by Calculated Risk on 5/22/2015 07:01:00 AM

Friday, May 22, 2015

Black Knight: Mortgage Delinquencies increased slightly in April

According to Black Knight's First Look report for April, the percent of loans delinquent increased 1% in April compared to March, and declined 15% year-over-year.

The percent of loans in the foreclosure process declined 2% in March and were down 25% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.77% in April, up from 4.70% in March.

The percent of loans in the foreclosure process declined in April to 1.51%. This was the lowest level of foreclosure inventory since January 2008.

The number of delinquent properties, but not in foreclosure, is down 406,000 properties year-over-year, and the number of properties in the foreclosure process is down 252,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for April in early June.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2015 | Mar 2015 | Apr 2014 | Apr 2013 | |

| Delinquent | 4.77% | 4.70% | 5.62% | 6.21% |

| In Foreclosure | 1.51% | 1.55% | 2.02% | 3.17% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,463,000 | 1,409,000 | 1,634,000 | 1,717,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 952,000 | 971,000 | 1,187,000 | 1,394,000 |

| Number of properties in foreclosure pre-sale inventory: | 764,000 | 782,000 | 1,016,000 | 1,588,000 |

| Total Properties | 3,179,000 | 3,162,000 | 3,837,000 | 4,699,000 |

Thursday, May 21, 2015

Friday: CPI, Yellen

by Calculated Risk on 5/21/2015 07:03:00 PM

Earlier from the Philly Fed: May Manufacturing Survey

Manufacturing activity in the region increased modestly in May, according to firms responding to this month’s Manufacturing Business Outlook Survey. Indicators for general activity, new orders, and shipments were positive but remain at low readings. Employment increased at the reporting firms, but the employment index moderated compared with April. Firms reported continued price reductions in May, with indicators for prices of inputs and the firms’ own products remaining negative. The survey’s indicators of future activity suggest that firms expect continuing growth in the manufacturing sector over the next six months.This was below the consensus forecast of a reading of 8.0 for May.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 7.5 in April to 6.7 in May. ...

Firms’ responses suggest some weakening in labor market conditions this month compared with April. ... The current employment index, however, fell 5 points, to 6.7.

emphasis added

Also the Kansas City Fed reported: Tenth District Manufacturing Activity Declined More Sharply

“Factories in our region saw an even sharper decline in May than in March or April, as exports fell further and energy-related producers saw another drop in orders,” said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City] “However, firms’ overall still plan a modest increase in employment over the next six to twelve months.”

...

Tenth District manufacturing activity declined more sharply in May than in previous months and producers’ expectations also fell, with both reaching their lowest levels since mid-2009. ... The month-over-month composite index was -13 in May, down from -7 in April and -4 in March ... Production fell most sharply in energy-producing states like Oklahoma and New Mexico, but it was also down in most other District states.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys increased slightly in May, and this suggests a another weak ISM report for May.

Friday:

• At 8:30 AM ET, the Consumer Price Index for April from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core CPI.

• At 1:00 PM, Speech by Fed Chair Janet L. Yellen, U.S. Economic Outlook, At the Greater Providence Chamber of Commerce Economic Outlook Luncheon, Providence, Rhode Island

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/21/2015 03:26:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in April.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase in foreclosures in Baltimore).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers has been declining.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Apr-15 | Apr-14 | Apr-15 | Apr-14 | Apr-15 | Apr-14 | Apr-15 | Apr-14 | |

| Las Vegas | 7.2% | 12.4% | 8.3% | 11.4% | 15.5% | 23.8% | 30.4% | 41.4% |

| Reno** | 6.0% | 15.0% | 5.0% | 6.0% | 11.0% | 21.0% | ||

| Phoenix | 2.5% | 4.0% | 3.8% | 6.5% | 6.3% | 10.5% | 25.3% | 32.2% |

| Sacramento | 5.6% | 9.5% | 6.6% | 7.5% | 12.2% | 17.0% | 18.4% | 21.9% |

| Minneapolis | 2.9% | 5.1% | 9.2% | 16.0% | 12.0% | 21.1% | ||

| Mid-Atlantic | 4.5% | 5.9% | 12.9% | 10.0% | 17.3% | 15.9% | 17.2% | 19.5% |

| Orlando | 4.8% | 9.1% | 24.7% | 23.7% | 29.5% | 32.8% | 37.4% | 42.4% |

| Florida SF | 4.0% | 6.9% | 19.1% | 21.1% | 23.1% | 28.0% | 37.2% | 43.4% |

| Florida C/TH | 2.0% | 4.5% | 14.6% | 15.6% | 16.6% | 20.1% | 65.4% | 70.9% |

| Miami MSA SF | 6.2% | 10.5% | 18.4% | 16.5% | 24.7% | 27.0% | 37.8% | 44.4% |

| Miami MSA C/TH | 2.3% | 5.5% | 18.2% | 17.5% | 20.6% | 23.0% | 68.9% | 73.4% |

| Tampa MSA SF | 4.5% | 7.0% | 20.3% | 23.2% | 24.8% | 30.1% | 34.5% | 41.6% |

| Tampa MSA C/TH | 2.9% | 4.6% | 15.5% | 18.8% | 18.4% | 23.3% | 60.8% | 66.7% |

| So. California* | 4.4% | 5.0% | 4.5% | 5.2% | 8.9% | 10.2% | ||

| Chicago (city) | 20.3% | 27.3% | ||||||

| Hampton Roads | 22.2% | 24.4% | ||||||

| Northeast Florida | 28.9% | 38.0% | ||||||

| Hampton Roads | 22.2% | 24.4% | ||||||

| Tucson | 27.1% | 30.5% | ||||||

| Toledo | 30.2% | 33.4% | ||||||

| Wichita | 19.8% | 25.1% | ||||||

| Des Moines | 13.8% | 17.1% | ||||||

| Peoria | 17.3% | 21.2% | ||||||

| Georgia*** | 21.6% | 34.3% | ||||||

| Omaha | 16.4% | 22.3% | ||||||

| Pensacola | 32.3% | 35.6% | ||||||

| Knoxville | 23.1% | 25.3% | ||||||

| Richmond VA MSA | 11.5% | 15.4% | 18.2% | 22.5% | ||||

| Memphis | 16.1% | 17.3% | ||||||

| Springfield IL** | 10.3% | 13.2% | 17.9% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Existing Home Sales Dipped in April; Sales in South Seem Low

by Calculated Risk on 5/21/2015 01:33:00 PM

From housing economist Tom Lawler:

The National Association of Realtors reported that US existing home sales ran at an estimated seasonally adjusted annual rate of 5.04 million in April, down 3.3% from March’s upwardly-revised pace and up 6.1% from last March’s seasonally adjusted pace. The NAR’s estimate was below both my projection based on regional tracking and the “consensus” forecast. Relative to March, April sales (seasonally adjusted) were up 1.7% in the Midwest, but down 1.7% in the West, down 3.3% in the Northeast, and down a sizable 6.8% in the South.

In terms of my tracking, my “miss” was almost entirely in the South. According to the NAR’s estimates, existing home sales in the South last month (not seasonally adjusted) were up just 2.9% from last April, which seems way too low based on realtor/MLS reports from the South. For example, MLS-based reports show that home sales registered double-digit YOY gains in the broad Mid-Atlantic region (mainly most of Maryland, DC and Northern Virginia), Florida, Georgia, South Carolina, Alabama, and much of Kentucky and Arkansas (my coverage in those states is limited). MLS-based reports in most other states suggest YOY sales gains in the 5% (e.g., Texas) to 9% (e.g., North Carolina) range. To be sure, some areas in the region saw YOY declines in sales (e.g., Oklahoma at -2%, and Jackson, Mississippi at -13%). But for the region as a whole, local realtor/MLS reports would have suggested YOY sales growth for the region as a whole well above 2.9%.

Often when my projection for the NAR sales number is off, it turns out that realtor/MLS reports released subsequent to my projection (e.g., today) show significantly different sales numbers than I had had been assuming. That was not the case this month. Based on local realtor/MLS reports released through today (which included quite a few, including Florida and Texas), the NAR’s estimate for existing home sales in the South for April look way too low. The NAR’s estimates for the other regions, in contrast, look reasonable.

The NAR also reported that its preliminary estimate of the number of existing homes for sale at the end of April was 2.21 million, down 10.0% from March’s upwardly-revised (to 2.10 million from 2.00 million) level, and down 0.9% from last April’s level. This inventory number was just slightly below my projection.

Finally, the NAR estimated that the median existing SF home sales price in April, $221,200, up 10.0% from last April, and well above my projection based on regional tracking. The YOY % change in the median existing SF home sales price for March was revised downward to 7.9% from 8.7%.

A Few Comments on April Existing Home Sales

by Calculated Risk on 5/21/2015 11:37:00 AM

Inventory is still very low (and down 0.9% year-over-year in April). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch over the next few months during the Spring buying season.

Also, the NAR reported total sales were up 6.1% from April 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales — foreclosures and short sales — were 10 percent of sales in April, unchanged from March and below the 15 percent share a year ago. Seven percent of April sales were foreclosures and 3 percent were short sales.Last year in April the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in April 2014 were reported at 4.75 million SAAR with 15% distressed. That gives 712 thousand distressed (annual rate), and 4.04 million equity / non-distressed. In April 2015, sales were 5.04 million SAAR, with 10% distressed. That gives 504 thousand distressed - a decline of about 29% from April 2014 - and 4.54 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 12%.

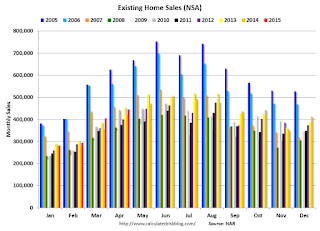

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) were just below April 2013 (NSA).

Earlier:

• Existing Home Sales in April: 5.04 million SAAR, Inventory down 0.9% Year-over-year

Existing Home Sales in April: 5.04 million SAAR, Inventory down 0.9% Year-over-year

by Calculated Risk on 5/21/2015 10:10:00 AM

The NAR reports: Existing-Home Sales Lose Momentum in April

Total existing–home sales, which are completed transactions that include single–family homes, townhomes, condominiums and co–ops, declined 3.3 percent to a seasonally adjusted annual rate of 5.04 million in April from an upwardly revised 5.21 million in March. Despite the monthly decline, sales have increased year–over–year for seven consecutive months and are still 6.1 percent above a year ago. ...

Total housing inventory at the end of April increased 10.0 percent to 2.21 million existing homes available for sale, but is still 0.9 percent below a year ago (2.23 million). Unsold inventory is at a 5.3–month supply at the current sales pace, up from 4.6 months in March.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.04 million SAAR) were 3.3% lower than last month, and were 6.1% above the April 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.21 million in April from 2.01 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.21 million in April from 2.01 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 0.9% year-over-year in April compared to April 2014.

Inventory decreased 0.9% year-over-year in April compared to April 2014. Months of supply was at 5.3 months in April.

This was below expectations of sales of 5.20 million. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increased to 274,000, Lowest 4-Week average in 15 years

by Calculated Risk on 5/21/2015 08:35:00 AM

The DOL reported:

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 274,000, an increase of 10,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 266,250, a decrease of 5,500 from the previous week's unrevised average of 271,750. This is the lowest level for this average since April 15, 2000 when it was 266,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 266,250.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs. This is the lowest 4-week average in 15 years (since April 2000).

Note: If the 4-week average falls to 266,000, it will be the lowest in 40 years!

Wednesday, May 20, 2015

Thursday: Existing Home Sales, Unemployment Claims and More

by Calculated Risk on 5/20/2015 07:27:00 PM

From Jon Hilsenrath at the WSJ: Fed Looks Past June for First Rate Hike

Federal Reserve officials at their April policy meeting said in the most explicit terms yet that they are unlikely to start raising short-term interest rates in June, as seemed possible when 2015 began.Thursday:

Officials have been saying they won’t begin lifting their benchmark federal funds rate from near zero until they see more improvement in the labor market and are confident inflation will rise toward their 2% target. Several of them started the year thinking they might reach that point by midyear.

But by last month, after watching the economy stumble through the winter, many at the April 28-29 meeting were doubtful those criteria for a rate increase would be met, according to minutes of the meeting released Wednesday.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 270 thousand from 264 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for April. This is a composite index of other data.

• At 10:00 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 8.0, up from 7.5 last month (above zero indicates expansion).

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 5.22 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 5.19 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.20 million SAAR.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

• At 1:30 PM, Speech by Fed Vice Chairman Stanley Fischer, Past, Present, and Future Challenges for the Euro Area, At the ECB Forum on Central Banking, Linho Sintra, Portugal

CoreLogic: Southern California April Home Sales up 8.5% Year-over-year

by Calculated Risk on 5/20/2015 04:26:00 PM

From CoreLogic (formerly DataQuick): CoreLogic Reports Southern California Home Sales Rose 8.5 Percent Year over Year in April 2015

A total of 21,708 new and existing houses and condominiums sold in April 2015 in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties, up 9.9 percent month over month from 19,760 sales in March 2015. April 2015 sales also rose by 8.5 percent compared to April 2014 when there were 20,008 sales, marking the second straight month with year-over-year increases. Southern California home sales in April 2015 were the second highest for the month of April since 2006, only behind April 2013 when 21,795 homes sold.The NAR will release existing home sales for April tomorrow at 10:00 AM ET. The consensus is for sales of 5.22 million on seasonally adjusted annual rate (SAAR) basis, up about 10% from April 2014.

Sales activity picked up last month, making it one of the stronger Aprils since the housing bust, though sales remained below average," said Andrew LePage, a data analyst for CoreLogic. "Many buyers still face credit and affordability hurdles, and the inventory of homes for sale remains relatively tight in many markets. New home construction is still well below historically normal levels, too."

...

Real estate-owned (REO) sales represented 4.5 percent of all Southern California home sales in April, down from 5.1 percent of sales in March 2015 and down from 5.2 percent in April 2014.

...

Short sales accounted for 4.4 percent of total sales in April, up from 4 percent in March 2015 and down from 5 percent in April 2014.

emphasis added

FOMC Minutes: June Rate Hike Unlikely

by Calculated Risk on 5/20/2015 02:32:00 PM

From the Fed: Minutes of the Federal Open Market Committee, April 28-29, 2015 . Excerpts:

In their discussion of communications regarding the path of the federal funds rate over the medium term, participants expressed a range of views about when economic conditions were likely to warrant an increase in the target range for the federal funds rate. Participants continued to judge that it would be appropriate to raise the target range for the federal funds rate when they had seen further improvement in the labor market and were reasonably confident that inflation would move back to its 2 percent objective over the medium term. Although participants expressed different views about the likely timing and pace of policy firming, they agreed that the Committee's decision to begin firming would appropriately depend on the incoming data and their implications for the economic outlook. A few anticipated that the information that would accrue by the time of the June meeting would likely indicate sufficient improvement in the economic outlook to lead the Committee to judge that its conditions for beginning policy firming had been met. Many participants, however, thought it unlikely that the data available in June would provide sufficient confirmation that the conditions for raising the target range for the federal funds rate had been satisfied, al-though they generally did not rule out this possibility. Participants discussed the merits of providing an explicit indication, in postmeeting statements released prior to the commencement of policy firming, that the target range for the federal funds rate would likely be raised in the near term. However, most participants felt that the timing of the first increase in the target range for the federal funds rate would appropriately be determined on a meeting-by-meeting basis and would depend on the evolution of economic conditions and the outlook. In keeping with this data-dependent approach, some participants further suggested that the postmeeting statement's description of the economic situation and outlook, and of progress toward the Committee's goals, provided the appropriate means by which the Committee could help the public assess the likely timing of the initial increase in the target range for the federal funds rate.

emphasis added