by Calculated Risk on 8/04/2014 02:00:00 PM

Monday, August 04, 2014

Fed Survey: Banks eased lending standards, "broad-based pickup in loan demand"

From the Federal Reserve: The July 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July survey results showed a continued easing of lending standards and terms for many types of loan categories amid a broad-based pickup in loan demand. Domestic banks generally continued to ease their lending standards and various terms for commercial and industrial (C&I) loans. In contrast, foreign banks reported little change in standards and in most of the surveyed terms for C&I loans on net. Domestic respondents, meanwhile, also reported having eased standards on most types of commercial real estate (CRE) loans on balance. Although many banks reported having eased standards for prime residential real estate (RRE) loans, respondents generally indicated little change in standards and terms for other types of loans to households. However, a few large banks had eased standards, increased credit limits, and reduced the minimum required credit score for credit card loans. Banks also reported having experienced stronger demand over the past three months, on net, for many more loan categories than on the April survey.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a solid pickup in demand for all categories of CRE.

Banks are seeing a solid pickup in demand for all categories of CRE.This suggests (along with the Architecture Billing Index) that we will see an increase in commercial real estate development.

Goldman Sachs' Hui on House Price Seasonal Adjustments

by Calculated Risk on 8/04/2014 01:03:00 PM

A few excerpts from some analysis by Goldman's Hui Shan: "Are investors getting too pessimistic about US housing"

This month’s housing data showed weakness in both price and activity measures. On the price side, market consensus expected 0.3% month-over-month growth in the S&P Case-Shiller 20-City Composite. The actual print was -0.3%, the first decline since January 2012 when house prices bottomed. ...CR Note: This is similar to the argument I made last week A few comments on the Seasonal Pattern for House Prices. The seasonal adjustment should normalize over the next few years.

In our previous research, we showed that seasonal adjustments have become a tricky business for housing owing to heightened distressed sales over the past few years (see “Enough about the weather: Let’s talk seasonal adjustments”, Mortgage Analyst, February 28, 2014). In the US housing market, more people buy and sell homes in the summer than in the winter because of the school calendar. A thinner market in the winter implies that sellers typically accept lower prices to close transactions. As a result, seasonal factors would nudge prices up in the winter and down in the summer to arrive at the seasonally adjusted series. Normally, such adjustments are within the range of plus/minus one percentage point.

The recent housing downturn is the most severe in US history since the Great Depression, featuring a wave of distressed sales. According to the National Association of Realtors, at the worst of the crisis, nearly half of home sales were distressed. Because distressed sales take place throughout the year while non-distressed sales are more concentrated in the summer, distressed sales account for a larger share of total sales in the winter than in the summer. Also, because distressed properties tend to transact at a significant discount relative to non-distressed properties, they drag down observed transaction prices and the effect is more pronounced in the winter (when the distressed share is high) than in the summer (when the distressed share is low). This amplifies the normal seasonal pattern. In recent years, seasonal adjustments have expanded from the normal “plus/minus one percentage point” to “plus/minus three percentage points”.

As the housing market recovers and the share of distressed sales drops, the true underlying seasonal pattern is normalizing. However, seasonal factors are usually derived using data from the past 5-7 years. In other words, we are using the amplified seasonal factors to adjust more muted seasonal patterns, meaning pushing up house prices too much in the winter and also pushing down house prices too much in the summer. This is consistent with what we have seen over the past year: the S&P Case-Shiller house price index beat consensus expectations at the beginning of the year and it was surprisingly weak for the May reading. This seasonal adjustment problem is likely to persist in coming months, causing the next few months’ house price prints to appear softer than they really are.

emphasis added

Black Knight releases Mortgage Monitor for June

by Calculated Risk on 8/04/2014 09:05:00 AM

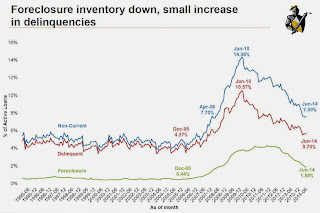

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for June today. According to BKFS, 5.70% of mortgages were delinquent in June, up from 5.62% in May. BKFS reports that 1.88% of mortgages were in the foreclosure process, down from 2.93% in June 2013.

This gives a total of 7.58% delinquent or in foreclosure. It breaks down as:

• 1,728,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,155,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 951,000 loans in foreclosure process.

For a total of 3,834,000 loans delinquent or in foreclosure in June. This is down from 4,785,000 in May 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

An analysis of the month’s mortgage performance data showed that the nation’s inventory of loans in foreclosure is disproportionately distributed in states with judicial foreclosure processes. According to Kostya Gradushy, Black Knight’s manager of Research and Analytics, while foreclosure inventories have been declining nationwide, judicial states’ foreclosure inventories are 3.5 times that of their non-judicial counterparts.There is much more in the mortgage monitor.

“Nationally, the foreclosure inventory rate has declined for 26 straight months, and is currently at its lowest point since April 2008, but this can obscure the stark difference that remains between judicial and non-judicial states,” said Gradushy. “Although judicial states account for about 42 percent of all active mortgages, some 70 percent of loans in foreclosure are in these states. Today, the share of loans in foreclosure in judicial states is 3.23 percent – a significant decline from its January 2012 high of 6.6 percent, but still more than four times higher than the pre-crisis ‘norm.’ Further, more than 60 percent of the foreclosure inventory in judicial states has been past due for two years or more. In fact, these loans have been delinquent an average of 1,084 days, as compared to just 775 days in non-judicial states. The states with the highest number of average days past due for loans in foreclosure are all judicial states: New York and Hawaii are each above 1,300 days, while New Jersey and Florida both top 1,200 days. emphasis added

Sunday, August 03, 2014

Sunday Night Futures

by Calculated Risk on 8/03/2014 08:35:00 PM

Monday:

• Early: Black Knight Mortgage Monitor report for June.

Weekend:

• Schedule for Week of Aug 3rd

• Demographics: Prime Working-Age Population Growing Again

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3 and DOW futures are down 50 (fair value).

Oil prices moved down over the last week with WTI futures at $97.70 per barrel and Brent at $105.73 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.50 per gallon (down more than a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics: Prime Working-Age Population Growing Again

by Calculated Risk on 8/03/2014 03:25:00 PM

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through July 2014.

Click on graph for larger image.

Click on graph for larger image.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

The second shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

The second shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

The near-prime group has still been growing - especially the 55 to 64 age group.

The key points are:

1) A slowdown in the US was expected this decade just based on demographics (the housing bust, financial crisis were piled on top of weak demographics).

2) The prime working age population in the US will start growing solidly again soon.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 8/03/2014 12:09:00 PM

By request, here is an update on an earlier post through the July employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 21 | 3,687 |

| 1Eighteen months into 2nd term | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Eighteen months into Mr. Obama's second term, there are now 5,685,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 657,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 21 | 56 |

| 1Seventeen months into 2nd term | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are over at the state and local levels in the aggregate, but it appears cutbacks at the Federal level have slowed. Right now I'm expecting some increase in public employment in 2014, but nothing like what happened during Reagan's second term.

Saturday, August 02, 2014

Schedule for Week of August 3rd

by Calculated Risk on 8/02/2014 01:01:00 PM

This will be a very light week for economic data.

Early: Black Knight Mortgage Monitor report for June.

10:00 AM: ISM non-Manufacturing Index for July. The consensus is for a reading of 56.5, up from 56.0 in June. Note: Above 50 indicates expansion.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is for a 0.6% increase in June orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. Imports decreased and exports increased in May.

The consensus is for the U.S. trade deficit to be at $45.0 billion in June from $44.4 billion in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 302 thousand.

Early: Trulia Price Rent Monitors for July. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

3:00 PM: Consumer Credit for June from the Federal Reserve. The consensus is for credit to increase $18.3 billion.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for June. The consensus is for a 0.6% increase in inventories.

Unofficial Problem Bank list declines to 451 Institutions

by Calculated Risk on 8/02/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 1, 2014.

Changes and comments from surferdude808:

Actions by the Federal Reserve were responsible for the two changes to the Unofficial Problem Bank List this week. There was one removal lowering the list count to 451 institutions with assets of $145.7 billion. A year ago, the list held 726 institutions with assets of $260.9 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 451.

The Federal Reserve terminated the Written Agreement against Peoples Bank & Trust Co., Troy, MO ($424 million) and they issued a Prompt Corrective Action order against Premier Bank, Denver, CO ($44 million), which has been under a Written Agreement since April 2010.

We expect few changes to the list over the next week and it will not be until August 15th until the OCC provides an update on its enforcement action activity.

Friday, August 01, 2014

Lawler: More Builder Results and Summary Table

by Calculated Risk on 8/01/2014 08:26:00 PM

From housing economist Tom Lawler:

The Ryland Group reported that net home orders in the quarter ended June 30, 2014 totaled 2,228, up 1.7% from the comparable quarter of 2013. Sales per community last quarter were down 13.8% from a year ago. Home deliveries last quarter totaled 1,700, up 2.5% from the comparable quarter of 2013, at an average sales price of $333,000, up 15.0% from last year. The company’s order backlog at the end of June was 3,860, up 5.5% from last June, at an average order price of $336,000, up 11.3% from a year ago. Ryland owned or controlled 40,966 lots at the end of June, up 11.5% from last June and up 58.3% from two years ago. The company said that concessions averaged 6.7% of sales prices last quarter, down from 7.3% a year earlier but up from 6.4% in the previous quarter.

Beazer Homes reported that net home orders in the quarter ended June 30, 2014 totaled 1,290, down 6.6% from the comparable quarter of 2013. Sales per community were off 3.9% from a year ago. Home deliveries totaled 1,241 last quarter, up 0.6% from the comparable quarter of 2013, at an average sales price of $284,600, up 12.1% from a year ago. The company’s order backlog at the end of June was 2,212, down 6.2% from last June. Beazer owned or controlled 29,783 lots at the end of June, up 10.4% from last June and up 18.7% from two years ago.

Standard Pacific Corporation reported that net home orders in the quarter ended June 30, 2014 totaled 1,524, up 0.5% from the comparable quarter of 2013. Sales per community were down 9.9% from a year ago. Home deliveries last quarter totaled 1,236, up 12.9% from the comparable quarter of 2013, at an average sales price of $479,000, up 20.7% from a year ago. The company’s order backlog at the end of June was 2,304, up 1.4% from the comparable quarter of 2013. The company owned or controlled 35,948 lots at the end of June, up 30.7% from last June and up 68.2% from two years ago.

Below are some summary stats for nine large publicly-traded home builders. Net home orders per community for these combined home builders were unchanged from a year ago.

Last week Census estimated that new SF home sales last quarter were down about 6% from the comparable quarter of 2013 (not seasonally adjusted). Comparing large builder orders to Census data can be tricky, as (1) Census treats sales cancellations differently from reported builder numbers; (2) there appears to be a difference in the timing of the recognition of a “sale;” and (3) market shares can change. Normally the above large builder results would lead me to conclude that there is a good chance Census will revise its home sales estimates for last quarter upward in the next report. Given D.R. Horton’s move last quarter to increase its sales pace by materially increasing sales incentives in many markets, however, it seems likely that the overall market share of these builders increased last quarter. (In addition, Horton’s orders last quarter were boosted by about 290 from an acquisition.). As a result, it’s not clear if the builder results below point to a likely upward revision in Census sales numbers.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg | 06/14 | 06/13 | % Chg |

| D.R. Horton | 8,551 | 6,822 | 25.3% | 7,676 | 6,464 | 18.8% | $272,316 | 252,290 | 7.9% |

| PulteGroup | 4,778 | 4,885 | -2.2% | 3,798 | 4,152 | -8.5% | $328,000 | 294,000 | 11.6% |

| NVR | 3,415 | 3,278 | 4.2% | 2,943 | 2,878 | 2.3% | $368,200 | 344,700 | 6.8% |

| The Ryland Group | 2,228 | 2,191 | 1.7% | 1,700 | 1,659 | 2.5% | $333,000 | 287,000 | 16.0% |

| Beazer Homes | 1,290 | 1,381 | -6.6% | 1,241 | 1,234 | 0.6% | $284,600 | 253,800 | 12.1% |

| Standard Pacific | 1,524 | 1,516 | 0.5% | 1,236 | 1,095 | 12.9% | $479,000 | 397,000 | 20.7% |

| Meritage Homes | 1,647 | 1,637 | 0.6% | 1,368 | 1,321 | 3.6% | $368,000 | 330,000 | 11.5% |

| MDC Holdings | 1,419 | 1,351 | 5.0% | 1,158 | 1,183 | -2.1% | $372,000 | 338,400 | 9.9% |

| M/I Homes | 1,016 | 1,078 | -5.8% | 894 | 788 | 13.5% | $306,000 | 281,000 | 8.9% |

| Total | 25,868 | 24,139 | 7.2% | 22,014 | 20,774 | 6.0% | $324,282 | $294,852 | 10.0% |

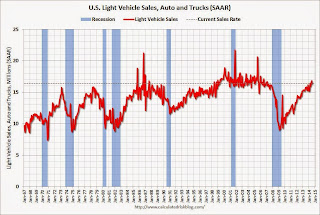

U.S. Light Vehicle Sales decline to 16.4 million annual rate in July

by Calculated Risk on 8/01/2014 02:45:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 16.4 million SAAR in July. That is up 5% from July 2013, and down 2.5% from the 16.9 million annual sales rate last month.

This was below the consensus forecast of 16.7 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 16.4 million SAAR from WardsAuto).

Note: AutoData estimates sales at 16.48 million SAAR for July.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery - although sales growth will slow this year.

Sales have average close to 16.5 million over the last five months following a weak winter due to severe weather.