by Calculated Risk on 9/04/2014 10:00:00 AM

Thursday, September 04, 2014

ISM Non-Manufacturing Index increased to 59.6% in August

The August ISM Non-manufacturing index was at 59.6%, up from 58.7% in July. The employment index increased in August to 57.1%, up from 56.0% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 55th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59.6 percent in August, 0.9 percentage point higher than the July reading of 58.7 percent. This represents continued growth in the Non-Manufacturing sector. The August reading of 59.6 percent is the highest for the composite index since its inception in January 2008. The Non-Manufacturing Business Activity Index increased to 65 percent, which is 2.6 percentage points higher than the July reading of 62.4 percent, reflecting growth for the 61st consecutive month at a faster rate. This is the highest reading for the index since December of 2004 when the index also registered 65 percent. The New Orders Index registered 63.8 percent, 1.1 percentage points lower than the reading of 64.9 percent registered in July. The Employment Index increased 1.1 percentage points to 57.1 percent from the July reading of 56 percent and indicates growth for the sixth consecutive month. The Prices Index decreased 3.2 percentage points from the July reading of 60.9 percent to 57.7 percent, indicating prices increased at a slower rate in August when compared to July. According to the NMI®, 15 non-manufacturing industries reported growth in August. Respondents' comments vary by business and industry. The majority of the comments reflect continued optimism in regards to business conditions. Some respondents indicate that there may be some tapering off in the recent strong rate of growth in the non-manufacturing sector."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was solidly above the consensus forecast of 57.1% and suggests faster expansion in August than in July.

The NMI was at the highest level since its inception. New orders was strong - and employment was up solidly.

Weekly Initial Unemployment Claims increase to 302,000

by Calculated Risk on 9/04/2014 08:33:00 AM

The DOL reports:

In the week ending August 30, the advance figure for seasonally adjusted initial claims was 302,000, an increase of 4,000 from the previous week's unrevised level of 298,000. The 4-week moving average was 302,750, an increase of 3,000 from the previous week's unrevised average of 299,750.The previous week was unrevised at 298,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 302,750.

This was close to the consensus forecast of 305,000.

ADP: Private Employment increased 204,000 in August

by Calculated Risk on 9/04/2014 08:15:00 AM

Private sector employment increased by 204,000 jobs from July to August according to the August ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 213,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "Steady as she goes in the job market. Businesses continue to hire at a solid pace. Job gains are broad based across industries and company sizes. At the current pace of job growth the economy will return to full employment by the end of 2016.”

The BLS report for August will be released on Friday.

Wednesday, September 03, 2014

Thursday: ECB's Draghi, ADP Employment, Unemployment Claims, Trade Deficit, ISM Non-Manufacturing

by Calculated Risk on 9/03/2014 08:31:00 PM

From the WSJ: Small Firms Poised to Spend More on Plants, Equipment

Among 798 small private firms with less than $20 million in revenue, for instance, 51% said in August that they planned to increase their capital outlays in the next 12 months.This survey has only been conducted for a couple of years, but this is a positive sign. On credit, the Federal Reserve's July Senior Loan Officer survey indicated some pickup in small firm demand for loans, and slightly easier lending standards.

That is ... up from 42% a year ago, according to the survey by The Wall Street Journal and Vistage International, a San Diego executive-advisory group.

August marked the first month since June 2012, when the monthly survey began, that owners of small firms who planned to spend more on fixed investments outnumbered those who planned to hold steady or cut back.

Thursday:

• At 7:45 AM ET, Press conference following the Governing Council meeting of the ECB in Frankfurt with Mario Draghi. Here is the ECB website and press conference page.

• At 8:15 AM, the ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 213,000 payroll jobs added in August, down from 218,000 in July.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 298 thousand.

• Also at 8:30 AM, the Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be at $42.7 billion in July from $41.5 billion in June.

• At 10:00 AM, the ISM non-Manufacturing Index for August. The consensus is for a reading of 57.1, down from 58.7 in July. Note: Above 50 indicates expansion.

Lawler on Toll Brothers: Net Home Orders Down, Price Gains Slow; Some “Lessening” in Pricing Power

by Calculated Risk on 9/03/2014 06:01:00 PM

From housing economist Tom Lawler: Toll Brothers: Net Home Orders Down, Price Gains on Orders Slows; Some “Lessening” in Pricing Power but No “Need” to Increase Incentives Much -- Yet

Toll Brothers, the self-described “nation’s leading builder of luxury homes,” reported that net home orders in the quarter ended July 31, 2014 totaled 1,324, down 5.8% from the comparable quarter of 2013. Net orders per community last quarter were down 15.9% from the comparable quarter of 2013. The company average net order price last quarter was $717,000, up 1.4% from a year ago. Toll’s sales cancellation rate, expressed as a % of gross orders, was 6.6% last quarter, up from 4.6% in the comparable quarter of 2013. Home deliveries last quarter totaled 1,364, up 36.8% from the comparable quarter of 2013, at an average sales price of $732,000, up 12.4% from a year ago. The company’s order backlog at the end of July was 4,204, up 5.1% from last July, at an average order price of $737,300, up 4.1% from a year ago. The company controlled 49,037 home sites at the end of July, up 3.9% from last July and up 25.1% from two years ago.

For its “traditional” home building business (i.e., ex city living), net home orders totaled 1,281 last quarter, down 5.0% from the comparable quarter of 2014, at an average net order price of $700,500, up 3.4% from a year ago.

Here are a few excerpts from the company’s press release.

Douglas C. Yearley, Toll Brothers' chief executive officer:

"Although we have seen some lessening of pricing power in the past year, we have not felt the need to incentivize to spur home sales. Because we generally do not build 'spec' homes, we are not under pressure to move standing inventory. We are driven by bottom-line growth and are pleased with our continued margin expansion through what we still believe is a recovering, albeit bumpy, housing cycle. We have been particularly pleased with our performance in a number of the markets we have targeted for growth, especially Coastal California, Texas, and the urban New York City area.Robert I. Toll, executive chairman

"With pent-up demand still yet to be unleashed, we are growing community count in attractive locations.”

"The national housing data has been somewhat volatile in recent months. Without real urgency pushing buyers to make a decision, general industry demand continues to be impacted by uncertainty about the economy and world events, improving but fragile consumer confidence and reduced affordability due to rising prices and limited personal income growth. One data point we do have confidence in is the low level of production compared to historic norms. Population grew during the recession and has continued to increase since then. Based on trends over more than forty years, the industry should be building 50% more homes this year than its current pace to meet the increased population demographics.”As with many other builders, last year Toll raised prices aggressively based on stronger-than-expected demand as well as longer-than-expected development timelines that limited supply. Toll and many other builders are now increasing active communities at a double-digit pace, but are having trouble generating double-digit sales growth because prices were increased at too rapid a pace last year.

Toll’s net orders were significantly below consensus.

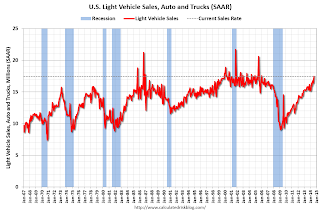

U.S. Light Vehicle Sales increase to 17.45 million annual rate in August, Highest since Jan 2006

by Calculated Risk on 9/03/2014 02:51:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 17.45 million SAAR in August. That is up 10% from August 2013, and up 6.4% from the 16.4 million annual sales rate last month.

This was well above the consensus forecast of 16.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for August (red, light vehicle sales of 17.45 million SAAR from WardsAuto).

From WardsAuto:

August's 17.45 million-unit seasonally adjusted annual rate of sales is the industry's highest monthly SAAR since January 2006.

The 103-month high was set as rising automaker incentives intersected with a strengthening economy and growing consumer confidence to boost deliveries well past 1.5 million units, for an industry wide 9.3% rise in daily sales.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

This is the highest sales rate since January 2006.

Fed's Beige Book: Economic Activity Expanded, No "distinct shift in the overall pace of growth"

by Calculated Risk on 9/03/2014 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Philadelphia and based on information collected on or before August 22, 2014."

Reports from the twelve Federal Reserve Districts indicated that economic activity has expanded since the previous Beige Book report; however, none of the Districts pointed to a distinct shift in the overall pace of growth. The New York, Cleveland, Chicago, Minneapolis, Dallas, and San Francisco Districts characterized their growth rates as moderate; Philadelphia, Atlanta, St. Louis, and Kansas City reported modest growth. Boston reported that business activity appeared to be improving, and Richmond reported further strengthening. Philadelphia, Atlanta, Chicago, Kansas City, and Dallas explicitly reported that contacts in their Districts generally remained optimistic about future growth; most of the other Districts cited various examples of ongoing optimism from specific sectors.And on real estate:

Barely half of the Districts reported stable or growing residential real estate activity related to the construction of new homes and sales of existing houses. New construction and existing home sales generally grew modestly; market conditions tended to vary by metropolitan area and by neighborhood within metropolitan areas. Boston, New York, and Dallas reported high levels of ongoing multifamily construction projects; Chicago reported a moderate pace of growth, and San Francisco noted a pickup in activity.Very cautious comments on residential real estate, although nonresidential is seeing some growth.

A little over half of the Districts reported some degree of growth in nonresidential real estate activity, with increased construction, leasing, or both tied to steady or falling vacancy rates and to rent increases. None of the Districts reported a decline in overall activity, although New York and St. Louis described activity as mixed. In addition to traditional office space, certain Districts reported increased demand for specific projects: Boston noted demand for construction in the hospitality sector, Philadelphia cited industrial and warehouse projects, Richmond noted distribution centers, and St. Louis reported new retail and mixed-use projects as well as new industrial facility construction.

emphasis added

Early: August Vehicle Sales may be over 17 Million SAAR, Highest Sales Rate since July 2006

by Calculated Risk on 9/03/2014 11:50:00 AM

From John Sousanis at WardsAuto Counting Cars: Summer Sales Heat Up

SUMMARY: With a few exceptions, automakers are reporting higher than expected August sales, pointing to the possibility that the forecasted July 17-million SAAR, which failed to materialize, just may have been a month late coming.WardsAuto is currently projecting sales in August at 17.06 million seasonally adjusted annual rate (SAAR). This would be the highest sales rate since July 2006.

A few excerpts:

Toyota beat WardsAuto expections by nearly 9%, delivering 246,100 LVs in August. The automaker's daily sales rose 10.2% from same-month year-ago ...

[Ford] daily deliveries up just 3.9% over same-month year-ago, on total LV sales of 217,040.

...

General Motors poored a little cold water on August sales reports, recording a 2.4% DSR gain on year-ago, with LV deliveries of 272,243 units - 3% below WardsAuto's expectations for the company ...

Nissan is reporting August sales of almost 135,000 LVs, a 15.7% rise in DSR compared with same-month 2013. Volkswagen brand daily sales fell 9.6%, but the result was better than expected, with VW moving 35,181 units during the month.

Fiat-Chrysler reports over 197,000 LV deliveries in August, a massive 24.2% leap over year-ago sales

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 9/03/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 29, 2014. ...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.25 percent, the lowest level since June 2013, from 4.28 percent, with points decreasing to 0.24 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Tuesday, September 02, 2014

Wednesday: Auto Sales, Fed's Beige Book

by Calculated Risk on 9/02/2014 05:30:00 PM

Wednesday:

• All day, Light vehicle sales for August. The consensus is for light vehicle sales to increase to 16.5 million SAAR in August from 16.4 million in July (Seasonally Adjusted Annual Rate).

• 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is for a 10.5% increase in July orders.

• At 2:00 PM, Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their District

Oil prices were down sharply today with Brent October futures down to $100.58 per barrel according to Bloomberg. A year ago Brent was at $115 per barrel - so this is a significant year-over-year decline.

The recent decline in prices could give a little boost to consumer spending on other items. This decline will also hold down the annual cost-of-living-adjustment (COLA) for this year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.43 per gallon (down about a 15 cents per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |