by Calculated Risk on 7/29/2014 09:00:00 AM

Tuesday, July 29, 2014

Case-Shiller: Comp 20 House Prices increased 9.3% year-over-year in May

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Continue to Moderate According to the S&P/Case-Shiller Home Price Indices

Data through May 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... show the Composite Indices increased at a slower pace. The 10-City Composite gained 9.4% year-over-year and the 20-City 9.3%, down significantly from the +10.9% and +10.8% returns reported last month. All cities with the exception of Charlotte and Tampa saw their annual rates decelerate.

In the month of May, the 10- and 20-City Composites posted gains of 1.1%. For the second consecutive month, all twenty cities posted increases. Charlotte posted its highest monthly increase of 1.4% in over a year. Tampa gained 1.8%, followed by San Francisco at +1.6% and Chicago at +1.5%. Phoenix and San Diego were the only cities to gain less than one percent with increases of 0.4% and 0.5%, respectively. ...

“Home prices rose at their slowest pace since February of last year,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The 10- and 20-City Composites posted just over 9%, well below expectations. Month-to-month, all cities are posting gains before seasonal adjustment; after seasonal adjustment 14 of 20 were lower."

Click on graph for larger image.

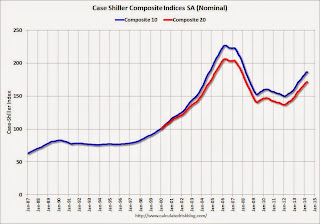

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.1% from the peak, and down 0.3% in May (SA). The Composite 10 is up 24.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.2% from the peak, and down 0.3% (SA) in May. The Composite 20 is up 24.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 9.3% compared to May 2013.

The Composite 20 SA is up 9.3% compared to May 2013.

Prices increased (SA) in 6 of the 20 Case-Shiller cities in May seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 43.2% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was lower than the consensus forecast for a 9.9% YoY increase and suggests a slowdown in price increases. I'll have more on house prices later.

Monday, July 28, 2014

Tuesday: Case-Shiller

by Calculated Risk on 7/28/2014 07:45:00 PM

A glass half empty view from Mark Hanson: Lack of Defaults/Foreclosures/Short Sales; A Serious Housing & Spending Headwind

Most think of the effects of foreclosures & short sales (distressed) only in the first derivative…that they are bad for housing and prices. As such, bullish leaning headlines of plunging defaults, foreclosures and short sales over the past two years are everywhere, often.I like Mark, but how do we get from the crisis phase of the housing bust to a more normal market without seeing fewer foreclosures and short sales? It isn't possible.

Some journalists and bloggers actually follow and publish the data weekly presenting them as further irrefutable evidence that “this” is the real “recovery”. But, of course, when it comes to new-era housing what instinctively sounds like a positive, or negative, is more often than not the exact opposite. And what’s ironic is that the lagging default, foreclosure, and short sale data they publish in the bullish sense is actually leading indicating data of a bearish trend-reversal in housing happening right now, which will lead to the third stimulus “hangover” in the past seven years.

So, the next time you see the headline “Mortgage Defaults (or Foreclosures) at a 6-year Low!!!” you might want to say to yourself “humm, that’s a real problem for purchase demand, house prices, construction labor, materials, appliance sales” and so on.

Bottom line: When it comes to defaults, foreclosures and short sales and how they really fit into the macro housing and economic mosaic less is bad. Foreclosures and short sales “were” a significant housing and macro economic tailwind that drove transactions, prices, home improvement retail, labor, materials, and durable goods sales, which now — down 75% since 2012 — have turned into a stiff headwind.

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. The consensus is for a 9.9% year-over-year increase in the Composite 20 index (NSA) for May.

• At 10:00 AM, the Conference Board's consumer confidence index for July. The consensus is for the index to increase to 85.5 from 85.2.

• Also at 10:00 AM, the Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

Weekly Update: Housing Tracker Existing Home Inventory up 15.6% YoY on July 28th

by Calculated Risk on 7/28/2014 05:53:00 PM

Here is another weekly update on housing inventory ...

SPECIAL NOTE from Ben at Housing Tracker:

I'm seeing higher than expected inventories in Dallas, Orlando and Tampa that do not appear to be accurate representations of reality. Data for those cities may be more suspect than data for other locales. National home inventory will also be skewed higher as a result. As always, consider this realtime data a rough and dirty estimate and use at your own risk.There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for June and indicated inventory was up 6.5% year-over-year).

Fortunately Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data, for 54 metro areas, for the last several years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays.

Inventory in 2014 (Red) is now 15.6% above the same week in 2013. (Note: There might be an issue with the Housing Tracker data over the last couple of weeks - Ben is checking - but inventory is still up significantly).

Inventory is also about 2.4% above the same week in 2012. According to several of the house price indexes, house prices bottomed in early 2012, and low inventories were a key reason for the subsequent price increases. Now that inventory is back above 2012 levels, I expect house price increases to slow (and possibly decline in some areas).

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Freddie Mac: Mortgage Serious Delinquency rate declined in June, Lowest since January 2009

by Calculated Risk on 7/28/2014 02:29:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in June to 2.07% from 2.10% in May. Freddie's rate is down from 2.79% in June 2013, and this is the lowest level since January 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for June on Thursday, July 31st.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.72 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2015 or early 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of distressed sales for perhaps 2 more years (mostly in judicial foreclosure states).

Dallas Fed: Manufacturing "Activity Picks up Pace Again" in July

by Calculated Risk on 7/28/2014 10:33:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks up Pace Again

Texas factory activity increased again in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 15.5 to 19.1, indicating output grew at a faster pace than in June.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing activity reflected significantly stronger growth in July. The new orders index doubled from 6.5 to 13. The capacity utilization index also posted a strong rise, moving to 18 from 9.2 in June. The shipments index rose 12 points to 22.8, reaching its highest level since January 2013. The July readings for these indexes were all more than twice their 10-year averages, suggesting notably robust manufacturing growth.

Perceptions of broader business conditions were more optimistic this month. The general business activity index edged up from 11.4 to 12.7, pushing to its highest level in 10 months. ...

Labor market indicators reflected continued employment growth and longer workweeks. The July employment index posted a second robust reading, although it edged down from 13.1 to 11.4. ... The hours worked index edged up from 4.7 to 6.3, indicating a slightly stronger rise in hours worked than last month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

All of the regional surveys showed stronger expansion in July, and it seems likely the ISM index will increase this month. The ISM index for July will be released Friday, August 1st.

NAR: Pending Home Sales Index decreased 1.1% in June, down 7.3% year-over-year

by Calculated Risk on 7/28/2014 10:00:00 AM

From the NAR: Pending Home Sales Slip in June

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 1.1 percent to 102.7 in June from 103.8 in May, and is 7.3 percent below June 2013 (110.8). Despite June’s decrease, the index is above 100 – considered an average level of contract activity – for the second consecutive month after failing to reach the mark since November 2013 (100.7).Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

...

The PHSI in the Northeast fell 2.9 percent to 83.8 in June, and is 3.2 percent below a year ago. In the Midwest the index rose 1.1 percent to 106.6, but remains 5.5 percent below June 2013.

Pending home sales in the South dipped 2.4 percent to an index of 113.8 in June, and is 4.3 percent below a year ago. The index in the West inched 0.2 percent in June to 95.7, but remains 16.7 percent below June 2013.

Black Knight (formerly LPS): House Price Index up 0.9% in May, Up 5.9% year-over-year

by Calculated Risk on 7/28/2014 09:27:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight (formerly LPS), Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.9 Percent for the Month; Up 5.9 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on May 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increases have been getting steadily smaller for the last 8 months - as shown in the table below:

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

The LPS HPI is off 11.1% from the peak in June 2006.

Note: The press release has data for the 20 largest states, and 40 MSAs.

LPS shows prices off 42.6% from the peak in Las Vegas, off 35.7% in Orlando, and 31.7% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in San Jose, CA and in Nashville, TN.

Note: Case-Shiller for May will be released tomorrow.

Sunday, July 27, 2014

Monday: Pending Home Sales, Dallas Fed Mfg Survey

by Calculated Risk on 7/27/2014 08:36:00 PM

A quick note on employment ... Party like it's 1999?

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It is possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,770 | 2,662 |

| 1 2014 is current pace annualized (through June). | ||

Monday:

• At 10:00 AM ET, the Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for July. This is the last of the regional Fed manufacturing surveys for July.

• During the day, the 2014 Social Security Trustees Report

Weekend:

• FOMC Preview: More Tapering

• Schedule for Week of July 27th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and DOW futures are down 29 (fair value).

Oil prices were mixed over the last week with WTI futures at $101.75 per barrel and Brent at $108.20 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.52 per gallon (down more than a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Preview: More Tapering

by Calculated Risk on 7/27/2014 09:57:00 AM

The Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday of this coming week, and it is almost certain that the FOMC will announce a reduction in monthly asset purchases by another $10 billion per month, from $35 billion to $25 billion. The FOMC statement will be released at 2:00 PM ET on Wednesday, and there will be no press conference after this meeting.

Right now it appears that the FOMC will also reduce QE3 another $10 billion at the September meeting (Sept 17th), and announce the end of QE3 in October (Oct 29th).

On the statement, the FOMC will probably only make small changes. From Goldman Sachs economist David Mericle:

We expect that next week’s FOMC statement will show very little change. The FOMC might choose to upgrade the language on growth in economic activity somewhat, and it might also strengthen the language on labor market indicators a touch in recognition of the strong June employment report. For the most part, however, recent data have supported the characterization of current conditions in the June statement. In particular, the softer June CPI print likely reinforced the Committee’s decision to downplay the firmer inflation prints seen from March to May, and weak housing starts and new home sales reports have likely reinforced concern about the housing sector.For review, here are the June FOMC projections (Projections will be updated next at the September meeting).

The advance estimate of Q2 GDP will be released Wednesday morning, and the consensus is that real GDP increased 2.9% annualized in Q2. Depending on revisions, this would suggest no growth in the first half of 2014 (although other indicators would suggest some growth) - and this would mean another downgrade for GDP at the September meeting.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 |

| Mar 2014 Meeting Projections | 2.8 to 3.0 | 3.0 to 3.2 | 2.5 to 3.0 |

The unemployment rate was at 6.1% in June, and it seems the unemployment rate projection will be lowered again in September. It is possible the FOMC will also lower their long run unemployment projection too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 |

| Mar 2014 Meeting Projections | 6.1 to 6.3 | 5.6 to 5.9 | 5.2 to 5.6 |

As of May, PCE inflation was up 1.8% from May 2013, and core inflation was up 1.5%. The FOMC expects inflation to increase in 2014, but remain below their 2% target (Note: the FOMC target is supposedly symmetrical around 2%, although some analysts think the FOMC is acting as if 2.0% is a ceiling).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 |

| Mar 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 |

| Mar 2014 Meeting Projections | 1.4 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

Overall tapering will probably continue at the same pace, and the FOMC will be a little more positive. But I expect there will be no change on the timing for the end of QE3 (at the October meeting) or on the first rate hike (sometime in 2015).

Saturday, July 26, 2014

Schedule for Week of July 27th

by Calculated Risk on 7/26/2014 01:17:00 PM

This will be a busy week for economic data with several key reports including the July employment report on Friday and the advance Q2 GDP report on Wednesday.

Other key reports include the ISM manufacturing index on Friday, July vehicle sales, also on Friday, and the May Case-Shiller house price index on Tuesday.

There will a two-day FOMC meeting on Tuesday and Wednesday, and the Fed is expected to announce on Wednesday a decrease in asset purchases from $35 billion per month to $25 billion per month.

10:00 AM ET: Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for July. This is the last of the regional Fed manufacturing surveys for July.

During the day: the 2014 Social Security Trustees Reports

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May.

9:00 AM: S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the April 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 9.9% year-over-year increase in the Composite 20 index (NSA) for May. The Zillow forecast is for the Composite 20 to increase 9.6% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for July. The consensus is for the index to increase to 85.5 from 85.2.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 235,000 payroll jobs added in July, down from 280,000 in June.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (advance estimate); Includes historical revisions from the BEA. The consensus is that real GDP increased 2.9% annualized in Q2.

2:00 PM: FOMC Meeting Announcement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 284 thousand.

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a increase to 63.0, up from 62.6 in June.

8:30 AM: Employment Report for July. The consensus is for an increase of 228,000 non-farm payroll jobs added in July, down from the 288,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to be unchanged at 6.1% in July.

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).June was the fifth month in a row with more than 200 thousand jobs added, and employment in June was up 2.495 million year-over-year.

The economy has added 9.7 million private sector jobs since employment bottomed in February 2010 (9.1 million total jobs added including all the public sector layoffs).

There are 895 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 415 thousand above the pre-recession peak.

8:30 AM: Personal Income and Outlays for June including revised estimates 2011 through May 2014. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 81.5, up from the preliminary reading of 81.3, and down from the June reading of 82.5.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to decrease to 16.7 million SAAR in July from 16.9 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for an increase to 55.9 from 55.3 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in June at 55.3%. The employment index was at 52.8%, and the new orders index was at 58.9%.