by Calculated Risk on 1/15/2015 02:36:00 PM

Thursday, January 15, 2015

DataQuick: California Bay Area "Home buying picked up steam" in December

From DataQuick: Bay Area Home Sales and Prices Rise in December 2014

Home buying picked up steam late in 2014, with December posting strong month-over-month and year-over-year sales gains. ... A total of 7,456 new and resale houses and condos sold in the nine-county Bay Area in December 2014. That was up month over month 24.2 percent from 6,003 in November 2014 and up year over year 14.1 percent from 6,532 in December 2013, according to CoreLogic DataQuick data.Last month I noted that it seemed like houses were moving again. I wrote 'in my area it seems like a large number of homes went "pending" during the last few weeks' - and sure enough the data suggests a pickup in sales in December.

...

“The Bay Area’s residential real estate market ended 2014 on a cautiously optimistic note, with moderate year-over-year increases in both median price and sales counts,” said John Karevoll, CoreLogic DataQuick analyst. “Supply continues to be constrained, and the mortgage market remains difficult. As long-term trends, cash sales and investor purchases are declining slowly, but they are still significant market factors. We know that there is a significant amount of pent-up demand lying in wait, and there is a good chance the market could see a surge this spring and summer as more homes are put up for sale.”

...

Foreclosure resales accounted for 3.7 percent of all resales in December 2014, up from 2.8 percent in November 2014, and down from 4.6 percent in December 2013. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.6 percent. Foreclosure resales are purchased homes that have been previously foreclosed upon in the prior 12 months.

Short sales made up an estimated 4.0 percent of Bay Area resales in December 2014, up from a revised 3.9 percent in November 2014 and down from 7.9 percent in December 2013. Short sales are transactions in which the sale price fell short of what was owed on the property.

emphasis added

CoStar: Commercial Real Estate prices increased in November

by Calculated Risk on 1/15/2015 01:22:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: CRE Price Recovery Continues With Strong Showing in November

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 1% and 0.7%, respectively, in the month of November 2014, contributing to annual gains of 9.9% and 14.8%, respectively, for the 12 months ending in November 2014.

...

VALUE-WEIGHTED U.S. COMPOSITE INDEX SET A NEW HIGH-WATER MARK. Investors’ healthy appetite for core properties propelled growth in the value-weighted U.S. Composite Index, which surpassed its pre-recession peak previously set in 2007 by 5.1% in November 2014.

PRICE GROWTH ACCELERATED IN EQUAL-WEIGHTED INDEX. Price growth in the equal-weighted U.S. Composite Index, influenced more by smaller, non-core deals, accelerated to an annual pace of 14.8% in November 2014, from an average annual pace of 7.5% in 2013.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is at a record high, but the equal weighted is still 14% below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak, but still somewhat elevated.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Philly Fed Manufacturing Survey declines to 6.3 in January

by Calculated Risk on 1/15/2015 10:10:00 AM

From the Philly Fed: January Manufacturing Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased 18 points, from a revised reading of 24.3 in December to 6.3 this month.This was below the consensus forecast of a reading of 18.8 for January.

...

The current employment index fell 10 points, from 8.4 to -2.0. ...

The diffusion index for future activity edged up by less than 1 point, to 50.9, in January and has remained near its current level over the past five months ...

emphasis added

Earlier today from the NY Fed: Empire State Manufacturing Survey

The headline general business conditions index climbed eleven points to 10.0.The NY Fed survey was above the consensus forecast of 5.0

...

Labor market conditions were mixed, with the index for number of employees rising several points to 13.7, while the average workweek index remained negative at -8.4.

...

Indexes assessing the six-month outlook conveyed considerable optimism about future business activity. The index for future general business conditions rose nine points to 48.4, with nearly 60 percent of respondents expecting conditions to improve.

Click on graph for larger image.

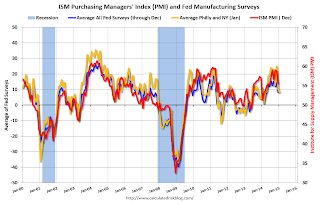

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys declined in January, but this still suggests a decent ISM report for January.

Weekly Initial Unemployment Claims increased to 316,000

by Calculated Risk on 1/15/2015 08:35:00 AM

The DOL reported:

In the week ending January 10, the advance figure for seasonally adjusted initial claims was 316,000, an increase of 19,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 294,000 to 297,000. The 4-week moving average was 298,000, an increase of 6,750 from the previous week's revised average. The previous week's average was revised up by 750 from 290,500 to 291,250.The previous week was revised yp to 297,000.

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 298,000.

This was higher than the consensus forecast of 295,000, and the level suggests few layoffs. Note: We might start seeing an increase in unemployment claims due to layoffs in oil producing states.

Wednesday, January 14, 2015

Thursday: Unemployment Claims, PPI, NY and Philly Fed Mfg Surveys

by Calculated Risk on 1/14/2015 07:41:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Back to 3.5% for Some

If you have a truly ideal credit profile and loan scenario, a few of the more aggressive lenders are quoting conforming, 30yr fixed mortgage rates at 3.5% today. Almost all other lenders are only an eighth of a point higher at 3.625% for top tier scenarios. This is a rate landscape that hasn't been seen since early May 2013. There's still quite a bit of ground to cover between here and the 3.125%-3.25% rates seen at the end of September 2012, but for all intents and purposes, 3.5%-3.625% was the upper end of the refi boom golden age from mid 2012 to mid 2013.Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 295 thousand from 294 thousand.

• Also at 8:30 AM, the Producer Price Index for December from the BLS. The consensus is for a 0.4% decrease in prices, and a 0.1% increase in core PPI.

• Also at 8:30 AM, the NY Fed Empire State Manufacturing Survey for January. The consensus is for a reading of 5.0, up from -3.6 last month (above zero is expansion).

• At 10:00 AM, the Philly Fed manufacturing survey for January. The consensus is for a reading of 18.8, down from 24.3 last month (above zero indicates expansion).

DataQuick: Southern California December Home Sales up 4% Year-over-year

by Calculated Risk on 1/14/2015 04:13:00 PM

From DataQuick: Southern California Home Sales and Median Sale Price Rise

The number of homes sold increased sharply from the month of November and rose modestly from the same time a year earlier, marking one of just two months in 2014 to post a year-over-year gain in sales. ... A total of 19,205 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in December 2014. That was up month over month 22.8 percent from 15,643 sales in November 2014, and up year over year 4.3 percent from 18,415 sales in December 2013, according to CoreLogic DataQuick data.Based on early reports from different areas, it looks like home sales picked up in December.

"One month doesn’t make a trend, but December’s uptick in home sales might indicate renewed interest in housing thanks to lower mortgage rates and job growth in recent months,” said Andrew LePage, data analyst for CoreLogic DataQuick. “The gain came despite a continued decline in the share of homes sold to investors and cash buyers. If demand continues to build we'll need more supply to keep up with it. One of the big questions hanging over the housing market is whether higher demand and home values will lead to a lot more people listing their homes for sale, as well as more new-home construction, which remains well below average.”

...

Foreclosure resales represented 5.0 percent of the resale market in December. That was down from a revised 5.5 percent in November 2014 and down from 5.8 percent in December 2013. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009. Foreclosure resales are purchased homes that have been previously foreclosed upon in the prior 12 months.

Short sales made up an estimated 6.2 percent of resales in December, down from a revised 6.4 in November 2014 and down from 10.2 percent in December 2013. Short sales are transactions in which the sale price fell short of what was owed on the property.

emphasis added

Fed's Beige Book: Economic Activity Expanded at "modest" or "moderate" Pace

by Calculated Risk on 1/14/2015 02:05:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of San Francisco and based on information collected on or before January 5, 2015. "

Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand during the reporting period of mid-November through late December, with most Districts reporting a "modest" or "moderate" pace of growth. In contrast, the Kansas City District reported only slight growth in December. However, most of their contacts, along with those of several other Districts, expect somewhat faster growth over the coming months. ...And on real estate:

Single-family residential real estate sales and construction were largely flat on balance across the Districts. Sales declined somewhat on a year-over-year basis in the Boston, Cleveland, Atlanta, Chicago, Minneapolis, Kansas City, and Dallas Districts. In the Philadelphia District, year-over-year existing home sales finished lower in November, but pending December sales in some areas were up notably over December 2013. However, builders of new homes in the Philadelphia District reported weak traffic for prospective buyers and fewer contract signings. San Francisco reported that overall home sales picked up in December. Richmond reported a modest increase in housing market activity. Home prices increased modestly, on balance, in the Boston, Philadelphia, Cleveland, Atlanta, Chicago, and Dallas Districts. The Cleveland, Atlanta, Chicago, Minneapolis, and Kansas City Districts all reported slightly slower single-family residential construction activity. However, the pace of single-family home construction increased in some areas of the San Francisco District.Residential real estate was "flat", however commercial was picking up.

Commercial real estate activity expanded in most Districts. The Philadelphia District reported a modest pace of growth for commercial real estate leasing activity, and Boston reported improving conditions in commercial real estate markets overall. Commercial real estate activity in the Chicago and Kansas City Districts expanded at a moderate pace. The Dallas District noted that office leasing activity remained strong, but one contact noted a slight pullback in demand from oil and gas firms. Demand for apartments in the Dallas District also remained strong. New York City's co-op and condo market showed continued strength in the final quarter of 2014; apartment sales volume was down from the exceptionally high levels of the prior year but still fairly brisk, while selling prices were up moderately. Commercial construction activity increased in most Districts. Activity grew modestly in the Philadelphia District and a bit faster in the Atlanta and Chicago Districts. Atlanta cited the multifamily residential segment as a source of growth, while Chicago credited demand for industrial and office buildings. Commercial builders in the Cleveland District reported a moderate to robust increase for projects in the pipeline. Dallas reported that overall commercial construction was strong. San Francisco reported that multifamily residential construction was strong in many areas of that District and that retail, office, industrial, or infrastructure projects were widespread across that District.

emphasis added

Sacramento Housing in December: Total Sales up 1.5% Year-over-year, First YoY increase since Oct 2012

by Calculated Risk on 1/14/2015 01:14:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For some time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In December 2014, 12.8% of all resales were distressed sales. This was up from 11.5% last month, and down from 18.8% in December 2013.

The percentage of REOs was at 6.7%, and the percentage of short sales was 6.1%.

Here are the statistics for November.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 32.2% year-over-year (YoY) in November. In general the YoY increases have been trending down after peaking at close to 100%.

Cash buyers accounted for 15.4% of all sales, down from 19.5% in December 2013 (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were up 1.5% from December 2013, and conventional equity sales were up 8.9% compared to the same month last year.

Summary: Distressed sales down, conventional sales up and less investor buying. This is what we'd expect to see in a healing market. As I've noted before, we are seeing a similar pattern in other distressed areas.

CoreLogic: "Foreclosure inventory down 35.5 percent nationally from a year ago"

by Calculated Risk on 1/14/2015 12:17:00 PM

From CoreLogic: Press Release and National Foreclosure Report

According to CoreLogic, for the month of November 2014, there were 41,000 completed foreclosures nationally, down from 46,000 in November 2013, a year-over-year decrease of 9.6 percent and down 64 percent from the peak of completed foreclosures in September 2010. ...A couple of points: As Khater noted, foreclosures are still an obstacle to new single family construction. In the report, CoreLogic notes that the "completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006" (foreclosure won't decline to zero).

As of November 2014, approximately 567,000 homes nationally were in some stage of foreclosure, known as the foreclosure inventory, compared to 880,000 in November 2013, a year-over-year decrease of 35.5 percent and representing 37 consecutive months of year-over-year declines. The foreclosure inventory as of November 2014 made up 1.5 percent of all homes with a mortgage, compared to 2.2 percent in November 2013.

...

“While there has been a large improvement in the reduction of foreclosure inventory, completed foreclosures remain high and serve as one of the obstacles to new single family construction. Until the flow of completed foreclosures declines to normal levels, new-home construction will not pickup because builders have little incentive to compete with foreclosure stock.” Sam Khater, deputy chief economist at CoreLogic

Retail Sales decreased 0.9% in December

by Calculated Risk on 1/14/2015 08:30:00 AM

On a monthly basis, retail sales decreased 0.9% from November to December (seasonally adjusted), and sales were up 3.2% from December 2013. Sales in November were revised down from an increase of +0.7% to +0.4%.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $442.9 billion, a decrease of 0.9 percent from the previous month, but up 3.2 percent above December 2013. ... The October to November 2014 percent change was revised from +0.7 percent to +0.4 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline decreased 0.3%.

Retail sales ex-autos decreased 1.0%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 5.5% on a YoY basis (3.2% for all retail sales).

Retail and Food service sales ex-gasoline increased by 5.5% on a YoY basis (3.2% for all retail sales).The decrease in December was well below consensus expectations of a 0.1% decrease. Both October and November were revised down.

This was a weak report even after removing the impact of lower gasoline prices.