by Calculated Risk on 6/30/2014 10:00:00 AM

Monday, June 30, 2014

NAR: Pending Home Sales Index increased 6.1% in May, down 5.2% year-over-year

From the NAR: Pending Home Sales Surge in May

Pending home sales rose sharply in May, with lower mortgage rates and increased inventory accelerating the market, according to the National Association of Realtors®. All four regions of the country saw increases in pending sales, with the Northeast and West experiencing the largest gains.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 6.1 percent to 103.9 in May from 97.9 in April, but still remains 5.2 percent below May 2013 (109.6).

...

The PHSI in the Northeast jumped 8.8 percent to 86.3 in May, and is now 0.2 percent above a year ago. In the Midwest the index rose 6.3 percent to 105.4 in May, but is still 6.6 percent below May 2013.

Pending home sales in the South advanced 4.4 percent to an index of 117.0 in May, and is 2.9 percent below a year ago. The index in the West rose 7.6 percent in May to 95.4, but remains 11.1 percent below May 2013.

Sunday, June 29, 2014

Monday: Chicago PMI, Pending Home Sales

by Calculated Risk on 6/29/2014 09:00:00 PM

Monday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

• At 10:00 AM, the Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Weekend:

• Demographics: Prime and Near-Prime Population and Labor Force

• Schedule for Week of June 29th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 11 (fair value).

Oil prices moved down slightly over the last week with WTI futures at $105.45 per barrel and Brent at $113.10 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.68 per gallon, up about 20 cents from a year ago. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics: Prime and Near-Prime Population and Labor Force

by Calculated Risk on 6/29/2014 12:33:00 PM

Earlier this week, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

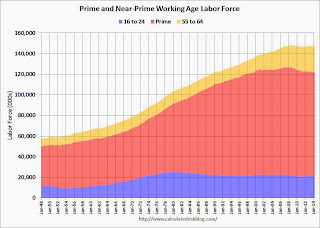

Here are a couple more graphs making this point. The first shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

Click on graph for larger image.

Click on graph for larger image.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The near-prime group has been growing - especially the 55 to 64 age group.

The good news is the prime working age group will start growing again by 2020, and this should boost economic activity.

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased).

As Bruegel notes, the working age population in the US is expected to grow over the next few decades - so the US has much better demographics than Europe, China or Japan (not included).

The key points are:

1) A slowdown in the US was expected this decade just based on demographics (the housing bust, financial crisis were piled on top of weak demographics).

2) The prime working age population in the US will start growing again soon.

Saturday, June 28, 2014

Schedule for Week of June 29th

by Calculated Risk on 6/28/2014 01:11:00 PM

This will be a busy holiday week for economic data with several key reports including the June employment report on Thursday.

Other key reports include the ISM manufacturing index on Tuesday, June vehicle sales on Tuesday, and the May Trade Deficit and June ISM non-manufacturing index on Thursday.

Fed Chair Janet Yellen will speak on Financial Stability.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

10:00 AM ET: Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in May at 55.4%. The employment index was at 52.8%, and the new orders index was at 56.9%.

Early: Reis Q2 2014 Apartment Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in June, up from 180,000 in May.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 0.3% decrease in May orders.

11:00 AM: Speech by Fed Chair Janet Yellen, Financial Stability, At the Inaugural Michel Camdessus Central Banking Lecture at the International Monetary Fund, Washington, D.C.

Early: Reis Q2 2014 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 314 thousand from 312 thousand.

8:30 AM: Employment Report for June. The consensus is for an increase of 211,000 non-farm payroll jobs added in June, down from the 217,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to be unchanged at 6.3% in May.

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!The economy has added 9.4 million private sector jobs since employment bottomed in February 2010 (8.8 million total jobs added including all the public sector layoffs).

There are 617 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 98 thousand above the pre-recession peak.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. Both imports and exports increased in April.

The consensus is for the U.S. trade deficit to be at $45.1 billion in May from $47.2 billion in April.

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a reading of 56.2, down from 56.3 in May. Note: Above 50 indicates expansion.

All US markets are closed in observance of the Independence Day holiday.

Unofficial Problem Bank list declines to 468 Institutions, Q2 2014 Transition Matrix

by Calculated Risk on 6/28/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 27, 2014.

Changes and comments from surferdude808:

FDIC providing an update on its enforcement action activities and a deeper scrubbing of the list drove a net decline in the Unofficial Problem Bank List to 468 institutions with assets of $149.2 billion. In all, there were 21 removals and one addition this week. A year ago, the list held 749 institutions with assets of $273.3 billion. During this June, the list declined by a net 28 institutions after 26 action terminations, two failures, one merger, and one addition. The failure this week, The Freedom State Bank, Freedom, OK surprisingly was not on the list as the only action issued by FDIC that can be located is a Prompt Corrective Action order only issued less than 60 days ago.

Removals this week were The Bank of Delmarva, Seaford, DE ($425 million); Community Bank of the South, Smyrna, GA ($348 million); Mercantile Bank, Quincy, IL ($347 million); The Pueblo Bank and Trust Company, Pueblo, CO ($320 million); First Farmers & Merchants Bank, Cannon Falls, MN ($265 million); Firstier Bank, Kimball, NE ($245 million); SouthPoint Bank, Birmingham, AL ($202 million); Marine Bank & Trust Company, Vero Beach, FL ($152 million); Bank of Fairfield, Fairfield, WA ($147 million); Concord Bank, St. Louis, MO ($138 million); Town & Country Bank, Las Vegas, NV ($120 million); Freedom Bank of America, Saint Petersburg, FL ($107 million); State Bank of Park Rapids, Park Rapids, MN ($100 million); Community Pride Bank, Isanti, MN ($94 million); First Bank, West Des Moines, IA ($90 million); First Carolina Bank, Rocky Mount, NC ($89 million); Sherburne State Bank, Becker, MN ($84 million); Bank of the Prairie, Olathe, KS ($80 million); Security Bank, New Auburn, WI ($75 million); Holladay Bank & Trust, Salt Lake City, UT ($51 million); and Maple Bank, Champlin, MN ($51 million).

The sole addition this week Community 1st Bank Las Vegas, Las Vegas, NM ($146 million).

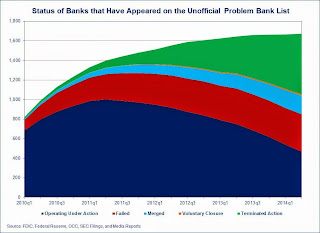

We have updated the Unofficial Problem Bank List transition matrix through the second quarter of 2014. Full details are available in the accompanying table and a graphic depicting trends in how institutions have arrived and departed the list. Since publication of the Unofficial Problem Bank List started in August 2009, a total of 1,672 institutions have appeared on the list. New entrants have slowed since late 2012, but this quarter seven institutions were added up from only three being added in the previous two quarters.

At the end of the second quarter, only 468 or 28 percent of the banks that have been on a list at some point remain. Action terminations of 619 account for around 51 percent of the 1,204 institutions removed. However, a significant number of institutions have left the list through failure. So far, 381 institutions have failed accounting for nearly 32 percent of departures. Should another institution on the list not fail, then more than 22 percent of the 1,672 institutions making an appearance would have failed. A 22 percent default rate would be more than double the rate often cited by media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 141 | (55,759,559) | |

| Unassisted Merger | 32 | (6,697,723) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (5,411,792) | ||

| Still on List at 6/30/2014 | 58 | 13,590,663 | |

| Additions after 8/7/2009 | 478 | 135,599,760 | |

| End (6/30/2014) | 468 | 149,190,423 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 478 | 206,393,188 | |

| Unassisted Merger | 158 | 71,031,845 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 227 | 111,634,071 | |

| Total | 873 | 391,383,246 | |

| 1Institution not on 8/7/2009 or 6/30/2014 list but appeared on a weekly list. | |||

Friday, June 27, 2014

Bank Failure #12 in 2014: The Freedom State Bank, Freedom, Oklahoma

by Calculated Risk on 6/27/2014 05:30:00 PM

From the FDIC: Alva State Bank & Trust Company, Alva, Oklahoma, Assumes All of the Deposits of The Freedom State Bank, Freedom, Oklahoma

As of March 31, 2014, The Freedom State Bank had approximately $22.8 million in total assets and $20.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.8 million. ... The Freedom State Bank is the 12th FDIC-insured institution to fail in the nation this year, and the second in Oklahoma.There have been 12 failures so far in 2014, half the 24 failures in 2013. So it is possible there will be more failures this year than in 2013.

Lawler on Homebuilders Lennar and KB Home

by Calculated Risk on 6/27/2014 03:48:00 PM

Lennar Corporation, the second largest US home builder in 2013, reported that net home orders in the quarter ended May 31, 2014 totaled 6,183, up 8.4% from the comparable quarter of 2013. Sales per active community were down about 7.5% from a year ago. Home deliveries last quarter totaled 4,987, up 11.7% from the comparable quarter of 2013, at an average sales price of $322,000, up 13.8% from a year ago. The company’s order backlog at the end of May was 6,858, up 11.3% from last May, at an average order price of $343,000, up 13.6% from a year earlier.

Here is a comment from Lennar’s CEO in its press release.

"While the spring selling season was softer than anticipated by us and the investor community, the homebuilding recovery continued its progression at a slow and steady pace. The fundamentals of the homebuilding industry remain strong driven by high affordability levels, favorable monthly payment comparisons to rentals and overall supply shortages. Demand in most of our markets continues to outpace supply, which is constrained by limited land availability."With respect to land, the company said in its conference call that it owned or controlled bout 164,000 homesites at the end of May, up 18.3% from last May ... That lot inventory was 7.6 times Lennar’s expected level of home deliveries in 2014 – which is a lot!

In its conference call officials said that the company’s sizable land/lot position left it “well positioned” to take advantage of an increase in demand from first-time home buyers, but officials said that demand from first-time home buyers last quarter remained very weak – which officials attributed mainly to continued very tight mortgage lending standards. Officials also highlighted the company’s relatively new multifamily rental segment, which it apparently started on concerns that a higher share of householders, especially young adults/new householders, may be more likely to be renters and/or live in urban areas than has been the case in the past.

KB Home, the fifth largest US home builder in 2013, reported that net home orders in the quarter ended May 31, 2014 totaled 2,269, up 4.9% from the comparable quarter of 2013. Net orders per community last quarter were down 2.2% from a year ago. Home deliveries last quarter totaled 1,751, down 2.6% from the comparable quarter of 2013, at an average sales price of $319,700, up 10.1% from a year ago. The company’s order backlog at the end of May was 3,398, up 8.6% from last May.

In an excessively long opening remark on the company’s earnings conference call, KB Home’s CEO Jeff Mezger made two observations that raised analysts’ eyebrow: he said that (1) while mortgage credit remained tight, the company has seen evidence of easing in credit standards; and (2) the company has seen some “re-emergence” of first-time home buyers. Not surprisingly he faced questions on these observations in the Q&A session. On mortgage credit standards, Mezger pointed to “still high” but lower average credit scores on mortgage bonds issued, and to “anecdotal” reports of reduced “credit overlays” from “some lenders.” (No story here!). On the re-emergence of first-time home buyers, Mezger said that there’s been an increase in first-time home buyer purchases in some areas of Texas where job growth has been strong.

Here are net orders for the quarter ended May 31, 2014 for three large home builders. (Note: Hovnanian reported result for the quarter ended April 30, 2014, but it showed net orders for May 2014 in its earnings presentation).

| Net Home Orders, 3 Months Ending: | 5/31/2014 | 5/31/2013 | % Change |

|---|---|---|---|

| Lennar | 6,183 | 5,705 | 8.4% |

| KB Home | 2,269 | 2,162 | 4.9% |

| Hovnanian | 1,799 | 1,862 | -3.4% |

| Total | 10,251 | 9,729 | 5.4% |

Earlier this week, Census estimated that new SF home sales in the first five months of 2014 totaled 194,000 (not seasonally adjusted), up just 0.5% from the first five months of 2013.

Net, the “spring” new home buying season, while not really a “bust,” fell considerably short of “consensus” forecasts at the beginning of the year. While results varied considerably among large publicly-traded builders, overall net home orders appear to have fallen considerably short of builder expectations as well, and net order per community appear on aggregate to have declined about 6% YOY. The 13 large publicly-traded home builders I track in aggregate increased the number of lots they owned or controlled from the fall of 2011 to the fall of 2013 by about 30% -- with the bulk of the gain occurring since the middle of 2012 – and in aggregate these companies planned to increase both community counts and sales by 15-17% this year. One reason net orders have been below consensus is that many builders raised prices aggressively last year. Now that builders have substantially larger land/lot inventories – and a lot more of it is developed now compared to a year ago – it is a pretty good bet that builders’ “pricing power” has fallen sharply, and that new home prices will on average (and adjusted for mix) show little if any increase for the remainder of this year.

Chemical Activity Barometer for June Suggests "continued growth"

by Calculated Risk on 6/27/2014 02:38:00 PM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Leading Economic Indicator Continues Upward Trend Despite Impacts of Global Unrest

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), continued its upward growth this month, with a 0.5 percent gain from May. Measured on a three-month moving average (3MMA), the CAB’s 0.5 percent gain beat the average first quarter monthly gains of 0.3 percent. Though the pace of growth has slowed significantly, gains in June have brought the CAB up a solid 4.3 percent over this time last year.

“Overall, we are seeing signs of continued growth in the U.S. economy, and trends in construction-related chemistry show a market which has not yet reached its full potential,” said Dr. Kevin Swift, chief economist at ACC. “However, unrest in Iraq is already affecting chemical equity prices, and the potential for an energy price shock is worrying,” he added.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests continued growth.

Vehicle Sales Forecasts: Over 16 Million SAAR again in June

by Calculated Risk on 6/27/2014 11:45:00 AM

The automakers will report June vehicle sales on Tuesday, July 1st. Sales in May were at 16.71 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in June will be above 16 million (SAAR) again.

Note: There were only 24 selling days in June this year compared to 26 last year.

Here are a few forecasts:

From WardsAuto: Forecast Calls for Strong June Sales

A new WardsAuto forecast calls for strong U.S. light-vehicle sales in June, with competition in the midsize car segment and healthy inventories across all segments fueling growth. ... The projected 16.4 million-unit seasonally adjusted annual rate would be less than May’s 87-month-high 16.7 million SAAR ...From J.D. Power: J.D. Power and LMC Automotive Report: New-Vehicle Sales Continue Year-over-Year Growth

Total light-vehicle sales in June 2014 are expected to approach 1.4 million units, a 5 percent increase from June 2013. The pace of fleet volume growth continues to be lower than retail, with a 1 percent increase year over year, accounting for 19 percent of total sales in June. ... [16.3 million SAAR]

From TrueCar: June SAAR to Hit 16.4 Million Vehicles, According to TrueCar; 2014 New Vehicle Sales Expected to be up 1.0 Percent Year-Over-Year

Seasonally Adjusted Annualized Rate ("SAAR") of 16.4 million new vehicle sales is up 3.2 percent from June 2013 and down 1.8 percent over May 2014.Another solid month for auto sales.

Final June Consumer Sentiment increases to 82.5

by Calculated Risk on 6/27/2014 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for June increased to 82.5 from the May reading of 81.9, and was up from the preliminary June reading of 81.2.

This was above the consensus forecast of 82.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.