by Calculated Risk on 1/18/2015 11:12:00 PM

Sunday, January 18, 2015

Duy: "Will The Fed Take a Dovish Turn Next Week?"

Another excellent piece from Tim Duy: Will The Fed Take a Dovish Turn Next Week?

As it stands now, we are heading into the next FOMC meeting with the growing expectation that the Fed will take a dovish turn. Is it not obvious that global economic turmoil, collapsing oil prices, weak inflation, and a stronger dollar are clearly pointing to rapidly rising downside risks to the US economy? For financial market participants, they answer is a clear "yes." Expectations of the first rate hike have been pushed out to the end of this year, seemingly in complete defiance of Fed plans for policy normalization. The Fed may get there as well and abandon their carefully crafted mid-year plan, but I suspect they will not move quite as rapidly as financial market participants desire.

As a general rule, the Fed tends to act in a more deliberate fashion....

Bottom Line: I reiterate my view that despite the generally positive data flow, and the upward boost from oil, I don't see how they can justify raising rates without some reasonable acceleration in wage growth. ... my broader point is this: During normal times the Fed moves methodically if not ponderously. The current state of the economy gives them room to move as such. So I would not be surpised to see a fairly steady hand revealed in the next FOMC statement.

Update: Predicting the Next Recession

by Calculated Risk on 1/18/2015 09:37:00 AM

Recently there has been some discussion of a recession in 2015. That seems very unlikely to me - I'm not even on "recession watch". I decided to repeat a post I wrote in January 2013. (two years ago). This still seems correct - and I've added a few updates in italics.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

[CR Update: 2013 was a little better than I expected, but still sluggish. And 2014 had a weak start, but the last three quarters were solid.]

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR Update: Most of the poor policy choices in the U.S. are behind us. Austerity hurt the recovery, but austerity appears over at the state and local level and diminished at the Federal level.]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR Update: This still seems correct - no recession this year.]

Saturday, January 17, 2015

Lawler on Builder Pricing and Incentives

by Calculated Risk on 1/17/2015 06:38:00 PM

On Friday I posted an article from housing economist Tom Lawler: Lawler: “Surprise” Warnings on Margins/Effective Prices Whacks Home Builder Stocks

A few people took this as Lawler being "surprised". Nothing could be further from reality!

First, from the piece from Lawler:

"While most competent housing analysts had expected diminished price increases and increased sales incentives at most home builders in 2014 and 2015 following the surprising sharp price increases in 2013, the majority of housing analysts and investors had no such expectation."That was Lawler making fun of the people who got it wrong!

Lawler started 2014 warning about incentives and reduced margins - and he warned about them all year. As an example, Lawler wrote in May:

"it seems highly likely that the “pricing power” builders had in 2013 will not be evident in 2014, and in fact “effective” home prices may ease a bit as builders significantly increase their use of sales incentives from 2013’s unusually low level."Many people were "surprised" by the builder announcements, but not Lawler!

Schedule for Week of January 18, 2015

by Calculated Risk on 1/17/2015 12:15:00 PM

The key economic reports this week are December housing starts on Wednesday, and existing home sales on Friday.

All US markets will be closed in observance of Martin Luther King, Jr. Day

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 58, up from 57 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts were at 1.028 million (SAAR) in November. Single family starts were at 677 thousand SAAR in November.

The consensus is for total housing starts to increase to 1.040 million (SAAR) in December.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 316 thousand.

9:00 AM: FHFA House Price Index for November 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

11:00 AM: the Kansas City Fed manufacturing survey for January.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 5.05 million on seasonally adjusted annual rate (SAAR) basis. Sales in November were at a 4.93 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.15 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

Unofficial Problem Bank list declines to 392 Institutions

by Calculated Risk on 1/17/2015 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 16, 2015.

Changes and comments from surferdude808:

A bank failure and the OCC releasing an anticipated update on its recent enforcement action activities led to several changes to the Unofficial Problem Bank List. This week there were eight removals and one addition that leave the list at 392 institutions with assets of $122.8 billion. A year ago, the list held 605 institutions with $199.8 billion in assets.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 392 - almost full circle!

First Federal Savings Bank of Elizabethtown, Elizabethtown, KY ($754 million) and Bank of Coral Gables, Coral Gables, FL ($103 million) found merger partners to make their way off the list. The OCC terminated actions against The Bank of Maine, Portland, ME ($790 million); The First National Bank of Talladega, Talladega, AL ($389 million); Universal Bank, West Covina, CA ($321 million); Atlantic National Bank, Brunswick, GA ($142 million); and Clay County Savings Bank, Liberty, MO ($87 million).

First National Bank of Crestview Crestview, FL ($80 million) was the first bank failure in 2015. It is the 72nd failure of a Florida-based institution since the on-set of the Great Recession in 2008. With 88, only Georgia has more failed institutions.

The OCC issued a new action against First National Bank, Waupaca, WI ($778 million).

Next week will likely see fewer changes to the list.

Friday, January 16, 2015

1st Bank Failure of 2015: First National Bank of Crestview, Crestview, Florida

by Calculated Risk on 1/16/2015 07:51:00 PM

And it begins ... from the FDIC: First NBC Bank, New Orleans, Louisiana, Assumes All of the Deposits of First National Bank of Crestview, Crestview, Florida

As of September 30, 2014, First National Bank of Crestview had approximately $79.7 million in total assets and $78.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.4 million. ... First National Bank of Crestview is the 1st FDIC-insured institution to fail in the nation this year. The last FDIC-insured institution closed in the state was Valley Bank, Fort Lauderdale, on June 20, 2014.The FDIC closed 18 banks last year, down from 24 closures in 2013 and 51 in 2012. Failures peaked at 157 in 2010.

Lawler: “Surprise” Warnings on Margins/Effective Prices Whacks Home Builder Stocks

by Calculated Risk on 1/16/2015 04:05:00 PM

From housing economist Tom Lawler:

While two major home builders this week reported ‘ok” (KB Home) to better than consensus (Lennar) operating results for the quarter ended November 30, 2014, both home builders “stunned” many investors by warning that weaker than anticipated demand and “diminished” pricing power in several markets across the country had resulted in increased sales incentives and in some markets modest price reductions – developments which, when combined with continued increases in labor and material costs, would result in lower margins in FY 2015 compared to FY 2014. I say that many investors were “stunned” because home builder stocks took a savage beating this week, especially the stock of KB Home, whose ‘margin warning” was the most surprising.

| KB Home | ||||||

|---|---|---|---|---|---|---|

| Housing Units | Average Price | |||||

| Qtr. Ended: | 11/30/2014 | 11/30/2013 | % Change | 11/30/2014 | 11/30/2013 | % Change |

| Net Orders | 1,706 | 1,556 | 9.6% | $344,500 | $309,600 | 11.3% |

| Deliveries | 2,229 | 2,038 | 9.4% | $351,500 | $301,100 | 16.7% |

| Backlog (EOQ) | 2,909 | 2,557 | 13.8% | $314,200 | $266,900 | 17.7% |

| Net Orders/Community | 7.97 | 8.19 | -2.7% | |||

| Lennar Corporation | ||||||

|---|---|---|---|---|---|---|

| Housing Units | Average Price | |||||

| Qtr. Ended: | 11/30/2014 | 11/30/2013 | % Change | 11/30/2014 | 11/30/2013 | % Change |

| Net Orders | 5,492 | 4,498 | 22.1% | $325,000 | $320,000 | 1.6% |

| Deliveries | 6,950 | 5,650 | 23.0% | $329,000 | $308,000 | 6.8% |

| Backlog (EOQ) | 5,832 | 4,806 | 21.3% | $339,000 | $337,000 | 0.6% |

| Net Orders/Community | 9 | 8.7 | 3.4% | |||

In terms of unit sales guidance, KB Home said that it expected its community count to increase by 15-20% over the next year, and that it expected its order pace to track the increase in its community count. Lennar said that it expects home deliveries in FY 2015 to be between 12% and 14% above deliveries in FY 2014.

While most competent housing analysts had expected diminished price increases and increased sales incentives at most home builders in 2014 and 2015 following the surprising sharp price increases in 2013, the majority of housing analysts and investors had no such expectation. In the latter part of 2012 and the first half of 2013 many builders experienced a significant and unexpected increase in demand that outpaced their ability to finish homes (partly related to “supply-channel” issues), and in response many builders hiked prices substantially in order to keep demand on pace with their ability to produce homes. As builders’ ability to increase production increased in 2014, however, few builders responded by paring back prices or increasing incentives, and as a result overall unit sales lagged expectations. Another key factor in 2014 that kept demand below expectations was mortgage credit conditions – many analysts and builders had expected mortgage credit to be significantly less restrictive in 2014, but that was not the case for most of the year. Indeed, by some “metrics” mortgage credit was actually a bit “tighter” in the first half of 2014 than in 2013, in part reflecting lenders’ “adjustments” to the January implementation of the CFPB QM rules as well as its new servicing rules.

Yet another factor that appeared to contribute to lower than consensus new home sales last year was that many (though not all builders) were not very aggressive in opening and marketing communities designed for the “typical” first-time buyer (as opposed to the “high income/strong credit first-time and trade-up buyer), which generally have lower price points, fewer amenities, and lower margins than communities targeted to the “trade-up” buyers. The notion that new SF home building could start to return to “normal” levels while at the same time the elevated home sizes, prices, and margins would remain the same seemed silly, and in hindsight it was.

While the notion that builder margins will on average be lower in 2015 than the “higher than sustainable” levels in 2014 seems quite reasonable and was quite predictable, by the same token the outlook for improved sales volumes at lower margins/price points has improved. Obviously, of course, mortgage interest rates have come down; the FHA lowered its annual insurance premium by 50 bp; and it appears as if an increasing number of mortgage lenders have eased mortgage credit conditions/credit overlays in recent months. In addition, the overall US economy has continued to improve, as has the labor market – though more in terms of jobs than in terms of income growth, highlighting the need for lower price points for homes targeted for potential first-time buyers.

emphasis added

Key Measures Show Low Inflation in December

by Calculated Risk on 1/16/2015 01:22:00 PM

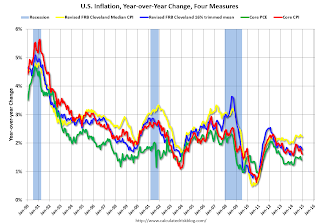

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in December. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for December here. Motor fuel declined at a 69% annualized rate in December, following a 55% annualized rate decline in November, and a 31% annualized rate decline in October!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.4% (-4.4% annualized rate) in December. The CPI less food and energy was unchanged (0.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.6%. Core PCE is for November and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.2% annualized, and core CPI was unchanged annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is close to 2%).

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in December

by Calculated Risk on 1/16/2015 11:46:00 AM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in December.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales.

Short sales are down in these areas (except Sacramento).

Foreclosures are up in a few areas (working through the logjam).

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | |

| Las Vegas | 10.0% | 20.7% | 8.0% | 8.5% | 18.0% | 29.2% | 34.1% | 44.4% |

| Reno** | 8.0% | 24.0% | 5.0% | 4.0% | 13.0% | 28.0% | ||

| Phoenix | 29.2% | 32.9% | ||||||

| Sacramento | 6.2% | 6.1% | 7.1% | 5.4% | 13.3% | 11.5% | 15.4%** | 19.5%** |

| Minneapolis | 3.7% | 5.5% | 12.6% | 17.1% | 16.3% | 22.7% | ||

| Mid-Atlantic | 4.9% | 8.0% | 11.2% | 9.3% | 16.1% | 17.3% | 20.3% | 19.3% |

| Orlando | 4.8% | 13.5% | 26.7% | 19.1% | 31.5% | 32.7% | 40.0% | 45.0% |

| Bay Area CA* | 4.0% | 7.9% | 3.7% | 4.6% | 7.7% | 12.5% | 19.0% | 23.5% |

| So. California* | 6.2% | 10.2% | 5.0% | 5.8% | 11.2% | 16.0% | 23.8% | 28.8% |

| Hampton Roads | 21.5% | 29.1% | ||||||

| Northeast Florida | 30.6% | 37.9% | ||||||

| Toledo | 37.9% | 36.5% | ||||||

| Tucson | 28.7% | 32.3% | ||||||

| Des Moines | 20.3% | 23.1% | ||||||

| Georgia*** | 25.5% | N/A | ||||||

| Omaha | 20.5% | 23.9% | ||||||

| Memphis* | 15.0% | 21.0% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Preliminary January Consumer Sentiment increases to 98.2

by Calculated Risk on 1/16/2015 10:01:00 AM