by Calculated Risk on 1/10/2015 11:11:00 AM

Saturday, January 10, 2015

Schedule for Week of January 11, 2015

The key economic report this week is December retail sales on Wednesday.

For manufacturing, the December Industrial Production and Capacity Utilization report, and the January NY Fed (Empire State), and Philly Fed surveys, will be released this week.

For prices, PPI will be released on Thursday, and CPI will be released on Friday.

At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

7:30 AM ET: NFIB Small Business Optimism Index for December.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in October to 4.834 million from 4.685 million in September.

he number of job openings (yellow) were up 21% year-over-year compared to October 2013, and Quits were up 12% year-over-year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for December will be released.

8:30 AM ET: Retail sales for December will be released.This graph shows retail sales since 1992 through November 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.7% from October to November (seasonally adjusted), and sales were up 5.1% from November 2013.

The consensus is for retail sales to decrease 0.1% in December, and to decrease 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.2% increase in inventories.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 295 thousand from 294 thousand.

8:30 AM: The Producer Price Index for December from the BLS. The consensus is for a 0.4% decrease in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire Manufacturing Survey for January. The consensus is for a reading of 5.0, up from -3.6 last month (above zero is expansion).

10:00 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 18.8, down from 24.3 last month (above zero indicates expansion).

8:30 AM: Consumer Price Index for December. The consensus is for a 0.4% decrease in CPI, and for core CPI to increase 0.1%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for no change in Industrial Production, and for Capacity Utilization to decrease to 80.0%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 94.1, up from 93.6 in December.

Friday, January 09, 2015

Unofficial Problem Bank list declines to 399 Institutions

by Calculated Risk on 1/09/2015 08:36:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 2, 2015 (to be updated next week).

Changes and comments from surferdude808:

Slow week as expected for changes to the Unofficial Problem Bank List. There was only removal that lowered the list count to 399 institutions with assets of $124.6 billion. A year ago, the list held 618 institutions with assets of $205.6 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 399.

The FDIC terminated the action against Business Bank, Burlington, WA ($133 million), which then changed its name to SaviBank after being released from the enforcement action. Next week, we anticipate the OCC will provide an update on its latest enforcement action activity.

Demographics, Unemployment Rate and Inflation

by Calculated Risk on 1/09/2015 04:25:00 PM

A number of people are wondering when inflation (and wage growth) will start to increase. One key: First come the jobs, and then come real wages. No one knows how much employment needs to increase before real wages start to increase, but at least we are making progress.

On inflation, I've been looking at this from a demographics perspective. If we look at the annual change in the prime working age population, there is one other period similar to the current situation - the early-to-mid 60s.

The first graph shows the year-over-year change in the prime working age population (25 to 54 years old).

Note: Ignore the steps up and down - the data was affected by changes in population controls.

The key is the prime working age population was declining in the early part of this decade and has only started increasing again recently.

This is very similar to what happened in the 60s.

In the early 60s, there was a slow increase in the prime working age population until the baby boomers started pouring into the labor force.

In the 1960s, inflation didn't pickup until the unemployment rate had fallen close to 4%. There could be several demographics reasons for the low inflation (in addition to policy reasons). As an example, maybe older workers were being replaced by younger workers who made less (just like today), and maybe the slow increase in the prime working age population put less pressure on resources.

Ignoring for the moment monetary and fiscal policy differences between the periods (LBJ's guns and butter and some austerity recently), maybe the unemployment rate will have to fall below 5% before inflation picks up.

Update on FHA Mortgage Insurance Premium (MIP) Reduction

by Calculated Risk on 1/09/2015 01:32:00 PM

Jann Swanson at Mortgage News Daily Update on Mortgage Insurance Cut: FHA to Allow Case Number Cancellation

According to the executive order announced yesterday FHA will almost immediately cut .5 percent from the annual premium for the FHA backed loans with terms greater than 15yrs. For most FHA loans this will reduce the annual premium from 1.35 percent of the loan balance to .85 percent. Loans with balances above the loan limits in effect in most areas and with current MIP of 1.50 to 1.55 percent will see new premiums of 1.00 or 1.05 percent respectively. The upfront premium for all loans will remain unchanged at 1.75 percent.Key points:

Borrowers with FHA Case Numbers issued on or after January 26 will be eligible for the new premium rates. However, today's letter has good news for borrowers already in process of getting their FHA loan. Lenders will temporarily be allowed to cancel Case Numbers issued before that date.

1) Cut applies to loan greater than 15 years (15 year loan are already at lower levels).

2) Borrowers with FHA-insured loans can refinance and obtain the lower annual MIP, as long as the original endorsement was after May 31, 2009 (Older loans have a lower annual MIP. The annual MIP was increased from 0.55% to 0.90% in October 2010, to 1.15% in April 2011, to 1.25% in April 2012, and to 1.35% in April 2013 for borrowers with less than 5% down.) Note: HUD told me yesterday that they expect 100,000 to 200,000 FHA-insured borrowers to refinance in the next year.

3) Lenders can cancel loans in process so borrowers can obtain lower annual MIP. As Swanson notes, there will probably be a surge in loans starting January 26th (all the canceled loans, and an increase in refinance activity).

Note: Borrowers with FHA-insured loans that are thinking of refinancing should check other alternatives (if the value of the home has increased - or other changes - maybe the borrower can get a lower rate with a different program).

Employment Report Comments: First come the jobs, then comes the real wage growth

by Calculated Risk on 1/09/2015 10:02:00 AM

Earlier: December Employment Report: 252,000 Jobs, 5.6% Unemployment Rate

In November, I posted a possible list of economic words for the year since I started this blog. This included "bubble", "subprime", "bailout" and more. For 2014 I suggested "employment", and 2014 was definitely about jobs! That is something to celebrate.

2014 was the best year for total employment since 1999, and the best year for private employment since 1997. Awesome news.

Looking forward, hopefully 2015 will be about "wages". My thinking is first come the jobs, then comes the real wage growth.

Overall this was a strong employment report with 252,000 jobs added, and job gains for October and November were revised up. A few other positives: U-6 declined to 11.2% (an alternative measure for labor underutilization) and was at the lowest level since 2008, the number of part time workers for economic reasons declined (lowest since October 2008), and the number of long term unemployed declined to the lowest level since January 2009.

Unfortunately there was disappointing news on wage growth, from the BLS: "In December, average hourly earnings for all employees on private nonfarm payrolls decreased by 5 cents to $24.57, following an increase of 6 cents in November. Over the year, average hourly earnings have risen by 1.7 percent." But wages will hopefully be a 2015 story.

With the unemployment rate at 5.6%, there is still little upward pressure on wages. Hopefully wage growth will pick up as the unemployment rate falls over the next couple of years.

A few more numbers:

Total employment increased 252,000 from November to December and is now 2.0 million above the previous peak. Total employment is up 10.7 million from the employment recession low.

Private payroll employment increased 314,000 from October to November, and private employment is now 2.4 million above the previous peak. Private employment is up 11.2 million from the recession low.

Year-over-year Change in Employment

In December, the year-over-year change was 2.95 million jobs, and it appears the pace of hiring is increasing.

This was the highest year-over-year gain since the '90s.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers at a solid pace in 2014.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels (highest since the '90s). Note: I expect the long term trend will be down with more and more internet holiday shopping.

This suggests retailers were optimistic about the holiday season, and my guess is holiday retail sales were solid.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in December at 80.8%, and the 25 to 54 employment population ratio increased to 77.0%. As the recovery continues, I expect the participation rate for this group to increase a little (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

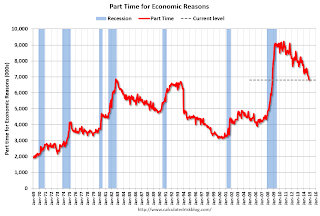

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in December at 6.8 million.The number of persons working part time for economic reasons decreased in December to 6.790 million from 6,850 million in November. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.2% in December from 11.4% in November.

This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.785 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.815 in November. This is trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In December 2014, state and local governments added 11,500 jobs. State and local government employment is now up 169,500 from the bottom, but still 574,500 below the peak.

State and local employment is now increasing. And Federal government layoffs have slowed (payroll increased by 1 thousand in December), but Federal employment was still down 17,000 for the year.

December Employment Report: 252,000 Jobs, 5.6% Unemployment Rate

by Calculated Risk on 1/09/2015 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 252,000 in December, and the unemployment rate declined to 5.6 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, construction, food services and drinking places, health care, and manufacturing.

...

The change in total nonfarm payroll employment for October was revised from +243,000 to +261,000, and the change for November was revised from +321,000 to +353,000. With these revisions, employment gains in October and November were 50,000 higher than previously reported.

Click on graph for larger image.

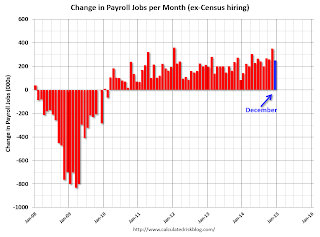

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Eleven consecutive months over 200 thousand.

Employment is now up 2.952 million year-over-year.

Here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total employment, 2014 was the best year since 1999.

For private employment, 2014 was the best year since 1997.

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,408 | 3,213 | 195 |

| 1998 | 3,003 | 2,734 | 313 |

| 1999 | 3,177 | 2,716 | 461 |

| 2000 | 1,946 | 1,682 | 264 |

| 2001 | -1,735 | -2,286 | 551 |

| 2002 | -508 | -741 | 233 |

| 2003 | 105 | 147 | -42 |

| 2004 | 2,033 | 1,886 | 147 |

| 2005 | 2,506 | 2,320 | 186 |

| 2006 | 2,085 | 1,876 | 209 |

| 2007 | 1,140 | 852 | 288 |

| 2008 | -3,576 | -3,756 | 180 |

| 2009 | -5,087 | -5,013 | -74 |

| 2010 | 1,058 | 1,277 | -219 |

| 2011 | 2,083 | 2,400 | -317 |

| 2012 | 2,236 | 2,294 | -58 |

| 2013 | 2,331 | 2,365 | -34 |

| 2014 | 2,952 | 2,861 | 91 |

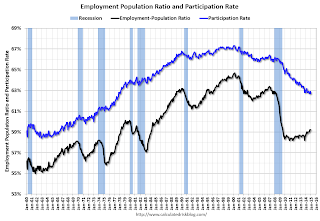

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate declined in December to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate declined in December to 5,6%.

This was above expectations of 245,000, and with the upward revisions to prior months, this was another strong report.

I'll have much more later ...

Thursday, January 08, 2015

Friday: Jobs

by Calculated Risk on 1/08/2015 07:49:00 PM

First an important point from Tim Duy: Volatile Week Ahead of Employment Report

I tend agree that the net impact [from the decline in oil prices] will be positive, but note that the negative impacts will be fairly concentrated and easy for the media to sensationalize, while the positive impacts will be fairly dispersed. We all know what is going to happen to rig counts, high-yield energy debt, and the economies of North Dakota and at least parts of Texas. "Kablooey," I think, is the technical term. Easy media fodder. Much more difficult to see the positive impact spread across the real incomes of millions of households, with particularly solid gains at the lower ends of the income distribution. This will be most likely revealed in the aggregate data and be much less newsworthy.We are already seeing stories about layoffs in oil related industries (and suppliers). However, since the US is a large net importer of oil, the overall impact of lower oil prices should be positive for the US economy. The negative stories are newsworthy, but it is worth remembering - as Tim Duy notes - that the positive stories will be hidden in the aggregate data.

emphasis added

Here was an employment preview I posted earlier: Preview: Employment Report for December

Friday:

• At 8:30 AM ET, the Employment Report for December. The consensus is for an increase of 240,000 non-farm payroll jobs added in December, down from the 321,000 non-farm payroll jobs added in November. The consensus is for the unemployment rate to decline to 5.7% in December from 5.8% the previous month.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.3% increase in inventories.

Clarification: Current FHA-insured borrowers WILL need to Refinance to obtain lower MIP

by Calculated Risk on 1/08/2015 04:33:00 PM

Just to be clear, current FHA-insured borrowers will need to refinance to obtain the 0.85% annual Mortgage Insurance Premium (MIP).

New borrowers will obtain the lower MIP automatically.

HUD will send out a letter very soon clarifying what this means for borrowers currently in the process of obtaining an FHA-insured loan.

HUD estimates that approximately 100,000 to 200,000 FHA-insured borrowers will refinance in the next year.

FHA Insured Loans: HUD Corrects wording on lower Mortgage Insurance Premium (MIP)

by Calculated Risk on 1/08/2015 03:04:00 PM

Update2: Clarification: Current FHA-insured borrowers WILL need to Refinance to obtain lower MIP

I was thinking there would be a refinance boom for FHA loans. The HUD press release read:

"FHA’s new annual premium prices will take effect for all new FHA-insured mortgages endorsed toward the end of January 2015. FHA will publish a mortgagee letter detailing its new pricing structure shortly."That sounded like people would need to refinance to obtain the lower MIP.

emphasis added

This would be a significant number of borrowers because the annual MIP was increased to 1.15% in April 2011, to 1.25% in April 2012, and to 1.35% in April 2013 (for borrowers with less than 5% down). Looking at the mortgage rates available at those times, it appeared a large number of FHA insured borrowers would consider refinancing now.

However HUD just corrected their press release to read:

"FHA’s new annual premium prices are expected to take effect towards the end of the month. FHA will publish a mortgagee letter detailing its new pricing structure shortly."The "new FHA-insured" was removed. Update: Or this change could mean that loans currently in the process will receive the old MIP, and loans originated after January will receive the new MIP. It is difficult to lower the MIP for current borrowers ...

So I'm expecting an FHA refi boom.

Trulia: "What Falling Oil Prices Mean for Home Prices"

by Calculated Risk on 1/08/2015 01:37:00 PM

From Trulia chief economist Jed Kolko: What Falling Oil Prices Mean for Home Prices

Nationwide, asking prices on for-sale homes were up 0.5% month-over-month in December, seasonally adjusted — a slowdown after larger increases in September, October, and November. Year-over-year, asking prices rose 7.7%, down from the 9.5% year-over-year increase in December 2013. Asking prices increased year-over-year in 97 of the 100 largest U.S. metros.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and although year-over-year price increases had been slowing, the year-over-year change increased in November.

Four of the five markets where asking prices rose most year-over-year are in the South, including Atlanta, Cape Coral-Fort Myers, North Port-Sarasota-Bradenton, and Deltona-Daytona Beach-Ormond Beach. Of the top 10, four are in the Midwest, including Cincinnati, Detroit, Lake-Kenosha Counties, and Indianapolis. Among markets with the largest asking price increases, Houston stands out for having a large local oil industry, accounting for 5.6% of jobs there.

Only Bakersfield and Baton Rouge have an even higher employment share in oil-related industries than Houston. Oklahoma City, Tulsa, New Orleans, and Fort Worth round out the seven large metros where oil-related industries account for at least 2% of employment. It’s not until you look at smaller metros that you find oil-related industries representing a larger employment share. In Williston, ND, and Midland, TX, they account for almost 30% of local jobs. [see graph of percent oil jobs at article]

This history offers three lessons for today’s housing market. First, any negative impact of falling oil prices on home prices should be concentrated in oil-producing markets in Texas, Oklahoma, Louisiana, and other places with large oil-related industries. Second, in these markets, oil prices won’t tank home prices immediately. Rather, falling oil prices in the second half of 2014 might not have their biggest impact on home prices until late 2015 or in 2016. Third, falling oil prices will probably help local economies and home prices in markets that lack oil-related industries.

...

Nationwide, rents rose 6.1% year-over-year in December. The least affordable rental markets are Miami, Los Angeles, and New York, where median rent for a two-bedroom unit eats up more than half of the local average wage.

emphasis added

The month-to-month increase suggests further house price increases over the next few months on a seasonally adjusted basis.

There is much more in the article, especially on the impact of falling oil prices on housing.