by Calculated Risk on 5/29/2015 08:37:00 AM

Friday, May 29, 2015

Q1 GDP Revised Down to -0.7% Annual Rate

From the BEA: Gross Domestic Product: First Quarter 2015 (Second Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- decreased at an annual rate of 0.7 percent in the first quarter of 2015, according to the "second" estimate released by the Bureau of Economic Analysis. ...Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 1.9% to 1.8%. Residential investment was revised up from 1.3% to 5.0%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, real GDP increased 0.2 percent. With the second estimate for the first quarter, imports increased more and private inventory investment increased less than previously estimated ...

emphasis added

Net exports was revised down, private inventory investment was revised down, and government was revised down (from -0.8% to -1.1%).

Thursday, May 28, 2015

Friday: Ugly GDP, Chicago PMI, Consumer Sentiment

by Calculated Risk on 5/28/2015 06:52:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Microscopically Lower

Mortgage rates barely budged today. Those that budged moved almost imperceptibly lower from yesterday's latest rate sheets. In general, there was simply very little movement in underlying markets and lenders' rate sheets matched the tone. [Rates at 4.0%]Friday:

Ironically, Freddie Mac's weekly rate survey results came out this morning indicating higher rates. Keep in mind that the Freddie survey receives most of it's responses early in the week and then reports on Thursday mornings. That means that any changes in rates over the intervening days are not captured in the data. In the current case, it's not that rates have moved significantly lower in the past few days, but more to do with the fact that last week's Freddie survey didn't capture the brunt of the rise in rates that occurred on Tuesday.

emphasis added

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2015 (second estimate). The consensus is that real GDP decreased 0.9% annualized in Q1, revised down from the 0.2% advance estimate.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 53.0, up from 52.3 in April.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 90.0, up from the preliminary reading of 88.6, and down from the April reading of 95.9.

Vehicle Sales Forecasts for May: Over 17 Million Annual Rate

by Calculated Risk on 5/28/2015 03:04:00 PM

The automakers will report May vehicle sales on Tuesday, June 2nd. Sales in April were at 16.5 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales will be strong in May too.

Note: There were 26 selling days in May, one less than in May 2014. Here are a few forecasts:

From Edmunds.com: Nearly 1.6 Million New Cars Sold in May Push Seasonally Adjusted Annual Rate (SAAR) to Impressive 17.4 Million, says Edmunds.com

Edmunds.com ... forecasts that 1,591,221 new cars and trucks will be sold in the U.S. in May for an estimated Seasonally Adjusted Annual Rate (SAAR) of 17.4 million.From J.D. Power: New-Vehicle Retail Sales SAAR in May to Hit 14.1M Units, Highest Level So Far in 2015

Total light-vehicle sales in May 2015 are projected to reach 1,591,100, a 3 percent increase on a selling day adjusted basis compared with May 2014. [Total forecast 17.3 million SAAR]From Kelley Blue Book: New-Car Sales to Reach 17.3 Million SAAR in May 2015, According to Kelley Blue Book

New-vehicle sales are expected to decline 1 percent year-over-year to a total of 1.59 million units in May 2015, resulting in an estimated 17.3 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...Another strong month for auto sales. Good times!

...

"May sales will reach the highest total year-to-date, and could remain the highest until December of this year," said Alec Gutierrez, senior analyst for Kelley Blue Book. "While we expect an overall decline in volume versus last year, the difference is the result of one fewer sales day from May 2014, and total SAAR will reflect year-over-year improvement."

Freddie Mac: Mortgage Serious Delinquency rate declined in April

by Calculated Risk on 5/28/2015 01:02:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in April to 1.66%, down from 1.73% in March. Freddie's rate is down from 2.15% in April 2014, and the rate in March was the lowest level since November 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for April in a few days.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.49 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

NAR: Pending Home Sales Index increased 3.4% in April, up 14% year-over-year

by Calculated Risk on 5/28/2015 10:02:00 AM

From the NAR: Pending Home Sales Climb in April to Highest Level since May 2006

Pending home sales rose in April for the fourth straight month and reached their highest level in nine years, according to the National Association of Realtors®. Led by the Northeast and Midwest, all four major regions saw increases in April.This was abpve expectations of a 0.8% increase.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 3.4 percent to 112.4 in April from a slight upward revision of 108.7 in March and is now 14.0 percent above April 2014 (98.6) — the largest annual increase since September 2012 (15.1 percent). The index has now increased year-over-year for eight consecutive months and is at its highest level since May 2006 (112.5).

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

Weekly Initial Unemployment Claims increased to 282,000

by Calculated Risk on 5/28/2015 08:34:00 AM

The DOL reported:

In the week ending May 23, the advance figure for seasonally adjusted initial claims was 282,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 274,000 to 275,000. The 4-week moving average was 271,500, an increase of 5,000 from the previous week's revised average. The previous week's average was revised up by 250 from 266,250 to 266,500.The previous week was revised to 275,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 271,500.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, May 27, 2015

Thursday: Pending Home Sales, Unemployment Claims

by Calculated Risk on 5/27/2015 08:06:00 PM

From Reuters: EU officials dismiss Greek statement on aid agreement being drafted

Greece's government on Wednesday said it is starting to draft an agreement with creditors that would pave the way for aid, but European officials quickly dismissed that as wishful thinking.Thursday:

...

But European Commission Vice President Valdis Dombrovskis said the two sides still had some way to go before any agreement could be drawn up.

"We are working very intensively to ensure a staff-level agreement," he said. "We are still not there yet."

Other officials in the euro zone, speaking to Reuters on condition of anonymity, were more blunt. One called the Greek remarks "nonsense". Another said: "I wish it were true."

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 274 thousand.

• At 10:00 AM, the Pending Home Sales Index for April. The consensus is for a 0.8% increase in the index.

Zillow Forecast: Expect Case-Shiller National House Price Index up 4.0% year-over-year change in April

by Calculated Risk on 5/27/2015 03:22:00 PM

The Case-Shiller house price indexes for March were released this yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Expect More of the Same from Case-Shiller in April

The March S&P/Case-Shiller (SPCS) data published [yesterday] showed home prices continuing to appreciate at around 5 percent annually for both the 10- and 20- City Indices, and roughly 4 percent for the national index. March marks the seventh consecutive month in which the national home price index has appreciated at a less than 5 percent annual appreciation rate (seasonally adjusted).So the year-over-year change in for April Case-Shiller National index will be about the same as in the March report.

In March, the 10-City Index appreciated at an annual rate of 4.7 percent, compared to 5.0 percent for the 20-City Index (SA). The non-seasonally adjusted (NSA) 10-City Index was up 0.8 percent month-over-month, while the 20-City index rose 0.9 percent (NSA) from February to March. We expect the change from March to April to show increases of more than 1 percent (NSA) for both the 10- and 20- City Indices.

All forecasts are shown in the table below. These forecasts are based on the March SPCS data release and the April 2015 Zillow Home Value Index (ZHVI), published May 21. Officially, the SPCS Composite Home Price Indices for March will not be released until Tuesday, June 30.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| March Actual YoY | 4.7% | 4.7% | 5.0% | 5.0% | 4.1% | 4.1% |

| April Forecast YoY | 4.9% | 4.9% | 5.2% | 5.2% | 4.0% | 4.0% |

| April Forecast MoM | 1.2% | 0.5% | 1.3% | 0.6% | 1.0% | 0.0% |

From Zillow:

Annual appreciation in the Zillow Home Value Index (ZHVI) peaked in April 2014 and has declined since then. In April, the U.S. ZHVI rose 3 percent year-over-year, one percentage point lower than the annual change in rents (4 percent). The April Zillow Home Value Forecast calls for a 2 percent rise in home values through April 2016. Further details on our forecast of home values can be found here.

FDIC: Fewer Problem banks, Residential REO Declines in Q1

by Calculated Risk on 5/27/2015 11:55:00 AM

The FDIC released the Quarterly Banking Profile for Q1 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $39.8 billion in the first quarter of 2015, up $2.6 billion (6.9 percent) from a year earlier. The increase in earnings was mainly attributable to a $4.3 billion rise in net operating revenue (net interest income plus total noninterest income). Financial results for the first quarter of 2015 are included in the FDIC's latest Quarterly Banking Profile released today.

...

"Problem List" Continues to Shrink: The number of banks on the FDIC's Problem List fell from 291 to 253 during the first quarter. This is the smallest number of banks on the Problem List in six years. The number of problem banks was down 72 percent from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $86.7 billion to $60.3 billion during the first quarter.

Deposit Insurance Fund (DIF) Rises $2.5 Billion to $65.3 Billion: The DIF increased from $62.8 billion to $65.3 billion in the first quarter, largely driven by $2.2 billion in assessment income. The DIF reserve ratio rose to 1.03 percent from 1.01 percent during the quarter.

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1 2015, and year end prior to 2015):

The number of insured commercial banks and savings institutions filing quarterly financial reports declined from 6,509 to 6,419 in the first quarter. Mergers absorbed 86 institutions, while four insured institutions failed. For a fifth consecutive quarter, no new charters were added. The number of full-time equivalent employees declined by 5,349 to 2,042,596. The number of institutions on the FDIC’s “Problem List” declined for the 16th consecutive quarter, falling from 291 to 253. Total assets of problem institutions fell from $86.7 billion to $60.3 billion.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.98 billion in Q4 2014 to $5.72 billion in Q1. This is the lowest level of REOs since Q3 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.98 billion in Q4 2014 to $5.72 billion in Q1. This is the lowest level of REOs since Q3 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

BLS: Twenty-Three States had Unemployment Rate Decreases in April

by Calculated Risk on 5/27/2015 10:10:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in April. Twenty-three states and the District of Columbia had unemployment rate decreases from March, 11 states had increases, and 16 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nebraska had the lowest jobless rate in April, 2.5 percent. Nevada had the highest rate among the states, 7.1 percent. The District of Columbia had a rate of 7.5 percent.

Click on graph for larger image.

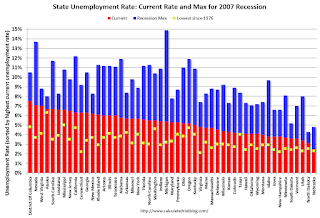

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Only two states (Nevada and West Virginia) and D.C. are still at or above 7% (dark blue).