by Calculated Risk on 1/09/2015 10:02:00 AM

Friday, January 09, 2015

Employment Report Comments: First come the jobs, then comes the real wage growth

Earlier: December Employment Report: 252,000 Jobs, 5.6% Unemployment Rate

In November, I posted a possible list of economic words for the year since I started this blog. This included "bubble", "subprime", "bailout" and more. For 2014 I suggested "employment", and 2014 was definitely about jobs! That is something to celebrate.

2014 was the best year for total employment since 1999, and the best year for private employment since 1997. Awesome news.

Looking forward, hopefully 2015 will be about "wages". My thinking is first come the jobs, then comes the real wage growth.

Overall this was a strong employment report with 252,000 jobs added, and job gains for October and November were revised up. A few other positives: U-6 declined to 11.2% (an alternative measure for labor underutilization) and was at the lowest level since 2008, the number of part time workers for economic reasons declined (lowest since October 2008), and the number of long term unemployed declined to the lowest level since January 2009.

Unfortunately there was disappointing news on wage growth, from the BLS: "In December, average hourly earnings for all employees on private nonfarm payrolls decreased by 5 cents to $24.57, following an increase of 6 cents in November. Over the year, average hourly earnings have risen by 1.7 percent." But wages will hopefully be a 2015 story.

With the unemployment rate at 5.6%, there is still little upward pressure on wages. Hopefully wage growth will pick up as the unemployment rate falls over the next couple of years.

A few more numbers:

Total employment increased 252,000 from November to December and is now 2.0 million above the previous peak. Total employment is up 10.7 million from the employment recession low.

Private payroll employment increased 314,000 from October to November, and private employment is now 2.4 million above the previous peak. Private employment is up 11.2 million from the recession low.

Year-over-year Change in Employment

In December, the year-over-year change was 2.95 million jobs, and it appears the pace of hiring is increasing.

This was the highest year-over-year gain since the '90s.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers at a solid pace in 2014.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels (highest since the '90s). Note: I expect the long term trend will be down with more and more internet holiday shopping.

This suggests retailers were optimistic about the holiday season, and my guess is holiday retail sales were solid.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in December at 80.8%, and the 25 to 54 employment population ratio increased to 77.0%. As the recovery continues, I expect the participation rate for this group to increase a little (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

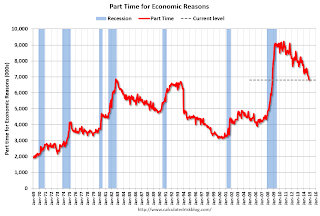

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in December at 6.8 million.The number of persons working part time for economic reasons decreased in December to 6.790 million from 6,850 million in November. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.2% in December from 11.4% in November.

This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.785 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.815 in November. This is trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In December 2014, state and local governments added 11,500 jobs. State and local government employment is now up 169,500 from the bottom, but still 574,500 below the peak.

State and local employment is now increasing. And Federal government layoffs have slowed (payroll increased by 1 thousand in December), but Federal employment was still down 17,000 for the year.