by Calculated Risk on 8/01/2014 09:55:00 AM

Friday, August 01, 2014

Final July Consumer Sentiment at 81.8

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for July was at 81.8, down from 82.5 in June, and up from the preliminary July reading of 81.3.

This was close to the consensus forecast of 81.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

July Employment Report: 209,000 Jobs, 6.2% Unemployment Rate

by Calculated Risk on 8/01/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 209,000 in July, and the unemployment rate was little changed at 6.2 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for May was revised from +224,000 to +229,000, and the change for June was revised from +288,000 to +298,000. With these revisions, employment gains in May and June were 15,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

This was the sixth month in a row with more than 200 thousand jobs added, and employment is now up 2.57 million year-over-year.

Total employment is now 639 thousand above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was increased in July to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate increased in July to 6.2%.

Although below expectations, this was another solid employment report - including the positive revisions to prior months. 2014 is on pace to be the best year for employment gains since 1999.

I'll have much more later ...

Thursday, July 31, 2014

Friday: Jobs, Autos, ISM Manufacturing and More

by Calculated Risk on 7/31/2014 09:06:00 PM

From Goldman Sachs economist Sven Jari Stehn: July Payroll Preview

We expect a 235,000 increase in nonfarm payrolls and a one tenth drop in the unemployment rate to 6.0%. As far as payrolls are concerned, our forecast would be a solid gain but at a pace slightly below that seen over the past few months. While a number of labor market indicators improved slightly in July (including jobless claims, the business survey employment components and household job market perceptions), other considerations point to a deceleration in the pace of employment creation (including a slowdown in ADP employment growth, softer online job advertising, higher layoffs and the composition of the June payroll gain).Friday:

• At 8:30 AM ET, the Employment Report for July. The consensus is for an increase of 228,000 non-farm payroll jobs added in July, down from the 288,000 non-farm payroll jobs added in June. The consensus is for the unemployment rate to be unchanged at 6.1% in July.

• At 8:30 AM, Personal Income and Outlays for June including revised estimates 2011 through May 2014. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 81.5, up from the preliminary reading of 81.3, and down from the June reading of 82.5.

• All day, Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

• At 10:00 AM, ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June. The ISM manufacturing index indicated expansion in June at 55.3%. The employment index was at 52.8%, and the new orders index was at 58.9%.

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since October 2008

by Calculated Risk on 7/31/2014 03:59:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in June to 2.05% from 2.08% in May. The serious delinquency rate is down from 2.77% in June 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in June to 2.07% from 2.10% in May. Freddie's rate is down from 2.79% in June 2013, and is at the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.72 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in late 2015 or early 2016.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in 2016.

Preview: Employment Report for July

by Calculated Risk on 7/31/2014 02:31:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus, according to Bloomberg, is for an increase of 233,000 non-farm payroll jobs in July (range of estimates between 200,000 and 280,000), and for the unemployment rate to be unchanged at 6.1%.

Note: The BLS reported 288,000 payroll jobs added in June with the unemployment rate at 6.1%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 218,000 private sector payroll jobs in July. This was below expectations of 235,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing and non-manufacturing employment indexes for July will be released after the employment report this month. The ADP report indicated a 3,000 increase for manufacturing jobs in July.

Although the ISM reports are not available, the regional manufacturing surveys were all positive on employment for July (even the disappointing Chicago PMI improved on employment).

• Initial weekly unemployment claims averaged close to 302,000 in July, down from 316,000 in June. For the BLS reference week (includes the 12th of the month), initial claims were at 303,000; this was down from 314,000 during the reference week in June.

The lower reference week reading suggests some upside to the consensus forecast.

• The preliminary July Reuters / University of Michigan consumer sentiment index decreased to 81.3 from the June reading of 82.5. This is frequently coincident with changes in the labor market, but there are other factors too.

• On small business hiring: The small business index from Intuit showed a 15,000 increase in small business employment in July. From Intuit:

U.S. small businesses added 15,000 jobs in July, bringing the number of new jobs added over the last six months to more than 90,000. While 610,000 jobs have been added since the small business recovery began in March 2010, small business employment remains 870,000 jobs below its peak in March 2007.• A few comments from Merrill Lynch economists:

...

"This month's employment increase shows additional progress." said Susan Woodward, the economist who works with Intuit to create the indexes. "Things continue to get better, but slowly. The jobs added by small business over the most recent six months, including July, are more than double what we saw over the prior six months."

We look for nonfarm payrolls to increase 250,000 in July, a slight slowdown from the three-month average of 272,000. The unemployment rate will likely hold at 6.1% while average hourly earnings edge up a trend-like 0.2% mom. This will translate to a 2.2% yoy pace for wage growth. The wage data will be in focus – despite the continued notable drop in the unemployment rate, wage growth has remained lackluster. This suggests that there is indeed spare capacity in the labor market, which can be seen by the large number of discouraged and marginally attached workers. We should therefore continue to look at these broader measures of unemployment, which have improved but remain historically elevated.• Conclusion: The ADP report was lower in July than in June - and below forecasts - but still fairly solid. Weekly unemployment claims were at the lowest level during the reference period in a number of years. However the Intuit small business index showed somewhat less hiring in July.

The early indicators of the labor market look healthy: initial jobless claims continued to slide lower while the regional manufacturing surveys showed a pickup in hiring. Furthermore, the labor differential has been improving, falling to -17.1 in June — the best since the summer of 2008, when the recession was just getting underway. In particular, we look for private payrolls to be up 235,000 while government jobs expand by 15,000, driven by state and local hiring. Special focus will be construction and retail jobs — we think the risk is that construction hiring looks sluggish, in part due to seasonal adjustment issues. Retail job growth should improve, but may look soft relative to the recent trend.

Within the household survey, we look for some slowdown in household job growth after the strong 407,000 gain in June. However, we think job creation will still look strong in this more volatile survey. The labor force participation rate was little changed last month and we think the risk is that it inches up slightly; however, we have been surprised by the continued weak trend in participation. Hence, we wouldn’t be surprised if the unemployment rate fell by another tenth.

There is always some randomness to the employment report, but the I'll take the under on the consensus forecast of 233,000 nonfarm payrolls jobs added in July.

Restaurant Performance Index declined in June

by Calculated Risk on 7/31/2014 11:36:00 AM

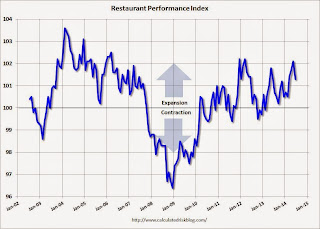

From the National Restaurant Association: Restaurant Performance Index Declined in June Amid Softer Customer Traffic

Due in large part to softer customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) registered a moderate decline in June. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.3 in June, down from a level of 102.1 in May and the first decline in four months. Despite the drop, the RPI remained above 100 for the 16th consecutive month, which signifies expansion in the index of key industry indicators.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.3 in June, down from 102.1 in May. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and even with the monthly decline this is a solid reading.

Chicago PMI declines to 52.6

by Calculated Risk on 7/31/2014 09:52:00 AM

From the Chicago ISM: Chicago Business Barometer Down 10.0 points to 52.6 in July

The Chicago Business Barometer dropped 10.0 points to 52.6 in July, significantly down from May’s seven month high of 65.5, led by a collapse in Production and the ordering components, all of which have been strong since last fall.This was well below the consensus estimate of 63.0.

A monthly fall of this magnitude has not been seen since October 2008 and left the Barometer at its lowest level since June 2013.

In spite of the sharp decline this month, feedback from purchasing managers was that they saw the downturn as a lull rather than the start of a new downward trend. This was especially so given the recent strong performance and the fact that Employment managed to increase further in July.

emphasis added

Weekly Initial Unemployment Claims at 302,000, 4-Week Average Lowest since April 2006

by Calculated Risk on 7/31/2014 08:36:00 AM

The DOL reports:

In the week ending July 26, the advance figure for seasonally adjusted initial claims was 302,000, an increase of 23,000 from the previous week's revised level. The previous week's level was revised down by 5,000 from 284,000 to 279,000. The 4-week moving average was 297,250, a decrease of 3,500 from the previous week's revised average. This is the lowest level for this average since April 15, 2006 when it was 296,000. The previous week's average was revised down by 1,250 from 302,000 to 300,750.The previous week was revised down to 279,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 297,250.

This was lower than the consensus forecast of 305,000. The 4-week average is now at normal levels for an expansion.

Wednesday, July 30, 2014

Thursday: Unemployment Claims, Chicago PMI

by Calculated Risk on 7/30/2014 07:47:00 PM

From Tim Duy on the FOMC Statement at Economist's View

At the conclusion of this week's FOMC meeting, policymakers released yet another statement that only a FedWatcher could love. It is definitely an exercise in reading between the lines. The Fed cut another $10 billion from the asset purchase program, as expected. The statement acknowledged that unemployment is no longer elevated and inflation has stabilized. But it is hard to see this as anything more that describing an evolution of activity that is fundamentally consistent with their existing outlook. Continue to expect the first rate hike around the middle of next year; my expectation leans toward the second quarter over the third.Thursday:

...

Rather than something to worry over, I sense that the majority of the FOMC is feeling relief over the recent inflation data. It is often forgotten that the Fed WANTS inflation to move closer to 2%. The reality is finally starting to look like their forecast, which clears the way to begin normalizing policy next year. Given the current outlook, expect only gradual normalization. ...

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 284 thousand.

• At 9:45 AM, the Chicago Purchasing Managers Index for July. The consensus is for a increase to 63.0, up from 62.6 in June.

Q2 GDP: Investment Contributions

by Calculated Risk on 7/30/2014 04:00:00 PM

Private investment rebounded in Q2. Residential investment increased at a 7.5% annual rate in Q2, equipment investment increased at a 7.0% annual rate, and investment in non-residential structures increased at a 5.3% annual rate.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) increased in Q2, but the three quarter average was negative (red).

Residential investment is so low - as a percent of the economy - that this small decline is not a concern. However, for the rate of economic growth to increase, RI will probably have to continue to make positive contributions.

Equipment and software added 0.4 percentage points to growth in Q2 and the three quarter average moved higher (green).

The contribution from nonresidential investment in structures was also positive in Q2. Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery.

I expect to see all areas of private investment increase over the next few quarters - and that is key for stronger GDP growth.