by Calculated Risk on 7/08/2014 10:11:00 AM

Tuesday, July 08, 2014

BLS: Jobs Openings increase to 4.6 million in May

Note: I have limited internet access until later today.

From the BLS: Job Openings and Labor Turnover Summary

There were 4.6 million job openings on the last business day of May, little changed from 4.5 million in April, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in May for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note: graph is from last month (power outage - limited internet access and cannot upload graphs)

Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in May to 4.635 million from 4.464 million in April.

The number of job openings (yellow) are up 19% year-over-year compared to May 2013.

Quits are up 15%year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the fourth consecutive month, and that quits are increasing.

NFIB; Small business optimism declines in June

by Calculated Risk on 7/08/2014 08:46:00 AM

From NFIB: SMALL BUSINESS OPTIMISM CAN’T BE SUSTAINED

" After a promising 3 month run, June’s Optimism Index fell 1.6 points to 95.0. While job components improved ..."

"NFIB owners increased employment by an average of 0.05 workers per firm in June (seasonally adjusted), the ninth positive month in a row and the best string of gains since 2006."

Monday, July 07, 2014

Tuesday: Job Openings, Small Business Survey

by Calculated Risk on 7/07/2014 09:01:00 PM

Special Note: Due to a power outage and internet interruption (thanks SCE), posting may be light or non-existent until Tuesday afternoon. I'm also unable to respond to most emails. I'll be back online soon!

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for June.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS. In April, Job Openings were up 17% year-over-year and quits were up 11% year-over-year.

• At 3:00 PM, Consumer Credit for May from the Federal Reserve. The consensus is for credit to increase $17.5 billion.

Weekly Update: Housing Tracker Existing Home Inventory up 13.6% YoY on July 7th

by Calculated Risk on 7/07/2014 06:36:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

NOTE: THIS GRAPH IS FOR LAST WEEK DUE TO POWER OUTAGE. This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 13.6% above the same week in 2013. (Note: There are differences in how the data is collected between Housing Tracker and the NAR).

Inventory is slightly below the same week in 2012 (it was above last week). This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

Duy: "Inflation Hysteria Redux"

by Calculated Risk on 7/07/2014 03:29:00 PM

From Tim Duy at Economist's View: Fed Watch: Inflation Hysteria Redux. Excerpt:

It is simply difficult for me to become too worried about inflation given the history of the past twenty years - twenty years in which the US economy was at times substantially outperforming the current environment no less. Underlying inflation simply has not be[en] a problem.

It was not a problem because the Federal Reserve tightened policy multiple times to preempt inflation. Expect the same during this cycle as well - the Fed will begin to gradually raise interest rates sometime next year, and they will maintain a gradual pace of tightening as long as they believe core-PCE will consistently average 2.25% or less. Currently, I anticipate the first rate hike will occur in the second quarter of 2015. If the unemployment rate falls to 5.5% by the end of this year, I would expect the first hike to be in the first quarter of 2015.

What about headline inflation? Headline inflation is at the mercy of the Middle East and the weather, leaving it more volatile than core ...

How will headline inflation influence monetary policy? If you combine headline inflation well in excess of 2.25% (I suspect something more like 3%) with tight labor markets and rapid wage/unit labor cost growth, I think the Fed will accelerate the pace of tightening (indeed, the second two conditions alone would probably do the trick). If we experience high headline inflation in the context of weak wage growth, expect the gradual pace of tightening to continue. Under those circumstances, the Fed will believe that headline inflation will depress demand and lessen inflationary pressures endogenously.

Bottom Line: If you are making a short-term bet on higher headline inflation, primarily you are making a bet on energy and food. That bet is about the Middle East and weather, not monetary policy. I don't have an opinion on that bet. If you are betting on inflation over the medium-term, primarily you are making a bet on higher core inflation. More to the point, you are betting against the Fed. You are essentially betting that the Fed will not do what it has done since Federal Reserve Chair Paul Volker - tighten policy in the face of credible inflationary pressures. I would think twice, maybe three times before making that bet.

Demographics and Behavior

by Calculated Risk on 7/07/2014 12:15:00 PM

Imagine if you were born in 1900. You'd have a 23% chance of dying before age 20 (a 13% change before age 1). You'd have a 38% chance of dying before age 45 (see first two graphs below).

Compare that to kids born recently. You'd have about a 1% chance of dying before age 20, and about a 4% chance of dying before age 45. A dramatic change over the last century.

How would this effect your behavior? If you were born in 1900, you'd want to get married early, and have plenty of children. If you were born recently, you'd probably take your time - get married later, have fewer children - and education would be more valuable (because you'd probably live longer).

So we'd expect to see more young people stay in school, and more older people stay in the work force - and that is exactly what is happening.

Some people look at these trends and worry about supporting all the old people. To me, this is all great news - the vast majority of people can look forward to a long life - with fewer people dying in childhood or during their prime working years.

Here is some data from the CDC United States Life Tables, 2009 by Elizabeth Arias released earlier this year (repeated from an earlier post):

The most frequently used life table statistic is life expectancy (ex), which is the average number of years of life remaining for persons who have attained a given age (x). ... Another way of assessing the longevity of the period life table cohort is by determining the proportion that survives to specified ages. ... To illustrate, 56,572 persons out of the original 2009 hypothetical life table cohort of 100,000 (or 56.6%) were alive at exact age 80. In other words, the probability that a person will survive from birth to age 80, given 2009 age-specific mortality, is 56.6%.Instead of look at life expectancy, here is a graph of survivors out of 100,000 born alive, by age for three groups: those born in 1900-1902, born in 1949-1951 (baby boomers), and born in 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.There was a dramatic change between those born in 1900 (blue) and those born mid-century (orange). The risk of infant and early childhood deaths dropped sharply, and the risk of death in the prime working years also declined significantly.

The CDC is projecting further improvement for childhood and prime working age for those born in 2009, but they are also projecting that people will live longer.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.The peak age for deaths didn't change much for those born in 1900 and 1950 (between 76 and 80, but many more people born in 1950 will make it).

Now the CDC is projection the peak age for deaths - for those born in 2009 - will increase to 86 to 90! Using these stats - for those born in 2014 - about half will make it to the next century.

Also the number of deaths for those younger than 20 will be very small (down to mostly accidents, guns, and drugs). Self-driving cars might reduce the accident component of young deaths.

And the next graph shows the impact of changing demographics on labor force participation. The 2022 projections are based on a recent article from BLS economist Mitra Toossi: Labor force projections to 2022: the labor force participation rate continues to fall

Probably the main reason for the decline in the participation rate for the younger age groups is that more people are pursuing higher education (graphs in previous post show increase in enrollment).

Probably the main reason for the decline in the participation rate for the younger age groups is that more people are pursuing higher education (graphs in previous post show increase in enrollment).I'll have more on this soon, but all of this is great news!

Dorms as "Parents' Home": The long term trends for higher enrollment

by Calculated Risk on 7/07/2014 09:44:00 AM

On Friday I noted an article by Derek Thompson in the Atlantic: The Misguided Freakout About Basement-Dwelling Millennials

More than 15.3 million twentysomethings—and half of young people under 25—live "in their parents’ home," according to official Census statistics.As Thompson noted, most of the recent increase in the percent living "in their parents' home" is related to living in dorms.

There's just one problem with those official statistics. They're criminally misleading. When you read the full Census reports, you often come upon this crucial sentence:

It is important to note that the Current Population Survey counts students living in dormitories as living in their parents' home.

This is an important point since there is a long term trend for higher school enrollment (so we shouldn't "freak out" about the reported increase in young people living at home).

And higher school enrollment generally means lower labor force participation (as I've pointed out before, the decline in the overall labor force participation rate is due to several factors, but two of the most important are aging of the baby boomers and more younger people staying in school).

Click on graph for larger image.

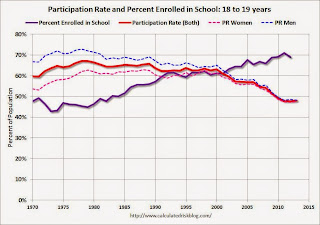

Click on graph for larger image.This graph uses data from the BLS on participation rate, and the National Center for Education Statistics (NCES) on enrollment rates (most recent data for 2012).

This graph shows the participation and enrollment rates for the 18 to 19 year old age group. These two lines are a "mirror image".

Note: I added the participation rate for men and women too. One of the key labor stories in the 2nd half of the 1900s was the surge in participation by women.

The third graph shows the participation and enrollment rates for the 20 to 24 year old age group.

The third graph shows the participation and enrollment rates for the 20 to 24 year old age group.Once again the participation rate is declining as the enrollment rate is increasing. The participation rate (all) was rising in the '70s and early '80s because of the increase in women entering the labor force.

So don't worry about the kids living in their parents' basements - they are actually living in dorms. In the long run, more education is a positive for the economy.

Hey, the kids are alright!

Sunday, July 06, 2014

Sunday Night Futures

by Calculated Risk on 7/06/2014 07:51:00 PM

On inflation: I'm sympathetic to people like Joe Weisenthal at Business Insider who is looking for signs of inflation increasing; I'm starting to look for signs of real wage increases and inflation too. I just think inflation isn't a concern right now (Weisenthal was correct on inflation over the last several years in contrast to the people who were consistently wrong on inflation).

It is easy to understand the concern about inflation when we see articles like this from Ben Leubsdorf and Jon Hilsenrath at the WSJ: As Food Prices Rise, Fed Keeps a Watchful Eye

The consumer price of ground beef in May rose 10.4% from a year earlier while pork chop prices climbed 12.7%. The price of fresh fruit rose 7.3% and oranges 17.1% ... The U.S. Department of Agriculture predicts overall food prices will increase 2.5% to 3.5% this year after rising 1.4% in 2013, as measured by the Labor Department's consumer-price index.Meanwhile gasoline prices are up year-over-year too (see graph below). I suspect this is going to reignite the CPI (or PCE prices) vs. core prices again.

For food prices, the drought in California is having an impact. From an earlier WSJ article:

Because California boasts a bigger agricultural sector than any other state, the drought could have an outsize economic impact nationally, raising produce prices.And gasoline and oil prices have been impacted by the turmoil in Iraq. Monetary policy can't halt the violence in Iraq or make it rain in California - and this is why it is important to track various core measures of inflation.

On the Employment Report:

• June Employment Report: 288,000 Jobs, 6.1% Unemployment Rate

• Comment on Employment Report

• More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Weekend:

• Mid-Year Review: Ten Economic Questions for 2014

• Schedule for Week of July 6th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 11 (fair value).

Oil prices moved mostly sideways down the last week with WTI futures at $103.91 per barrel and Brent at $110.61 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.65 per gallon (about 20 cents higher than a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Is Inflation Coming?

by Calculated Risk on 7/06/2014 02:42:00 PM

Joe Weisenthal at Business Insider writes: These Three Charts Show Inflation Is Finally Right Around The Corner

After this week's strong Jobs Report, it's becoming conventional wisdom that the economy is heating up for real this time. After numerous false starts and disappointments since the financial crisis, it appears we've kicked into a higher gear.I also think the economy is picking up, and I agree that as slack diminishes, we will probably see real wage growth and an uptick in inflation.

A stronger economy should mean higher inflation. That's because as the economy grows, slack diminishes in the economy (both industrial slack and labor market slash) and that puts pricing pressure on existing resources. It makes sense, as the unemployed become more scarce, employed workers have greater bargaining power for wages.

However, this is unconvincing:

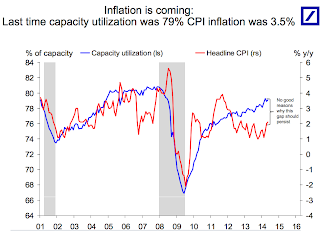

These three charts from Deutsche Bank economist Torsten Slok make for a good overview of the case that inflation is coming. ... Historically, when Capacity Utilization is as high as its now (suggesting not much industrial slack) the inflation rate has been much higher.

Click on graph for larger image.

Click on graph for larger image.Here is the first chart. This shows capacity utilization and the year-over-year change in CPI.

Capacity Utilization has been increasing, and the author write "No good reasons why this gap should persist" (gap between Capacity utilization on the chart and CPI).

Whenever I see a correlation chart like this, I like to see what happened in earlier periods.

The second graph shows the same data, but this time starting in 1990 (instead of 2001).

The second graph shows the same data, but this time starting in 1990 (instead of 2001).For most of the '90s there was a huge "gap" between capacity utilization and CPI.

There were periods when capacity utilization was higher than now - and inflation lower. As an example, capacity utilization was close to 83% in 1998, and YoY inflation averaged 1.5%.

So I don't think the first graph is convincing that inflation is "right around the corner". (the last two graphs are from a small survey and also not convincing).

My view is inflation is increasing a little (as was expected), but is not a concern this year.

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 7/06/2014 11:39:00 AM

Thursday on the employment report:

• June Employment Report: 288,000 Jobs, 6.1% Unemployment Rate

• Comments on Employment Report

A few more employment graphs by request ...

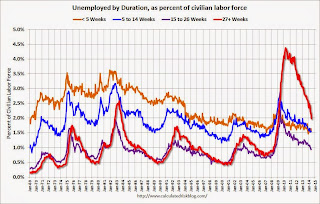

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 2.0% of the labor force - the lowest since February 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 583 thousand.

Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup more this year.

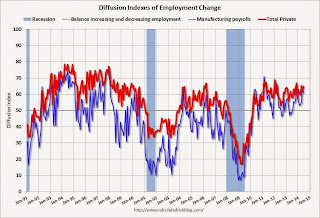

The BLS diffusion index for total private employment was at 64.8 in June, up from 62.9 in May.

The BLS diffusion index for total private employment was at 64.8 in June, up from 62.9 in May.For manufacturing, the diffusion index decreased to 61.1, down from 63.6 in May.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in June.