by Calculated Risk on 9/08/2015 08:01:00 PM

Tuesday, September 08, 2015

Wednesday: Job Openings

From Matthew Graham at Mortgage News Daily: Mortgage Rates Indecisively Higher

Mortgage rates moved back up into their recent indecisive range today, foiling a halfhearted attempt to move lower late last week. Much of the indecision is assumed to be due to the Fed's upcoming meeting. Many market participants think the Fed will hike rates for the first time since the Financial Crisis, though just as many think they'll hold off until December at the earliest. Mortgage rates are not directly dictated by the Fed's policy rate, but they tend to move higher during periods where the Fed is raising rates.Wednesday:

...

Most consumers will continue to see the same contract interest rates they've been seeing, and the adjustments will instead be seen in the form of slightly higher or lower closing costs. Most lenders continue to quote conventional 30yr fixed rates of 4.0% on top tier scenarios.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings decreased in June to 5.249 million from 5.357 million in May. The number of job openings were up 11% year-over-year, and Quits were up 1% year-over-year.

• Also at 10:00 AM, the Q2 Quarterly Services Report from the Census Bureau.

CBO: Fiscal 2015 Federal Deficit through August more than 10% below Last Year

by Calculated Risk on 9/08/2015 04:43:00 PM

More good news ... the budget deficit in fiscal 2015 will probably decline more than 10% compared to fiscal 2014.

From the Congressional Budget Office (CBO) today: Monthly Budget Review for August 2015

The federal government’s budget deficit amounted to $528 billion for the first 11 months of fiscal year 2015, the Congressional Budget Office estimates. That deficit was $61 billion smaller than the one recorded during the same period last year. Revenues and outlays were both higher than last year’s amounts, by 8 percent and 5 percent, respectively. Adjusted for shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the 11-month period decreased by $42 billion.The Treasury will run a surplus in September, and it appears the deficit for fiscal 2015 (ends in September) will be below 2.4% of GDP.

In its most recent budget projections, CBO estimated that the deficit for fiscal year 2015 (which will end on September 30, 2015) would total $426 billion, about $59 billion less than the shortfall in fiscal year 2014. ...

Phoenix Real Estate in August: Sales up 9%, Inventory down 14%

by Calculated Risk on 9/08/2015 01:57:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the ninth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in August were up 9.2% year-over-year.

2) Cash Sales (frequently investors) were down to 22.6% of total sales.

3) Active inventory is now down 13.7% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices are increasing a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 2.5% through June (prices increased more in 6 months in 2015, than all of 2014).

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Aug-08 | 5,660 | --- | 1,004 | 17.7% | 53,5691 | --- |

| Aug-09 | 8,008 | 41.5% | 2,849 | 35.6% | 38,085 | -28.9% |

| Aug-10 | 7,358 | -8.1% | 3,129 | 42.5% | 44,307 | 16.3% |

| Aug-11 | 8,712 | 18.4% | 3,953 | 45.4% | 26,983 | -39.1% |

| Aug-12 | 7,574 | -13.1% | 3,382 | 44.7% | 20,934 | -22.4% |

| Aug-13 | 7,055 | -6.9% | 2,409 | 34.1% | 21,444 | 2.4% |

| Aug-14 | 6,431 | -8.8% | 1,621 | 25.2% | 26,138 | 21.9% |

| Aug-15 | 7,023 | 9.2% | 1,588 | 22.6% | 22,554 | -13.7% |

| 1 August 2008 probably includes pending listings | ||||||

Black Knight July Mortgage Monitor

by Calculated Risk on 9/08/2015 10:42:00 AM

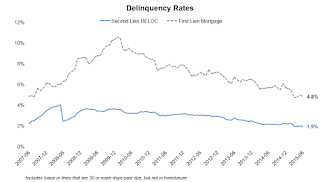

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for July today. According to BKFS, 4.71% of mortgages were delinquent in July, down from 4.82% in June. BKFS reported that 1.40% of mortgages were in the foreclosure process, down from 1.85% in July 2014.

This gives a total of 6.11% delinquent or in foreclosure. It breaks down as:

• 1,503,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 886,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 711,000 loans in foreclosure process.

For a total of 3,100,000 loans delinquent or in foreclosure in July. This is down from 3,785,000 in July 2014.

Press Release: Black Knight’s July Mortgage Monitor: Total Equity in U.S. Mortgage Market at $7.6 Trillion, Up $825 Billion Year-to-Date; $4.5 Trillion in Equity “Tappable” by Borrowers

Today, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of July 2015. Looking at the nation’s population of mortgage holders and comparing first and second lien debt against May property values, Black Knight has determined that total home equity in the U.S. has increased by nearly $1 trillion in the past year to the highest level since 2007. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, this growth in available equity has direct implications for borrowers’ ability to access the equity in their homes.

“We’ve seen total home equity in the mortgage market expand by $825 billion in just the first five months of this year,” said Graboske. “At $7.6 trillion, total net equity is nearly 2.5 times more than it was at the end of 2011, and is at the highest level it’s been since the start of the housing crisis. To put this growth in perspective, consider that the average American homeowner with a mortgage has about $19,000 more equity in his or her home today than a year ago."

Click on graph for larger image.

Click on graph for larger image.From Black Knight:

Second lien HELOC delinquency rates are currently at 1.9 percent, the lowest level seen since April 2007There is much more in the mortgage monitor.

Delinquency rates on second lien HELOCs have declined by over 11 percent so far in 2015, slightly behind the 16 percent reduction on first lien mortgage delinquencies

NFIB: Small Business Optimism Index increased in August

by Calculated Risk on 9/08/2015 09:18:00 AM

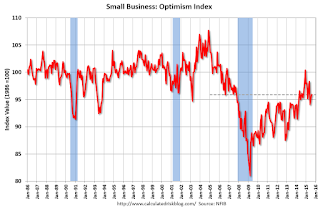

From the National Federation of Independent Business (NFIB): NFIB Small Business Optimism Index increased only 0.5 points last month

The Index of Small Business Optimism went nowhere in August, so the good news is it did not fall. Two Index components, job openings and earnings trends both posted a solid 4 point gain, but there was not much action in the remaining components ...

On balance, owners added a net 0.13 workers per firm in recent months, better than July’s 0.05 but historically a solid reading.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.9 in August from 95.4 in July.

Monday, September 07, 2015

Monday Night Futures

by Calculated Risk on 9/07/2015 08:15:00 PM

Weekend:

• Schedule for Week of September 6, 2015

Tuesday:

• At 9:00 AM ET, the NFIB Small Business Optimism Index for August.

• At 10:00 AM, the Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 3:00 PM, Consumer Credit for July from the Federal Reserve. The consensus is for an increase of $18 billion in credit.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 20 and DOW futures are up 150 (fair value).

Oil prices were down over the last week with WTI futures at $44.61 per barrel and Brent at $47.63 per barrel. A year ago, WTI was at $97, and Brent was at $100 - so prices are down over 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.39 per gallon (down more than $1.00 per gallon from a year ago). Gasoline prices will probably continue to decline over the next month (follow oil prices down).

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 9/07/2015 11:06:00 AM

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity.

Demographics are now improving in the U.S.!

Sunday, September 06, 2015

August Employment Revisions

by Calculated Risk on 9/06/2015 11:43:00 AM

Last year, in 2014, the BLS initially reported job gains in August at 142,000. Douglas Holtz-Eakin wrote "Disaster!". I couldn't help myself and made fun of Holtz-Eakin.

Not only wasn't the initial August 2014 report a "disaster", but it has since been revised up to 213,000. And 2014 was the best year for employment gains since the '90s. Some "disaster"!

Here is a table of revisions for August since 2005. Note that most of the revisions have been up. This doesn't mean that the August 2015 revision will be up, but it does seem likely. I'm not sure why the BLS has underestimated job growth in August (possibly because of the timing of end of the summer job changes).

Overall I think the August employment report was decent and indicates further improvement in the labor market.

| August Employment Report (000s) | |||

|---|---|---|---|

| Year | Initial | Revised | Revision |

| 2005 | 169 | 196 | 27 |

| 2006 | 128 | 185 | 57 |

| 2007 | -4 | -17 | -13 |

| 2008 | -84 | -259 | -175 |

| 2009 | -216 | -217 | -1 |

| 2010 | -54 | -39 | 15 |

| 2011 | 0 | 128 | 128 |

| 2012 | 96 | 188 | 92 |

| 2013 | 169 | 256 | 87 |

| 2014 | 142 | 213 | 71 |

| 2015 | 173 | --- | --- |

Note: In 2008, the BLS significantly under reported jobs losses. That wasn't surprising since the initial models the BLS used missed turning points (something I wrote about in 2007). The BLS has since improved this model.

Saturday, September 05, 2015

Schedule for Week of September 6, 2015

by Calculated Risk on 9/05/2015 08:11:00 AM

This will be light week for economic data.

All US markets will be closed in observance of the Labor Day holiday.

9:00 AM ET: NFIB Small Business Optimism Index for August.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

3:00 PM: Consumer Credit for July from the Federal Reserve. The consensus is for an increase of $18 billion in credit.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in June to 5.249 million from 5.357 million in May.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 1% year-over-year.

10:00 AM: The Q2 Quarterly Services Report from the Census Bureau.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 282 thousand the previous week.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.3% increase in inventories.

8:30 AM ET: The Producer Price Index for August from the BLS. The consensus is for a 0.2% decrease in prices, and a 0.1% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 91.0, down from 91.9 in August.

2:00 PM ET: The Monthly Treasury Budget Statement for August.

Friday, September 04, 2015

Will the Fed raise rates in September?

by Calculated Risk on 9/04/2015 07:22:00 PM

Economist are uncertain whether the Fed will increase the Fed Funds rate in September ...

From Neil Irwin at the NY Times The Upshot: A Positive Jobs Report Keeps the Fed in a Tricky Spot

Nothing about the latest numbers is likely to tip the balance for the Fed one way or the other. The unemployment rate is now down to 5.1 percent, its lowest since April 2008, when the Great Recession was a mere toddler. The 173,000 payroll jobs added in August were a little below analyst expectations, but revisions to earlier months were positive. Average hourly earnings rose a healthy 0.3 percent.From the WSJ: Blurry Job Picture Poses Test for Fed

Friday’s report, the last major gauge of job-market health before the Fed’s Sept. 16-17 meeting, leaves the central bank with a difficult decision as it ponders raising short-term interest rates this month for the first time since 2006: Has the U.S. economy improved enough to absorb higher rates, or does the fragile state of the world economy and the financial markets call for more patience?The key sentence in the July FOMC statement was

"The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term."Since that statement, the economy added 245 thousand jobs in July and 173 thousand jobs in August (and frequently August is revised up). The unemployment rate declined from 5.3% in June to 5.1% in August. My view is this is probably the "some further improvement" in the labor market that the FOMC mentioned in the July statement.

So the focus at the FOMC meeting will probably be on inflation. Is the FOMC "reasonably confident that inflation will move back to its 2 percent objective over the medium term" (emphasis added).

Fed Vice Chairman Stanley Fischer said last week:

As I have discussed, given the apparent stability of inflation expectations, there is good reason to believe that inflation will move higher as the forces holding down inflation dissipate further. While some effects of the rise in the dollar may be spread over time, some of the effects on inflation are likely already starting to fade. The same is true for last year's sharp fall in oil prices, though the further declines we have seen this summer have yet to fully show through to the consumer level. And slack in the labor market has continued to diminish, so the downward pressure on inflation from that channel should be diminishing as well.Although inflation may be low over the next few months (lower oil prices), it sounds like Fischer is "reasonably confident" that inflation will move higher in the "medium term". So my guess right now (with less than two weeks until the meeting) is the FOMC will raise rates at the September meeting.

emphasis added

Note: It is a different question if the Fed "should" raise rates in September. Clearly the risks are asymmetrical (hiking too soon poses much larger risks than waiting too long), and that argues for waiting a little longer. Also I've argued for some time (based partly on demographics) that the unemployment rate could fall further without inflation picking up.