by Calculated Risk on 6/08/2015 09:54:00 AM

Monday, June 08, 2015

Merrill and Goldman Expect GDP to Rebound in Q2

Some excerpts from two research reports ...

From Merrill Lynch: To everything, there is a season

After a dismal start to the new year, we think that the worst is behind us. At its low, our tracking model for 1Q GDP pegged growth at -1.2%; now it is tracking -0.2%. The low for 2Q was 2.3%; now it is tracking 2.9%. On a similar note, key monthly data releases have shifted from negative to neutral. On a negative note, both core retail sales and manufacturing output were flat in April; on a positive note, the latest housing starts and auto sales data were strong and the labor market continues to motor along, with 200,000-plus job gains and a modest pick-up in wage growth.From Goldman Sachs: After the Pothole

emphasis added

We view the recent turnaround in the US economic data as further confirmation that weak Q1 GDP growth was largely a result of temporary factors and statistical distortions with little bearing on the outlook for the rest of the year. Once again, the US economy seems to be climbing out of a Q1 pothole.Based on recent data, Q1 GDP will probably be revised up with the next release. And it looks like there will be a bounce back in Q2 (although the Atlanta Fed GDPNow model is only tracking 1.1% for Q2.

...

We continue to expect strong growth for the remainder of 2015. We are currently tracking Q2 GDP growth at 2.7% and expect a slight acceleration to 3% in 2015H2. We expect a pick-up in consumer spending to provide the largest contribution to stronger growth over the remainder of this year. Consumption grew a puzzlingly soft 1.8% in 2015Q1 despite strong disposable income growth and high consumer confidence. While many have expressed concern about softer spending in recent months, it is worth recalling that consumption has risen a respectable 2.7% over the last year ... We expect a rebound in coming quarters as the 1 percentage point (pp) increase in the saving rate seen over the last six months reverses.

Black Knight April Mortgage Monitor

by Calculated Risk on 6/08/2015 08:06:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for April today. According to BKFS, 4.77% of mortgages were delinquent in April, up from 4.70% in March. BKFS reported that 1.51% of mortgages were in the foreclosure process, down from 2.02% in April 2014.

This gives a total of 6.28% delinquent or in foreclosure. It breaks down as:

• 1,463,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 952,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 764,000 loans in foreclosure process.

For a total of 3,179,000 loans delinquent or in foreclosure in April. This is down from 3,837,000 in April 2014.

From Black Knight:

From Black Knight’s ‘First Look’ report, a high level view at the month’s mortgage performance data, we saw a slight seasonal uptick in delinquencies push the national rate back up to nearly 4.8 percentAlso: Black Knight’s April Mortgage Monitor: 62 Percent of Seriously Delinquent Loans Have Undergone Home Retention Actions; Florida Sees Greatest Backlog Improvement

As of April month-end, the nation’s foreclosure inventory fell by 18,000 to 764,000 total, a drop of over 250,000 from this time last year

April saw a slight uptick in delinquency rates – rising 1.5 percent month-over month

Seasonal increases in April are typical (they’ve been seen in eight of the past 10 years)

This month, Black Knight examined the most recent data on home retention actions – i.e., loan modifications and repayment plans – and found that of the approximately 952,000 borrowers who are 90 or more days past due but not yet in foreclosure, 62 percent have been through some form of home retention program. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, while overall retention actions have decreased over the past two years, they are making up a greater share of that seriously delinquent inventory.

“In analyzing the data around home retention initiatives, we found that nearly one in five seriously delinquent borrowers are currently taking part in an active trial modification or payment plan,” said Graboske. “With 62 percent of loans 90 or more days delinquent but not yet in foreclosure having been through some form of home retention action, we’re currently seeing the highest level of saturation yet, but that’s only marginally up from last year – in other words, that saturation level is beginning to flatten. Overall, home retention actions have declined 42 percent over the past two years, but at the same time have increased nine percent as a share of that seriously delinquent inventory. We’re also starting to see some redundancy in this activity – 70 percent of all new trial modifications and repayment plans have already been through one or more home retention actions previously.”

Home retention actions have declined 42 percent over the past two years, but at the same time, have increased 9 percent as share of 90+ days delinquent inventoryThere is much more in the mortgage monitor.

In Q1 2015, 15 percent of loans 90 or more days delinquent saw some form of home retention action each month (using a 3-month weighted average)

Sunday, June 07, 2015

Sunday Night Futures

by Calculated Risk on 6/07/2015 09:25:00 PM

From Nick Timiraos at the WSJ: New Housing Headwind Looms as Fewer Renters Can Afford to Own

Demographics tell the story. Urban Institute researchers predict that more than 3 in 4 new households this decade, and 7 of 8 in the next, will be formed by minorities. These new households—nearly half of which will be Hispanic—have lower incomes, less wealth and lower homeownership rates than the U.S. average.My sense is that the homeownership rate is near a bottom.

The upshot is that fewer than half of new households formed this decade and next will own homes. By contrast, almost three-quarters of new households in the 1990s became homeowners. The downtrend would push homeownership below 62% in 2020, and it would hold the rate near 61% in 2030, below the lowest level since records began in 1965.

...

Economists at Goldman Sachs say demographics could ultimately be a tailwind. They noted in an April report that even though Hispanics, for example, have lower homeownership rates than non-Hispanic whites, those rates have been rising for the past four decades. They see the homeownership rate stabilizing next year after it falls to 63.5%.

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of June 7, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 2 and DOW futures are down 15 (fair value).

Oil prices were down over the last week with WTI futures at $58.67 per barrel and Brent at $62.90 per barrel. A year ago, WTI was at $103, and Brent was at $109 - so prices are down 40%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.76 per gallon (down about $0.90 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 6/07/2015 12:33:00 PM

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through May 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and is now growing close to 0.4% per year - and this should boost economic activity.

Saturday, June 06, 2015

Phoenix Real Estate in May: Sales Up 11.4%, Inventory DOWN 15% Year-over-year

by Calculated Risk on 6/06/2015 06:39:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

For the sixth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in May were up 11.4% year-over-year.

2) Cash Sales (frequently investors) were down to 24.0% of total sales.

3) Active inventory is now down 15.4% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| May Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Inventory | YoY Change Inventory | |

| May-08 | 5,6371 | --- | 1,062 | 18.8% | 54,1611 | --- |

| May-09 | 9,284 | 64.7% | 3,592 | 38.7% | 39,902 | -26.3% |

| May-10 | 9,067 | -2.3% | 3,341 | 36.8% | 41,326 | 3.6% |

| May-11 | 9,811 | 8.2% | 4,523 | 46.1% | 31,661 | -23.4% |

| May-12 | 8,445 | 13.5% | 3,907 | 46.3% | 20,162 | -36.3% |

| May-13 | 9,440 | 11.8% | 3,669 | 38.9% | 19,734 | -2.1% |

| May-14 | 7,442 | -21.2% | 2,193 | 29.5% | 29,091 | 47.4% |

| May-15 | 8,293 | 11.4% | 1,988 | 24.0% | 24,616 | -15.4% |

| 1 May 2008 does not include manufactured homes, ~100 more | ||||||

Schedule for Week of June 7, 2015

by Calculated Risk on 6/06/2015 08:41:00 AM

The key economic report this week is May Retail sales on Thursday.

At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

9:00 AM: NFIB Small Business Optimism Index for May.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in March to 4.994 million from 5.144 million in February.

The number of job openings (yellow) were up 19% year-over-year, and Quits were up 14% year-over-year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: The Q1 Quarterly Services Report from the Census Bureau.

2:00 PM ET: The Monthly Treasury Budget Statement for May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 276 thousand from 275 thousand.

8:30 AM ET: Retail sales for May will be released.

8:30 AM ET: Retail sales for May will be released.This graph shows retail sales since 1992 through April 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were unchanged from March to April (seasonally adjusted), and sales were up 0.9% from April 2014.

The consensus is for retail sales to increase 1.3% in May, and to increase 0.8% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.2% increase in inventories.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM ET: The Producer Price Index for May from the BLS. The consensus is for a 0.4% increase in prices, and a 0.1% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 91.2, up from 90.7 in May.

Friday, June 05, 2015

CBO: Fiscal 2015 Federal Deficit through May about 10% below Last Year

by Calculated Risk on 6/05/2015 09:09:00 PM

More good news ... the budget deficit in fiscal 2015 will probably be lower than the recent CBO March forecast.

From the Congressional Budget Office (CBO) today: Monthly Budget Review for May 2015

The federal government ran a budget deficit of $368 billion for the first eight months of fiscal year 2015, CBO estimates. That deficit was $68 billion smaller than the one recorded during the same period last year. Revenues and outlays were both higher than the amounts recorded during the same period in fiscal year 2014—by 9 percent and 4 percent, respectively. If not for shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the eight-month period would have been $33 billion less this year than it was in fiscal year 2014. ...And for May 2015:

The federal government recorded a deficit of $85 billion in May 2015, CBO estimates—$45 billion less than the deficit in May 2014. If not for the effects of timing shifts that occurred in May 2014, the deficit in May 2015 would have been $9 billion (or 10 percent) smaller than it was in the same month last year.The consensus was the deficit for May would be around $97 billion, and it appears the deficit for fiscal 2015 will be smaller than the CBO currently expects (less than 2.7% of GDP).

emphasis added

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 6/05/2015 05:21:00 PM

By request, here is an update on an earlier post through the April employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 6,3221 |

| 128 months into 2nd term: 10,838 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Twenty eight months into Mr. Obama's second term, there are now 8,340,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 638,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 641 |

| 128 months into 2nd term, 110 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

For the public sector, the cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level might also be over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Here is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 64 thousand public sector jobs have been added during the first twenty eight months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is less than 8% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,885 | 692 | 11,577 |

| 2 | Clinton 2 | 10,070 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 6,322 | 64 | 6,386 | |

| Pace2 | 10,838 | 110 | 10,948 | |

| 128 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The second table shows the jobs need per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 228 | 260 | ||

| #2 | 187 | 246 | ||

| #3 | 152 | 220 | ||

Hotels: On Pace for Record Occupancy in 2015, New Construction Increasing

by Calculated Risk on 6/05/2015 01:41:00 PM

From HotelNewsNow.com: STR: US results for week ending 30 May

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 24-30 May 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year measurements, the industry’s occupancy increased 2.2 percent to 63.5 percent. Average daily rate increased 4.7 percent to finish the week at US$114.73. Revenue per available room for the week was up 7.0 percent to finish at US$72.83.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above last year.

Right now 2015 is slightly above 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

This strong occupancy and RevPAR performance is why investment in hotels has started picking up. In the recent construction spending report, spending on hotels was up 20% year-over-year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

May Employment Report Comments and Graphs

by Calculated Risk on 6/05/2015 10:01:00 AM

Earlier: May Employment Report: 280,000 Jobs, 5.5% Unemployment Rate

This was a solid employment report with 280,000 jobs added, and March and April were revised up by a combined 32,000 jobs.

There was even some hints of wage growth, from the BLS: "In May, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $24.96. Over the year, average hourly earnings have risen by 2.3 percent." Weekly hours were unchanged.

A few more numbers: Total employment increased 280,000 from April to May and is now 3.3 million above the previous peak. Total employment is up 12.0 million from the employment recession low.

Private payroll employment increased 262,000 from April to May, and private employment is now 3.8 million above the previous peak. Private employment is up 12.6 million from the recession low.

In May, the year-over-year change was just under 3.1 million jobs.

Overall this was a very positive report.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in May at 81.0%, and the 25 to 54 employment population ratio was unchanged at 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased 2.3% YoY, and the pace is increasing. Wages will probably pick up a little more this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged at 6.7 million in May and has shown little movement in recent months. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased in May to 6.65 million from 6.58 million in April. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 10.8% in May.

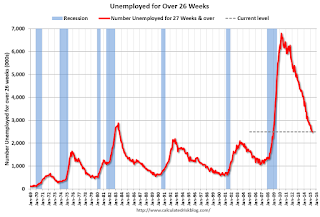

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.502 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.525 million in April.

This is trending down - and is at the lowest level since November 2008 - but is still very high.

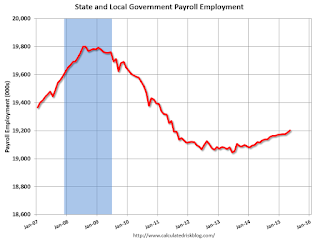

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In May 2015, state and local governments added 15,000 jobs. State and local government employment is now up 160,000 from the bottom, but still 598,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs appear to have ended (Federal payrolls added 3,000 jobs in May, and Federal employment is up 6,000 year-to-date).

This was a solid employment report for May.