by Calculated Risk on 5/16/2014 03:47:00 PM

Friday, May 16, 2014

Sacramento Housing in April: Total Sales down 5% Year-over-year, Equity (Conventional) Sales up 17%, Active Inventory increases 46%

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April 2014, 16.3% of all resales (single family homes) were distressed sales. This was unchanged from last month, and down from 31.9% in April 2013.

The percentage of REOs was at 7.2%, and the percentage of short sales was 9.1%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2 years (blue).

Active Listing Inventory for single family homes increased 46.3% year-over-year in April.

Cash buyers accounted for 21.9% of all sales, down from 37.2% in April 2013, and down from 22.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 4.8% from April 2013, but conventional equity sales were up 17.0% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas.

A few comments on Housing Starts

by Calculated Risk on 5/16/2014 12:46:00 PM

The Census Bureau reported that housing starts increased 26.4 percent year-over-year in April to a 1.072 million seasonally adjusted annual rate (SAAR). A few points:

1) This is just one month of data (the usual caveat).

2) Most of the month-to-month increase was due to multi-family starts (Multi-family is volatile month-to-month).

3) Some of the increase appears to be payback from the severe weather earlier this year.

4) This was an easy year-over-year comparison since starts in April last year were near the low for 2013 (see first graph below).

Most of the commentary today is focused on the increase in multi-family starts - and that single family starts have stalled. Yes, but going forward I expect multi-family starts to mostly move sideways and for single family starts to pickup (the opposite of most of the commentary).

There were 301 thousand total housing starts during the first four months of 2014 (not seasonally adjusted, NSA), up 6% from the 284 thousand during the same period of 2013. Single family starts are up close to 2%, and multi-family starts up 17%. The weak start to 2014 was due to several factors: severe weather, higher mortgage rates, higher prices and probably supply constraints in some areas.

It is also important to note that Q1 was a difficult year-over-year comparison for housing starts. There was a huge surge for housing starts in Q1 2013 (up 34% over Q1 2012). Then starts softened a little over the next 7 months until November.

Click on graph for larger image.

Click on graph for larger image.

This year, I expect starts to be stronger over the next few quarters (I expect Q1 was the weakest) - and more starts combined with an easier comparison means starts will be up solidly year-over-year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts have been moving up (but the increase has slowed recently), and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: "State unemployment rates were generally lower in April"

by Calculated Risk on 5/16/2014 10:57:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in April. Forty-three states had unemployment rate decreases, two states had increases, and five states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island had the highest unemployment rate among the states in April, 8.3 percent. North Dakota again had the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. No state has double digit or even a 9% unemployment rate. Only Rhode Island (8.3%) and Nevada are at or above 8%.

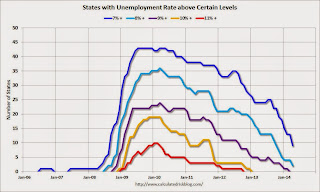

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 9% (purple), 2 states are at or above 8% (light blue), and 9 states are at or above 7% (blue).

Preliminary May Consumer Sentiment decreases to 81.8

by Calculated Risk on 5/16/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May was at 81.8, down from 84.1 in April.

This was below the consensus forecast of 84.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Housing Starts at 1.072 Million Annual Rate in April

by Calculated Risk on 5/16/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,072,000. This is 13.2 percent above the revised March estimate of 947,000 and is 26.4 percent above the April 2013 rate of 848,000.

Single-family housing starts in April were at a rate of 649,000; this is 0.8 percent above the revised March figure of 644,000. The April rate for units in buildings with five units or more was 413,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,080,000. This is 8.0 percent above the revised March rate of 1,000,000 and is 3.8 percent above the April 2013 estimate of

Single-family authorizations in April were at a rate of 602,000; this is 0.3 percent above the revised March figure of 600,000. Authorizations of units in buildings with five units or more were at a rate of 453,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in April (Multi-family is volatile month-to-month).

Single-family starts (blue) also increased in April.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was above expectations of 980 thousand starts in April. Note: Starts for February and March were revised up slightly. I'll have more later.

Thursday, May 15, 2014

Friday: Housing Starts, Consumer Sentiment

by Calculated Risk on 5/15/2014 08:39:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" soon).

In April 2013, starts were at a 852 thousand seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.022 million SAAR in April (possible). For NDD to win, starts would have to fall to 752 thousand SAAR (not likely). NDD could also "win" if permits fall to 790 thousand SAAR from 905 thousand SAAR in April 2013 (possible).

Friday:

• At 8:30 AM, Housing Starts for April. Total housing starts were at 946 thousand (SAAR) in March. Single family starts were at 635 thousand SAAR in March. The consensus is for total housing starts to increase to 980 thousand (SAAR) in April.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 84.5, up from 84.1 in April.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for April 2014.

Key Inflation Measures Show Increase, but still Low year-over-year in April

by Calculated Risk on 5/15/2014 04:55:00 PM

Note: The year-over-year change increased in April, but it is important to note that CPI declined in April 2013 (and core CPI was essentially unchanged) - and April 2013 was dropped out of the calculation this month so some increase in the year-over-year change was expected. Looking forward, I think inflation (year-over-year) will increase a little this year as growth picks up, but too much inflation will not be a concern this year.

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also increased 0.2% (2.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.2% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.8%. Core PCE is for March and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 2.9% annualized, and core CPI increased 2.9% annualized.

In general these measures suggest inflation remains below the Fed's target.

Earlier: Philly and NY Fed Manufacturing Surveys suggest Solid Expansion in May

by Calculated Risk on 5/15/2014 01:48:00 PM

From the Philly Fed: May Manufacturing Survey

The diffusion index of current general activity decreased slightly from a reading of 16.6 in April to 15.4 this month. The index has remained positive for three consecutive months, following the weather‐influenced negative reading in February.This was above the consensus forecast of a reading of 12.5 for May.

...

Indicators suggest slightly improved labor market conditions this month. The employment index remained positive for the 11th consecutive month but increased only 1 point [to 7.8].

emphasis added

From the NY Fed: Empire State Manufacturing Survey

Business conditions improved significantly for New York manufacturers, according to the May 2014 survey. On the heels of a rather weak reading of just 1.3 in April, the general business conditions index shot up eighteen points to 19.0, its highest level since mid-2010. ...This was well above the consensus forecast of 5.0

Employment expanded significantly; although the average workweek index held steady at 2.2, the index for number of employees rose thirteen points to 20.9. Indexes for the six-month outlook were highly optimistic, with the future general business conditions index rising to 44.0, its highest level in more than two years.

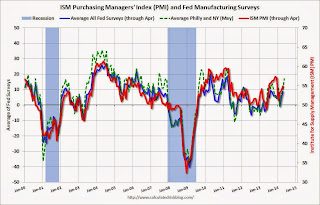

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys is at the highest level since 2011, and this suggests stronger expansion in the ISM report for May.

NAHB: Builder Confidence decreased slightly in May to 45

by Calculated Risk on 5/15/2014 10:55:00 AM

Catching up: The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45 in May, down from 46 in April. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Remains in Holding Pattern

Builder confidence in the market for newly built, single-family homes in May fell one point to 45 from a downwardly revised April reading of 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

...

“Builders are waiting for consumers to feel more secure about their financial situation,” said NAHB Chief Economist David Crowe. “Once job growth becomes more consistent, consumers will return to the market in larger numbers and that will boost builder confidence.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The index’s components were mixed in May. The component gauging sales expectations in the next six months rose one point to 57 and the component measuring buyer traffic increased two points to 33. The component gauging current sales conditions fell two points to 48.

Looking at the three-month moving averages for regional HMI scores, the South rose one point to 48 while the Midwest fell a single point to 47 and the West posted a four-point drop to 47. The Northeast held steady at 33.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the fourth consecutive reading below 50.

MBA: "Delinquency and Foreclosure Rates Continue to Improve" in Q1

by Calculated Risk on 5/15/2014 10:00:00 AM

From the MBA: Delinquency and Foreclosure Rates Continue to Improve

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.11 percent of all loans outstanding at the end of the first quarter of 2014, the lowest level since the fourth quarter of 2007. The delinquency rate decreased 28 basis points from the previous quarter, and 114 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 2.65 percent, down 21 basis points from the fourth quarter and 90 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the first quarter of 2008.

The percentage of loans on which foreclosure actions were started during the first quarter fell to 0.45 percent from 0.54 percent, a decrease of nine basis points, and the lowest level since the second quarter of 2006.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 5.04 percent, a decrease of 37 basis points from last quarter, and a decrease of 135 basis points from the first quarter of last year. Similar to the previous quarter, 75 percent of seriously delinquent loans were originated in 2007 and earlier, with another 20 percent originated between 2008 and 2010. Loans originated in 2011 and later only accounted for five percent of all seriously delinquent loans.

“We are seeing sustained and significant improvement in overall mortgage performance,” said Mike Fratantoni, MBA’s Chief Economist. “A more stable and stronger job market, coupled with strong credit standards on new loans, has kept delinquency rates on recent vintages low, while the portfolio of loans made pre-crisis is steadily being resolved. Increasing home prices, caused by tight inventories of homes for sale, have helped build an equity cushion for many new borrowers and have helped some homeowners who had been underwater regain positive equity in their properties. The increase in values also helps to facilitate sales of distressed properties, which may further expedite the pace of resolution of pre-crisis loans.”

“Judicial states continue to account for the majority of loans in foreclosure, making up almost 70 percent of loans in foreclosure, while only representing about 40 percent of loans serviced. Of the 17 states that had a higher foreclosure inventory rate than the national average, 15 of those were judicial states. While the percentages of loans in foreclosure dropped in both judicial and non-judicial states, the average rate for judicial states was 4.6 percent compared to the average rate of 1.4 percent for non-judicial states.

“New Jersey, a state with a judicial foreclosure system, was the only state in the nation to see an increase in loans in foreclosure over the previous quarter and now has the highest percentage of loans in foreclosure in the nation with eight percent of its loans in the foreclosure process. New Jersey also had the highest percentage of new foreclosures started in the first quarter of 2014, but also had a significant drop in its loans that were 90+ days delinquent, a sign that a large portion of loans previously held in the 90+ day delinquency category entered the foreclosure process during the quarter. emphasis added

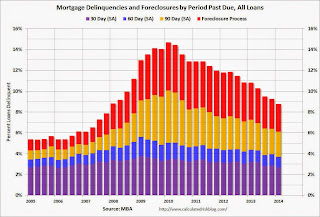

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 2.70% from 2.89% in Q4. This is a normal level.

Delinquent loans in the 60 day bucket decreased to 1.00% in Q1, from 1.06% in Q4. This is slightly above normal.

The 90 day bucket decreased to 2.41% from 2.45%. This is still way above normal (just under 1.0% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 2.65% from 2.86% and is now at the lowest level since Q1 2008.

This survey has shown steady improvement in delinquency and foreclosure rates, but it will take a few more years to work through the backlog - especially in judicial foreclosure states.

Note 1: Most of the remaining problems are with loans made in 2007 or earlier: "75 percent of seriously delinquent loans were originated in 2007 and earlier" and are in judicial foreclosure states.

Note 2: This survey includes all mortgage loans (including terrible lending via Wall Street). The total serious delinquency rate is 5.04% compared to 2.2% for Fannie and Freddie.