by Calculated Risk on 3/09/2015 11:15:00 AM

Monday, March 09, 2015

CBO Projection: Budget Deficit to be lower than previous forecast

The Congressional Budget Office (CBO) released their new Updated Budget Projections: 2015 to 2025

Under the assumption that current laws will generally remain unchanged, the budget deficit is projected to decline in 2016, to $455 billion, or 2.4 percent of GDP, and then to hold roughly steady relative to the size of the economy through 2018. Beyond that time, however, the gap between spending and revenues is projected to grow faster than GDP: The deficit in 2025 is projected to reach $1.0 trillion, or 3.8 percent of GDP ...The CBO projects the deficit will decline further in 2015, 2016 and 2017, and be below 3% of GDP for the next five years.

CBO’s estimate of the deficit for 2015 is $18 billion greater than the shortfall it projected in January, mostly because the agency has increased estimated outlays for student loans, Medicare, and Medicaid. In contrast, the projected deficits for the 2016–2025 period total $431 billion less than the cumulative deficit that CBO projected in January. The largest factor underlying that reduction is a downward revision to projected growth in private health insurance spending, which is estimated to lower the net cost of the provisions of the Affordable Care Act (ACA) that are related to insurance coverage and to increase overall revenues from income and payroll taxes (because a larger share of employees’ compensation over the coming decade is now projected to be paid in the form of taxable wages and salaries).

emphasis added

This is a significant improvement from the previous forecast. As an example, last year, the CBO forecast the deficit to be 2.9% in 2016; now the CBO is forecasting the deficit will be 2.4% in 2016.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

After 2017, the deficit will start to increase again according to the CBO.

From a policy perspective and using these projections, further short term deficit reduction is not a priority.

Black Knight Mortgage Monitor: Foreclosure Starts increase in January

by Calculated Risk on 3/09/2015 07:30:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for January today. According to BKFS, 5.56% of mortgages were delinquent in January, down from 5.64% in December. BKFS reported that 1.61% of mortgages were in the foreclosure process, down from 2.35% in January 2014.

This gives a total of 7.17% delinquent or in foreclosure. It breaks down as:

• 1,701,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,112,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 815,000 loans in foreclosure process.

For a total of 3,628,000 loans delinquent or in foreclosure in January. This is down from 4,315,000 in January 2014.

From Black Knight:

The month’s data showed that both first-time and repeat foreclosure starts reached 12-month highs, although there was clear separation in the levels of increase between the two. According to Trey Barnes, Black Knight’s senior vice president of Loan Data Products, separation also continues to be seen between judicial and non-judicial foreclosure states across multiple performance indicators.This is still mostly clearing out the backlog.

“Overall foreclosure starts hit a 12-month high in January, and that held true when looking at both first-time and repeat foreclosure starts individually,” said Barnes. “Repeat foreclosure starts made up 51 percent of all foreclosure starts and increased 11 percent from December. In contrast, first-time foreclosure starts were up just a fraction of a percent from the month prior. Similarly, Black Knight found that January foreclosure starts jumped about 10 percent from December in judicial states as compared to just a 1.7 percent increase in non-judicial states. Judicial states are also seeing higher levels of both new problem loans and serious delinquencies (loans 90 or more days delinquent, but not yet in foreclosure) than non-judicial states, although volumes are down overall in both categories.

Sunday, March 08, 2015

Sunday Night Futures

by Calculated Risk on 3/08/2015 07:54:00 PM

From Bloomberg: Greek Tensions Revived as Creditors Reject Reform List

The list of measures Greece’s government sent to euro region finance ministers last Friday, including the idea of hiring non-professional tax collectors such as tourists, is “far” from complete and the country probably won’t receive an aid disbursement this month, Eurogroup chairman Jeroen Dijsselbloem said on Sunday.Ouch.

Monday:

• Early, Black Knight Mortgage Monitor for January

• At 10:00 AM ET, the Fed will release the monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of March 8, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are unchanged and DOW futures are up 12 (fair value).

Oil prices were mixed over the last week with WTI futures at $49.47 per barrel and Brent at $59.26 per barrel. A year ago, WTI was at $102, and Brent was at $108 - so prices are down around 50% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.45 per gallon (down about $1.00 per gallon from a year ago). Prices in California have risen significantly due to a refinery fire in February and a strike.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 3/08/2015 11:49:00 AM

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through February 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Saturday, March 07, 2015

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 3/07/2015 08:04:00 PM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

• Employment Report Comments and Graphs

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is close to 1.7% of the labor force - the lowest since December 2008 - however the number (and percent) of long term unemployed remains a serious problem.

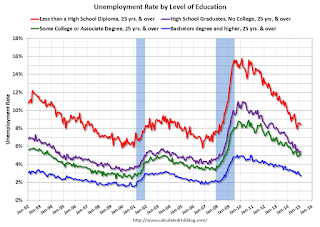

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

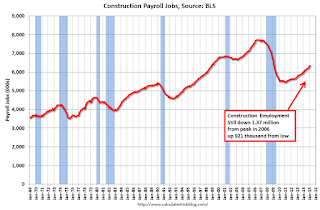

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 921 thousand.

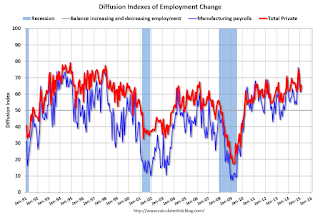

The BLS diffusion index for total private employment was at 65.4 in February, up from 62.0 in January.

The BLS diffusion index for total private employment was at 65.4 in February, up from 62.0 in January.For manufacturing, the diffusion index was at 64.4, up from 61.3 in January.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall job growth was widespread in February - another good sign.

Schedule for Week of March 8, 2015

by Calculated Risk on 3/07/2015 10:00:00 AM

The key economic report this week is February retail sales on Thursday.

Also the Census Bureau will release the Q4 Quarterly Services Report on Wednesday, and the Fed will release the Q4 Flow of Funds report on Thursday.

At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

7:30 AM ET: NFIB Small Business Optimism Index for February.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in December to 5.028 million from 4.847 million in November.

The number of job openings (yellow) were up 28% year-over-year, and Quits were up 12% year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.1% decrease in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: The Q4 Quarterly Services Report from the Census Bureau.

4:30 PM: The Federal Reserve will release the Comprehensive Capital Analysis and Review Results (Stress Test)

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 320 thousand.

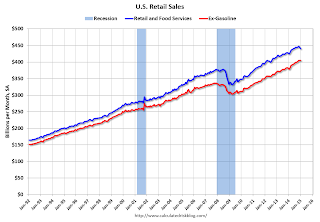

8:30 AM ET: Retail sales for February will be released.

8:30 AM ET: Retail sales for February will be released.This graph shows retail sales since 1992 through January 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014.

The consensus is for retail sales to increase 0.3% in February, and to increase 0.5% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.1% increase in inventories.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

2:00 PM ET: The Monthly Treasury Budget Statement for February.

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 95.5, up from 95.4 in February.

Friday, March 06, 2015

Duy: "Patient" is History

by Calculated Risk on 3/06/2015 06:00:00 PM

From Tim Duy at Fed Watch: "Patient" is History

The February employment report almost certainly means the Fed will no longer describe its policy intentions as "patient" at the conclusion of the March FOMC meeting. And it also keep a June rate hike in play. But for June to move from "in play" to "it's going to happen," I still feel the Fed needs a more on the inflation side. ...CR Note: Based on Yellen's testimony last week, it seemed likely that "patient" would be dropped from the March FOMC statement. June might be in play, but like Duy, I think the FOMC will wait until it is clear inflation is moving towards 2% before raising rates.

Bottom Line: "Patient" is out. Tough to justify with unemployment at the top of the Fed's central estimates of NAIRU. Pressure to begin hiking rates will intensify as unemployment heads lower. The inflation bar will fall, and Fed officials will increasingly look for reasons to hike rates rather than reasons to delay. They may not want to admit it, but I suspect one of those reasons will be fear of financial instability in the absence of tighter policy. June is in play.

emphasis added

Update: Best Private Sector Job Creation "Ever"?

by Calculated Risk on 3/06/2015 03:33:00 PM

Last month, I mentioned that private job creation was on pace for the best ever during a presidential term. I received a few emails asking if that was correct. The answer is "yes".

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Here is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Note: Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s. The prime working age labor force was growing more than 3% per year in the '80s with a surge in younger workers and women joining the labor force. Now, the overall population is larger, but the prime working age population has declined this decade and the participation rate is generally declining now.

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term. Public sector job creation increased the most during Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 34 thousand public sector jobs have been added during the first twenty five months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is just 2% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,885 | 692 | 11,577 |

| 2 | Clinton 2 | 10,070 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 5,799 | 34 | 5,833 | |

| Pace2 | 11,134 | 65 | 11,199 | |

| 125 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The second table shows the jobs need per month for Obama's 2nd term to be in the top three presidential terms.

| Jobs needed per month (average) for Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 221 | 250 | ||

| #2 | 186 | 238 | ||

| #3 | 155 | 216 | ||

Trade Deficit decreased in January to $41.8 Billion

by Calculated Risk on 3/06/2015 11:59:00 AM

Earlier the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.8 billion in January, down $3.8 billion from $45.6 billion in December, revised. January exports were $189.4 billion, down $5.6 billion from December. January imports were $231.2 billion, down $9.4 billion from December.The trade deficit was at the consensus forecast of $41.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in January (some impact of West Coast port slowdown).

Exports are 14% above the pre-recession peak and down 2% compared to January 204; imports are at the pre-recession peak, and unchanged compared to January 2014.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $58.96 in January, down from $73.64 in December, and down from $90.21 in January 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts.

The trade deficit with China increased to $28.6 billion in January, from $27.8 billion in January 2013. The deficit with China is a large portion of the overall deficit.

The decrease in the trade deficit was due to a lower volume and lower price of oil imports (volatile month-to-month), and a slightly larger deficit with the Euro Area ($8.0 billion in Jan 2015 compared to $7.2 billion in Jan 2014).

Employment Report Comments and Graphs

by Calculated Risk on 3/06/2015 09:45:00 AM

Earlier: February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

This was a very solid employment report with 295,000 jobs added, although job gains for January were revised down 18,000.

Unfortunately there was little good news on wage growth, from the BLS: "In February, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.78. Over the year, average hourly earnings have risen by 2.0 percent."

However I expect real wages to increase this year.

A few more numbers: Total employment increased 295,000 from January to February and is now 2.8 million above the previous peak. Total employment is up 11.5 million from the employment recession low.

Private payroll employment increased 288,000 from January to February, and private employment is now 3.2 million above the previous peak. Private employment is up 12.0 million from the recession low.

In February, the year-over-year change was 3.3 million jobs. This was the highest year-over-year gain since March '00.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 81.0%, and the 25 to 54 employment population ratio increased to 77.3%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth has been running close to 2% since 2010 and will probably pick up a little this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in February at 6.6 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in February to 6.635 million from 6.810 million in January. This is the lowest level since September 2008. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.0% in February from 11.3% in January. This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.709 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.800 in January. This is trending down, but is still very high.

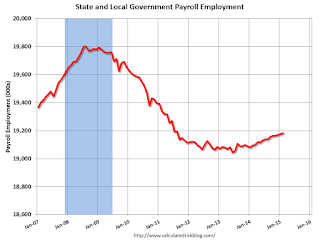

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In February 2015, state and local governments added 7,000 jobs. State and local government employment is now up 138,000 from the bottom, but still 620,000 below the peak.

State and local employment is now generally increasing. And Federal government layoffs have slowed (Federal payrolls were unchanged in February).

Overall this was a very solid employment report.