by Calculated Risk on 2/10/2015 05:21:00 PM

Tuesday, February 10, 2015

FNC: Residential Property Values increased 5.0% year-over-year in December

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their December index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased slightly from November to December (Composite 100 index, not seasonally adjusted).

The 10 city MSA RPI declined in December, and the 20-MSA and 30-MSA RPIs increased . These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in December than in November, with the 100-MSA composite up 5.0% compared to December 2013. In general, for FNC, the YoY increase has been slowing since peaking in March at 9.0%.

The index is still down 19.6% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through December 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the price indexes have been showing a slowdown in price increases.

The December Case-Shiller index will be released on Tuesday, February 24th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

Las Vegas Real Estate in January: Sales Decline, Non-contingent Inventory up 13% YoY

by Calculated Risk on 2/10/2015 02:24:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices up 8 percent for year

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in January 2015 was 2,239, down from 2,734 in December 2014 and down from 2,565 one year ago. At the current sales pace, Lynam said Southern Nevada continues to have roughly a four-month supply of available homes. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

...

GLVAR has been tracking a two-year trend of fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In January, 9.7 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10 percent in December and 17 percent a year ago. Another 9.4 percent of January sales were bank-owned, up from 8 percent in December, but down from 11 percent last year.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in January was 12,666, up 2.3 percent from 12,377 in December, but down 6.4 percent from one year ago. GLVAR tracked a total of 3,429 condos, high-rise condos and townhomes listed for sale on its MLS in January, up 4.5 percent from 3,282 in December and up 15.1 percent from January 2014.

By the end of January, GLVAR reported 7,382 single-family homes listed without any sort of offer. That’s down 5.0 percent from 7,774 such homes listed in December, but up 12.9 percent from one year ago. For condos and townhomes, the 2,327 properties listed without offers in January represented a 0.8 percent increase from 2,309 such properties listed in December and a 35.9 percent increase from one year ago.

emphasis added

1) Overall sales were down 12.7% year-over-year.

2) However conventional (equity, not distressed) sales were only down about 2% year-over-year. In January 2014, only 72.0% of all sales were conventional equity. In January 2015, 80.9% were standard equity sales. Note: In January 2013 (two years ago), only 51.3% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 46.8% in January 2014 to 36.0% in January 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 12.9% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

Trulia: Asking House Prices up 7.5% year-over-year in January

by Calculated Risk on 2/10/2015 11:58:00 AM

From Trulia chief economist Jed Kolko: For Home Prices, The Rebound Effect Is Over. Long Live Job Growth

Nationwide, asking prices on for-sale homes climbed 0.5% month-over-month in January, seasonally adjusted — the smallest monthly gain since August. Year-over-year, asking prices rose 7.5%, down from the 9.3% year-over-year increase in January 2014. Asking prices increased year-over-year in 94 of the 100 largest U.S. metros.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and although year-over-year price increases had been slowing, the year-over-year change increased in January compared to December.

The biggest home price increases are not necessarily in markets that had more severe housing busts. But the metros where home prices are now rising fastest are, almost without exception, the ones with faster job growth. Why? A growing economy fuels housing demand. Among the 10 metros with the biggest year-over-year price increases, nine had at least 2% year-over-year job growth. ...

Nationwide, rents rose 6.5% year-over-year in January. The three large rental markets with the steepest rent increases – Denver, Oakland, and San Francisco – all have had job growth of 2% or more. In general, metros with faster job growth have larger rent increases, though some Sunbelt markets like Riverside-San Bernardino, Houston, and San Diego have had impressive job growth with more limited rent increases.

emphasis added

The month-to-month increase suggests further house price increases over the next few months on a seasonally adjusted basis.

There is much more in the article.

BLS: Jobs Openings at 5.0 million in December, Up 28% Year-over-year

by Calculated Risk on 2/10/2015 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 5.0 million job openings on the last business day of December, little changed from 4.8 million in November, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in December, little changed from November.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December, the most recent employment report was for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in December to 5.028 million from 4.847 million in November.

The number of job openings (yellow) are up 28% year-over-year compared to December 2013.

Quits are up 12% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another very positive report. It is a good sign that job openings are over 5 million, and that quits are increasing year-over-year.

NFIB: Small Business Optimism Index Decreased in January

by Calculated Risk on 2/10/2015 09:01:00 AM

From the National Federation of Independent Business (NFIB): SMALL BUSINESS OPTIMISM FALLS, BUT STILL IN NORMAL ZONE

The Small Business Optimism Index fell 2.5 points to 97.9, giving back the December gain that took the Index over 100. Still, the Index indicates that the small business sector is operating in a somewhat “normal” zone.

The percent of owners reporting job creation fell 4 percentage points to a net 5 percent of owners, still a solid number. ... Twenty-six percent of all owners reported job openings they could not fill in the current period, up 1 point and a very solid reading. ...

...

Labor costs continue to put pressure on the bottom line but energy prices are down a lot. Two percent reported reduced worker compensation and 25 percent reported raising compensation, yielding a seasonally adjusted net 25 percent reporting higher compensation, unchanged from December.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 97.9 in January from 100.4 in December.

Monday, February 09, 2015

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 2/09/2015 07:21:00 PM

From the NY Times: Greece to Propose a Debt Compromise Plan to Creditors

Hoping to defuse a standoff that has set Europe and financial markets on edge, Greek officials intend to propose a detailed compromise plan at an emergency meeting with creditors on Wednesday in Brussels, a finance ministry official here said on Monday.Tuesday:

...

Greece still plans to reject some of the harshest austerity conditions attached to Greece’s bailout loans, but will propose retaining about 70 percent of the terms, according to the official.

Athens will propose replacing the remaining 30 percent of the austerity conditions with new reforms that the Greek government will devise together with the Organization for Economic Cooperation and Development.

• At 7:30 AM ET, NFIB Small Business Optimism Index for January.

• Early: Trulia Price Rent Monitors for January. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 10:00 AM, Job Openings and Labor Turnover Survey for December from the BLS. Jobs openings increased in November to 4.972 million from 4.830 million in October. The number of job openings were up 21% year-over-year compared to November 2013, and Quits were up 7% year-over-year.

West Coast Port Slowdown Ongoing

by Calculated Risk on 2/09/2015 03:20:00 PM

At least this is getting more media attention ...

From the LA Times: Ship unloading resumes at West Coast ports as labor talks continue

Employers and the International Longshore and Warehouse Union have been locked in bitter talks for a new West Coast dockworkers contract for nearly nine months -- a period that has seen debilitating congestion up and down the West Coast.From CNBC: West Coast ports: Retail's $7 billion problem

...

The line of ships anchored off the Long Beach and Los Angeles coast waiting for berths grew over the weekend, from 28 Friday afternoon to 31 Sunday morning, according to the Marine Exchange of Southern California.

...

The two sides are expected to meet again this afternoon.

Retailers' anxiety levels are rising as gridlock grinds on with contract negotiations between West Coast dockworkers and port terminal operators.

It has been a long nine months for those dealing directly, or indirectly, with the lack of a West Coast port contract, and after a temporary shutdown over the weekend, retail lobby groups and consultants are assigning potential costs to the issue.

According to a Kurt Salmon analysis, congestion at West Coast ports could cost retailers as much as $7 billion this year. That congestion cost comes from a combination of the higher price of carrying goods and missed sales due to below optimal inventory levels.

Prime Working-Age Population Growing Again

by Calculated Risk on 2/09/2015 11:59:00 AM

Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through January 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 2/09/2015 09:50:00 AM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• January Employment Report: 257,000 Jobs, 5.7% Unemployment Rate

• Employment Report Comments and Graphs

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 1.8% of the labor force - the lowest since January 2009 - however the number (and percent) of long term unemployed remains a serious problem.

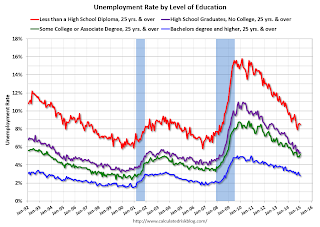

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

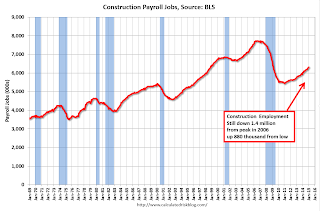

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 882 thousand.

The BLS diffusion index for total private employment was at 62.4 in January, down from 69.0 in December.

The BLS diffusion index for total private employment was at 62.4 in January, down from 69.0 in December.For manufacturing, the diffusion index was at 58.1, down from 64.4 in December.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall job growth was widespread in January - another good sign.

Sunday, February 08, 2015

Sunday Night Futures

by Calculated Risk on 2/08/2015 08:59:00 PM

From the WSJ: Air of Optimism Pervades Athens Even as Country Heads for Showdown in Brussels

The defiant, antiausterity position taken by the just-elected government toward Greece’s creditors has given new hope to many Athenians, even those who didn’t vote for the leftist Syriza party, which came out on top in last month’s election.Austerity has failed (obvious to almost everyone), and anything else is welcome. I wrote several years ago that austerity wouldn't survive for too many years in a democracy.

“People in Greece had to deal with so many difficulties during the last five years that they now feel they have nothing to lose,” says Chrysa Stratou, a 52-year-old psychologist. “The only thing left for Greeks is to battle.”

Elsewhere in Europe, the Greek government’s firm rejection of the terms governing its bailout has been met with a mix of consternation and outright hostility.

Monday:

• At 10:00 AM ET: the Fed will release the monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of February 8, 2015

• Best Private Sector Job Creation "Ever"?

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 8 and DOW futures are down 60 (fair value).

Oil prices were up sharply over the last week with WTI futures at $52.34 per barrel and Brent at $58.20 per barrel. A year ago, WTI was at $97, and Brent was at $110 - so prices are a little less than 50% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.18 per gallon (down over $1.00 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |