by Calculated Risk on 5/12/2015 10:26:00 PM

Tuesday, May 12, 2015

Wednesday: Retail Sales

From the WSJ: Don’t Expect Cheap Gasoline to Fuel Retail Sales

The slump in crude oil had, as of February, led to pump-price savings estimated at over $100 billion annually for American households. But tepid retail-sales data from December through February left forecasters scratching their heads about consumers’ failure to spend much of it.Wednesday:

Back in November, year-over-year growth in retail sales was running at 4.7%. It had slipped to 1.26% by March. Even stripping out gas-station sales, it had slowed to 4% from 5.8% over the same period.

There are two likely explanations: the weather and the fact spending is sticky.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Retail sales for April will be released. The consensus is for retail sales to increase 0.2% in April, and to increase 0.5% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.2% increase in inventories.

Mortgage News Daily: Mortgage Rates at 2015 Highs, Average Lender at 4%

by Calculated Risk on 5/12/2015 05:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Keep Pushing 2015 Highs

Mortgage rates moved disconcertingly higher again today, despite the fact that underlying market levels actually improved during the day. Guaranteeing rates in such a volatile environment is expensive for lenders. The result is yet another high for 2015. The average lender is quoting conventional 30yr fixed rates of 4.0% on top tier scenarios. Just a few short weeks ago, the average rate was 3.625%. That makes this the most abrupt move higher in roughly 2 years, with the last notable example being the mid-2013 'taper tantrum.'Here is a table from Mortgage News Daily:

NY Fed: Household Debt increased slightly in Q1 2015

by Calculated Risk on 5/12/2015 01:11:00 PM

Here is the Q1 report: Household Debt and Credit Report.

From the NY Fed: Delinquencies, Foreclosures and Bankruptcies Improve as Household Debt Stays Flat

The Federal Reserve Bank of New York’s Household Debt and Credit Report revealed that aggregate household debt balances were largely flat in the first quarter of 2015. As of the end of March, total household indebtedness was $11.85 trillion, a $24 billion, or 0.2 percent, increase during the first quarter of this year. The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

The slowdown in growth can be attributed to a negligible uptick in mortgage balances, which are the largest component of household debt. Mortgage balances stood at $8.17 trillion in the first quarter. Additionally, balances on home equity lines of credit (HELOC), which were $510 billion at the end of fourth quarter, 2014, were unchanged in the first quarter of this year.

Non-housing debt balances increased by 0.7 percent from the end of last year, largely due to increases in student loans ($32 billion) and auto loans ($13 billion). These gains were partially offset by a $16 billion decline in credit card balances.

Measures on delinquencies, foreclosures and bankruptcies all improved in the first quarter. The percentage of outstanding debt in some stage of delinquency fell to 5.7 percent from 6.0 percent in the fourth quarter of 2014, with continuing improvements in mortgages. About 112,000 individuals had a new foreclosure notation added to their credit reports in the first quarter of this year, the lowest total since at least 1999. Four percent fewer consumers had a bankruptcy notation added to their credit reports, bringing the quarterly total to its lowest point since early 2006.

“Tight standards on mortgage lending are reflected in both sluggish growth in housing debt as well as substantial reductions in mortgage delinquency and defaults,“ said Andrew Haughwout, senior vice president and economist at the New York Fed.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased slightly in Q1. Household debt peaked in 2008, and bottomed in Q2 2013.

The recent increase in debt suggests households (in the aggregate) deleveraging is over.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased to 5.7% in Q1, from 6.0% in Q4.

There are a number of credit graphs at the NY Fed site.

BLS: Jobs Openings at 5.0 million in March, Up 19% Year-over-year

by Calculated Risk on 5/12/2015 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 5.0 million job openings on the last business day of March, little changed from 5.1 million in February, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.1 million in March and separations were little changed at 5.0 million....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.8 million quits in March, little changed from February.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 4.994 million from 5.144 million in February.

The number of job openings (yellow) are up 19% year-over-year compared to March 2014.

Quits are up 14% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are around 5 million, and that quits are increasing solidly year-over-year.

NFIB: Small Business Optimism Index increased in April

by Calculated Risk on 5/12/2015 09:06:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Rises, But Future Sales Cloud Outlook

The Small Business Optimism Index increased 1.7 points from March to 96.9, this in spite of a quarter of virtually no economic growth. Unfortunately, the Index remained below the January reading. Nine of the 10 Index components gained, only real sales expectations were weaker. But this still leaves the Index below its historical average, oscillating between 95 and 98 but never breaking out except for December, when the Index just tipped past 100, only to fall again.More good news: Only 11 percent of companies reported "poor sales" as the most important problem, down from 16% a year ago, and a recession high of 34%.

...

Small businesses posted another decent month of job creation. Those that hired were more aggressive than those reducing employment, producing an average increase of 0.14 workers per firm, continuing a string of solid readings for 2015. ... Twenty-seven percent of all owners reported job openings they could not fill in the current period, up 3 points from March. A net 11 percent plan to create new jobs, up 1 point and a solid reading.

emphasis added

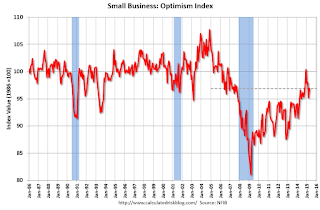

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.9 in April from 95.2 in March.

Monday, May 11, 2015

Tuesday: Job Openings, Q1 Household Debt and Credit Report

by Calculated Risk on 5/11/2015 09:27:00 PM

A couple of posts on consumers ...

From Professor Hamilton at Econbrowser: Energy prices and consumer spending

Whatever the explanation, the facts seem to be that, unlike what we usually observed historically, consumers have been using much of the gains from lower energy prices to bolster their saving rather than using it to increase spending on other goods and services.And from Dr. Altig at Macroblog: All Eyes on the Consumer

... the "fundamentals" suggest the four-month annualized growth of consumer spending should have been in excess of 4 percent, as opposed to the approximately 1.5 percent we actually saw. That is a story we don't expect to persist, and our current view of the year is that first-quarter consumer spending results are not indicative of future performance.My sense is the increase in consumer spending will be larger in Q2.

Consumers are, of course, a forward-looking bunch, and it is possible the recent weak spending reflects a looming reality not captured by the simple model described above. But our forecast for now is that consumers will move to the fundamentals, and not vice versa.

Tuesday:

• At 9:00 AM ET, NFIB Small Business Optimism Index for April.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for March from the BLS. Jobs openings increased in February to 5.133 million from 4.965 million in January. This was the highest level for job openings since January 2001. The number of job openings (yellow) were up 23% year-over-year, and Quits were up 10% year-over-year.

• At 11:00 AM, the The New York Fed will release their Q1 2015 Household Debt and Credit Report

Research: Natural Rate of Unemployment under 5% and Falling

by Calculated Risk on 5/11/2015 05:32:00 PM

From the Chicago Fed: Changing labor force composition and the natural rate of unemployment Excerpts:

We estimate our baseline natural rate of unemployment as of 2014:Q4 to be 4.9% —0.5 percentage points lower than the CBO’s estimate of the short-run natural rate. We project this rate to fall by about 0.06 percentage points per year through the end of the decade, reaching 4.5% at the end of 2020—0.7 percentage points below the CBO’s estimate.

Two broad assumptions underlie these simple calculations. First, demographics and educational attainment are fundamental determinants of unemployment, and thus, changes in them over time should drive overall levels of aggregate unemployment. Second, the unemployment rate was at its natural rate in late 2005. Both of these assumptions seem plausible, but neither is completely unassailable. ...

...

While great progress has been made over the past few years, significant labor market slack remains. We estimate the natural rate at or below 5%, at least half of a percentage point below its actual level as of March 2015. This estimate of slack, in combination with labor market measures such as LFP and involuntary part-time workers, may help explain why wage inflation and price inflation remain so low. Moreover, we estimate that absent major new developments, demographic and educational changes will persist, potentially reducing the trend unemployment rate to around 4.4% to 4.8% by 2020.

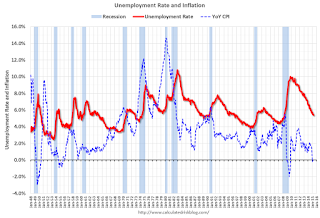

Demographics, Unemployment Rate and Inflation

by Calculated Risk on 5/11/2015 03:19:00 PM

It wasn't long ago that several FOMC members were arguing inflation would pick up when the unemployment rate declined to 6%. They were wrong with the unemployment rate now at 5.4%. I think they were looking at the '70s and ignoring the demographic differences.

The first graph shows the year-over-year change in the prime working age population (25 to 54 years old) with projections for the next 25 years.

If there is a demographic component to inflation, then we would have expected inflation to increase in the '70s, and be very low now.

Note: Ignore the steps up and down - the data was affected by changes in population controls.

The dashed red line is based on Census Bureau projections through 2040.

A key is the prime working age population was declining in the early part of this decade and has only started increasing again recently.

This is very similar to what happened in the '60s. In the early '60s, there was a slow increase in the prime working age population until the baby boomers started pouring into the labor force.

Now the prime working age population is growing again, and we can expect growth to pick up over the next decade. However there will not be as large in increase in the prime working age labor force like in the '70s and '80s.

In the 1960s, inflation didn't pickup until the unemployment rate had fallen close to 4% - and when the early baby boomers started entering the labor force.

The current period is similar to the '60s (although there won't be as large a group entering the labor force). And the current period - from a demographics perspective - is very different from the '70s and '80s.

Ignoring for the moment monetary and fiscal policy differences between the '60s and now, demographics suggests that the unemployment rate will have to fall below 5% before inflation picks up.

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 5/11/2015 11:58:00 AM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• April Employment Report: 223,000 Jobs, 5.4% Unemployment Rate

• Employment Report Comments and Graphs

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and the "less than 5 weeks", "6 to 14 weeks" and "15 to 26 weeks" are all close to normal levels.

The long term unemployed is less than 1.6% of the labor force - the lowest since November 2008 - however the number (and percent) of long term unemployed remains elevated.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 951 thousand.

Construction employment is still far below the bubble peak - and below the level in the late '90s.

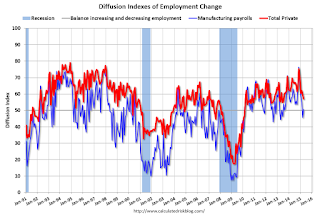

The BLS diffusion index for total private employment was at 57.0 in April, down from 59.5 in March.

The BLS diffusion index for total private employment was at 57.0 in April, down from 59.5 in March. For manufacturing, the diffusion index was at 50.6, up from 45.6 in March.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall private job growth was less widespread in April.

FNC: Residential Property Values increased 4.6% year-over-year in March

by Calculated Risk on 5/11/2015 09:31:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their March 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.9% from February to March (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.6% in March, and the 20-MSA and 30-MSA RPIs both increased by about 0.9% in March. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was slightly higher in March than in February, with the 100-MSA composite up 4.6% compared to March 2014. For FNC, the YoY increase had been slowing since peaking in March at 9.0%, but had held steady for the last few months.

The index is still down 18.6% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through March 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change mostly steady at around 5% for the last several months.

Note: The March Case-Shiller index will be released on Tuesday, May 26th.