by Calculated Risk on 6/12/2014 08:30:00 AM

Thursday, June 12, 2014

Weekly Initial Unemployment Claims increase to 317,000

The DOL reports:

In the week ending June 7, the advance figure for seasonally adjusted initial claims was 317,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 312,000 to 313,000. The 4-week moving average was 315,250, an increase of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 310,250 to 310,500.The previous week was revised up from 312,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 315,250.

This was above the consensus forecast of 309,000. The 4-week average is now at normal levels for an expansion.

Wednesday, June 11, 2014

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 6/11/2014 07:24:00 PM

Thursday:

• At 8:30 AM ET, Retail sales for May will be released. The consensus is for retail sales to increase 0.6% in May, and to increase 0.4% ex-autos.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 312 thousand.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.4% increase in inventories.

Also here is a price index for commercial real estate that I follow. From CoStar: Property Price Gains In April Strongest At High End Of Market

•HIGH-END CRE PROPERTIES ENJOY BIGGEST PRICING GAINS IN APRIL: Bolstered by continued demand for large, core properties, the value-weighted U.S. Composite Index advanced by 2% in April 2014, while the equal-weighted U.S. Composite Index, which is more heavily influenced by smaller, second-tier properties, declined by 0.8% for the same month. In particular, average sale prices for core multifamily and office properties in major markets have soared well above their 2006–07 average as investors continued to aggressively pursue those types of properties. This investment activity is reflected in the value-weighted U.S. Composite Index, which has recovered to within 2.2% of its prior peak level in September of 2007, while the equal-weighted U.S. Composite Index sits 21.9% below its prior peak.

...

DISTRESS SALES CONTINUE TO DISSIPATE: As market fundamentals and liquidity have improved, the distress percentage of total observed sale pair counts declined to just 10.6% through the first four months of 2014, down from 16.6% for the same timeframe in 2013 and down 32% from the bottom of the market in 2010.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Equal and Value Weighted indexes through April. The value-weighted index is almost back to the pre-recession peak.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

DataQuick on SoCal: May Home Sales down 15% Year-over-year, Non-Distressed sales up Year-over-year

by Calculated Risk on 6/11/2014 03:05:00 PM

From DataQuick: Southland Home Sales Slow; Median Price Rises Again but at Slower Pace

Southern California home sales lost momentum in May, falling from both April and a year earlier as investor demand fell and buyers continued to face inventory, affordability and credit constraints. ...Both distressed sales and investor buying is declining - and this has been dragging down overall sales. Even though total sales are still down year-over-year, the percent of non-distressed sales is up slightly year-over-year. There were 19,556 total sales this year, and 11.6% were distressed. In May 2013, there were 23,034 total sales, and 26.6% were distressed.

A total of 19,556 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 2.3 percent from 20,008 sales in April, and down 15.1 percent from 23,034 sales in May last year, according to San Diego-based DataQuick.

On average, sales have increased 5.8 percent between April and May since 1988, when DataQuick’s statistics begin. Sales have fallen on a year-over-year basis for eight consecutive months. May sales have ranged from a low of 16,917 in May 2008 to a high of 35,557 in May 2005. Last month’s sales were 23.0 percent below the May average of 25,393 sales.

...

“We expected rising prices to unlock more inventory this spring and that's happened. But the supply of homes for sale still falls short of demand in many markets, contributing to a rise in prices and a below-average sales pace. The drop in affordability has also hampered activity, helping to explain how sales could be lower now even though today’s inventory is higher than a year ago. The recent dip in mortgage rates will help fuel demand, adding pressure to home prices. But the sort of price spikes we saw this time last year – annual gains of 20 percent or more – are less likely today given affordability constraints, higher inventory and the drop-off in investor purchases,” said Andrew LePage, a DataQuick analyst.

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.0 percent of the Southland resale market in May. That was down from a revised 5.8 percent the prior month and down from 10.9 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.6 percent of Southland resales last month. That was up slightly from a revised 6.2 percent the prior month and down from 15.7 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 25.0 percent of the Southland homes sold last month, which is the lowest share since September 2011, when 24.6 percent of homes sold to absentee buyers. Last month’s figure was down from 26.7 percent in April and down from 29.5 percent a year earlier. The peak was 32.4 percent in January 2013, while the monthly average since 2000, when the absentee data begin, is about 19 percent.

emphasis added

Treasury: Budget Deficit declined in May 2014 compared to May 2013

by Calculated Risk on 6/11/2014 02:00:00 PM

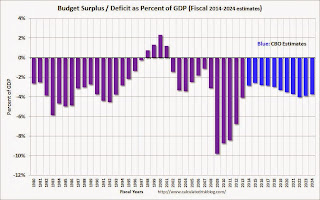

The Treasury released the May Monthly Treasury Statement today. The Treasury reported a $130 billion deficit in May 2014, down from $138 billion in May 2013. For fiscal year 2014 through May, the deficit was $436 billion compared to $626 billion for the same period in fiscal 2013.

In April, the Congressional Budget Office (CBO) released their new Updated Budget Projections: 2014 to 2024. The projected budget deficits were reduced for each of the next ten years, and the projected deficit for 2014 was revised down from 3.0% to 2.8%. Based on the Treasury release today, I expect the deficit for fiscal 2014 to be lower than the current CBO projection.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The deficit should decline further next year.

The decline in the deficit, as a percent of GDP, from almost 10% to under 3% in 2014 is the fastest decline in the deficit since the demobilization following WWII (not shown on graph).

Will Congress "Pay the Bills" in 2015?

by Calculated Risk on 6/11/2014 11:19:00 AM

I wrote several posts about the "debt ceiling" debate in 2011 and again in 2013. Unfortunately "debt ceiling" sounds virtuous, but it isn't - it is actually a question of "paying the bills". And I've always argued that Congress would "pay the bills". So even though the debate in 2011 clearly scared many Americans and impacted the economy, I was confident that Congress would eventually do its job.

These political stunts always happen in off election years with the hope that most voters will forget about the nonsense by the next election. So there is a risk in 2015 - and right now I'm a little more concerned than in previous years. Most of the commentary concerning the upset of Congressman Eric Cantor has focused on immigration reform, but his opponent has also argued that the government should not pay the bills (default on payments to the American companies and people).

This is an economic risk for next year (and a political risk for the GOP). As Republican Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

Back in 2013 I promised to start criticizing Congress earlier in the process since 2011 was ridiculous and reckless (2013 was also dumb). I think there is a general ignorance of how the budget works, and what it means to be fiscally responsible. I'll write more about these topics and start earlier this time!

Note: There are certain politicians who think it is OK to not pay the bills as long as the U.S. makes interest and principal payments on the debt. That is crazy talk. There is a name for people who don't pay their bills: deadbeats. If politicians don't pay their personal bills, they are deadbeats. But if they stop the government from paying the bills, we are all deadbeats. And there will be serious economic consequences for not paying the bills on time. The consequences will build over time, but after several months, not "paying the bills" in 2015 would ripple through the entire economy.

MBA:"Strong Growth in Mortgage Application Volume Following Memorial Day Holiday"

by Calculated Risk on 6/11/2014 07:00:00 AM

From the MBA: Strong Growth in Mortgage Application Volume Following Memorial Day Holiday

Mortgage applications increased 10.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 6, 2014. The previous week’s results included an adjustment for the Memorial Day holiday. ...

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.34 percent from 4.26 percent, with points increasing to 0.16 from 0.13 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 71% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 13% from a year ago.

Tuesday, June 10, 2014

Update: Will Mortgage Rates be down year-over-year in late June?

by Calculated Risk on 6/10/2014 07:18:00 PM

It is fun to try to guess future headlines, and it looks like we might see "Mortgage Rates down year-over-year" in a couple of weeks.

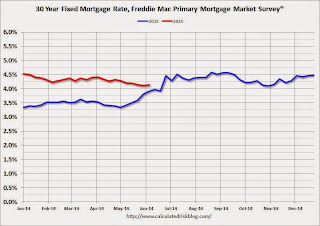

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates increased today to 4.25% from 4.23% yesterday.

One year ago rates were at 4.05% and rising. If the current rate holds, mortgage rates will be down year-over-year in less than 2 weeks.

Here is a table from Mortgage News Daily:

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the Freddie Mac PMMS® - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.25% according to Mortgage News Daily).

Las Vegas Real Estate in May: Year-over-year Non-contingent Inventory Doubles, Distressed Sales and Cash Buying down sharply

by Calculated Risk on 6/10/2014 01:12:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices rebound in May, GLVAR reports

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in May was 3,450, up from 3,215 in April, but down from 3,884 one year ago.There are several key trends that we've been following:

GLVAR said 40.2 percent of all existing local homes sold in May were purchased with cash. That’s down from 41.4 percent in April, well short of the February 2013 peak of 59.5 percent and suggesting that investors are accounting for a smaller percentage of local buyers.

...

In May, 7.9 percent of all existing local home sales were short sales, down substantially from 12.4 in April. Another 9.1 percent of all May sales were bank-owned properties, down from 11.4 in April.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in May was 13,637. That’s down 1.4 percent from 13,833 in April and down 1.3 percent from one year ago.

By the end of May, GLVAR reported 6,615 single-family homes listed without any sort of offer. That’s up 3.0 percent from 6,420 such homes listed in April, and a 100.6 percent jump from one year ago. For condos and townhomes, the 2,258 properties listed without offers in May represented a 0.3 percent decrease from 2,264 such properties listed in April, but a 76.8 percent jump from one year ago.

emphasis added

1) Overall sales were down about 11% year-over-year.

2) Conventional (equity, not distressed) sales were up 27% year-over-year. In May 2013, only 57.9% of all sales were conventional equity. This year, in May 2014, 83.0% were equity sales.

3) The percent of cash sales has declined year-over-year from 57.9% in May 2013 to 40.2% in May 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 100.6% year-over-year (double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory (a major theme for 2014) suggests price increases will slow.

FNC: Residential Property Values increased 8.4% year-over-year in April

by Calculated Risk on 6/10/2014 12:31:00 PM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their April index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.6% from March to April (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.6% and 0.7% in April. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year change slowed in April, with the 100-MSA composite up 8.4% compared to April 2013. The index is still down 21.7% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through April 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

This might be the beginning of a slowdown in prices increases in the FNC index.

The April Case-Shiller index will be released on Tuesday, June 24th, and I expect Case-Shiller to show a slowdown in price increases.

BLS: Jobs Openings increase sharply to 4.5 million in April

by Calculated Risk on 6/10/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.5 million job openings on the last business day of April, up from 4.2 million in March, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in April for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in April to 4.455 million from 4.166 million in March.

The number of job openings (yellow) are up 17% year-over-year compared to April 2013.

Quits are up 11% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the third consecutive month, and that quits are increasing.