% in July. Freddie's rate is down from 1.98% in August 2014, and the rate in August was the lowest level since October 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for August later this week.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.53 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Dallas Fed: "Texas Manufacturing Activity Remains Steady" in September

by Calculated Risk on 9/28/2015 10:41:00 AM

From the Dallas Fed: Texas Manufacturing Activity Remains Steady

Texas factory activity was essentially flat in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained near zero (0.9), suggesting output held steady for a second month in a row after several months of declines.This was the last of the regional Fed surveys for September. All of the regional surveys indicated contraction in September, mostly due to weakness in oil producing areas.

...

Perceptions of broader business conditions remained weak in September. The general business activity index, which has been negative all year, rose 6 points to -9.5. The company outlook index plunged to -10.3 in August but recovered somewhat this month, climbing to -5.2.

Labor market indicators reflected employment declines and shorter workweeks. The September employment index posted a fifth consecutive negative reading, falling to -6.1.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

It seems likely the ISM index will be weak in September, and could possibly show contraction - a reading below 50. (although these regional surveys overemphasize oil producing areas). The consensus is for a decrease to 51.2 for the ISM index, from 51.6 in August.

NAR: Pending Home Sales Index decreased 1.4% in August, up 6% year-over-year

by Calculated Risk on 9/28/2015 10:02:00 AM

From the NAR: Pending Home Sales Retreat Again in August but Remain at Healthy Level

The Pending Home Sales Index, a forward–looking indicator based on contract signings, decreased 1.4 percent to 109.4 in August from 110.9 in July but is still 6.1 percent above August 2014 (103.1).This was below expectations of a 0.5% increase.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

Personal Income increased 0.3% in August, Spending increased 0.4%

by Calculated Risk on 9/28/2015 08:42:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $52.5 billion, or 0.3 percent ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $54.9 billion, or 0.4 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in August, compared with an increase of 0.3 percent in July. ... The price index for PCE increased 0.3 percent in May, compared with an increase of less than 0.1 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent in May, the same increase as in April.

The August price index for PCE increased 0.3 percent from August a year ago. The August PCE price index, excluding food and energy, increased 1.3 percent from August a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was lower than expected. And the increase in PCE was above the 0.3% increase consensus. Including upward revisions, this was a strong report.

On inflation: The PCE price index increased 0.3 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.3 percent year-over-year in August.

Using the two-month method to estimate Q3 PCE growth, PCE was increasing at a 3.5% annual rate in Q3 2015 (using the mid-month method, PCE was increasing 3.3%). This suggests the estimates for Q3 GDP will be revised up.