by Calculated Risk on 9/14/2014 09:05:00 PM

Sunday, September 14, 2014

Sunday Night Futures

This will be interesting to watch on Tuesday from the WSJ: Ties to Scotland Bring Debate to U.S.

With Scotland set to vote Thursday on whether to end a 307-year-old union with the U.K., Scottish-Americans and Scottish expatriates across the U.S. also are watching—and debating—a campaign that polls suggest is too close to call.Weekend:

...

A survey released late Saturday by ICM Research for the Telegraph newspaper put support for independence at 49% of those surveyed with 42% against. Two other surveys put support for the union at 47% in both, versus 43% or 41% and a survey by Panelbase for the Sunday Times also put the union camp slightly ahead.

• Schedule for Week of September 14th

• FOMC Preview: More Tapering

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 7 and DOW futures are down 50 (fair value).

Oil prices were down over the last week with WTI futures at $90.96 per barrel and Brent at $96.42 per barrel. A year ago, WTI was at $108, and Brent was at $113 - so prices are down 15%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.39 per gallon (down almost 15 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Preview: More Tapering

by Calculated Risk on 9/14/2014 08:15:00 AM

The FOMC will meet on Tuesday and Wednesday. The FOMC statement will be released Wednesday at 2:00 PM ET. Fed Chair Janet Yellen will hold a press conference at 2:30 PM.

What will know for this meeting:

• The FOMC will not raise rates. D'oh!

• The FOMC will reduce asset purchases (aka QE3) by $10 billion to $15 billion for the month of October. Note: the FOMC is expected to end QE3 at the October 29th meeting, so the October purchases are likely the final $15 billion for QE3.

• During the press conference, Dr. Yellen will break into a happy dance when asked about her comment in June that inflation data was "noisy". In June she said:

"I think recent readings on CPI index have been a bit on the high side but I think the data we're seeing is noisy. Broadly speaking inflation is evolving in line with the committee's expectations."OK, no dance, but Yellen was correct.

What we don't know for this meeting:

• What changes the FOMC will make to the statement. Here is the July statement. It is possible the sentence about not raising rates for a "considerable time" after the end of QE3 will be modified or removed. Here is the sentence:

"The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored."Obviously this sentence will have to be changed soon, since the asset purchase program is expected to end next month.

• Will the FOMC or Dr. Yellen indicate the first rate hike might happen before mid-year 2015? In March, Yellen said:

"[T]he language that we used in the statement is considerable period. So I, you know, this is the kind of term it’s hard to define. But, you know, probably means something on the order of around six months, that type of thing.”My guess is Yellen will clearly state the first rate hike will not happen for some time, and that the rate hike will be data dependent.

It will also be interesting to see the changes to the FOMC projections. For review, here are the previous projections. GDP bounced back sharply in Q2, and is looking solid in Q3, but Q1 was very weak. It is possible GDP projections for 2014 will be increased slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 |

| Mar 2014 Meeting Projections | 2.8 to 3.0 | 3.0 to 3.2 | 2.5 to 3.0 |

The unemployment rate was at 6.1% in August, so the unemployment rate projection for Q4 2014 will probably be lowered slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 |

| Mar 2014 Meeting Projections | 6.1 to 6.3 | 5.6 to 5.9 | 5.2 to 5.6 |

As of July, PCE inflation was up 1.6% from July 2013, and core inflation was up 1.5%. Both PCE and core PCE inflation projections will probably be unchanged and will still be below the FOMC's 2% target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 |

| Mar 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 |

| Mar 2014 Meeting Projections | 1.4 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

Saturday, September 13, 2014

Schedule for Week of September 14th

by Calculated Risk on 9/13/2014 01:01:00 PM

The key economic report this week is August housing starts on Thursday.

For manufacturing, the August Industrial Production and Capacity Utilization report, and the September NY Fed (Empire State) and Philly Fed manufacturing surveys, will be released this week.

For prices, PPI will be released Tuesday, and CPI on Wednesday.

The FOMC meets on Tuesday and Wednesday, and the FOMC is expected to taper QE3 asset purchases another $10 billion per month at this meeting.

Also the BLS will release the 2014 preliminary employment Benchmark Revision, and the Fed will release the Q2 Flow of Funds report on Thursday.

8:30 AM: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 16.0, up from 14.7 in August (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for August. The consensus is for no change in CPI in August and for core CPI to increase 0.2%.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to reduce monthly QE3 asset purchases from $25 billion per month to $15 billion per month at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 305 thousand from 315 thousand.

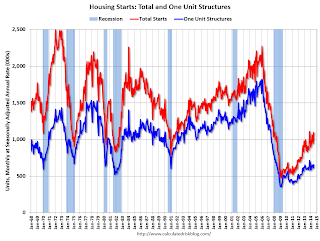

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts were at 1.093 million (SAAR) in July. Single family starts were at 656 thousand SAAR in July.

The consensus is for total housing starts to decrease to 1.040 million (SAAR) in August.

8:45 AM: Speech by Fed Chair Janet Yellen, The Importance of Asset Building for Low and Middle Income Households, At the Corporation for Enterprise Development's 2014 Assets Learning Conference, Washington, D.C. (via prerecorded video)

10:00 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 22.0, down from 28.0 last month (above zero indicates expansion).

10:00 AM: 2014 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS:

"Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The final benchmark revision will be issued with the publication of the January 2015 Employment Situation news release in February."12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2014

Unofficial Problem Bank list declines to 435 Institutions

by Calculated Risk on 9/13/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 12, 2014.

Changes and comments from surferdude808:

Two mergers lowered the Unofficial Problem Bank List to 435 institutions with assets of $137.5 billion. A year ago, the list held 700 institutions with assets of $246 billion. Finding their way off the list by finding a merger partner were United Central Bank, Garland, TX ($1.3 billion) and Idaho Banking Company, Boise, ID ($96 million). Idaho Banking company had also been operating under a Prompt Corrective Action order since February 2011. Next Friday we expect for the OCC to provide an update on its enforcement action activities.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 435.

Friday, September 12, 2014

Housing: "Price cuts are back"

by Calculated Risk on 9/12/2014 06:56:00 PM

From Tim Logan and Andrew Khouri at the LA Times: Housing price cuts point to a shift in Southland market

The latest sign that buyers are gaining leverage in Southern California's housing market: Price cuts are back.Inventory has increased significantly in a number of markets, after bottoming in 2013. And more inventory means slower price increases (maybe even price declines in some markets). Yet many sellers have listed their homes assuming the double digit price increases would continue. The result: no buyers and price cuts.

The number of homes with reduced asking prices has risen sharply in recent months ... In Orange County, the region's priciest market, about one-third of sellers have been forced to cut prices, according to data from real estate firm Redfin. ...

These trends have been building all year. But home sellers -- often the last to see market shifts -- are finally getting the message, said Paul Reid, a Redfin agent in Temecula.

"A lot of what we've seen over the last six or eight weeks is people lowering their prices to get buyers in the door," Reid said.

A few Analysts comments on FOMC meeting next week

by Calculated Risk on 9/12/2014 01:18:00 PM

Here are some analyst comments on the upcoming FOMC meeting. From Nomura:

We expect the September FOMC meeting to give us additional insight into the future path of monetary policy. We will receive another round of FOMC forecasts for the first time since June, which will incorporate significant new data. Forecasts should also be extended to 2017, thus giving us a better sense of how the participants judge the current balance between actual and potential output.From Merrill Lynch:

We expect the FOMC to make changes to its forward guidance. At a minimum, we expect the FOMC to add language that stresses the “data dependence” of future interest rate decisions. We expect the FOMC to continue to state that the adjustment of interest rates, when it comes, will be “balanced” and that it expects interest rates to converge to normal levels more slowly than employment and inflation. But in light of sustained improvement in labor market performance, and the inherent complexities in assessing their state, we expect that the FOMC to drop its assessment that “lift-off” is still a “considerable time” away

[P]inpointing the exact timing of the first rate hike is more of a guess than a forecast. Nonetheless, the case for an earlier move has grown over the last several months. ... The more immediate question is: when will the Fed change its rhetoric enough to scare the markets? In particular, could the FOMC do something big in its announcement on Wednesday? It is hard to predict the specific changes, but the risk of a hawkish signal is high:And from Goldman Sachs:

• Given the soft August jobs report, we expect them to continue to see a “significant underutilization of labor resources.” That language change probably requires a couple of better jobs reports.

• It is a close call, but we expect them to modify their promise to keep the funds rate near zero for “considerable time.” However, they will try to change the statement in a market neutral fashion, dropping the reference to “considerable time” and substituting “considerable reduction in slack and notable progress toward the inflation goal.”

• We expect small changes in the FOMC forecasts. In particular, we see some risk of another uptick in the “dot plot.” At this meeting, they introduce forecasts for 2017, and we expect median “dots” of 3.25 to 3.50%.

• Finally, we think Yellen and her allies will try to avoid shocking the markets. In the past, when the FOMC has reworked its forward guidance, they have often softened the blow by explicitly noting that their view on the likely timing of the exit has not changed or by downplaying the change in the press conference.

With respect to the appropriate timing of the first hike of the funds rate, recent comments point to a greater clustering of FOMC participants' views around mid-2015. In particular, one or two FOMC participants (namely, Presidents Lockhart and Rosengren) have likely pulled forward their views on the most appropriate date for liftoff; there is nothing to indicate that those previously expecting a mid-2015 hike have moved; and the more hawkish participants have also likely stayed in place.CR note: I'll post some thoughts on the upcoming meeting this weekend.

Preliminary September Consumer Sentiment increases to 84.6

by Calculated Risk on 9/12/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for September was at 84.6, up from 82.5 in August.

This was above the consensus forecast of 83.1. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Retail Sales increased 0.6% in August

by Calculated Risk on 9/12/2014 08:41:00 AM

On a monthly basis, retail sales increased 0.6% from July to August (seasonally adjusted), and sales were up 5.0% from August 2013. Sales in July were revised up to a 0.3% increase from unchanged. Sales in June were also revised up.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $444.4 billion, an increase of 0.6 percent from the previous month, and 5.0 percent (±0.9%) above August 2013. ... The June to July 2014 percent change was revised from virtually unchanged to 0.3 percent.

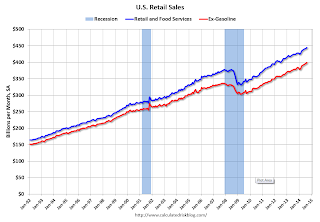

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.3%.

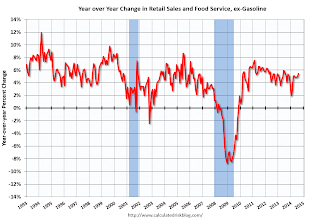

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.5% on a YoY basis (5.0% for all retail sales).

Retail sales ex-gasoline increased by 5.5% on a YoY basis (5.0% for all retail sales).The increase in August was above consensus expectations of a 0.4% increase.

Including the upward revisions to June and July, this was a strong report.

Thursday, September 11, 2014

Friday: Retail Sales

by Calculated Risk on 9/11/2014 07:43:00 PM

First, from Merrill Lynch:

We have revised up our forecast for 3Q GDP growth to 3.5% from 3.0% and 2Q tracking has moved up to 4.8%, from 4.0%.Some of this is a bounce back from the -2.1% decline in Q1 GDP (on a seasonally adjusted annual rate basis, SAAR).

Friday:

• At 8:30 AM ET, Retail sales for August will be released. The consensus is for retail sales to increase 0.4% in August, and to increase 0.3% ex-autos.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 83.1, up from 82.5 in August.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.5% increase in inventories.

DataQuick: Home Sales slow in SoCal and Bay Area

by Calculated Risk on 9/11/2014 04:32:00 PM

From DataQuick: Southland Home Sales Sputter; Median Sale Price Hits 80-Month High

A total of 18,796 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 7.7 percent from 20,369 sales in July, and down 18.5 percent from 23,057 sales in August 2013, according to CoreLogic DataQuick data. ...From DataQuick: Bay Area Home Sales Slow in August; Prices Increases Ease Back

...

Foreclosure resales – homes foreclosed on in the prior 12 months – represented 5.0 percent of the Southland resale market last month. That was down from 5.2 percent the prior month and down from 7.0 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 5.9 percent of Southland resales last month. That was up slightly from 5.8 percent the prior month and down from 11.5 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.5 percent of the Southland homes sold last month. That tied the July level as the lowest absentee share since December 2010, when 23.4 percent of homes sold to absentee buyers. Last month’s figure was down from 26.7 percent a year earlier. The peak was 32.4 percent in January 2013, while the monthly average since 2000, when the CoreLogic DataQuick absentee data begin, is about 19 percent.

emphasis added

A total of 7,578 new and resale houses and condos sold in the nine-county Bay Area last month. That was down 10.6 percent from 8,474 in July and down 12.0 percent from 8,616 in August last year, according to CoreLogic DataQuick data. ...A few key year-over-year trends: 1) declining distressed sales (about half as many this year as in August 2013), 2) generally declining investor buying, and 3) declining total sales. For August, it looks like non-distressed sales were also down significantly.

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.9 percent of resales, up from 2.7 percent the month before, and down from 4.3 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent, CoreLogic DataQuick reported.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 3.8 percent of Bay Area resales last month. That was down from an estimated 4.0 percent in July and down from 7.6 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 18.4 percent of all Bay Area homes. That was down from a revised 18.9 percent the prior month, and down from 20.3 percent a year earlier.

emphasis added