by Calculated Risk on 8/15/2014 08:30:00 AM

Friday, August 15, 2014

NY Fed: Empire State Manufacturing Survey indicates "business conditions continued to improve" in August

From the NY Fed: Empire State Manufacturing Survey

The August 2014 Empire State Manufacturing Survey indicates that business conditions continued to improve for New York manufacturers, but the improvement was less wide-spread than in the previous month. The headline general business conditions index retreated eleven points to 14.7, after reaching a four-year high in July. The new orders index slipped almost five points to 14.1, while the shipments index edged up a point to 24.6—a multiyear high. ...This is the first of the regional surveys for August. The general business conditions index was below the consensus forecast of a reading of 20.0, but still indicates solid expansion (above zero suggests expansion). However this is slower expansion in August than in July (the index was at a four-year high in July).

Labor market conditions were mixed but continued to improve overall. The index for number of employees slipped three points to 13.6, suggesting a slight pullback in the pace of hiring. However, the average workweek index rose six points to 8.0, signaling a slight increase in hours worked.

Despite the pullback in most of the survey’s indexes for current conditions, optimism about the near-term outlook grew increasingly widespread. The index for future general business conditions climbed eighteen points to 46.8—its highest level in two-and-a-half years.

emphasis added

Thursday, August 14, 2014

Friday: Industrial Production, NY Fed Mfg Survey, PPI, Consumer Sentiment

by Calculated Risk on 8/14/2014 08:15:00 PM

First from the WSJ: New Rules Near on Credit-Ratings Firms

The rules, expected to be somewhat tougher than those proposed more than three years ago, will take additional steps to ensure that the firms' interest in winning business doesn't affect ratings analysis, said the people familiar with the process.The downgrades might have triggered the crisis, but the key problem wasn't the downgrade - it was that the bonds were rated too high when first rated. I'll review why this happened (ratings too high) again soon.

Credit raters have been lambasted by critics and lawmakers over their actions in the run-up to the 2008 financial crisis. A 2011 U.S. congressional report cited widespread and sudden downgrades of mortgage-related bonds as being perhaps "more than any other single event ... the immediate trigger for the financial crisis." The bonds had previously been given top-notch ratings by the firms.

Friday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 20.0, down from 25.6 in July (above zero is expansion).

• Also at 8:30 AM, the Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 82.3, up from 81.8 in July.

Repeat: U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 8/14/2014 04:30:00 PM

Repeat: Here are graphs of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

There are many interesting points - the Depression baby bust (that started before the Depression), the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more.

What jumps out at me are the improvements in health care ... and also that the largest cohorts will all soon be under 40.

Notes: For animation, population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

Reader Druce put together the graphic below of the U.S population distribution, by age, from 1900 through 2060 using a slider. In 1900, the graph was fairly steep, but with improving health care, the graph has flattened out over the last 100 years.

DataQuick on California Bay Area: July Home Sales down 9% Year-over-year, Distressed Sales and Investor Buying declines

by Calculated Risk on 8/14/2014 01:34:00 PM

From DataQuick: Sluggish Bay Area Home Sales in July; Prices Up – at a Slower Pace

A total of 8,474 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 7.1 percent from 7,915 in June and down 9.3 percent from 9,339 in July last year, according to Irvine-based CoreLogic DataQuick, a real estate information service.A few key year-over-year trends: 1) declining distressed sales, 2) generally declining investor buying, 3) flat or declining total sales, but 4) flat or some increase in non-distressed sales.

Bay Area sales usually decline around 5 percent from June to July. Sales for the month of July have varied from 6,666 in 1995 to 14,258 in 2004. The average since 1988, when CoreLogic DataQuick statistics begin, is 9,333. ...

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.7 percent of resales, down from a revised 2.9 percent from the month before, and down from 4.6 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 4.2 percent of Bay Area resales last month. That was down from an estimated 4.4 percent in June and down from 8.5 percent a year earlier.

Last month absentee buyers – mostly investors – accounted for 18.8 percent of all Bay Area home sales, which was the lowest absentee share of purchases since that figure was 18.5 percent in September 2010.

emphasis added

Though total sales were down 9.3% year-over-year, the percent of non-distressed sales was down about 2%.

NY Fed: Household Debt decreased Slightly in Q2 2014, Delinquency Rates Lowest Since Q3 2007

by Calculated Risk on 8/14/2014 11:00:00 AM

Here is the Q2 report: Household Debt and Credit Report. From the NY Fed:

Aggregate consumer debt was roughly flat in the 2nd quarter of 2014, showing a minor decrease of $18 billion. As of June 30, 2014, total consumer indebtedness was $11.63 trillion, down by 0.2% from its level in the first quarter of 2014. Overall consumer debt still remains 8.2% below its 2008Q3 peak of $12.68 trillion.

Mortgages, the largest component of household debt, decreased by 0.8%. Mortgage balances shown on consumer credit reports stand at $8.10 trillion, down by $69 billion from their level in the first quarter. Balances on home equity lines of credit (HELOC) also dropped by $5 billion (1.0%) in the second quarter and now stand at $521 billion. Non-housing debt balances increased by 1.9 %, boosted by gains in all categories. Auto loan balances increased by $30 billion; student loan balances increased by $7 billion; credit card balances increased by $10 billion; and other non-housing balances increased by $9 billion.

Delinquency rates improved across the board in 2014Q2. As of June 30, 6.2% of outstanding debt was in some stage of delinquency, compared with 6.6% in 2014Q1. About $724 billion of debt is delinquent, with $521 billion seriously delinquent (at least 90 days late or “severely derogatory”).

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt was flat in Q2.

Even though debt was down slightly in Q2, the recent increase in debt suggests households (in the aggregate) may be near the end of deleveraging.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate declined to 6.2% in Q2, from 6.6% in Q1. This is the lowest rate since Q3 2007.

The Severely Derogatory (red) rate has fallen to 2.28%, the lowest since Q1 2008.

The 120+ days late (orange) rate has declined to 1.90%, the lowest since Q3 2008.

Short term delinquencies are back to normal levels (lowest since series started in 2001).

Here is the press release from the NY Fed: New York Fed Report Shows Rises in Auto Loan Originations and Balances

There are a number of credit graphs at the NY Fed site.

Weekly Initial Unemployment Claims increase to 311,000

by Calculated Risk on 8/14/2014 08:38:00 AM

The DOL reports:

In the week ending August 9, the advance figure for seasonally adjusted initial claims was 311,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 289,000 to 290,000. The 4-week moving average was 295,750, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 250 from 293,500 to 293,750.The previous week was revised up to 290,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 295,750.

This was higher than the consensus forecast of 295,000.

Wednesday, August 13, 2014

Thursday: Unemployment Claims, NY Fed Q2 Household Debt and Credit Report

by Calculated Risk on 8/13/2014 07:26:00 PM

Thursday:

• At 8:30 AM ET, initial weekly unemployment claims report will be released. The consensus is for claims to increase to 295 thousand from 289 thousand.

• At 11:00 AM, the Q2 2014 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

On mortgage rates: I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates decreased slightly today to 4.17% from 4.18% yesterday.

One year ago, rates were at 4.41% and rising. So rates are down year-over-year, but up from late 2012 and early 2013. Daily rates peaked last year at 4.85% in early September.

DataQuick on SoCal: July Home Sales down 12% Year-over-year, Distressed Sales and Investor Buying Declines Further

by Calculated Risk on 8/13/2014 01:33:00 PM

From DataQuick: Southland Home Sales Fall Yr/Yr Again; Prices Rise at Slower Pace

Southern California home sales fell to a three-year low for the month of July as supply continued to fall short of demand, some buyers struggled with higher prices, and investor activity fell. Cash deals declined to the lowest level in more than four years ...Both distressed sales and investor buying is declining - and this has been dragging down overall sales. Even though total sales are down 12.4% year-over-year, the percent of non-distressed sales was only down about 2% year-over-year.

A total of 20,369 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 1.4 percent from 20,654 sales in June, and down 12.4 percent from 23,253 sales in July 2013, according to Irvine-based CoreLogic DataQuick. ...

On average, sales have declined 6.3 percent between June and July since 1988, when CoreLogic DataQuick statistics begin. Southland sales have fallen on a year-over-year basis for 10 consecutive months. Sales during the month of July have ranged from a low of 16,225 in July 1995 to a high of 38,996 in July 2003. Last month’s sales were 19.4 percent below the July average of 25,269 sales.

...

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.2 percent of the Southland resale market last month. That was down from a revised 5.3 percent the prior month and down from 7.7 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 5.9 percent of Southland resales last month. That was down from a revised 6.0 percent the prior month and down from 12.7 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.6 percent of the Southland homes sold last month. That was the lowest share since December 2010, when 23.4 percent of homes sold to absentee buyers. Last month’s 23.6 percent absentee share was down from a revised 23.9 percent in June and down from 27.4 percent a year earlier. ...

emphasis added

The NAR is scheduled to release existing home sales for July on Thursday, August 21st.

Flashback to August 2011 and 2013 (And a hint for 2015)

by Calculated Risk on 8/13/2014 11:44:00 AM

Here are two posts from August in 2011 and 2013.

First, from August 14, 2011: Event Driven Declines in Consumer Sentiment.

Consumer sentiment had plunged to the lowest level in 30 years. This (and other data) led many analysts to predict the US was headed into a recession. As an example, from the WSJ in September 2011: Recession Is a ‘Done Deal,’ Per ECRI

“We are going into a recession,” ECRI director Lakshman Achuthan told CNBC this morning. “Last week we announced to our clients we are slipping into a recession. This is the first time I’m saying it publicly.”I disagreed. In the above post I argued that the plunge in sentiment was due to the threat by Congress not to pay the bills (event driven), and that sentiment would bounce quickly. I wrote:

My feeling is the debt ceiling decline - assuming the decline was due to the insanity in D.C. - is most similar to the 1987 stock market crash (that scared everyone, but had little impact on the economy) and to Hurricane Katrina (although Katrina led to higher oil prices and a direct impact on consumption in several gulf states).Second, from August 12, 2013: Comment: The Key Downside Economic Risk

If I'm correct, then sentiment should bounce back fairly quickly - but only to an already low level. And the impact on consumption should be minimal.

At the beginning of every year I post Ten Economic Questions for the year. Since 2013 (like 2011) was an off-year for elections, I expected Congress to act up again and ranked fiscal policy as the #1 downside risk in 2013. I wrote in August 2013:

Unfortunately we live in the real world, and politics trump reality. ...I was correct about the Debt Ceiling (this is a fake issue and should be eliminated), but I was too optimistic about the government shutdown. And I was correct fiscal policy is not a big downside risk this year, but this does remind us about 2015!

Still - even in the insane world of politics - the debt ceiling is a fake issue (the House will cave again - they have no choice). And hopefully we will not see a government shutdown, but I expect the negotiations will go down to the wire. My guess is we will see another "continuing resolution", but you never know with politics.

The good news is these showdowns mostly happen in odd years with the hope that the voters will forget the congressional shenanigans by the next election. So IF we can get through the fall, fiscal policy will probably not be a big downside risk in 2014. Unfortunately that is a big "if".

While most of the media is focused on the 2014 election "horse race", I'm concerned about the downside risks in 2015 from more "shenanigans". Unfortunately voters have short memories.

Retail Sales unchanged in July

by Calculated Risk on 8/13/2014 08:40:00 AM

On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 3.7% from July 2013. Sales in June were unrevised at a 0.2%. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.8 billion, virtually unchanged from the previous month, and 3.7 percent above July 2013. ... The May to June 2014 percent change was unrevised from +0.2 percent.

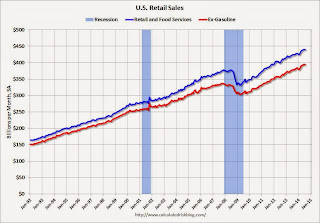

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.4% on a YoY basis (3.7% for all retail sales).

Retail sales ex-gasoline increased by 4.4% on a YoY basis (3.7% for all retail sales).The increase in July was below consensus expectations of a 0.2% increase.