by Calculated Risk on 1/09/2015 10:02:00 AM

Friday, January 09, 2015

Employment Report Comments: First come the jobs, then comes the real wage growth

Earlier: December Employment Report: 252,000 Jobs, 5.6% Unemployment Rate

In November, I posted a possible list of economic words for the year since I started this blog. This included "bubble", "subprime", "bailout" and more. For 2014 I suggested "employment", and 2014 was definitely about jobs! That is something to celebrate.

2014 was the best year for total employment since 1999, and the best year for private employment since 1997. Awesome news.

Looking forward, hopefully 2015 will be about "wages". My thinking is first come the jobs, then comes the real wage growth.

Overall this was a strong employment report with 252,000 jobs added, and job gains for October and November were revised up. A few other positives: U-6 declined to 11.2% (an alternative measure for labor underutilization) and was at the lowest level since 2008, the number of part time workers for economic reasons declined (lowest since October 2008), and the number of long term unemployed declined to the lowest level since January 2009.

Unfortunately there was disappointing news on wage growth, from the BLS: "In December, average hourly earnings for all employees on private nonfarm payrolls decreased by 5 cents to $24.57, following an increase of 6 cents in November. Over the year, average hourly earnings have risen by 1.7 percent." But wages will hopefully be a 2015 story.

With the unemployment rate at 5.6%, there is still little upward pressure on wages. Hopefully wage growth will pick up as the unemployment rate falls over the next couple of years.

A few more numbers:

Total employment increased 252,000 from November to December and is now 2.0 million above the previous peak. Total employment is up 10.7 million from the employment recession low.

Private payroll employment increased 314,000 from October to November, and private employment is now 2.4 million above the previous peak. Private employment is up 11.2 million from the recession low.

Year-over-year Change in Employment

In December, the year-over-year change was 2.95 million jobs, and it appears the pace of hiring is increasing.

This was the highest year-over-year gain since the '90s.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers at a solid pace in 2014.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels (highest since the '90s). Note: I expect the long term trend will be down with more and more internet holiday shopping.

This suggests retailers were optimistic about the holiday season, and my guess is holiday retail sales were solid.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in December at 80.8%, and the 25 to 54 employment population ratio increased to 77.0%. As the recovery continues, I expect the participation rate for this group to increase a little (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

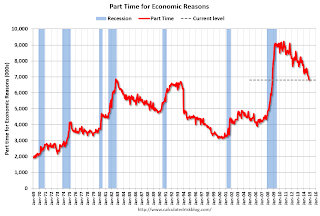

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in December at 6.8 million.The number of persons working part time for economic reasons decreased in December to 6.790 million from 6,850 million in November. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.2% in December from 11.4% in November.

This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.785 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.815 in November. This is trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In December 2014, state and local governments added 11,500 jobs. State and local government employment is now up 169,500 from the bottom, but still 574,500 below the peak.

State and local employment is now increasing. And Federal government layoffs have slowed (payroll increased by 1 thousand in December), but Federal employment was still down 17,000 for the year.

December Employment Report: 252,000 Jobs, 5.6% Unemployment Rate

by Calculated Risk on 1/09/2015 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 252,000 in December, and the unemployment rate declined to 5.6 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, construction, food services and drinking places, health care, and manufacturing.

...

The change in total nonfarm payroll employment for October was revised from +243,000 to +261,000, and the change for November was revised from +321,000 to +353,000. With these revisions, employment gains in October and November were 50,000 higher than previously reported.

Click on graph for larger image.

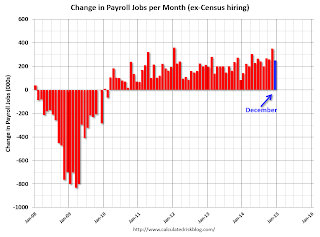

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Eleven consecutive months over 200 thousand.

Employment is now up 2.952 million year-over-year.

Here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total employment, 2014 was the best year since 1999.

For private employment, 2014 was the best year since 1997.

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,408 | 3,213 | 195 |

| 1998 | 3,003 | 2,734 | 313 |

| 1999 | 3,177 | 2,716 | 461 |

| 2000 | 1,946 | 1,682 | 264 |

| 2001 | -1,735 | -2,286 | 551 |

| 2002 | -508 | -741 | 233 |

| 2003 | 105 | 147 | -42 |

| 2004 | 2,033 | 1,886 | 147 |

| 2005 | 2,506 | 2,320 | 186 |

| 2006 | 2,085 | 1,876 | 209 |

| 2007 | 1,140 | 852 | 288 |

| 2008 | -3,576 | -3,756 | 180 |

| 2009 | -5,087 | -5,013 | -74 |

| 2010 | 1,058 | 1,277 | -219 |

| 2011 | 2,083 | 2,400 | -317 |

| 2012 | 2,236 | 2,294 | -58 |

| 2013 | 2,331 | 2,365 | -34 |

| 2014 | 2,952 | 2,861 | 91 |

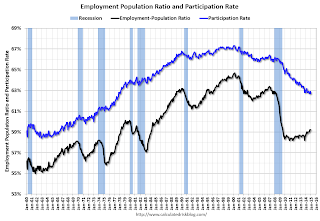

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate declined in December to 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate declined in December to 5,6%.

This was above expectations of 245,000, and with the upward revisions to prior months, this was another strong report.

I'll have much more later ...

Thursday, January 08, 2015

Friday: Jobs

by Calculated Risk on 1/08/2015 07:49:00 PM

First an important point from Tim Duy: Volatile Week Ahead of Employment Report

I tend agree that the net impact [from the decline in oil prices] will be positive, but note that the negative impacts will be fairly concentrated and easy for the media to sensationalize, while the positive impacts will be fairly dispersed. We all know what is going to happen to rig counts, high-yield energy debt, and the economies of North Dakota and at least parts of Texas. "Kablooey," I think, is the technical term. Easy media fodder. Much more difficult to see the positive impact spread across the real incomes of millions of households, with particularly solid gains at the lower ends of the income distribution. This will be most likely revealed in the aggregate data and be much less newsworthy.We are already seeing stories about layoffs in oil related industries (and suppliers). However, since the US is a large net importer of oil, the overall impact of lower oil prices should be positive for the US economy. The negative stories are newsworthy, but it is worth remembering - as Tim Duy notes - that the positive stories will be hidden in the aggregate data.

emphasis added

Here was an employment preview I posted earlier: Preview: Employment Report for December

Friday:

• At 8:30 AM ET, the Employment Report for December. The consensus is for an increase of 240,000 non-farm payroll jobs added in December, down from the 321,000 non-farm payroll jobs added in November. The consensus is for the unemployment rate to decline to 5.7% in December from 5.8% the previous month.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.3% increase in inventories.

Clarification: Current FHA-insured borrowers WILL need to Refinance to obtain lower MIP

by Calculated Risk on 1/08/2015 04:33:00 PM

Just to be clear, current FHA-insured borrowers will need to refinance to obtain the 0.85% annual Mortgage Insurance Premium (MIP).

New borrowers will obtain the lower MIP automatically.

HUD will send out a letter very soon clarifying what this means for borrowers currently in the process of obtaining an FHA-insured loan.

HUD estimates that approximately 100,000 to 200,000 FHA-insured borrowers will refinance in the next year.

FHA Insured Loans: HUD Corrects wording on lower Mortgage Insurance Premium (MIP)

by Calculated Risk on 1/08/2015 03:04:00 PM

Update2: Clarification: Current FHA-insured borrowers WILL need to Refinance to obtain lower MIP

I was thinking there would be a refinance boom for FHA loans. The HUD press release read:

"FHA’s new annual premium prices will take effect for all new FHA-insured mortgages endorsed toward the end of January 2015. FHA will publish a mortgagee letter detailing its new pricing structure shortly."That sounded like people would need to refinance to obtain the lower MIP.

emphasis added

This would be a significant number of borrowers because the annual MIP was increased to 1.15% in April 2011, to 1.25% in April 2012, and to 1.35% in April 2013 (for borrowers with less than 5% down). Looking at the mortgage rates available at those times, it appeared a large number of FHA insured borrowers would consider refinancing now.

However HUD just corrected their press release to read:

"FHA’s new annual premium prices are expected to take effect towards the end of the month. FHA will publish a mortgagee letter detailing its new pricing structure shortly."The "new FHA-insured" was removed. Update: Or this change could mean that loans currently in the process will receive the old MIP, and loans originated after January will receive the new MIP. It is difficult to lower the MIP for current borrowers ...

So I'm expecting an FHA refi boom.

Trulia: "What Falling Oil Prices Mean for Home Prices"

by Calculated Risk on 1/08/2015 01:37:00 PM

From Trulia chief economist Jed Kolko: What Falling Oil Prices Mean for Home Prices

Nationwide, asking prices on for-sale homes were up 0.5% month-over-month in December, seasonally adjusted — a slowdown after larger increases in September, October, and November. Year-over-year, asking prices rose 7.7%, down from the 9.5% year-over-year increase in December 2013. Asking prices increased year-over-year in 97 of the 100 largest U.S. metros.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and although year-over-year price increases had been slowing, the year-over-year change increased in November.

Four of the five markets where asking prices rose most year-over-year are in the South, including Atlanta, Cape Coral-Fort Myers, North Port-Sarasota-Bradenton, and Deltona-Daytona Beach-Ormond Beach. Of the top 10, four are in the Midwest, including Cincinnati, Detroit, Lake-Kenosha Counties, and Indianapolis. Among markets with the largest asking price increases, Houston stands out for having a large local oil industry, accounting for 5.6% of jobs there.

Only Bakersfield and Baton Rouge have an even higher employment share in oil-related industries than Houston. Oklahoma City, Tulsa, New Orleans, and Fort Worth round out the seven large metros where oil-related industries account for at least 2% of employment. It’s not until you look at smaller metros that you find oil-related industries representing a larger employment share. In Williston, ND, and Midland, TX, they account for almost 30% of local jobs. [see graph of percent oil jobs at article]

This history offers three lessons for today’s housing market. First, any negative impact of falling oil prices on home prices should be concentrated in oil-producing markets in Texas, Oklahoma, Louisiana, and other places with large oil-related industries. Second, in these markets, oil prices won’t tank home prices immediately. Rather, falling oil prices in the second half of 2014 might not have their biggest impact on home prices until late 2015 or in 2016. Third, falling oil prices will probably help local economies and home prices in markets that lack oil-related industries.

...

Nationwide, rents rose 6.1% year-over-year in December. The least affordable rental markets are Miami, Los Angeles, and New York, where median rent for a two-bedroom unit eats up more than half of the local average wage.

emphasis added

The month-to-month increase suggests further house price increases over the next few months on a seasonally adjusted basis.

There is much more in the article, especially on the impact of falling oil prices on housing.

Las Vegas Real Estate in December: Lowest Sales in Years, Non-contingent Inventory up 18% YoY

by Calculated Risk on 1/08/2015 11:38:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices stay up through holidays

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in December was 2,734, up from 2,483 in November, but down from 2,915 one year ago. At the current sales pace, [GLVAR President Keith] Lynam said Southern Nevada continues to have less than a four-month supply of available homes. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

For all of 2014, GLVAR reported that 36,550 total properties were sold through its MLS. Lynam noted that was the lowest number of sales in at least six years, down from 47,685 sales in 2009; 44,045 in 2010; 48,798 in 2011; 45,698 in 2012; and 41,477 in 2013.

...

GLVAR said 34.1 percent of all local properties sold in December were purchased with cash. That’s up from 31.9 percent in November, but well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors have been buying homes in Southern Nevada.

...

GLVAR has been tracking a two-year trend toward fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That continued in December, when 10 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s up slightly from 9.6 percent in November. Another 8 percent of all December sales were bank-owned properties, down from 8.7 percent in November.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in December was 12,377, down 7.8 percent from 13,421 in November and down 7.0 percent from one year ago. GLVAR tracked a total of 3,282 condos and townhomes listed for sale on its MLS in December, down 7.0 percent from 3,529 in November, but up 13.1 percent from December 2013.

By the end of December, GLVAR reported 7,774 single-family homes listed without any sort of offer. That’s down 5.1 percent from 8,195 such homes listed in November, but up 18.0 percent from one year ago. For condos and townhomes, the 2,309 properties listed without offers in December represented a 6.1 percent decrease from 2,458 such properties listed in November, but a 38.8 percent increase from one year ago.

emphasis added

1) Overall sales were down 6,2% year-over-year.

2) However conventional (equity, not distressed) sales were up about 9% year-over-year. In December 2013, only 70.8% of all sales were conventional equity. In December 2014, 82.0% were standard equity sales. Note: In December 2012, only 44.7% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 44.4% in December 2013 to 34.1% in December 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 18.0% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

CoreLogic: "273,000 Residential Properties Regained Equity in Q3 2014"

by Calculated Risk on 1/08/2015 09:25:00 AM

From CoreLogic: CoreLogic Reports 273,000 Residential Properties Regained Equity in Q3 2014

CoreLogic ... today released new analysis showing nearly 273,000 U.S. homes returned to positive equity in the third quarter of 2014, bringing the total number of mortgaged residential properties with equity to approximately 44.6 million, or 90 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by approximately $800 billion in Q3 2014. The CoreLogic analysis indicates that approximately 5.1 million homes, or 10.3 percent of all residential properties with a mortgage, were still in negative equity as of Q3 2014 compared to 5.4 million homes, or 10.9 percent, for Q2 2014. This compares to a negative equity share of 13.3 percent, or 6.5 million homes, in Q3 2013, representing a year-over-year decrease in the number of underwater homes by almost 1.5 million (1,433,296), or 3.0 percent.

... Of the 44.6 million residential properties with positive equity, approximately 9.4 million, or 19 percent, have less than 20-percent equity (referred to as “under-equitied”) and 1.3 million of those have less than 5-percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near-negative equity are considered at risk of moving into negative equity if home prices fall. In contrast, if home prices rose by as little as 5 percent, an additional 1 million homeowners now in negative equity would regain equity. ...

“Nationally, the negative equity share is down over three percentage points over the past year. Declines were concentrated in a handful of states, such as Nevada, Georgia, Michigan and Florida,” said Sam Khater, deputy chief economist for CoreLogic. “Forecasted house price appreciation of about five percent over the next year suggests that negative equity should be at about 8 percent a year from now, still above average, but approaching the pre-crisis level.”

emphasis added

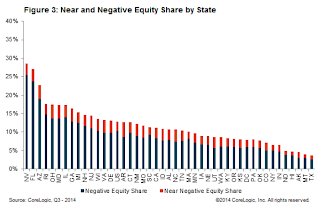

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 25.4 percent, followed by Florida (23.8 percent), Arizona (19 percent), Rhode Island (14.8 percent) and Illinois (14.1 percent). These top five states together account for 33.1 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago (Q3 2013) when the negative equity share in Nevada was at 32.2 percent, and at 28.8 percent in Florida.

The second graph shows the distribution of home equity in Q3 compared to Q2 2014. Close to 4% of residential properties have 25% or more negative equity, down from Q2.

The second graph shows the distribution of home equity in Q3 compared to Q2 2014. Close to 4% of residential properties have 25% or more negative equity, down from Q2.In Q3 2013, there were 6.4 million properties with negative equity - now there are 5.1 million. A significant change.

Weekly Initial Unemployment Claims decreased to 294,000

by Calculated Risk on 1/08/2015 08:33:00 AM

The DOL reported:

In the week ending January 3, the advance figure for seasonally adjusted initial claims was 294,000, a decrease of 4,000 from the previous week's unrevised level of 298,000. The 4-week moving average was 290,500, a decrease of 250 from the previous week's unrevised average of 290,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased slightly to 290,500.

This was lower than the consensus forecast of 300,000, and the level suggests few layoffs.

Wednesday, January 07, 2015

Thursday: Unemployment Claims

by Calculated Risk on 1/07/2015 07:25:00 PM

Interesting from Jon Hilsenrath And Brian Blackstone at the WSJ: Fed Backs More Overseas Stimulus

Fed officials rarely comment on the decisions taken by foreign central banks and have generally played down risks to domestic growth emanating from abroad. Yet minutes of the Fed’s Dec. 16-17 policy meeting included several references to the urgency U.S. officials and market participants are placing on new policy actions to counteract slow growth outside the U.S.Thursday:

...

The minutes showed Fed officials “regarded the international situation as an important source of downside risks to domestic real activity and employment.” They added that the risks were particularly serious “if foreign policy responses were insufficient.”

In another place in the Fed minutes, officials warned that financial markets had been “importantly influenced by concerns about prospects for foreign economic growth and by associated expectations of monetary policy actions in Europe and Japan.”

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 298 thousand.

• Early, Trulia Price Rent Monitors for December. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 3:00 PM, Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $15.0 billion.