by Calculated Risk on 7/14/2015 06:34:00 PM

Tuesday, July 14, 2015

Wednesday: Yellen, Industrial Production, NY Fed Mfg Survey, Beige Book and more

From the WSJ: White House Cuts Growth Forecast for 2015, 2016

The White House said it sees U.S. growth rising by just 2% this year before rebounding to 2.9% in 2016—down from its earlier forecast of 3% growth for both 2015 and 2016 released in February—after the economy stalled during the first quarter.Due to demographics, 2% really is the new 4%. But there is good news on the deficit and unemployment!

...

The White House estimates that the annual budget deficit will fall to $455 billion this year, down 22% from its estimate of $583 billion in February.

...

It sees the unemployment rate falling to 5.3% this year and 4.9% next year, down from forecasts of 5.4% and 5.1%, respectively, published in February.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• Also at 8:30 AM, the NY Fed Empire State Manufacturing Survey for July. The consensus is for a reading of 3.5, up from -2.0 last month (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.1%.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Update: The California Budget Surplus

by Calculated Risk on 7/14/2015 03:23:00 PM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved significantly since then. Here is the most recent update from California State Controller Betty Yee: CA Controller’s June Cash Report Shows Another Surge to End 2014-15 Fiscal Year

California ended the fiscal year with another unexpected revenue surge in June, with total General Fund receipts surpassing the Governor’s May estimates by $859.4 million, according to State Controller Betty T. Yee’s monthly report of California’s cash balance, receipts, and disbursements published today.Some states are still struggling, but California is doing much better.

For the second year in a row, the General Fund ended with a positive cash balance.

June capped a 12-month boom in state revenues, driven largely by personal income tax. For the fiscal year ending June 30, total revenues for the General Fund (the source of most state spending) were $6.8 billion more than anticipated a year ago, when the 2014-15 budget was enacted. This was 6.4 percent higher than projected. Compared to the previous fiscal year, California revenues were $12.7 billion higher, a bump of 12.5 percent.

June’s revenues easily outstripped projections included in the Governor’s revised budget released only a month earlier. Personal income tax led the way, coming in $762.5 million higher than anticipated in the May Revision

emphasis added

CoreLogic: "Foreclosure Rate of 1.3 Percent is Back to December 2007 Levels"

by Calculated Risk on 7/14/2015 12:40:00 PM

From CoreLogic: National Overview through May 2015

A CoreLogic analysis shows 41,000 foreclosures were completed in May 2015, a 19.2 percent year-over-year decline from 51,000 in May 2014. By comparison, before the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

...

Approximately 491,000 homes in the United States were in some stage of foreclosure as of May 2015, compared to 676,000 in May 2014, a decrease of 27.4 percent. This was the 43rd consecutive month with a year-over-year decline. As of May 2015, the foreclosure inventory represented 1.3 percent of all homes with a mortgage, compared to 1.7 percent in May 2014.

Click on graph for larger image.

Click on graph for larger image.Here is a map from the May report that shows foreclosure inventory by state.

Some key "bubble" states - like Arizona and California - have mostly recovered.

Several judicial foreclosure states - like New Jersey and Florida - are still struggling.

NFIB: Small Business Optimism Index decreased in June

by Calculated Risk on 7/14/2015 10:45:00 AM

From the National Federation of Independent Business (NFIB): Small Business Takes Significant Hit in June

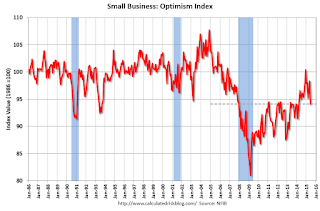

The Small Business Optimism Index fell 4.2 points to 94.1 ... The 42 year Index average is 98.0, while the pre-recession average is 99.5 (1974-2007). This leaves the current reading 4 points below the overall average ...

It looks like small businesses “hired in May and then went away”. So, small businesses took a breather from job creation in June after a string of five solid months of job creation. On balance, owners added a net -0.01 workers per firm in recent months, essentially zero.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 94.1 in June from 98.3 in May. This is the lowest level since May 2014.

Retail Sales decreased 0.3% in June

by Calculated Risk on 7/14/2015 08:39:00 AM

On a monthly basis, retail sales were down 0.3% from May to June (seasonally adjusted), and sales were up 1.4% from June 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $442.0 billion, a decrease of 0.3 percent from the previous month, but up 1.4 percent above June 2014. ... The April 2015 to May 2015 percent change was revised from +1.2 percent to +1.0 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline decreased 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.5% on a YoY basis (1.4% for all retail sales).

Retail and Food service sales ex-gasoline increased by 3.5% on a YoY basis (1.4% for all retail sales).The decrease in June was below the consensus expectations of unchanged, and sales in April and May were revised down. A weak report.

Monday, July 13, 2015

Tuesday: Retail Sales

by Calculated Risk on 7/13/2015 05:56:00 PM

The verdict is almost unanimous. The Greek deal is bad for Greece, bad for Germany and bad for Europe. Everyone loses.

It appears the negotiations became personal - and destructive. Europe was Schäuble'd.

From the WSJ: Third Time’s the Charm? Little Optimism Over New Greece Bailout

The plan repeats the central features of the previous bailouts in 2010 and 2012. In return for loans, Greece’s creditors—other eurozone governments and the International Monetary Fund—want to see stringent fiscal retrenchment as well as market-oriented overhauls of Greece’s economy.The definition of insanity: "doing the same thing over and over again and expecting different results." (attributed to Einstein).

...

Although heavy austerity greatly reduced Greece’s budget deficit, the economic collapse meant that its ratio of debt to gross domestic product—an indicator of solvency—rose even higher. ...

Critics including many economists and some policy makers have leveled a string of criticisms at Greece’s earlier bailouts. Among the most common charges: The scale and pace of fiscal austerity proved to be an overdose that Greece’s sclerotic economy and unstable political system couldn’t cope with. Forecasts for growth, tax revenues and privatization revenues were overly optimistic.

Tuesday:

• At 8:30 AM ET, Retail sales for June will be released. The consensus is for retail sales to increase 0.3% in June, and to increase 0.6% ex-autos.

• At 9:00 AM, NFIB Small Business Optimism Index for June.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.2% increase in inventories.

The Shrinking Deficit

by Calculated Risk on 7/13/2015 02:37:00 PM

From the WSJ: U.S. Annual Budget Deficit Remains Near 7-Year Low in June

The U.S. reported a $52 billion surplus in June, a month in which the government in recent decades has typically generated a surplus on account of corporate and individual taxes collected at month’s end.The most recent CBO projection was for the fiscal 2015 budget deficit to be 2.7% of GDP. Right now it looks like fiscal 2015 will be closer to 2.4% (a significant change).

The monthly surplus brought the budget deficit over the past 12 months to $431 billion, down nearly 20% from a year earlier.

...

Meanwhile, Congress has yet to raise the federal debt limit. The Treasury has been using emergency measures since mid-March to avoid breaching the ceiling.

The Treasury hasn’t said how long it might be able to do that, but budget analysts have said the emergency measures could last until November or December.

Zillow Forecast: Expect Case-Shiller National House Price Index up 4.0% year-over-year change in May

by Calculated Risk on 7/13/2015 11:59:00 AM

The Case-Shiller house price indexes for April were released two weeks ago. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Expected to Continue Recent Leveling-Off Trend in May

The April S&P/Case-Shiller (SPCS) data published [2 weeks ago] showed home prices continuing to rise slightly less than 5 percent annually for both the 10- and 20-city indices, and slightly more than 4 percent annually for the national index. April marks the eighth consecutive month in which the national home price index has appreciated at a less than 5 percent annual appreciation rate (seasonally adjusted).So the year-over-year change in for May Case-Shiller National index will be about the same as in the April report.

In April, the 10-city index appreciated at an annual rate of 4.6 percent, compared to 4.9 percent for the 20-City Index (SA). The non-seasonally adjusted (NSA) 10-City Index was up 1 percent month-over-month, while the 20-City index rose 1.1 percent (NSA) from March to April. We expect the change from April to May to show increases of more than 1 percent (NSA) for both the 10- and 20-city indices.

All Case-Shiller forecasts are shown in the table below. ... Officially, the SPCS Composite Home Price Indices for May will not be released until Tuesday, July 28.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| April Actual YoY | 4.6% | 4.6% | 4.9% | 4.9% | 4.2% | 4.2% |

| May Forecast YoY | 4.7% | 4.7% | 5.0% | 5.0% | 4.0% | 4.0% |

| May Forecast MoM | 1.1% | 0.2% | 1.2% | 0.3% | 1.0% | 0.0% |

Greek Deal

by Calculated Risk on 7/13/2015 10:08:00 AM

From the WSJ: Eurozone Leaders Reach Unanimous Agreement on Greece

Eurozone leaders said Monday morning that they would give Greece up to €86 billion ($96 billion) in fresh bailout loans as long as the government of Prime Minister Alexis Tsipras manages to implement a round of punishing austerity measures in the coming days.From the Financial Times: Eurozone leaders reach deal on Greece

The beatings will continue until morale improves.

Sunday, July 12, 2015

Sunday Night Futures: Uncertainty in Europe

by Calculated Risk on 7/12/2015 08:29:00 PM

After some absurd demands from Germany, it appears there might be some movement towards a deal with Greece tonight. But maybe not ... crazy.

Monday:

• At 2:00 PM ET, the Monthly Treasury Budget Statement for June.

Weekend:

• Schedule for Week of July 12, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 11 and DOW futures are down 87 (fair value).

Oil prices were down over the last week with WTI futures at $52.13 per barrel and Brent at $58.00 per barrel. A year ago, WTI was at $102, and Brent was at $105 - so prices are down almost 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.77 per gallon (down about $0.85 per gallon from a year ago).