by Calculated Risk on 5/08/2015 11:52:00 AM

Friday, May 08, 2015

Employment Report Comments and Graphs

Earlier: April Employment Report: 223,000 Jobs, 5.4% Unemployment Rate

This was a decent employment report with 223,000 jobs added, but February and March were revised down by a combined 39,000 jobs.

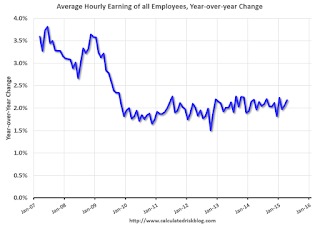

However there is still limited wage growth, from the BLS: "In April, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.87. Over the past 12 months, average hourly earnings have increased by 2.2 percent." Weekly hours were unchanged.

A few more numbers: Total employment increased 223,000 from March to April and is now 3.0 million above the previous peak. Total employment is up 11.7 million from the employment recession low.

Private payroll employment increased 213,000 from March to April, and private employment is now 3.5 million above the previous peak. Private employment is up 12.3 million from the recession low.

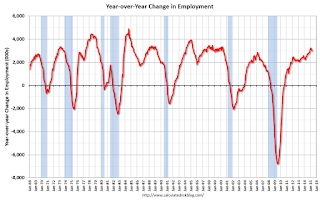

In April, the year-over-year change was just under 3.0 million jobs.

Overall this is another positive month ... and moving in the right direction!

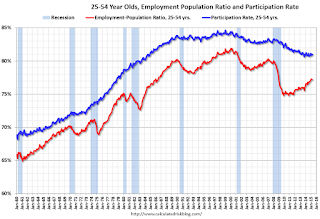

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in April to 81.0%, and the 25 to 54 employment population ratio was unchanged at 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased slightly to 2.2%, however wages were revised down for February and March. Wages will probably pick up a little this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 6.6 million in April, but is down by 880,000 from a year earlier. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in April to 6.58 million from 6.70 million in March. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 10.8% in April from 10.9% in March. This is the lowest level for U-6 since August 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.525 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.563 million in March.

This is trending down - and is at the lowest level since November 2008 - but is still very high.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In April 2015, state and local governments added 8,000 jobs (after losing 8,000 in March). State and local government employment is now up 132,000 from the bottom, but still 626,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs have slowed (Federal payrolls added 2,000 jobs in April, and Federal employment is unchanged year-to-date).

This was a decent employment report for April (not great, but not terrible). The year-over-year employment gains are still solid.

April Employment Report: 223,000 Jobs, 5.4% Unemployment Rate

by Calculated Risk on 5/08/2015 08:35:00 AM

From the BLS:

Total nonfarm payroll employment increased by 223,000 in April, and the unemployment rate was essentially unchanged at 5.4 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, health care, and construction. Mining employment continued to decline.

...

The change in total nonfarm payroll employment for February was revised from +264,000 to +266,000, and the change for March was revised from +126,000 to +85,000. With these revisions, employment gains in February and March combined were 39,000 lower than previously reported.

emphasis added

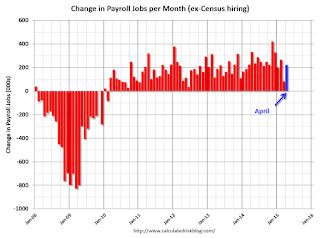

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 223 thousand in April (private payrolls increased 213 thousand).

Payrolls for February and March were revised down by a combined 39 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was just under 3.0 million jobs.

This is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in April to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was declined in April to 5.4%.

This was at expectations of 220,000, however there March was revised down ... still a decent report.

I'll have much more later ...

Thursday, May 07, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 5/07/2015 07:42:00 PM

Here is the employment preview I posted earlier: Preview: Employment Report for April

Goldman Sachs is forecasting 230,000 jobs added, and for the unemployment rate to decline to 5.4%.

Merrill Lynch is forecasting 235,000 jobs added in April, and the unemployment rate declining to 5.4%.

Nomura is forecasting 210,000 jobs, a 0.28% increase in wages month-to-month, and a 5.4% unemployment rate.

Friday:

• At 8:30 AM ET, the Employment Report for April. The consensus is for an increase of 220,000 non-farm payroll jobs added in April, up from the 126,000 non-farm payroll jobs added in March. The consensus is for the unemployment rate to decline to 5.4%.

Phoenix Real Estate in April: Sales Up 9.3%, Inventory DOWN 13% Year-over-year

by Calculated Risk on 5/07/2015 05:31:00 PM

For the fifth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were up 9.3% year-over-year.

2) Cash Sales (frequently investors) were down to 25.3% of total sales.

3) Active inventory is now down 13.2% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | --- | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 75.7% | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 8.1% | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 0.7% | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | -9.5% | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3.6% | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | -12.4% | 2,469 | 32.2% | 29,889 | 48.8% |

| Apr-15 | 8,368 | 9.3% | 2,120 | 25.3% | 25,950 | -13.2% |

| 1 April 2008 does not include manufactured homes, ~100 more | ||||||

Goldman Sachs April Employment Preview

by Calculated Risk on 5/07/2015 03:15:00 PM

Yesterday I discussed several indicators: Preview: Employment Report for April

Some excerpts from a research piece by Goldman Sachs economist David Mericle:

We expect nonfarm payroll job growth of 230k in April ... We expect the unemployment rate to decline by one-tenth to 5.4% and average hourly earnings to rise 0.2%.

...

Based on our method for estimating the payrolls effect of deviations in weather conditions from seasonal norms, we expect that warmer temperatures should be a substantial positive factor for April payrolls. The weeks leading into the March reference week were much colder than usual, while the weeks leading into the April reference period were quite a bit warmer than usual. Furthermore, the change in employment in both the construction and leisure and hospitality industries was about 30k below trend in March.

...

We also see some upside risk to our baseline forecast from a calendar effect. There were five rather than four weeks between the reference weeks for the March and April payrolls surveys this year. While the relevant history is limited and the BLS's seasonal adjustment procedure does attempt to control for the four-versus-five week effect, we have found that five-week Aprils tend to see above-trend payroll growth. Moreover, we have found that this calendar effect is not fully captured by other employment-related data. We expect an unusually large and positive calendar effect this month.

Part II: Demographics are Now Improving, Projections

by Calculated Risk on 5/07/2015 01:15:00 PM

Yesterday I pointed out that a blog post on demographics at the Financial Times would make more sense if it had been written a decade ago.

A decade ago it was obvious that demographics would be a drag on the economy. Even without the financial crisis, we would have expected a slowdown in growth.

But now the prime working age population is growing again, and we can expect growth to pick up over the next decade.

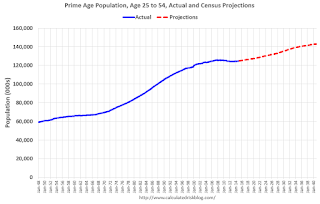

Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through March 2015 - with projections from the Census Bureau through 2040.

In the '80s, the prime working age population was growing 2% or more per year. Over the last 10 years (March 2005 through March 2015), the prime working age population was mostly unchanged (up less than 1% for the decade).

That is key reason that growth has slowed (see Demographics and GDP: 2% is the new 4%). Add the residual effects of the financial crisis to the drag from demographics - and the last decade was no surprise.

Going forward, the prime working age population will grow at a 0.5% to 1.0% annual rate (Census projections). This isn't the 2%+ per year of the 1980s, but it is still decent growth.

Demographics are now improving in the U.S..

Las Vegas Real Estate in April: Sales Increased 5.1% YoY

by Calculated Risk on 5/07/2015 10:31:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local housing market seeing steady growth this spring

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in April was 3,379, up from 3,358 in March and up from 3,215 one year ago. Compared to the previous month, GLVAR reported that sales were up 1.7 percent for single-family homes, but down 3.8 percent for condos and townhomes. Compared to April 2014, 5.3 percent more homes and 4.3 percent more condos and townhomes sold this April.There are several key trends that we've been following:

...

GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In April, 7.2 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 8.3 percent in March and from 12.4 percent one year ago. Another 8.3 percent of April sales were bank-owned, down from 9.3 percent in March and down from 11.4 percent last April.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in April was 13,750, up 1.6 percent from 13,532 in March, but down 0.6 percent from one year ago. GLVAR tracked a total of 3,626 condos, high-rise condos and townhomes listed for sale on its MLS in April, up 0.4 percent from 3,613 in March, but down 1.9 percent from one year ago.

By the end of April, GLVAR reported 7,296 single-family homes listed without any sort of offer. That’s up 0.5 percent from March and up 13.6 percent from one year ago. For condos and townhomes, the 2,437 properties listed without offers in April represented a 0.3 percent decrease from March and a 7.6 percent increase from one year ago.

emphasis added

1) Overall sales were up 5.1% year-over-year.

2) Conventional(equity, not distressed) sales were up 16.5% year-over-year. In April 2014, only 76.2% of all sales were conventional equity. In April 2015, 84.5% were standard equity sales. Note: In April 2013 (two years ago), only 57.5% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 41.4% in April 2014 to 30.4% in April 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 7.6% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

Weekly Initial Unemployment Claims increased to 265,000, Lowest 4-Week average in 15 years

by Calculated Risk on 5/07/2015 08:30:00 AM

The DOL reported:

In the week ending May 2, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 3,000 from the previous week's unrevised level of 262,000. The 4-week moving average was 279,500, a decrease of 4,250 from the previous week's unrevised average of 283,750. This is the lowest level for this average since May 6, 2000 when it was 279,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 279,500.

This was well below the consensus forecast of 285,000, and the low level of the 4-week average suggests few layoffs. This is the lowest 4-week average in 15 years (since May 2000).

Wednesday, May 06, 2015

Demographics are Now Improving

by Calculated Risk on 5/06/2015 06:46:00 PM

The Financial Times blogs has a blog post about the demographic impact on the U.S. economy: The US economy’s demographic dividend is fast turning into a deficit. A few excerpts.

Demographic change is creating major headwinds for the US economy ... One key factor is that there are more older people than ever before, due to a combination of the ageing of the US baby boomer generation (those born between 1946 and 1964) and increasing life expectancy. Older people tend to spend less, as they already own most of what they need and their incomes decline as they enter retirement.If this post had been written a decade ago, it would make more sense.

Equally important is the collapse that has occurred in US fertility rates since the peak of the baby boom. These have nearly halved from the 3.33 babies/woman level of the mid-1950s to just 1.97 babies/woman today, below the level required to replace the population. As a result, the size of the 25-54 age group, historically the main wealth creators, has plateaued in the US.

Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through March 2015.

Click on graph for larger image.

Click on graph for larger image.There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Demographics are improving in the U.S.!

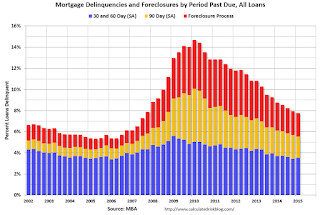

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q1, Lowest since Q2 2007

by Calculated Risk on 5/06/2015 02:47:00 PM

Earlier from the MBA: Mortgage Delinquencies and Foreclosures Fall in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.54 percent of all loans outstanding at the end of the first quarter of 2015. This was the lowest level since the second quarter of 2007. The delinquency rate decreased 14 basis points from the previous quarter, and 57 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 2.22 percent, down five basis points from the fourth quarter of 2014 and 43 basis points lower than the same quarter one year ago. This was the lowest foreclosure inventory rate since the fourth quarter of 2007.

...

"Delinquency rates and the percentage of loans in foreclosure continued to fall in the first quarter and are now at their lowest levels since 2007," said Joel Kan, MBA's Associate Vice President of Industry Surveys and Forecasting. "The job market continues to grow, and this is the most important fundamental improving mortgage performance. Additionally, home prices continued to rise, as did the pace of sales, thus increasing equity levels and enabling struggling borrowers to sell if needed."

"The foreclosure inventory rate has decreased in the last twelve quarters, and now is at the lowest level since the fourth quarter of 2007. The rate, at 2.22 percent, was about half of where it was at its peak in 2010. With a declining 90+ day delinquency rate and the improving credit quality of new loans, we expect that the foreclosure inventory rate will continue to decline in coming quarters. Foreclosure starts decreased one basis point from the previous quarter, and continue to fluctuate from quarter to quarter mainly due to state-level differences in the speed of the foreclosure process. At 0.45 percent, the level of foreclosure starts is at its long run average.

...

Around 40 percent of loans serviced are in judicial states and these states continue to have a foreclosure inventory rate that is well above that of non-judicial states. For states where the judicial process is more frequently used, 3.64 percent of loans serviced were in the foreclosure process, compared to 1.22 percent in non-judicial states. States that utilize both judicial and non-judicial foreclosure processes had a foreclosure inventory rate closer that of to the non-judicial states at 1.43 percent.

...

"Legacy loans continue to account for the majority of all troubled mortgages. Within loans that were seriously delinquent (either more than 90 days delinquent or in the foreclosure process), 73 percent of those loans were originated in 2007 or earlier, even as the overall rate of serious delinquencies for those cohorts decreases. More recent loan vintages, specifically loans originated in 2012 and later, continue to exhibit low serious delinquency rates."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 75% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 70% of the way back to normal.

So it has taken about 5 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 70%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016 (although progress has slowed). Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.