by Calculated Risk on 8/13/2015 09:00:00 PM

Thursday, August 13, 2015

Friday: PPI, Industrial Production, Consumer Sentiment

NOTE: CR is on vacation and will return on Sunday, August 23rd.

Friday:

• At 8:30 AM ET, the Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 93.5, up from 93.1 in July.

CR takes a Vacation!

by Calculated Risk on 8/13/2015 05:47:00 PM

I'll be on vacation - at an undisclosed location - starting tomorrow morning. I'm going to unplug completely from the internet for 10 days (hopefully nothing too crazy will happen).

I will return on August 23rd.

I've arranged to have posts every day, but there will not be any current reports (so I'll miss housing starts and existing home sales for July to be released next week).

All my best to everyone, Bill

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/13/2015 02:42:00 PM

From housing economist Tom Lawler:

Based on reports from local realtors/MLS from across the country released through today, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.64 million in July, up 2.7% from June’s pace and up 11.2% from last July’s seasonally adjusted pace.

I also project that the NAR’s estimate of the number of existing homes for sale at the end of July will be about 2.37 million, up 3.0% from June and up 0.9% from last July.

Finally, I predict that the NAR’s estimate of the median existing SF home sales price in July will be up by about 5.3% from last July.

CR Note: The NAR is scheduled to report July existing home sales next Thursday at 10:00 AM. The sales rate in July will likely be the highest since February 2007.

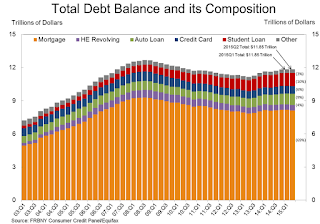

NY Fed: Household Debt "Flat" in Q2 2015

by Calculated Risk on 8/13/2015 11:34:00 AM

Here is the Q2 report: Household Debt and Credit Report.

From the NY Fed: Auto Loans Race Ahead, Foreclosures Plunge, and Overall Household Debt Remains Flat

Household debt balances were largely flat in the second quarter of this year, according to the Federal Reserve Bank of New York’s Household Debt and Credit Report. Total indebtedness increased just $2 billion from Q1 2015. Foreclosures hit their lowest point in the 16-year history of the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Auto loan originations reached a 10-year high in the second quarter, at $119 billion, supporting a $38 billion increase in the aggregate auto loan balance, which has now passed $1 trillion. The increase in auto loans also drove most of the $67 billion increase in non-housing debt balances. Credit card balances increased, by $19 billion, to $703 billion, while student loan balances remained flat. Mortgage balances and HELOC dropped by $55 billion and $11 billion, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased slightly in Q2. Household debt peaked in 2008, and bottomed in Q2 2013.

The recent increase in debt suggests household (in the aggregate) deleveraging is over although mortgage debt is still declining (foreclosures of legacy loans continue).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased to 5.6% in Q2, from 5.7% in Q1.

There are a number of credit graphs at the NY Fed site.

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q2

by Calculated Risk on 8/13/2015 10:55:00 AM

From the MBA: Mortgage Delinquencies and Foreclosures Continue to Drop in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.30 percent of all loans outstanding at the end of the second quarter of 2015. This was the lowest level since the second quarter of 2007. The delinquency rate decreased 24 basis points from the previous quarter, and 74 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 2.09 percent, down 13 basis points from the first quarter and 40 basis points lower than the same quarter one year ago. This was the lowest foreclosure inventory rate since the fourth quarter of 2007.

...

Marina Walsh, MBA's Vice President of Industry Analysis, offered the following commentary on the survey:

"Overall delinquency rates and the percentage of loans in foreclosure continued to fall in the second quarter and are at their lowest levels since 2007. Even more telling, nearly every state in the nation reported declining foreclosure inventory rates over the second quarter, reflecting a nationwide housing market recovery and strong job market that provide opportunities for distressed loans to be resolved rather than be put into foreclosure.

...

"As has been the case since the fourth quarter of 2012, New Jersey, New York, and Florida had the highest percentage of loans in foreclosure in the nation. ... "Legacy loans continued to account for the majority of all troubled mortgages. 73 percent of the loans that were seriously delinquent, either more than 90 days delinquent or in the foreclosure process were originated before 2008, even as the overall rate of serious delinquencies for those cohorts decreased."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 78% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 75% of the way back to normal.

So it has taken over 5 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 75%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Weekly Initial Unemployment Claims increased to 274,000, 4-Week Average Lowest since 2000

by Calculated Risk on 8/13/2015 09:15:00 AM

The DOL reported:

In the week ending August 8, the advance figure for seasonally adjusted initial claims was 274,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 270,000 to 269,000. The 4-week moving average was 266,250, a decrease of 1,750 from the previous week's revised average. This is the lowest level for this average since April 15, 2000 when it was 266,250. The previous week's average was revised down by 250 from 268,250 to 268,000.The previous week was revised down by 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 266,250.

This was higher than the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

This ties, with April 15, 2000, the lowest level for the 4-week average since 1973 (over 40 years).

Retail Sales increased 0.6% in July

by Calculated Risk on 8/13/2015 08:39:00 AM

On a monthly basis, retail sales were up 0.6% from June to July (seasonally adjusted), and sales were up 2.4% from July 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $446.5 billion, an increase of 0.6 percent from the previous month, and up 2.4 percent above July 2014. ... The May 2015 to June 2015 percent change was revised from -0.3 percent to virtually unchanged.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased 0.6%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis (2.4% for all retail sales including gasoline).

Retail and Food service sales ex-gasoline increased by 4.5% on a YoY basis (2.4% for all retail sales including gasoline).The increase in July was above the consensus expectations of a 0.5% increase, and sales in May and June were revised up. A solid report.

Wednesday, August 12, 2015

Thursday: Retail Sales, Unemployment Claims, NY Fed Q2 Household Debt and Credit Report

by Calculated Risk on 8/12/2015 07:27:00 PM

From the WSJ: Surge in Commercial Real-Estate Prices Stirs Bubble Worries

The valuations of office buildings sold in London, Hong Kong, Osaka and Chicago hit record highs in the second quarter of this year and reached post-1999 highs in New York, Los Angeles, Berlin and Sydney, according to industry tracker Real Capital Analytics.I haven't seen the wild speculative CRE lending like in 2005 and 2006, so I'm not concerned.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 270 thousand.

• Also at 8:30 AM, Retail sales for July will be released. The consensus is for retail sales to increase 0.5% in July, and to increase 0.4% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.3% increase in inventories.

• At 11:00 AM, the New York Fed will release the Q2 2015 Household Debt and Credit Report

Sacramento Housing in July: Sales up 12%, Inventory down 11% YoY

by Calculated Risk on 8/12/2015 03:32:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In July, total sales were up 12.3% from July 2014, and conventional equity sales were up 16.3% compared to the same month last year.

In July, 9.1% of all resales were distressed sales. This was down from 10.7% last month, and down from 12.3% in July 2014. This is the lowest percentage of distressed sales since they started breaking out distressed sales).

The percentage of REOs was at 4.7% in July, and the percentage of short sales was 4.4%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 10.8% year-over-year (YoY) in July. This was the third consecutive monthly YoY decrease in inventory in Sacramento (a big recent change).

Cash buyers accounted for 16.5% of all sales (frequently investors).

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.

The Shrinking Deficit

by Calculated Risk on 8/12/2015 02:07:00 PM

From the WSJ: Budget Deficit Totaled $488 Billion For Year Ended July, Down 9% From Year Earlier

The U.S. budget deficit rose in July but stood around 9% below its year-earlier level, the Treasury Department said on Wednesday.The most recent CBO projection was for the fiscal 2015 budget deficit to be 2.7% of GDP. Right now it looks like fiscal 2015 will be under 2.4% (a significant improvement).

The budget outlook has improved this year as economic growth has boosted revenues, but outlays were significantly higher in July from a year earlier, in part due to calendar timing differences. The U.S. ran a $149 billion deficit in July, a month in which the government typically runs a deficit.

...

The Congressional Budget Office last week said it expected the U.S. would run a $425 billion deficit for the fiscal year that ends Sept. 30, down more than 12% from its earlier forecast of $486 billion and from the prior year’s $483 billion deficit.