by Calculated Risk on 2/20/2015 10:15:00 PM

Friday, February 20, 2015

West Coast Port Deal Reached

Some good news from the LA Times: Shipping lines and dockworkers reach deal, port shutdown averted

Shipping companies and the dockworkers union have reached a tentative deal on a new labor contract, union officials said Friday night, staving off a shutdown of 29 ports that would have choked off trade through the West Coast.

...

It will take weeks, if not months, just to clear the current backlog, port officials said.

A Comment on Greece

by Calculated Risk on 2/20/2015 05:11:00 PM

There was an agreement today (pending some proposals on Monday) to extend the Greek bailout for four months.

My first reaction is that there seem to be two possible outcomes in four months:

1) The technocrats at the ECB / EU / IMF agree to change the target for the primary budget surplus. The current plan is for Greece to run a primary surplus of 3.0% in 2015 and 4.5% in 2016, however that assumed that the unemployment rate would peak at 14.8% (instead the unemployment rate increased to close to 28%), and that GDP would start increasing in 2012 - instead GDP kept falling - and Greece is now in a Great Depression size contraction.

Contractionary policy has been very contractionary!

It is amazing that Greece is even running a primary budget surplus with a collapsing economy. If the primary target isn't change, the depression will continue. A little growth would help everyone, so easing the primary budget target is critical.

2) The Greeks will take the four months and ready the drachma printing presses.

Point 1 is possible, but the technocrats are the only hope for Greece, not the politicians. See the following quote from German Finance minister Wolfgang Schauble in 2013:

"Nobody in Europe sees this contradiction between fiscal policy consolidation and growth,” Schauble said. “We have a growth-friendly process of consolidation, and we have sustainable growth, however you want to word it.”Not everyone is blind to the obvious - some people in Europe see the obvious contradiction (just look at the data for Europe as a whole and Greece in particular). Too many politicians can't (or won't) look at the data and change their minds.

Lawler: Homebuilder Summary Table

by Calculated Risk on 2/20/2015 03:52:00 PM

Economist Tom Lawler sent me the summary tables below for selected publicly-traded home builders.

The first table is for Q4.

This second and third tables are for Calendar Years 2014, 2013, and 2012.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/14 | 12/13 | % Chg | 12/14 | 12/13 | % Chg | 12/14 | 12/13 | % Chg |

| D.R. Horton | 7,370 | 5,454 | 35.1% | 7,973 | 6,188 | 28.8% | $281,036 | 263,542 | 6.6% |

| PulteGroup | 3,232 | 3,214 | 0.6% | 5,316 | 4,964 | 7.1% | $334,000 | 325,000 | 2.8% |

| NVR | 2,713 | 2,631 | 3.1% | 3,469 | 3,342 | 3.8% | $375,500 | 365,300 | 2.8% |

| The Ryland Group | 1,547 | 1,428 | 8.3% | 2,489 | 2,178 | 14.3% | $338,000 | 314,000 | 7.6% |

| Beazer Homes | 966 | 895 | 7.9% | 885 | 1,038 | -14.7% | $295,600 | 279,300 | 5.8% |

| Standard Pacific | 978 | 878 | 11.4% | 1,475 | 1,343 | 9.8% | $491,000 | 446,000 | 10.1% |

| Meritage Homes | 1,272 | 1,131 | 12.5% | 1,863 | 1,468 | 26.9% | $369,000 | 363,000 | 1.7% |

| MDC Holdings | 887 | 752 | 18.0% | 1,242 | 1,252 | -0.8% | $397,000 | 368,200 | 7.8% |

| M/I Homes | 773 | 793 | -2.5% | 1,105 | 1,120 | -1.3% | $322,000 | 292,000 | 10.3% |

| Total | 19,738 | 17,176 | 14.9% | 25,817 | 22,893 | 12.8% | $336,302 | $321,436 | 4.6% |

| Net Orders | Settlements | Average Closing Price $ | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Calendar Year | 2014 | 2013 | 2012 | 2014 | 2013 | 2012 | 2014 | 2013 | 2012 |

| D.R. Horton | 31,625 | 25,315 | 22,513 | 30,455 | 25,161 | 19,954 | 276,296 | 255,646 | 228,395 |

| PulteGroup | 16,652 | 17,080 | 19,039 | 17,196 | 17,766 | 16,505 | 329,000 | 305,000 | 276,000 |

| NVR | 12,389 | 11,800 | 10,954 | 11,859 | 11,834 | 9,843 | 368,500 | 349,100 | 317,073 |

| The Ryland Group | 7,668 | 7,263 | 5,781 | 7,677 | 7,035 | 4,897 | 333,000 | 296,000 | 262,000 |

| Beazer Homes | 4,819 | 4,989 | 5,111 | 4,798 | 5,056 | 4,603 | 287,960 | 262,004 | 229,126 |

| Standard Pacific | 4,967 | 4,898 | 4,014 | 4,956 | 4,602 | 3,291 | 478,000 | 413,000 | 362,000 |

| Meritage Homes | 5,944 | 5,615 | 4,795 | 5,862 | 5,259 | 4,238 | 365,000 | 339,000 | 279,000 |

| MDC Holdings | 4,623 | 4,327 | 4,342 | 4,366 | 4,710 | 3,740 | 377,300 | 345,400 | 307,800 |

| M/I Homes | 3,663 | 3,787 | 3,020 | 3,721 | 3,472 | 2,765 | 313,000 | 286,000 | 264,000 |

| Total | 92,350 | 85,074 | 79,569 | 90,890 | 84,895 | 69,836 | 326,777 | 302,631 | 269,578 |

| Net Orders (% Change) | Settlements (% Change) | Average Closing Price (% Change) | ||||

|---|---|---|---|---|---|---|

| Calendar Year | 2014 vs. 2013 | 2013 vs. 2012 | 2014 vs 2013 | 2013 vs. 2012 | 2014 vs 2013 | 2013 vs. 2012 |

| D.R. Horton | 24.9% | 12.4% | 21.0% | 26.1% | 8.1% | 11.9% |

| PulteGroup | -2.5% | -10.3% | -3.2% | 7.6% | 7.9% | 10.5% |

| NVR | 5.0% | 7.7% | 0.2% | 20.2% | 5.6% | 10.1% |

| The Ryland Group | 5.6% | 25.6% | 9.1% | 43.7% | 12.5% | 13.0% |

| Beazer Homes | -3.4% | -2.4% | -5.1% | 9.8% | 9.9% | 14.3% |

| Standard Pacific | 1.4% | 22.0% | 7.7% | 39.8% | 15.7% | 14.1% |

| Meritage Homes | 5.9% | 17.1% | 11.5% | 24.1% | 7.7% | 21.5% |

| MDC Holdings | 6.8% | -0.3% | -7.3% | 25.9% | 9.2% | 12.2% |

| M/I Homes | -3.3% | 25.4% | 7.2% | 25.6% | 9.4% | 8.3% |

| Total | 8.6% | 6.9% | 7.1% | 21.6% | 8.0% | 12.3% |

Greece: Tentative Deal, 4 Month Extension, Possible 2 PM ET Press Conference

by Calculated Risk on 2/20/2015 01:52:00 PM

Just an update: Some details have leaked out, although the text is not available yet. It appears there will be a four month extension of the loan agreement - not the program - and the Greek government will standstill for four months - with no additional austerity, and no new spending programs. This is all tentative and the details could be wrong.

Press conference here, possibly as soon as 2 PM ET.

Lawler: Regional Home Price Declines Used to be Quite Common; Just Not All at the Same Time

by Calculated Risk on 2/20/2015 10:45:00 AM

Some interesting analysis from housing economist Tom Lawler:

Using the Freddie Mac Home Price Index for 369 MSAs, below is a chart showing the number of MSAs where the FMHPI over 60-month period ending in the date shown either (1) declined, or (2) fell by at least 10%. (The FMHPIs are based on repeat transactions of homes backing GSE mortgages, and data are available back to January 1975.) The first chart covers the five-year period ending January 1980 through the five-year period ending December 1999.

In five-year periods that including the late 70’s there were very few MSAs whose HPI fell over those five years, mainly because this was a period of very high inflation (see last page). That changed significantly as inflation fell (and following a serve recession), and the number of MSAs experiencing home price declines over a five year period increased significantly in the 80’s – with the most severe declines coming in the oil-patch states. There was another significantly jump in the number of areas experiencing “sustained” home price declines in the 90’s, including many Northeast markets (including the Boston “bubble/bust,” with the bust from the late 80’s through the early/mid 90’s) and the California “boom/bust” (especially Southern California, with the bust from the summer of 1990 through the beginning of 1996.

The above chart doesn’t reflect the number of MSAs who have ever experienced a decline in home prices over a five-year period from 1975 to 1999, but rather the number whose HPI over the same five-year period experienced a drop. Over the 1975-1999 period the FMHPI for 198 MSAs saw a decline over some five year period, and the FMHPI for 87 MSAs fell by 10% or more. And for the top 25 MSAs (in terms of population), 15 experienced a decline in home prices over some five period from 1975 to 1999, with eight experienced a double-digit drop over some five year period (including four out of the top five MSAs.).

Now let’s look at the same chart, but expanding to include the period through 2005.

As the chart indicates, from the five-year period ending in late 2001 through the five-year period ending in late 2005, there were NO MSAs that saw a decline in their respective FMHPIs. Stated another way, for folks trying to “model” mortgage credit default using loan-level data only available on mortgages originated from 1996 through 2005, there were virtually NO areas of the country that were “distressed” in terms of experiencing a decline in home prices over any five-year period.

Now let’s extend the chart through September of 2014.

Oh My!

Finally, here is a chart comparing consumer price inflation (cumulative, using the CPI-U-RS) over a rolling 60-month period with the number of MSAs experiencing a decline in their respective HPIs over the same rolling 60-month period. The chart ends in 2005.

During the period from the second half of the 70’s through the very early part of the 80’s, there were few MSAs experiencing sustained home price declines, in part because of high inflation. That was obviously not the case during the period from the latter half of the 90’s through the middle of last decade.

Fannie and Freddie: REO inventory declined in Q4, Down 25% Year-over-year

by Calculated Risk on 2/20/2015 09:06:00 AM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

From Fannie Mae:

The continued decrease in the number of our seriously delinquent single-family loans, as well as lengthy foreclosure timelines in a number of states, have resulted in a reduction in the number of REO acquisitions and fewer dispositions in 2014 compared with 2013 and 2012.The decline in REO is related to fewer delinquencies (higher house prices and a better economy), and long foreclosure time lines in some states (like Florida).

...

We recognized a benefit for credit losses in 2014 primarily due to increases in home prices of 4.7% in 2014. Higher home prices decrease the likelihood that loans will default and reduce the amount of credit loss on loans that do default, which impacts our estimate of losses and ultimately reduces our total loss reserves and provision for credit losses.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q4 for both Fannie and Freddie, and combined inventory is down 25% year-over-year. For Freddie, this is the lowest level of REO since Q2 2008. For Fannie, this is the lowest level since 2009.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Thursday, February 19, 2015

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in January

by Calculated Risk on 2/19/2015 07:43:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in January.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic and Orlando are up year-over-year because of an increase foreclosure as lenders work through the backlog).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

It is pretty amazing that distressed sales still make up almost 40% of sales in Orlando. Florida has been very slow to recover from the severe damage of the housing bubble.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jan-15 | Jan-14 | Jan-15 | Jan-14 | Jan-15 | Jan-14 | Jan-15 | Jan-14 | |

| Las Vegas | 9.7% | 17.0% | 9.4% | 11.0% | 19.1% | 28.0% | 36.0% | 46.3% |

| Reno** | 10.0% | 16.0% | 6.0% | 9.0% | 16.0% | 25.0% | ||

| Phoenix | 3.7% | 6.8% | 6.5% | 9.6% | 10.2% | 16.5% | 32.0% | 36.3% |

| Sacramento | 6.9% | 11.8% | 9.5% | 8.4% | 16.4% | 20.2% | 22.7% | 26.6% |

| Minneapolis | 4.1% | 5.5% | 16.0% | 24.0% | 20.1% | 29.5% | ||

| Mid-Atlantic | 5.8% | 8.5% | 15.2% | 12.2% | 21.0% | 20.7% | 21.4% | 22.9% |

| Orlando | 5.3% | 11.7% | 33.9% | 25.7% | 39.2% | 37.4% | 47.1% | 49.2% |

| California * | 6.4% | 10.7% | 6.7% | 7.7% | 13.1% | 18.4% | ||

| Bay Area CA* | 4.0% | 8.5% | 4.5% | 5.2% | 8.5% | 13.7% | 22.6% | 25.8% |

| So. California* | 6.5% | 10.7% | 5.7% | 6.6% | 12.2% | 17.3% | 24.9% | 29.9% |

| Chicago (city) | 24.1% | 35.0% | ||||||

| Hampton Roads | 27.6% | 29.5% | ||||||

| Northeast Florida | 38.2% | 46.2% | ||||||

| Toledo | 37.6% | 43.9% | ||||||

| Tucson | 34.8% | 38.2% | ||||||

| Des Moines | 22.0% | 22.2% | ||||||

| Georgia*** | 31.3% | N/A | ||||||

| Omaha | 24.0% | 26.4% | ||||||

| Pensacola | 38.3% | 42.7% | ||||||

| Memphis* | 14.8% | 19.1% | ||||||

| Springfield IL** | 16.2% | 28.5% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early Read on Existing Home Sales in January

by Calculated Risk on 2/19/2015 03:45:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.90 million in January, down 2.8% from December’s preliminary pace but up 6.1% from last January’s depressed pace. Unadjusted sales are likely to show a smaller YOY gain, reflecting the fewer number of business days this January compared to last January.

(Note: in this month’s release the NAR will incorporate its annual seasonal factor revision, which will impact the monthly pattern of seasonally adjusted sales over the past few years. I’ve attempted to “allow” for this revision.)

On the inventory front, while there were sizable differences across market, in aggregate I estimate that the inventory of existing homes for sale as measured by the NAR at the end of January was unchanged from December, and down 1.6% from a year earlier. The NAR’s “seasonally adjusted” (derivable from supplemental data) inventory estimate fell sharply during the last few months of last year, for reasons that are not clear.

Finally, based on local realtor/MLS data I project that the NAR’s median SF home sales price in January will be up about 5.4% from last January. I should note, however, that of late the increase in the NAR’s median sales price estimate has been higher than that suggest by local realtor reports.

CR Note: The NAR is scheduled to release January existing home sales on Monday, February 23, 2015, at 10 AM ET.

Quarterly Housing Starts by Intent

by Calculated Risk on 2/19/2015 01:03:00 PM

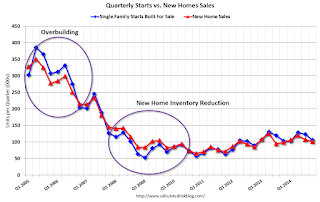

In addition to housing starts for January, the Census Bureau also released the Q4 "Started and Completed by Purpose of Construction" report yesterday.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released yesterday showed there were 106,000 single family starts, built for sale, in Q4 2014, and that was above the 102,000 new homes sold for the same quarter, so inventory increased slightly in Q4 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

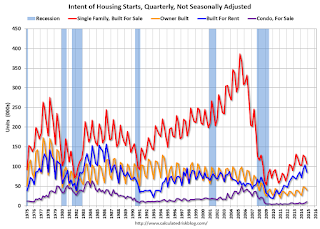

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 2% compared to Q4 2013.

Single family starts built for sale were up about 2% compared to Q4 2013. Owner built starts were up 25% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly over the last few years, and is near the highest level since the mid-80s, and was at the same level as in Q4 2013.

Philly Fed Manufacturing Survey declines to 5.2 in February

by Calculated Risk on 2/19/2015 10:11:00 AM

From the Philly Fed: February Manufacturing Survey

Firms responding to the Manufacturing Business Outlook Survey indicated continued modest growth in the region’s manufacturing sector in February. Although the current activity index fell for the third consecutive month, it remained positive, and the employment indicator increased from its reading last month. The survey’s future activity index also fell but continues to reflect general optimism about manufacturing growth in the region over the next six months.This was below the consensus forecast of a reading of 8.5 for January.

...

The diffusion index for current general activity fell slightly, from a reading of 6.3 in January to 5.2 this month ...

The survey’s indicators for current labor market conditions suggest a slight improvement this month, as the employment index increased 6 points and returned to a positive reading ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The light blue line is an average of the NY Fed (Empire State) and Philly Fed surveys through February. The ISM and total Fed surveys are through January.

The average of the Empire State and Philly Fed surveys declined in February, and this suggests a slightly weaker ISM report for February.