by Calculated Risk on 9/23/2014 04:30:00 PM

Tuesday, September 23, 2014

ATA Trucking Index increased 1.6% in August

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Increased 1.6% in August to New Record High

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1.6% in August, following a gain of 1.5% the previous month. In August, the index equaled 132.6 (2000=100) versus 130.5 in July. August’s index is the highest on record, surpassing November 2013 (131.0).

Compared with August 2013, the SA index increased 4.5%, up from July’s 3.7% year-over-year gain. The latest year-over-year increase was the largest this year. Year-to-date, compared with the same period last year, tonnage is up 3.1%. ...

“After a strong July, factory production and housing starts fell in August on a month-to-month basis,” said ATA Chief Economist Bob Costello. “Truck tonnage actually did the opposite. Not only did it increase, it accelerated.”

Costello stated that tonnage is up 3.1% over the last two months alone and has surged 6.8% since hitting a recent low in January.

“I’m optimistic about the second half of the year for the economy, which means truck tonnage should do well too,” he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 4.5% year-over-year.

Chemical Activity Barometer "Pace of Growth Slows for Leading Economic Indicator"

by Calculated Risk on 9/23/2014 12:49:00 PM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Pace of Growth Slows for Leading Economic Indicator for Second Consecutive Month

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), continued to see an easing of growth this month, with a 0.1 percent gain over August as measured on a three-month moving average (3MMA). Growth for the third quarter stands at an average monthly gain of 0.2 percent compared to the strong 0.5 percent monthly average during the first half of the year. Despite the softening pace, the September CAB marked a string of consecutive gains going back to July 2012. Though the pace of growth has slowed, current gains have the CAB up a healthy 3.9 percent over this time last year, and the barometer remains at its highest level since January 2008. ...

Though the production indicator was flat in September, construction-related coatings, pigments and other performance chemistries remained strong, despite last week’s weak housing report. Chemical equities were up sharply this month, continuing to outpace the broader market. New orders and inventories improved in September but at a slower pace than earlier months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests continued growth.

Richmond Fed: "Manufacturing conditions strengthened in September"

by Calculated Risk on 9/23/2014 10:03:00 AM

From the Richmond Fed: Manufacturing Sector Activity Grew Moderately; Employment Improved, Average Wages Edged Down

Overall, manufacturing conditions strengthened in September. The composite index for manufacturing moved to a reading of 14 following last month's reading of 12. The index for shipments edged up one point, ending at 11, while the index for new orders also gained one point, finishing at a reading of 14. ...Another solid regional manufacturing report for September.

Manufacturing employment picked up this month; the September index advanced six points ending at 17. The average workweek lengthened, moving the index up two points to end at 10. However, average wages slowed somewhat compared to a month ago, with that index ending two points below the previous month at 9.

Producers remained positive about business conditions for the six months ahead. They expected solid growth in shipments and in the volume of new orders. The indexes for expected shipments and new orders ended at readings of 41 and 37, respectively, slightly below their outlook of a month ago.

emphasis added

FHFA: House Prices increase 0.1% in July, Up 4.4% Year-over-year

by Calculated Risk on 9/23/2014 09:14:00 AM

This house price index is only for houses with Fannie or Freddie mortgages. Note: There is also a quarterly expanded index that was up 5.8% year-over-year in Q2.

From the FHFA: FHFA House Price Index Rises in July

U.S. house prices rose in July, up 0.1 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.4 percent increase in June was revised to reflect a 0.3 percent increase.

The FHFA HPI is calculated using home sales price information from mortgages either sold to or guaranteed by Fannie Mae and Freddie Mac. From July 2013 to July 2014, house prices were up 4.4 percent. The U.S. index is 6.4 percent below its April 2007 peak and is roughly the same as the July 2005 index level. This is the eighth consecutive monthly house price increase.

For the nine census divisions, seasonally adjusted monthly price changes from June 2014 to July 2014 ranged from -0.5 percent in the Middle Atlantic division to +0.4 percent in the East North Central division. The 12-month changes were all positive ranging from +1.6 percent in the Middle Atlantic division to +7.2 percent in the Pacific division.

emphasis added

Monday, September 22, 2014

Mortgage News Daily: Mortgage Rates at 4.22%, Down from 4.45% Last September

by Calculated Risk on 9/22/2014 08:41:00 PM

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates decreased today to 4.22% from 4.24% on Friday.

One year ago, on Sept 22, 2013, rates were at 4.45%. In 2013, mortgage rates increased rapidly in June, and that led to slower existing home sales later in the year. Sales were still high in July and August - following the rate increase - because borrowers had locked in mortgage rates.

This year, rates have been mostly moving sideways over the last few months - so sales probably won't be negatively impacted by mortgage rates like last year - and existing home sales will probably be up a little year-over-year later this year.

Here is a table from Mortgage News Daily:

Lawler: Existing Home Sales Eased in August; NAR Bogusly Blames Monthly Dip on “Retreat” by “All Cash” Investors

by Calculated Risk on 9/22/2014 04:07:00 PM

From housing economist Tom Lawler:

In today’s existing home sales report, the National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 5.05 million, down 1.8% from July’s downwardly-revised (to 5.14 million from 5.15 million), and down 5.3% from last August’s pace. The NAR’s estimate was slightly lower than my below-consensus projection based on regional tracking. The NAR also estimated that the number of existing homes for sale at the end of August was 2.31 million, down 1.7% from July’s downwardly-revised (to 2.35 million from 2.37 million) but up 4.5% from last August. The NAR’s inventory estimate was also slightly lower than my projection based on regional tracking. Finally, the NAR estimated that the median existing home sales price last month was $219,800, up 4.8% from last August, and that the median existing SF home sales price was $220,600, up 5.2% from a year ago. This YOY increase was higher than my projection based on regional tracking.

In what I thought was a “strange” press release, the NAR attributed the drop in sales last month to a retreat from the market by “investors paying in cash.” This attribution was based on the results of the NAR’s monthly survey of a relatively small number (in terms of respondents1) of realtors, who are asked about the characteristics of the buyer for the realtor’s last transaction in a month. The results of this survey often do not match trends in the market as a whole. Here are some selected results of the August survey compared to the July survey and last August’s survey.

| Share of Existing Home Sales based on NAR Survey of Realtors* | |||

|---|---|---|---|

| Aug-14 | Jul-14 | Aug-13 | |

| All Cash | 23% | 29% | 32% |

| "Individual" Investor | 12% | 16% | 17% |

| First-Time Home Buyer | 29% | 29% | 28% |

| Foreclosure | 6% | 6% | 8% |

| Short Sales | 2% | 3% | 4% |

| *Based on last transaction in month | |||

In the first quarter of 2014 the NAR survey suggested that the all-cash share of home sales was noticeably higher than in the first quarter of 2013, even though other reports (based on property records) and local realtor/MLS reports suggested otherwise. While these other reports do suggest that the all-cash share of sales over the last few months is down significantly from a year ago, they don’t suggest that the all-cash share plunged in August relative to July (first table below). The survey’s distressed-sales share also looks way too low (second table below).

| All-Cash Share | Monthly Change | ||

|---|---|---|---|

| Aug-14 | Jul-14 | ||

| Las Vegas | 32.1% | 35.6% | -3.5% |

| Phoenix | 25.2% | 24.8% | 0.4% |

| Sacramento | 20.2% | 20.9% | -0.7% |

| Mid-Atlantic (MRIS) | 17.5% | 17.1% | 0.4% |

| Orlando | 42.1% | 39.6% | 2.5% |

| Bay Area CA* | 21.8% | 20.2% | 1.6% |

| So. California* | 24.4% | 24.5% | -0.1% |

| Florida SF | 38.7% | 37.7% | 1.0% |

| Florida C/TH | 64.7% | 64.3% | 0.4% |

| Toledo | 32.2% | 32.9% | -0.7% |

| Wichita | 25.7% | 28.0% | -2.3% |

| Des Moines | 16.0% | 15.1% | 0.9% |

| Peoria | 21.3% | 18.4% | 2.9% |

| Tucson | 26.0% | 26.2% | -0.2% |

| Omaha | 18.3% | 17.0% | 1.3% |

| Georgia*** | 26.8% | 24.1% | 2.7% |

| NAR Survey | 23.0% | 29.0% | -6.0% |

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | |

| Las Vegas | 11.5% | 25.0% | 8.9% | 8.0% | 20.4% | 33.0% | 32.1% | 52.5% |

| Reno** | 8.0% | 21.0% | 4.0% | 5.0% | 12.0% | 26.0% | ||

| Phoenix | 3.6% | 10.3% | 6.6% | 8.9% | 10.3% | 19.3% | 25.2% | 34.1% |

| Sacramento | 5.4% | 4.8% | 6.4% | 14.6% | 11.8% | 19.4% | 20.2% | 25.4% |

| Minneapolis | 2.5% | 5.5% | 8.1% | 15.2% | 10.6% | 20.7% | ||

| Mid-Atlantic | 4.1% | 7.6% | 8.9% | 7.0% | 13.0% | 14.6% | 17.5% | 17.5% |

| Orlando | 7.1% | 17.2% | 25.8% | 16.7% | 32.9% | 33.9% | 42.1% | 46.0% |

| California * | 6.0% | 11.4% | 5.4% | 7.8% | 11.4% | 19.2% | ||

| Bay Area CA* | 3.8% | 7.6% | 2.9% | 4.3% | 6.7% | 11.9% | 21.8% | 23.7% |

| So. California* | 5.9% | 11.5% | 5.0% | 7.0% | 10.9% | 18.5% | 24.4% | 28.4% |

| Florida SF | 6.1% | 12.4% | 21.2% | 17.2% | 27.3% | 29.6% | 38.7% | 41.4% |

| Florida C/TH | 4.3% | 9.9% | 19.2% | 15.5% | 23.5% | 25.4% | 64.7% | 67.9% |

| Hampton Roads | 18.6% | 21.0% | ||||||

| Northeast Florida | 33.3% | 36.7% | ||||||

| Toledo | 32.2% | 30.1% | ||||||

| Wichita | 25.7% | 28.1% | ||||||

| Des Moines | 16.0% | 16.6% | ||||||

| Peoria | 21.3% | 20.8% | ||||||

| Tucson | 26.0% | 33.4% | ||||||

| Omaha | 18.3% | 17.0% | ||||||

| Georgia*** | 26.8% | N/A | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

1 The NAR says that it sends the monthly survey to about 50,000 real estate practitioners. Response rates vary significantly, but typically the NAR gets a little over 3,000 usable responses a month. The August results were based on 3,360 usable responses.

DOT: Vehicle Miles Driven increased 1.5% year-over-year in July

by Calculated Risk on 9/22/2014 03:01:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 1.5% (4.0 billion vehicle miles) for July 2014 as compared with July 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 266.8 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.6% (10.1 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways ...

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 80 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 2.0% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In July 2014, gasoline averaged of $3.75 per gallon according to the EIA. That was up from July 2013 when prices averaged $3.67 per gallon.

In July 2014, gasoline averaged of $3.75 per gallon according to the EIA. That was up from July 2013 when prices averaged $3.67 per gallon. Of course gasoline prices are just part of the story. The lack of growth in miles driven over the last 6+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it does seem like miles driven is now increasing slowly.

A Few Comments on August Existing Home Sales

by Calculated Risk on 9/22/2014 11:55:00 AM

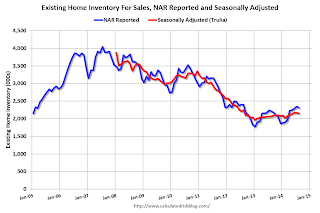

The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 4.5% year-over-year in August. It is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 9.7% from the bottom. On a seasonally adjusted basis, inventory was down 0.1% in August compared to July.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

And it appears investor buying is declining. From the NAR:

All-cash sales were 23 percent of transactions in August, dropping for the second consecutive month (29 percent in July) and representing the lowest overall share since December 2009 (22 percent). Individual investors, who account for many cash sales, purchased 12 percent of homes in August, down from 16 percent last month and 17 percent in August 2013. Sixty-four percent of investors paid cash in August.And another key point: The NAR reported total sales were down 5.3% from August 2013, but normal equity sales were probably up from July 2013, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – represented 8 percent of August sales, remaining in the single-digits for the second straight month and down from 12 percent a year ago. Six percent of August sales were foreclosures and 2 percent were short sales.Last year in August the NAR reported that 12% of sales were distressed sales.

A rough estimate: Sales in August 2013 were reported at 5.33 million SAAR with 12% distressed. That gives 640 thousand distressed (annual rate), and 4.69 million equity / non-distressed. In August 2014, sales were 5.05 million SAAR, with 8% distressed. That gives 404 thousand distressed - a decline of over 35% from August 2013 - and 4.65 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales flat or down slightly.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in August (red column) were below the level of sales in August 2013, and above sales for 2008 through 2012.

Overall this was a solid report.

Earlier:

• Existing Home Sales in August: 5.05 million SAAR, Inventory up 4.5% Year-over-year

Existing Home Sales in August: 5.05 million SAAR, Inventory up 4.5% Year-over-year

by Calculated Risk on 9/22/2014 10:00:00 AM

The NAR reports: Existing-Home Sales Slightly Lose Momentum in August as Investor Activity Declines

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 1.8 percent to a seasonally adjusted annual rate of 5.05 million in August from a slight downwardly-revised 5.14 million in July. Sales are at the second-highest pace of 2014, but remain 5.3 percent below the 5.33 million-unit level from last August, which was also the second-highest sales level of 2013. ...

Total housing inventory at the end of August declined 1.7 percent to 2.31 million existing homes available for sale, which represents a 5.5-month supply at the current sales pace. However, unsold inventory is 4.5 percent higher than a year ago, when there were 2.21 million existing homes available for sale.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (5.05 million SAAR) were 1.8% lower than last month, and were 5.3% below the August 2013 rate.

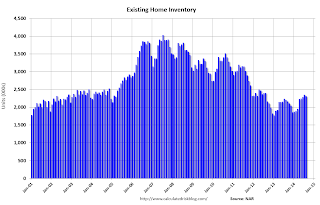

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.31 million in August from 2.35 million in July. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.31 million in August from 2.35 million in July. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 4.5% year-over-year in August compared to August 2013.

Inventory increased 4.5% year-over-year in August compared to August 2013. Months of supply was at 5.5 months in August.

This was below expectations of sales of 5.18 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Chicago Fed: "Index shows economic growth decelerated in August"

by Calculated Risk on 9/22/2014 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth decelerated in August

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.21 in August from +0.26 in July. Two of the four broad categories of indicators that make up the index decreased from July, and two of the four categories made negative contributions to the index in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.07 in August from +0.20 in July, marking its sixth consecutive reading above zero. August’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in August (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.