by Calculated Risk on 9/09/2015 06:45:00 PM

Wednesday, September 09, 2015

WSJ Articles on the FOMC Meeting next week

First from Jon Hilsenrath at the WSJ: Agreement on September Rate Increase Eludes Fed

Though officials appear to remain on track to raise rates this year—after September, there are Fed meetings in October and December—their recent remarks in interviews and elsewhere showed divisions and uncertainty about whether to move as soon as next week.It seems likely there will be several dissents at the meeting next week unless Fed Chair Janet Yellen can find a middle ground between the disparate views.

And analysis from Greg Ip at the WSJ: How the Fed Leaves Margin for Error Around Rate Hike

The Fed’s extraordinary patience thus far has brought the economy to the point where higher rates are no longer an existential threat. And by promising that the pace of rate increases will be glacial, the Fed gives itself ample room to stop or reverse course if something goes awry.Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 282 thousand the previous week.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.3% increase in inventories.

QE Timeline Update

by Calculated Risk on 9/09/2015 03:45:00 PM

With the first Fed Funds rate hike expected soon - maybe next week, maybe in October or December, or maybe early next year - here is an updated timeline of QE (and Twist operations):

• November 25, 2008: Press Release: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 purchases were completed at the end of Q2 2011.

• September 21, 2011: "Operation Twist" announced. "The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

• August 31, 2012: Fed Chairman Ben Bernanke hints at QE3: Analysis: Bernanke Clears the way for QE3 in September

• September 13, 2012: FOMC Statement: $40 Billion per month QE3 announced.

• December 12, 2012: FOMC Statement: Announced completion of "Operation Twist", expanded QE3 to $85 Billion per month.

• May 22, 2013: In Testimony to Congress, The Economic Outlook, Fed Chairman Ben Bernanke said “If we see continued improvement and we have confidence that that is going to be sustained, then in the next few meetings, we could take a step down in our pace of purchases.” (aka "Taper Tantrum").

• June 19, 2013: In Chairman Bernanke’s Press Conference, Bernanke said "If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year."

• December 18, 2013: FOMC Statement: Announced "tapering" of QE3. Note: QE3 tapered $10 billion per month at each meeting of 2014.

• October 29, 2014: FOMC Statement: FOMC completed QE3 in October 2014.

Las Vegas Real Estate in August: Sales Increased 11% YoY

by Calculated Risk on 9/09/2015 12:51:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Moving on up: GLVAR reports local home sales, prices up from same time last year

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in August was 3,454, up from 3,120 one year ago. Compared to August 2014, 11.2 percent more homes and 8.3 percent more condos and townhomes sold this August. Through Aug. 31, GLVAR reported a total of 26,225 sales so far in 2015, compared to 24,965 sales during the same period in 2014.There are several key trends that we've been following:

...

For more than two years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In August, 6.2 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 11.5 percent one year ago. Another 7.0 percent of August sales were bank-owned, down from 8.9 percent one year ago.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in August was 13,608, down 1.0 percent from one year ago. GLVAR tracked a total of 3,459 condos, high-rise condos and townhomes listed for sale on its MLS in August, down 4.5 percent from one year ago.

By the end of August, GLVAR reported 8,060 single-family homes listed without any sort of offer. That’s up 3.5 percent from one year ago. For condos and townhomes, the 2,319 properties listed without offers in August represented a 3.3 percent decrease from one year ago.

emphasis added

1) Overall sales were up 11% year-over-year.

2) Conventional (equity, not distressed) sales were up 21% year-over-year. In Aug 2014, 79.6% of all sales were conventional equity. In Aug 2015, 86.8% were standard equity sales.

3) The percent of cash sales has declined year-over-year from 32.1% in Aug 2014 to 28.2% in Aug 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 3.5% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

| Jun-15 | 4.3% |

| Jul-15 | 5.1% |

| Aug-15 | 3.5% |

BLS: Jobs Openings increased to 5.8 million in July, New Series High

by Calculated Risk on 9/09/2015 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings again rose to a series high of 5.8 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. The number of hires and separations edged down to 5.0 million and 4.7 million, respectively. Within separations, the quits rate was 1.9 percent for the fourth month in a row, and the layoffs and discharges rate declined to 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in July, little changed from June. Although the number of quits has been increasing overall since the end of the recession, the number has held between 2.7 million and 2.8 million for the past 11 months.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in July to 5.753 million from 5.323 million in June.

The number of job openings (yellow) are up 22% year-over-year compared to July 2014.

Quits are up 6% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are at a series high, and that quits are increasing year-over-year.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up Sharply YoY

by Calculated Risk on 9/09/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 4, 2015. ...

The Refinance Index decreased 10 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 41 percent higher than the same week one year ago. The annual change is inflated due to the shift in Labor Day from the first week in September last year to the second week this year.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.10 percent from 4.08 percent, with points increasing to 0.39 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

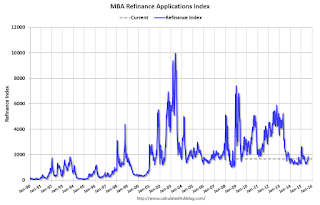

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

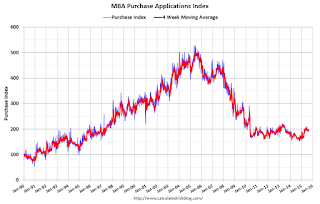

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 41% higher than a year ago - but is misleading due to the shift in timing of Labor Day.

Tuesday, September 08, 2015

Wednesday: Job Openings

by Calculated Risk on 9/08/2015 08:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Indecisively Higher

Mortgage rates moved back up into their recent indecisive range today, foiling a halfhearted attempt to move lower late last week. Much of the indecision is assumed to be due to the Fed's upcoming meeting. Many market participants think the Fed will hike rates for the first time since the Financial Crisis, though just as many think they'll hold off until December at the earliest. Mortgage rates are not directly dictated by the Fed's policy rate, but they tend to move higher during periods where the Fed is raising rates.Wednesday:

...

Most consumers will continue to see the same contract interest rates they've been seeing, and the adjustments will instead be seen in the form of slightly higher or lower closing costs. Most lenders continue to quote conventional 30yr fixed rates of 4.0% on top tier scenarios.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings decreased in June to 5.249 million from 5.357 million in May. The number of job openings were up 11% year-over-year, and Quits were up 1% year-over-year.

• Also at 10:00 AM, the Q2 Quarterly Services Report from the Census Bureau.

CBO: Fiscal 2015 Federal Deficit through August more than 10% below Last Year

by Calculated Risk on 9/08/2015 04:43:00 PM

More good news ... the budget deficit in fiscal 2015 will probably decline more than 10% compared to fiscal 2014.

From the Congressional Budget Office (CBO) today: Monthly Budget Review for August 2015

The federal government’s budget deficit amounted to $528 billion for the first 11 months of fiscal year 2015, the Congressional Budget Office estimates. That deficit was $61 billion smaller than the one recorded during the same period last year. Revenues and outlays were both higher than last year’s amounts, by 8 percent and 5 percent, respectively. Adjusted for shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the 11-month period decreased by $42 billion.The Treasury will run a surplus in September, and it appears the deficit for fiscal 2015 (ends in September) will be below 2.4% of GDP.

In its most recent budget projections, CBO estimated that the deficit for fiscal year 2015 (which will end on September 30, 2015) would total $426 billion, about $59 billion less than the shortfall in fiscal year 2014. ...

Phoenix Real Estate in August: Sales up 9%, Inventory down 14%

by Calculated Risk on 9/08/2015 01:57:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the ninth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in August were up 9.2% year-over-year.

2) Cash Sales (frequently investors) were down to 22.6% of total sales.

3) Active inventory is now down 13.7% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices are increasing a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 2.5% through June (prices increased more in 6 months in 2015, than all of 2014).

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Aug-08 | 5,660 | --- | 1,004 | 17.7% | 53,5691 | --- |

| Aug-09 | 8,008 | 41.5% | 2,849 | 35.6% | 38,085 | -28.9% |

| Aug-10 | 7,358 | -8.1% | 3,129 | 42.5% | 44,307 | 16.3% |

| Aug-11 | 8,712 | 18.4% | 3,953 | 45.4% | 26,983 | -39.1% |

| Aug-12 | 7,574 | -13.1% | 3,382 | 44.7% | 20,934 | -22.4% |

| Aug-13 | 7,055 | -6.9% | 2,409 | 34.1% | 21,444 | 2.4% |

| Aug-14 | 6,431 | -8.8% | 1,621 | 25.2% | 26,138 | 21.9% |

| Aug-15 | 7,023 | 9.2% | 1,588 | 22.6% | 22,554 | -13.7% |

| 1 August 2008 probably includes pending listings | ||||||

Black Knight July Mortgage Monitor

by Calculated Risk on 9/08/2015 10:42:00 AM

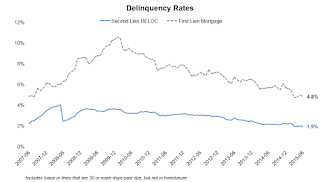

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for July today. According to BKFS, 4.71% of mortgages were delinquent in July, down from 4.82% in June. BKFS reported that 1.40% of mortgages were in the foreclosure process, down from 1.85% in July 2014.

This gives a total of 6.11% delinquent or in foreclosure. It breaks down as:

• 1,503,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 886,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 711,000 loans in foreclosure process.

For a total of 3,100,000 loans delinquent or in foreclosure in July. This is down from 3,785,000 in July 2014.

Press Release: Black Knight’s July Mortgage Monitor: Total Equity in U.S. Mortgage Market at $7.6 Trillion, Up $825 Billion Year-to-Date; $4.5 Trillion in Equity “Tappable” by Borrowers

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of July 2015. Looking at the nation’s population of mortgage holders and comparing first and second lien debt against May property values, Black Knight has determined that total home equity in the U.S. has increased by nearly $1 trillion in the past year to the highest level since 2007. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, this growth in available equity has direct implications for borrowers’ ability to access the equity in their homes.

“We’ve seen total home equity in the mortgage market expand by $825 billion in just the first five months of this year,” said Graboske. “At $7.6 trillion, total net equity is nearly 2.5 times more than it was at the end of 2011, and is at the highest level it’s been since the start of the housing crisis. To put this growth in perspective, consider that the average American homeowner with a mortgage has about $19,000 more equity in his or her home today than a year ago."

Click on graph for larger image.

Click on graph for larger image.From Black Knight:

Second lien HELOC delinquency rates are currently at 1.9 percent, the lowest level seen since April 2007There is much more in the mortgage monitor.

Delinquency rates on second lien HELOCs have declined by over 11 percent so far in 2015, slightly behind the 16 percent reduction on first lien mortgage delinquencies

NFIB: Small Business Optimism Index increased in August

by Calculated Risk on 9/08/2015 09:18:00 AM

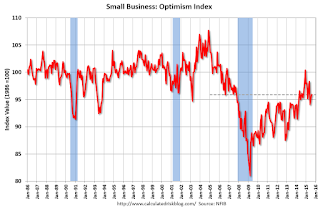

From the National Federation of Independent Business (NFIB): NFIB Small Business Optimism Index increased only 0.5 points last month

The Index of Small Business Optimism went nowhere in August, so the good news is it did not fall. Two Index components, job openings and earnings trends both posted a solid 4 point gain, but there was not much action in the remaining components ...

On balance, owners added a net 0.13 workers per firm in recent months, better than July’s 0.05 but historically a solid reading.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.9 in August from 95.4 in July.