by Calculated Risk on 2/09/2015 07:21:00 PM

Monday, February 09, 2015

Tuesday: Job Openings, Small Business Optimism

From the NY Times: Greece to Propose a Debt Compromise Plan to Creditors

Hoping to defuse a standoff that has set Europe and financial markets on edge, Greek officials intend to propose a detailed compromise plan at an emergency meeting with creditors on Wednesday in Brussels, a finance ministry official here said on Monday.Tuesday:

...

Greece still plans to reject some of the harshest austerity conditions attached to Greece’s bailout loans, but will propose retaining about 70 percent of the terms, according to the official.

Athens will propose replacing the remaining 30 percent of the austerity conditions with new reforms that the Greek government will devise together with the Organization for Economic Cooperation and Development.

• At 7:30 AM ET, NFIB Small Business Optimism Index for January.

• Early: Trulia Price Rent Monitors for January. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 10:00 AM, Job Openings and Labor Turnover Survey for December from the BLS. Jobs openings increased in November to 4.972 million from 4.830 million in October. The number of job openings were up 21% year-over-year compared to November 2013, and Quits were up 7% year-over-year.

West Coast Port Slowdown Ongoing

by Calculated Risk on 2/09/2015 03:20:00 PM

At least this is getting more media attention ...

From the LA Times: Ship unloading resumes at West Coast ports as labor talks continue

Employers and the International Longshore and Warehouse Union have been locked in bitter talks for a new West Coast dockworkers contract for nearly nine months -- a period that has seen debilitating congestion up and down the West Coast.From CNBC: West Coast ports: Retail's $7 billion problem

...

The line of ships anchored off the Long Beach and Los Angeles coast waiting for berths grew over the weekend, from 28 Friday afternoon to 31 Sunday morning, according to the Marine Exchange of Southern California.

...

The two sides are expected to meet again this afternoon.

Retailers' anxiety levels are rising as gridlock grinds on with contract negotiations between West Coast dockworkers and port terminal operators.

It has been a long nine months for those dealing directly, or indirectly, with the lack of a West Coast port contract, and after a temporary shutdown over the weekend, retail lobby groups and consultants are assigning potential costs to the issue.

According to a Kurt Salmon analysis, congestion at West Coast ports could cost retailers as much as $7 billion this year. That congestion cost comes from a combination of the higher price of carrying goods and missed sales due to below optimal inventory levels.

Prime Working-Age Population Growing Again

by Calculated Risk on 2/09/2015 11:59:00 AM

Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through January 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 2/09/2015 09:50:00 AM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• January Employment Report: 257,000 Jobs, 5.7% Unemployment Rate

• Employment Report Comments and Graphs

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 1.8% of the labor force - the lowest since January 2009 - however the number (and percent) of long term unemployed remains a serious problem.

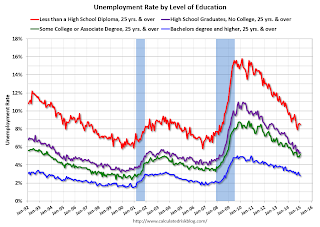

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

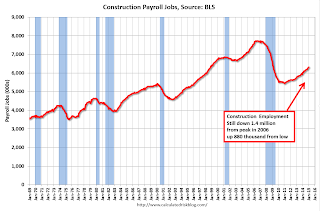

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 882 thousand.

The BLS diffusion index for total private employment was at 62.4 in January, down from 69.0 in December.

The BLS diffusion index for total private employment was at 62.4 in January, down from 69.0 in December.For manufacturing, the diffusion index was at 58.1, down from 64.4 in December.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall job growth was widespread in January - another good sign.

Sunday, February 08, 2015

Sunday Night Futures

by Calculated Risk on 2/08/2015 08:59:00 PM

From the WSJ: Air of Optimism Pervades Athens Even as Country Heads for Showdown in Brussels

The defiant, antiausterity position taken by the just-elected government toward Greece’s creditors has given new hope to many Athenians, even those who didn’t vote for the leftist Syriza party, which came out on top in last month’s election.Austerity has failed (obvious to almost everyone), and anything else is welcome. I wrote several years ago that austerity wouldn't survive for too many years in a democracy.

“People in Greece had to deal with so many difficulties during the last five years that they now feel they have nothing to lose,” says Chrysa Stratou, a 52-year-old psychologist. “The only thing left for Greeks is to battle.”

Elsewhere in Europe, the Greek government’s firm rejection of the terms governing its bailout has been met with a mix of consternation and outright hostility.

Monday:

• At 10:00 AM ET: the Fed will release the monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of February 8, 2015

• Best Private Sector Job Creation "Ever"?

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 8 and DOW futures are down 60 (fair value).

Oil prices were up sharply over the last week with WTI futures at $52.34 per barrel and Brent at $58.20 per barrel. A year ago, WTI was at $97, and Brent was at $110 - so prices are a little less than 50% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.18 per gallon (down over $1.00 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Best Private Sector Job Creation "Ever"?

by Calculated Risk on 2/08/2015 11:41:00 AM

On Friday, I mentioned that private job creation was on pace for the best ever during a presidential term. I received a few emails asking if that was correct. The answer is "yes".

Here is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Note: Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s. The prime working age labor force was growing more than 3% per year in the '80s with a surge in younger workers and women joining the labor force. Now, the overall population is larger, but the prime working age population has declined this decade and the participation rate is generally declining now.

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term. Public sector job creation increased the most during Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 14 thousand public sector jobs have been added during the first two years of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term).

This is 1% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,885 | 692 | 11,577 |

| 2 | Clinton 2 | 10,070 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 5,542 | 14 | 5,556 | |

| Pace2 | 11,084 | 28 | 11,112 | |

| 124 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The second table shows the jobs need per month for Obama's 2nd term to be in the top three presidential terms.

| Jobs needed per month (average) for Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 223 | 251 | ||

| #2 | 189 | 240 | ||

| #3 | 159 | 218 | ||

Saturday, February 07, 2015

Schedule for Week of February 8, 2015

by Calculated Risk on 2/07/2015 01:09:00 PM

The key economic report this week is January retail sales on Thursday.

At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

7:30 AM ET: NFIB Small Business Optimism Index for January.

Early: Trulia Price Rent Monitors for January. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in November to 4.972 million from 4.830 million in October.

The number of job openings (yellow) were up 21% year-over-year compared to November 2013, and Quits were up 7% year-over-year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 278 thousand.

8:30 AM ET: Retail sales for January will be released.

8:30 AM ET: Retail sales for January will be released.This graph shows retail sales since 1992 through December 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales decreased 0.9% from November to December (seasonally adjusted), and sales were up 3.2% from December 2013.

The consensus is for retail sales to decrease 0.5% in January, and to decrease 0.5% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.2% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 98.5, up from 98.1 in January.

Unofficial Problem Bank list declines to 387 Institutions

by Calculated Risk on 2/07/2015 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 7, 2015.

Changes and comments from surferdude808:

One subtraction from the Unofficial Problem Bank List this week that leaves the list at 387 institutions with assets of $121.4 billion. A year ago, the list held 588 institutions with assets of $195.1 billion.

Thanks to reader for catching an action termination against Pacific Mercantile Bank, Costa Mesa, CA ($1.1 billion). The other alternation to this list this week was a name change for Worthington Federal Bank, Huntsville, AL ($130 million) to American Bank of Huntsville.

Friday, February 06, 2015

Duy on the Fed and Jobs Report

by Calculated Risk on 2/06/2015 07:56:00 PM

First, from Jon Hilsenrath at the WSJ: Jobs Report Means Fed Could Still Raise Rates in June

Two important milestones now loom for the Fed. First, Fed Chairwoman Janet Yellen is due to deliver her semiannual testimony to Congress later this month. She’ll use that to update lawmakers and the public on the economic outlook.And from Tim Duy: Upbeat Jobs Report

Second, Fed officials will decide at their March meeting whether to change or drop the language in their policy statement pledging to “be patient” in deciding when to raise their benchmark short-term interest rate from zero.

... I don't think Yellen intended to imply that "patient" always means two meetings. Perhaps I just have too many memories about "considerable time" first meaning six months and then not. Plus, the Fed is aware of its past history, and in 2004 "patient" turned to "moderate" just one meeting before the hike. But it was technically the second meeting after "patient" was dropped, so is that two meetings? Also, as we saw with the "considerable" to "patient" transition, the Fed has its own unique way of wordsmithing that can deliver something for everyone. And finally, Yellen has the press conference to redefine her interpretation of "patient." But maybe I am wrong. In any event, I am not taking a fixed stand on what "patient" means until the press conference.CR Note: My understand was "patient" meant at least two meetings, perhaps more. So removing "patient" at the next meeting would mean June is possible.

Bottom Line: The US economy has very real momentum on its side at the moment. It is more resilient to shocks than commonly assumed. This isn't 2011. June is still on the table.

Lawler: Updated Estimates on the Size of the SF Rental Market

by Calculated Risk on 2/06/2015 03:41:00 PM

A long note from housing economist Tom Lawler:

While accurate and timely data on the size of the single-family rental market are not available, virtually all surveys suggest that the size of the single-family rental market surged from the end of 2007 through the end of last year. Below are some stats on the renter share of either the occupied single-family housing market (detached and attached, ACS and AHS) or the one-unit housing market (AHS, which includes manufactured housing, and is derived from detailed tables not shown in the press release).

While comparisons of these surveys with decennial Census results suggest that none of the surveys provide a particularly good “snapshot” of the overall US housing market, the fact that all surveys point to a sharp increase in the size of the SF rental market is quite consistent with anecdotal and other regional reports.

| Renter Share of Occupied One-Unit Properties | ||||

|---|---|---|---|---|

| Single Family (ex Mfg Housing) | One-Unit Structures (SF plus Mfg. Housing) | |||

| ACS | AHS | HVS | ||

| 2007 (avg) | 15.0% | 14.1% | Q4/2007 | 14.1% |

| 2010 (avg) | 16.8% | N/A | Q4/2010 | 16.5% |

| 2013 (avg) | 18.6% | 17.5% | Q4/2013 | 18.1% |

| Q4/2014 | 18.8% | |||

In terms of decennial Census data, in 2010 Census eliminated the “long form,” which in previous Censuses had supplied more detailed information on (among many things) the characteristics of the occupied and vacant housing stock. As such, tables on the “standard” Census website for housing tenure (owner/renter) by units in structure are not available.

In one of the reports from Census providing estimation results from the 2010 Census Coverage Measurement program (#2010-G-02), however, Census does provide estimates of occupied units by tenure and units in structure. Below are two tables: the first shows “official” decennial Census results for total, occupied, and vacant single-family units (attached and detached) by tenure from Census 2000 and Census 2010, and the second shows “updated” single-family estimates for these two years based on post-Census research results.

| Occupied and Vacant Single-Family Housing Units by Tenure (millions) | |||||

|---|---|---|---|---|---|

| Total | Owner-Occupied | Renter-Occupied | Vacant | Renter Share of Occupied SF Units | |

| 4/1/2000 | 76.3 | 60.1 | 10.6 | 5.6 | 15.0% |

| 4/1/2010 | 89.0 | 65.6 | 15.2 | 8.1 | 18.8% |

| Change | 12.7 | 5.5 | 4.6 | 2.5 | 3.8% |

| "Adjusted" Results Based on Post-Census Research | |||||

| Total | Owner-Occupied | Renter-Occupied | Vacant | Renter Share of Occupied SF Units | |

| 4/1/2000 | 77.0 | 60.5 | 10.7 | 5.8 | 15.0% |

| 4/1/2010 | 90.0 | 65.9 | 15.3 | 8.6 | 18.8% |

| Change | 13.0 | 5.4 | 4.6 | 2.8 | 3.8% |

Focusing on the bottom table (which probably reflect the “most accurate” aggregate statistics), adjusted decennial results suggest that from April 2000 to April 2010 the total single-family housing stock increased by about 13.0 million units, but the number of owner-occupied SF housing units rose by just 5.4 million units; the number of renter-occupied SF housing units increased by 4.6 million units; and the number of vacant SF housing units increased by 2.8 million units. As a result, the renter share of occupied SF housing units jumped to 18.8% in 2010 from 15.0% in 2000.

Note that the Census 2010 data indicate that the renter share of the occupied SF housing stock was higher than other surveys (ACS and especially HVS) suggest.

If one to believe that the CHANGE in the renter share of the occupied SF housing stock since April 1, 2000 were similar to the change in that share as derived from the HVS, then (using other assumptions) the SF housing stock in the fourth quarter of 2014 would look something like that shown below.

| Official Census Results | |||||

|---|---|---|---|---|---|

| Total | Owner-Occupied | Renter-Occupied | Vacant | Renter Share of Occupied SF Units | |

| 4/1/2000 | 76.3 | 60.1 | 10.6 | 5.6 | 15.0% |

| 4/1/2010 | 89.0 | 65.6 | 15.2 | 8.1 | 18.8% |

| Change | 12.7 | 5.5 | 4.6 | 2.5 | 3.8% |

| "Adjusted" Results Based on Post-Census Research | |||||

| Total | Owner-Occupied | Renter-Occupied | Vacant | Renter Share of Occupied SF Units | |

| 4/1/2000 | 77.0 | 60.5 | 10.7 | 5.8 | 15.0% |

| 4/1/2010 | 90.0 | 65.9 | 15.3 | 8.6 | 18.8% |

| Change | 13.0 | 5.4 | 4.6 | 2.8 | 3.8% |

| Q4/2014 Estimates based on Changes in HVS Results from Q2/2010 to Q4/2014 | |||||

| Total | Owner-Occupied | Renter-Occupied | Vacant | Renter Share of Occupied SF Units | |

| Q4/2014 (est) | 91.2 | 65.6 | 17.9 | 7.7 | 21.4% |

| Change from 4/1/2010) | 1.2 | -0.4 | 2.5 | -0.7 | 2.5% |

| Change from 4/1/2000 | 14.9 | 5.4 | 7.2 | 2.3 | 6.4% |

There are two “issues” with the numbers at the bottom of this table. First, of course, they use HVS results, which are not the most reliable. Second, in April 2014 the HVS began “phasing in” a new sample based on the Master Address File compiled during Census 2010, with the “phase-in” beginning in April 2014 and ending in July 2015. Since a comparison between decennial Census results and the HVS for 2010 indicated that the HVS was overstating homeownership rates and vacancy rates, a comparison between Q4/2014 results and earlier periods may not be “appropriate.” Specifically, as the new sample is phased in, one would expect the HVS quarterly data to show larger increases in the number of renters than could have been the case using the old sample.

Even if one used the change in the HVS renter share of the one-unit market from Q2/2010 to Q1/2014, however, the data would suggest that there was a considerable increase in number of renter-occupied single-family homes since 2010.

Here are what might be considered “best guess” estimates of the single-family housing stock (detached and attached) for 2000, 2010, and the last quarter of 2014.

| Occupied and Vacant Single-Family Housing Units by Tenure (millions) | |||||

|---|---|---|---|---|---|

| Total | Owner-Occupied | Renter-Occupied | Vacant | Renter Share of Occupied SF Units | |

| 4/1/2000 | 77.0 | 60.5 | 10.7 | 5.8 | 15.0% |

| 4/1/2010 | 90.0 | 65.9 | 15.3 | 8.6 | 18.8% |

| Q4/2014 (est) | 91.2 | 66.0 | 17.5 | 7.7 | 21.0% |

Much of the discussion on the sharp increase in the size of the SF rental market over the past several years has focused on “institutional” investor purchases of “distressed” SF properties, though it is quite clear that the size of the SF rental market was increasing well before most institutional investors entered the market.

There has been much less talk, however, about the demand for SF rentals, and specifically why so many households have decided to rent SF homes. E.g., how many householders are renting SF homes not because they “want” to rent, but because (1) mortgage credit has been “tight;” (2) the householders’ credit is “impaired,” in many cases because they lost their previous home to foreclosure and/or a short sale; and/or (3) they were consistently outbid by “investors” and now have been priced out of the market? On the other hand, how many householders are renting because they don’t want to purchase a home, either because they don’t like the “investment” prospects – especially those who believe they may want to move over those next few years, given the high costs of buying and selling a home – or because they don’t like the “hassle” of or potential but unknown costs associated with homeownership, but who want the “lifestyle” associated with owning a SF home? During much of the last decades householders wanting to live in a SF home in many markets faced extremely limited supplies of SF homes for rent. That is much less true today in many markets across the country.

Whatever the reasons, the surge in the size of the SF rental market has helped “sop up” much of the “excess building” during the first seven years of the previous decade, with the vast bulk of that “excess being in the built-for-sale SF market.

If for various reasons – e.g., an easing in mortgage credit, improved prospects for better-paying jobs and/or changes in potential mobility, shifts in home price expectations, etc. – an increasing number of current renters decided they wanted to own a home, then what might happen is (1) vacancy rates on existing SF rentals might increase and rents soften; (2) an increasing number of SF rental properties might be put up for sale; and (3) the resulting rise in the demand to purchase homes would not fully need to be met with an increase in the construction of new SF homes. (Just sumpin’ to think about.)

On the next page is a table showing the renter-occupied share of SF detached homes as measured by the ACS for 2006 and for 2013 by state. (Note: previous tables showed the renter share of SF detached and attached homes, which is higher. I just had already constructed this table.) This share increased from 2006 to 2013 in every state save for North Dakota, and the share jumped by more than three percentage points in 24 states.

| Renter Share of Occupied SF Detached Homes, ACS | |||

|---|---|---|---|

| 2006 | 2013 | Chg | |

| Alabama | 14.7% | 18.1% | 3.4% |

| Alaska | 14.0% | 16.0% | 1.9% |

| Arizona | 14.7% | 22.8% | 8.1% |

| Arkansas | 18.6% | 20.6% | 2.0% |

| California | 18.9% | 24.1% | 5.3% |

| Colorado | 13.1% | 16.9% | 3.8% |

| Connecticut | 6.6% | 8.9% | 2.3% |

| Delaware | 7.4% | 10.1% | 2.7% |

| District of Columbia | 12.7% | 14.6% | 1.9% |

| Florida | 13.0% | 18.4% | 5.5% |

| Georgia | 15.2% | 20.5% | 5.3% |

| Hawaii | 23.4% | 25.7% | 2.3% |

| Idaho | 15.0% | 18.2% | 3.2% |

| Illinois | 9.8% | 13.0% | 3.3% |

| Indiana | 12.3% | 15.7% | 3.4% |

| Iowa | 12.1% | 14.2% | 2.0% |

| Kansas | 15.1% | 17.9% | 2.8% |

| Kentucky | 14.3% | 17.6% | 3.3% |

| Louisiana | 17.1% | 18.7% | 1.6% |

| Maine | 8.8% | 11.8% | 3.1% |

| Maryland | 8.5% | 10.5% | 2.0% |

| Massachusetts | 6.2% | 7.4% | 1.3% |

| Michigan | 9.6% | 14.1% | 4.5% |

| Minnesota | 6.2% | 9.0% | 2.8% |

| Mississippi | 17.1% | 20.5% | 3.4% |

| Missouri | 13.5% | 16.9% | 3.4% |

| Montana | 15.9% | 19.0% | 3.2% |

| Nebraska | 15.6% | 17.1% | 1.4% |

| Nevada | 17.3% | 27.4% | 10.1% |

| New Hampshire | 7.0% | 8.6% | 1.6% |

| New Jersey | 6.6% | 8.5% | 1.9% |

| New Mexico | 16.8% | 19.3% | 2.5% |

| New York | 8.9% | 10.4% | 1.5% |

| North Carolina | 17.0% | 20.0% | 3.0% |

| North Dakota | 12.7% | 11.1% | -1.6% |

| Ohio | 11.8% | 16.0% | 4.2% |

| Oklahoma | 18.6% | 21.9% | 3.3% |

| Oregon | 15.6% | 20.1% | 4.5% |

| Pennsylvania | 8.9% | 10.9% | 2.1% |

| Rhode Island | 8.5% | 10.4% | 1.9% |

| South Carolina | 16.1% | 17.0% | 0.9% |

| South Dakota | 14.7% | 15.6% | 0.9% |

| Tennessee | 14.6% | 18.1% | 3.5% |

| Texas | 14.8% | 18.0% | 3.2% |

| Utah | 9.8% | 14.1% | 4.3% |

| Vermont | 10.0% | 10.3% | 0.3% |

| Virginia | 12.9% | 15.8% | 2.9% |

| Washington | 14.1% | 17.9% | 3.8% |

| West Virginia | 14.4% | 16.4% | 2.0% |

| Wisconsin | 8.2% | 11.0% | 2.7% |

| Wyoming | 15.4% | 16.4% | 1.0% |

| US | 13.1% | 16.7% | 3.6% |

Click on graph for larger image.

Click on graph for larger image.