by Calculated Risk on 10/26/2014 11:16:00 AM

Sunday, October 26, 2014

FOMC: End of QE3, Shorter Statement

Earlier I posted FOMC statement previews from Goldman Sachs and Merrill Lynch economists. Here is what I expect on Wednesday:

• The FOMC will announce the end of QE3.

• The FOMC statement will be shorter. Here is the September statement (895 words). Last year, in September 2013, the statement had 798 words. Ten years ago, in September 2004, the statement had only 277 words.

• Since there is no press conference following the FOMC meeting this month, I don't expect any major changes to the FOMC statement - just the elimination of certain sections, and some wording changes.

• Possible wording changes include:

1) some upgrade to "significant underutilization of labor resources",

2) some concern about less inflation, perhaps changing the word "diminished" in the phrase "the likelihood of inflation running persistently below 2 percent has diminished somewhat since early this year" to "increased recently". Note: Earlier this year, when inflation picked up a little, Yellen said: "The CPI index has been a bit on the high side, but I think the data that we’re seeing is noisy." So the FOMC might be patient on inflation again and wait until December to make any wording changes.

3) The "considerable time" phrase will probably remain (although the sentence might be tweaked).

"The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored."

emphasis added

Note: I don't expect any change to this key sentence: "The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

The over/under on the word count is probably around 800 words, and I'll take the under!

For some general thoughts on the QE, see: A Few Comments on QE

Saturday, October 25, 2014

Schedule for Week of October 26th

by Calculated Risk on 10/25/2014 02:31:00 PM

The key report this week is Q3 GDP on Thursday.

There will be an FOMC meeting on Tuesday and Wednesday, and the FOMC is expected to announce the end of QE3 on Wednesday.

10:00 AM ET: Pending Home Sales Index for September. The consensus is for a 0.8% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for October.

During the day (Monday or Tuesday): Q3 NMHC Apartment Tightness Index.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.9% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the July 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.9% year-over-year increase in the National Index for August , down from 5.7% in July (consensus 5.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 5.7% year-over-year in August, and for prices to increase 0.1% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

10:00 AM: Conference Board's consumer confidence index for October. The consensus is for the index to increase to 87.2 from 86.0.

10:00 AM: Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Meeting Statement. The FOMC is expected to announce the end of QE3 asset purchases at this meeting.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (advance estimate). The consensus is that real GDP increased 2.8% annualized in Q3.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 280 thousand from 283 thousand.

8:30 AM: Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 60.0, down from 60.5 in September.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 86.4, unchanged from the preliminary reading of 86.4, and up from the September reading of 84.6.

Unofficial Problem Bank list declines to 423 Institutions

by Calculated Risk on 10/25/2014 11:01:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 24, 2014.

Changes and comments from surferdude808:

It was the fourth time in 2014 for the FDIC to close a bank on back-to-back weeks. Other than the failure, two other removals pushed the Unofficial Problem Bank List count down to 423 institutions with assets of $133.4 billion. A year ago, the list held 670 institutions with assets of $234 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 423.

Northwestern Bank, Traverse City, MI ($849 million) and The First National Bank of Wyoming, Wyoming, DE ($302 million) found their way off the list through unassisted mergers.

The National Republic Bank of Chicago, Chicago, IL ($994 million) failed after operating under a formal action since April 2010 and a Prompt Corrective Action order since July 2014. This is the fifth bank headquartered in Illinois to fail this year and the 61st failure in the state since the onset of the Great Recession. Acquiring the bank in the assisted transaction was State Bank of Texas, Dallas, Texas, with has assets of $413 million. Usually the FDIC does not like an acquirer to be so much smaller than and this far away geographically from the failed bank. So it looks like these issues were deemed not as important as maintaining the minority ownership status of the failed assets.

Next week, we anticipate the FDIC to release an update on its enforcement action activities through September 2014.

Goldman Sachs: FOMC Preview

by Calculated Risk on 10/25/2014 08:11:00 AM

Excerpts from a research piece by economist Kris Dawsey at Goldman Sachs:

US data have generally been solid since the last FOMC meeting, with a few exceptions. However, concern about downside risks to global growth increased—echoed by Fed communications—while financial market volatility rose considerably. The market-implied date of the first rate hike shifted out by roughly a quarter to 2015 Q4.

Our analysis suggests that recent developments should have a limited effect on the Fed’s baseline expectation for growth in the near-term, although downside risks to inflation are more pronounced. The FOMC will probably acknowledge recent foreign developments in the October statement, but an explicit shift in the balance of risks for the US outlook to the downside would be a dovish surprise. Other changes to the statement will likely include a slight upgrade to the language on the labor market.

St. Louis Fed President Bullard’s suggestion that QE could be extended past the October meeting garnered a lot of attention, but this seems unlikely to us. ...

We think the “considerable time” forward guidance will only be adjusted slightly at the October meeting, removing the reference to the end of asset purchases. The September meeting minutes suggested that any major changes are most likely at a meeting with a press conference, such as December. ...

emphasis added

Friday, October 24, 2014

Merrill Lynch: FOMC Preview

by Calculated Risk on 10/24/2014 08:50:00 PM

From Merrill Lynch:

The October FOMC meeting is likely to see the end of QE3 buying, as the Fed tapers the final $15bn in asset purchases. ... Tapering has been largely contingent on an improving labor market, and that has generally continued. The FOMC also has indicated multiple times that they are likely to end QE3 in October. Thus, it would take a significant adverse shock to change that plan, in our view.I'll post a preview this weekend, but it seems QE3 will end ... and the FOMC statement will be shorter!

As for the statement language, we expect the “significant underutilization” language to once again remain in place — although we see a modest chance that is downgraded, say to “elevated underutilization.” Meanwhile, the likelihood of changing the “considerable time” language is much more evenly split. Our base case remains no change in October, largely because there is no urgent need to revise, especially with the increase in downside risks to the outlook and heightened market volatility since the last meeting. However, there is general dissatisfaction on the FOMC with this phrase, and Fed officials have had another month and a half to consider alternatives. With no press conference scheduled after this meeting, the Committee may opt for re-examining the forward guidance language more comprehensively at their December meeting.

Perhaps most notable at this meeting may be the number and nature of dissents. We see a high probability of hawkish dissents from Dallas’s Fisher and Philadelphia’s Plosser. In our view, there is some chance the FOMC statement will note a bit more concern about downside risks to inflation — a reflection of recent data, the drop in breakevens, the strong US dollar, and disinflationary forces abroad. Should the Committee opt not to add such language, a dovish dissent from Minneapolis’s Kocherlakota becomes a risk. ... We continue to recommend focusing on the statement language and prepared remarks from Chair Yellen and other key Fed officials to understand the views of the majority of voters, who favor a patient and gradual exit process.

Bank Failure #16 in 2014: National Republic Bank of Chicago

by Calculated Risk on 10/24/2014 06:41:00 PM

From the FDIC: State Bank of Texas, Dallas, Texas, Assumes All of the Deposits of the National Republic Bank of Chicago, Chicago, Illinois

As of June 30, 2014, The National Republic Bank of Chicago had approximately $954.4 million in total assets and $915.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $111.6 million. ... The National Republic Bank of Chicago is the 16th FDIC-insured institution to fail in the nation this year, and the fifth in Illinois.Bank failure friday two weeks in a row!

Lawler on New Home Sales: Silly-Looking August Guess Revised Down Sharply in the West – As Expected

by Calculated Risk on 10/24/2014 03:30:00 PM

From housing economist Tom Lawler:

Census “guesstimated” that new SF home sales ran at a seasonally adjusted annual rate of 467,000 in September, up 0.2% from August’s downwardly-revised (by 7.5% to 466,000) pace. Sales estimates for June and July were also revised downward (by 2.4% and 5.4%, respectively). Not surprisingly (see LEHC, 9/24/2014), the biggest downward revision in sales for August was in the West region, where sales were revised downward by almost 20%.

Census also estimated that the inventory of new SF homes for sale at the end of September was 207,000 on a seasonally adjusted basis, up 1.5% from August’s upwardly revised (to 204,000 from 203,000) level and up 13.1% from a year ago. Census estimated that the median new SF home sales price last month was $259,000, down 4% from last September.

| Census Estimates of New SF Home Sales in August (SAAR) | |||

|---|---|---|---|

| Preliminary | First Revision | % Difference | |

| US | 504,000 | 466,000 | -7.5% |

| Northeast | 31,000 | 30,000 | -3.2% |

| Midwest | 58,000 | 57,000 | -1.7% |

| South | 262,000 | 256,000 | -2.3% |

| West | 153,000 | 123,000 | -19.6% |

Here are Census’ estimates of new SF home sales for the first nine months of 2014 compared to the first nine months of 2013 (not seasonally adjusted).

| Census Estimates of New SF Home Sales, Jan - Sep (NSA) | |||

|---|---|---|---|

| 2014 | 2013 | % Change* | |

| US | 337,000 | 331,000 | 1.7% |

| Northeast | 21,000 | 24,000 | -12.5% |

| Midwest | 47,000 | 47,000 | -1.2% |

| South | 187,000 | 175,000 | 6.8% |

| West | 82,000 | 85,000 | -3.2% |

| *Note: Census only shows home sales rounded to the nearest thousand, but % changes are reported based on unrounded estimates | |||

New SF home sales so far this year have fallen well short of consensus industry expectations at the beginning of the year. A major reason appears to be weakness sales to first-time home buyers, partly because of tight credit, partly because of financial “issues” for many younger adults, but also partly because many builders have trouble meeting their high return targets for communities with smaller, lower-price homes that would normally be targeted for first-time buyers.

As an example, home builder Pulte noted this morning that given its return targets “most” of its current land development was going to communities focused on the move-up and active adult markets, as in many areas there is not enough “pricing power” in the first-time buyer market for the company to meet its return targets.

Comments on September New Home Sales

by Calculated Risk on 10/24/2014 12:31:00 PM

The new home sales report for September was slightly above expectations at 467 thousand on a seasonally adjusted annual rate basis (SAAR). With the downward revision to August sales, sales for September were at the the highest sales rate since July 2008.

Sales for the previous three months (June, July and August) were revised down.

Earlier: New Home Sales increased slightly to 467,000 Annual Rate in September

The Census Bureau reported that new home sales this year, through September, were 338,000, Not seasonally adjusted (NSA). That is up 2.4% from 330,000 during the same period of 2013 (NSA). Not much of a gain from last year. Right now it looks like sales will barely be up this year (maybe 3% or so for the year).

Sales were up 17.0% year-over-year in September - however sales declined sharply in Q3 2013 as mortgage rates increased - so this was an easy comparison. The comparisons for Q4 will be more difficult.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will probably be smaller in Q4, but I expect sales to be up for the quarter and for the year.

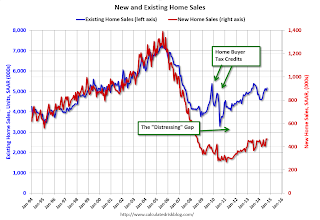

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be somewhat offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased slightly to 467,000 Annual Rate in September

by Calculated Risk on 10/24/2014 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 467 thousand.

August sales were revised down from 504 thousand to 466 thousand, and July sales were revised down from 427 thousand to 404 thousand.

"Sales of new single-family houses in September 2014 were at a seasonally adjusted annual rate of 467,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.2 percent above the revised August rate of 466,000 and is 17.0 percent above the September 2013 estimate of 399,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in September at 5.3 months.

The months of supply was unchanged in September at 5.3 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of September was 207,000. This represents a supply of 5.3 months at the current sales rate."

On inventory, according to the Census Bureau:

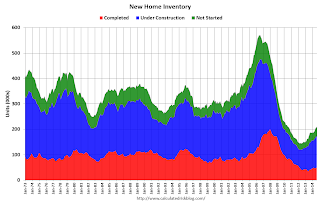

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2014 (red column), 38 thousand new homes were sold (NSA). Last year 31 thousand homes were sold in September. This was the best September since 2007.

The high for September was 99 thousand in 2005, and the low for September was 24 thousand in 2011.

This was close to expectations of 460,000 sales in September, although there were downward revisions to sales in June, July and August.

I'll have more later today.

Black Knight: Mortgage Delinquencies decreased in September

by Calculated Risk on 10/24/2014 08:01:00 AM

According to Black Knight's First Look report for September, the percent of loans delinquent decreased in September compared to August, and declined by 12% year-over-year.

Also the percent of loans in the foreclosure process declined further in September and were down 33% over the last year. Foreclosure inventory was at the lowest level since February 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.67% in September, down from 5.90% in August. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 1.76% in September from 1.80% in August.

The number of delinquent properties, but not in foreclosure, is down 388,000 properties year-over-year, and the number of properties in the foreclosure process is down 435,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for September in early November.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2014 | Aug 2014 | Sept 2013 | Sept 2012 | |

| Delinquent | 5.67% | 5.90% | 6.46% | 7.40% |

| In Foreclosure | 1.76% | 1.80% | 2.63% | 3.87% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,760,000 | 1,852,000 | 1,935,000 | 2,170,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,118,000 | 1,143,000 | 1,331,000 | 1,530,000 |

| Number of properties in foreclosure pre-sale inventory: | 893,000 | 913,000 | 1,328,000 | 1,940,000 |

| Total Properties | 3,771,000 | 3,908,000 | 4,593,000 | 5,640,000 |