by Calculated Risk on 6/25/2015 08:35:00 PM

Thursday, June 25, 2015

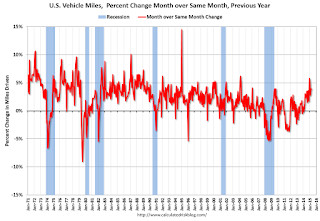

DOT: Vehicle Miles Driven increased 3.9% year-over-year in April, Rolling 12 Months at All Time High

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 3.9% (10.2 billion vehicle miles) for April 2015 as compared with April 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 267.9 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for April 2015 is 262.4 billion miles, a 3.7% (9.5 billion vehicle miles) increase over April 2014.

The rolling 12 month total is moving up, after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In April 2015, gasoline averaged of $2.56 per gallon according to the EIA. That was down significantly from April 2014 when prices averaged $3.74 per gallon.

In April 2015, gasoline averaged of $2.56 per gallon according to the EIA. That was down significantly from April 2014 when prices averaged $3.74 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is at a new high.

Update: "Scariest jobs chart ever"

by Calculated Risk on 6/25/2015 04:18:00 PM

During the recent recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever".

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak (now April 2014 with revisions).

I was asked if I could post an update to the graph, and here it is.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in April 2014, employment is now 2.4% above the previous peak.

Note: most previous recessions end on the graph when employment reached a new peak, although I continued the 2001 recession too. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Freddie Mac: Mortgage Serious Delinquency rate declined in May

by Calculated Risk on 6/25/2015 01:17:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 1.58%, down from 1.66% in April. Freddie's rate is down from 2.10% in May 2014, and the rate in May was the lowest level since November 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for May in a few days.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.52 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Kansas City Fed: Regional Manufacturing Activity Declined in June

by Calculated Risk on 6/25/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined at a Slower Pace

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined at a slightly slower pace, and producers’ expectations improved modestly.Some of this recent decline in the Kansas City region has been due to lower oil prices.

“Regional factory conditions continued to decline in June, especially in energy-producing areas,” said Wilkerson. “However, firms continue to expect some stabilization in the months ahead and for orders to rise by the end of the year.”

...

Tenth District manufacturing activity declined at a slightly slower pace than the previous month, and producers’ expectations improved modestly. Most price indexes continued to rise, particularly for raw materials.

The month-over-month composite index was -9 in June, up from -13 in May but down from -7 in April ... On the other hand, although still negative, the new orders, order backlog, employment, and new orders for export indexes edged higher.

emphasis added

Personal Income increased 0.5% in May, Spending increased 0.9%

by Calculated Risk on 6/25/2015 08:46:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $79.0 billion, or 0.5 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $105.9 billion, or 0.9 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.6 percent in May, compared with an increase of less than 0.1 percent in April. ... The price index for PCE increased 0.3 percent in May, compared with an increase of less than 0.1 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent in May, the same increase as in April.

The May price index for PCE increased 0.2 percent from May a year ago. The May PCE price index, excluding food and energy, increased 1.2 percent from May a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was higher than expected. And the increase in PCE was above the 0.7% increase consensus. A strong report.

On inflation: The PCE price index increased 0.2 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.2 percent year-over-year in May.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 3.1% annual rate in Q2 2015 (using the mid-month method, PCE was increasing 4.2%). This suggests a rebound in PCE in Q2, and decent Q2 GDP growth.

Weekly Initial Unemployment Claims increased to 271,000

by Calculated Risk on 6/25/2015 08:33:00 AM

The DOL reported:

In the week ending June 20, the advance figure for seasonally adjusted initial claims was 271,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 267,000 to 268,000. The 4-week moving average was 273,750, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 276,750 to 277,000.The previous week was revised up by 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 273,750.

This was below the consensus forecast of 273,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, June 24, 2015

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in May

by Calculated Risk on 6/24/2015 07:24:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 273 thousand from 267 thousand.

• At 8:30 AM, Personal Income and Outlays for May. The consensus is for a 0.4% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for June.

Economist Tom Lawler sent me an undated table below of short sales, foreclosures and cash buyers for a few selected cities in May.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase in foreclosures in Baltimore).

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

As Lawler noted last month: The Baltimore Metro area is included in the overall Mid-Atlantic region (covered by MRIS). Baltimore is shown separately because a large portion of the YOY increase in the foreclosure share of home sales in the Mid-Atlantic region was attributable to the significant increase in foreclosure sales in the Baltimore Metro area.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| May-15 | May-14 | May-15 | May-14 | May-15 | May-14 | May-15 | May-14 | |

| Las Vegas | 7.3% | 7.9% | 8.0% | 9.1% | 15.3% | 17.0% | 21.9% | 40.2% |

| Reno** | 5.0% | 11.0% | 4.0% | 6.0% | 9.0% | 17.0% | ||

| Phoenix | 2.8% | 3.9% | 3.2% | 6.7% | 6.0% | 10.7% | 24.0% | 29.5% |

| Sacramento | 4.7% | 7.0% | 5.4% | 8.3% | 10.1% | 15.3% | 17.4% | 20.5% |

| Minneapolis | 2.4% | 3.9% | 6.6% | 10.0% | 9.0% | 13.9% | ||

| Mid-Atlantic | 3.4% | 5.2% | 10.4% | 8.1% | 13.8% | 13.3% | 16.2% | 17.2% |

| Baltimore MSA**** | 3.6% | 5.8% | 16.3% | 11.9% | 19.8% | 17.6% | ||

| Orlando | 3.9% | 9.2% | 22.8% | 24.7% | 26.7% | 34.0% | 33.9% | 43.8% |

| Florida SF | 5.3% | 9.6% | 25.7% | 24.6% | 31.0% | 34.2% | 43.4% | 48.9% |

| Florida C/TH | 3.2% | 7.6% | 20.6% | 19.7% | 23.9% | 27.3% | 69.5% | 72.1% |

| Miami MSA SF | 6.2% | 9.6% | 16.1% | 16.4% | 22.3% | 26.0% | 34.9% | 42.6% |

| Miami MSA C/TH | 3.2% | 5.9% | 17.6% | 17.9% | 20.8% | 23.7% | 65.8% | 70.1% |

| Tampa MSA SF | 4.3% | 7.1% | 20.0% | 22.1% | 24.3% | 29.2% | 35.3% | 40.6% |

| Tampa MSA C/TH | 3.0% | 4.9% | 13.6% | 18.6% | 16.6% | 23.5% | 57.5% | 62.7% |

| Northeast Florida | 26.7% | 36.8% | ||||||

| Chicago (city) | 16.2% | 21.6% | ||||||

| Hampton Roads | 17.4% | 21.3% | ||||||

| Spokane | 12.8% | 17.0% | ||||||

| Hampton Roads | 17.4% | 21.3% | ||||||

| Spokane | 12.8% | 17.0% | ||||||

| Richmond VA MSA | 8.5% | 13.9% | 14.9% | 19.4% | ||||

| Memphis | 14.3% | 15.6% | 28.3% | 31.6% | ||||

| Springfield IL** | 5.4% | 8.7% | ||||||

| Tucson | 25.6% | 31.3% | ||||||

| Toledo | 26.1% | 36.6% | ||||||

| Des Moines | 14.0% | 17.5% | ||||||

| Peoria | 17.9% | 19.6% | ||||||

| Georgia*** | 20.3% | 26.0% | ||||||

| Omaha | 15.9% | 19.4% | ||||||

| Pensacola | 31.3% | 32.6% | ||||||

| Knoxville | 20.5% | 22.9% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here | ||||||||

ATA Trucking Index increased 1.1% in May

by Calculated Risk on 6/24/2015 04:08:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Rose 1.1% in May

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1.1% in May, following a revised loss of 1.4% during April. In May, the index equaled 132.1 (2000=100). The all-time high is 135.8, reached in January 2015.

Compared with May 2014, the SA index increased just 1.8%, which was well below the 2.7% gain in April and the smallest year-over-year gain since February 2013 (-4.3%). ...

“The good news is that truck tonnage increased in May,” said ATA Chief Economist Bob Costello. “But tonnage is certainly not strong at the moment as factory output is soft and there is an inventory reduction occurring throughout the supply chain.”

Costello noted that truck tonnage is off 2.7% from the high in January.

“I believe the inventory correction should end this summer and truck freight, helped by better personal consumption, will accelerate,” he said, “which is good because I think it is unlikely factory output will boost truck tonnage much until later this year or next year.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.8% year-over-year.

Black Knight: Mortgage Delinquencies increased in May

by Calculated Risk on 6/24/2015 01:11:00 PM

According to Black Knight's First Look report for May, the percent of loans delinquent increased 4% in May compared to April, and declined 12% year-over-year.

The percent of loans in the foreclosure process declined 2% in May and were down 22% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.96% in May, up from 4.77% in April.

The percent of loans in the foreclosure process declined in May to 1.49%. This was the lowest level of foreclosure inventory since January 2008.

The number of delinquent properties, but not in foreclosure, is down 326,000 properties year-over-year, and the number of properties in the foreclosure process is down 212,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for May in early July.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2015 | Apr 2015 | May 2014 | May 2013 | |

| Delinquent | 4.96% | 4.70% | 5.62% | 6.08% |

| In Foreclosure | 1.49% | 1.55% | 1.91% | 3.05% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,591,000 | 1,463,000 | 1,670,000 | 1,708,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 922,000 | 952,000 | 1,169,000 | 1,335,000 |

| Number of properties in foreclosure pre-sale inventory: | 754,000 | 764,000 | 966,000 | 1,525,000 |

| Total Properties | 3,268,000 | 3,179,000 | 3,805,000 | 4,569,000 |

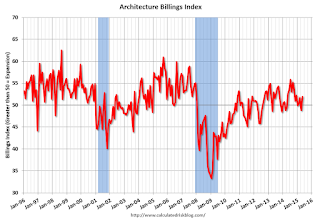

AIA: Architecture Billings Index increased in May

by Calculated Risk on 6/24/2015 10:12:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Returns to Positive Territory

Led by growing demand for new schools, hospitals, cultural facilities and municipal buildings, the Architecture Billings Index (ABI) increased in May following its second monthly drop this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 51.9, up from a mark of 48.8 in April. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.5, up from a reading of 60.1 the previous month.

“As has been the case for the past several years, while the design and construction industry has been in a recovery phase, we continue to receive mixed signals on business conditions in the marketplace,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Generally, the business climate is favorable, but there are still construction sectors and regions of the country that are struggling, producing the occasional backslide in the midst of what seems to be growing momentum for the entire industry.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in May, up from 48.8 in April. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative for the fourth consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting an increase in CRE investment in 2015.