by Calculated Risk on 5/15/2014 01:48:00 PM

Thursday, May 15, 2014

Earlier: Philly and NY Fed Manufacturing Surveys suggest Solid Expansion in May

From the Philly Fed: May Manufacturing Survey

The diffusion index of current general activity decreased slightly from a reading of 16.6 in April to 15.4 this month. The index has remained positive for three consecutive months, following the weather‐influenced negative reading in February.This was above the consensus forecast of a reading of 12.5 for May.

...

Indicators suggest slightly improved labor market conditions this month. The employment index remained positive for the 11th consecutive month but increased only 1 point [to 7.8].

emphasis added

From the NY Fed: Empire State Manufacturing Survey

Business conditions improved significantly for New York manufacturers, according to the May 2014 survey. On the heels of a rather weak reading of just 1.3 in April, the general business conditions index shot up eighteen points to 19.0, its highest level since mid-2010. ...This was well above the consensus forecast of 5.0

Employment expanded significantly; although the average workweek index held steady at 2.2, the index for number of employees rose thirteen points to 20.9. Indexes for the six-month outlook were highly optimistic, with the future general business conditions index rising to 44.0, its highest level in more than two years.

Click on graph for larger image.

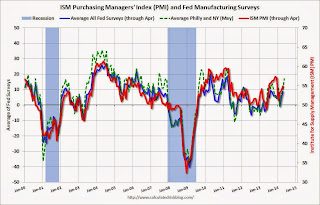

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys is at the highest level since 2011, and this suggests stronger expansion in the ISM report for May.

NAHB: Builder Confidence decreased slightly in May to 45

by Calculated Risk on 5/15/2014 10:55:00 AM

Catching up: The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45 in May, down from 46 in April. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Remains in Holding Pattern

Builder confidence in the market for newly built, single-family homes in May fell one point to 45 from a downwardly revised April reading of 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

...

“Builders are waiting for consumers to feel more secure about their financial situation,” said NAHB Chief Economist David Crowe. “Once job growth becomes more consistent, consumers will return to the market in larger numbers and that will boost builder confidence.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The index’s components were mixed in May. The component gauging sales expectations in the next six months rose one point to 57 and the component measuring buyer traffic increased two points to 33. The component gauging current sales conditions fell two points to 48.

Looking at the three-month moving averages for regional HMI scores, the South rose one point to 48 while the Midwest fell a single point to 47 and the West posted a four-point drop to 47. The Northeast held steady at 33.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the fourth consecutive reading below 50.

MBA: "Delinquency and Foreclosure Rates Continue to Improve" in Q1

by Calculated Risk on 5/15/2014 10:00:00 AM

From the MBA: Delinquency and Foreclosure Rates Continue to Improve

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.11 percent of all loans outstanding at the end of the first quarter of 2014, the lowest level since the fourth quarter of 2007. The delinquency rate decreased 28 basis points from the previous quarter, and 114 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 2.65 percent, down 21 basis points from the fourth quarter and 90 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the first quarter of 2008.

The percentage of loans on which foreclosure actions were started during the first quarter fell to 0.45 percent from 0.54 percent, a decrease of nine basis points, and the lowest level since the second quarter of 2006.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 5.04 percent, a decrease of 37 basis points from last quarter, and a decrease of 135 basis points from the first quarter of last year. Similar to the previous quarter, 75 percent of seriously delinquent loans were originated in 2007 and earlier, with another 20 percent originated between 2008 and 2010. Loans originated in 2011 and later only accounted for five percent of all seriously delinquent loans.

“We are seeing sustained and significant improvement in overall mortgage performance,” said Mike Fratantoni, MBA’s Chief Economist. “A more stable and stronger job market, coupled with strong credit standards on new loans, has kept delinquency rates on recent vintages low, while the portfolio of loans made pre-crisis is steadily being resolved. Increasing home prices, caused by tight inventories of homes for sale, have helped build an equity cushion for many new borrowers and have helped some homeowners who had been underwater regain positive equity in their properties. The increase in values also helps to facilitate sales of distressed properties, which may further expedite the pace of resolution of pre-crisis loans.”

“Judicial states continue to account for the majority of loans in foreclosure, making up almost 70 percent of loans in foreclosure, while only representing about 40 percent of loans serviced. Of the 17 states that had a higher foreclosure inventory rate than the national average, 15 of those were judicial states. While the percentages of loans in foreclosure dropped in both judicial and non-judicial states, the average rate for judicial states was 4.6 percent compared to the average rate of 1.4 percent for non-judicial states.

“New Jersey, a state with a judicial foreclosure system, was the only state in the nation to see an increase in loans in foreclosure over the previous quarter and now has the highest percentage of loans in foreclosure in the nation with eight percent of its loans in the foreclosure process. New Jersey also had the highest percentage of new foreclosures started in the first quarter of 2014, but also had a significant drop in its loans that were 90+ days delinquent, a sign that a large portion of loans previously held in the 90+ day delinquency category entered the foreclosure process during the quarter. emphasis added

Click on graph for larger image.

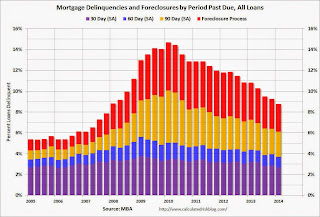

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 2.70% from 2.89% in Q4. This is a normal level.

Delinquent loans in the 60 day bucket decreased to 1.00% in Q1, from 1.06% in Q4. This is slightly above normal.

The 90 day bucket decreased to 2.41% from 2.45%. This is still way above normal (just under 1.0% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 2.65% from 2.86% and is now at the lowest level since Q1 2008.

This survey has shown steady improvement in delinquency and foreclosure rates, but it will take a few more years to work through the backlog - especially in judicial foreclosure states.

Note 1: Most of the remaining problems are with loans made in 2007 or earlier: "75 percent of seriously delinquent loans were originated in 2007 and earlier" and are in judicial foreclosure states.

Note 2: This survey includes all mortgage loans (including terrible lending via Wall Street). The total serious delinquency rate is 5.04% compared to 2.2% for Fannie and Freddie.

Fed: Industrial Production decreased 0.6% in April

by Calculated Risk on 5/15/2014 09:27:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.6 percent in April 2014 after having risen about 1 percent in both February and March. In April, manufacturing output fell 0.4 percent. The index had increased substantially in February and March following a decrease in January; severe weather had restrained production early in the quarter. The output of utilities dropped 5.3 percent in April, as demand for heating returned toward normal levels. The production at mines increased 1.4 percent following a gain of 2.0 percent in March. At 102.7 percent of its 2007 average, total industrial production in April was 3.5 percent above its level of a year earlier. The capacity utilization rate for total industry decreased 0.7 percentage point in April to 78.6 percent, a rate that is 1.5 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.6% is 1.5 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.6% in April to 102.7. This is 23% above the recession low, and 2.0% above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations.

Weekly Initial Unemployment Claims decrease to 297,000, CPI increases 0.3%

by Calculated Risk on 5/15/2014 08:30:00 AM

From the BLS on CPI:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ....The consensus was for a 0.3% increase in CPI in April and for core CPI to increase 0.1%. I'll have more later on inflation.

The index for all items less food and energy rose 0.2 percent in April ... The all items index increased 2.0 percent over the last 12 months; this compares to a 1.5 percent increase for the 12 months ending March, and is the largest 12-month increase since July. The index for all items less food and energy has increased 1.8 percent over the last 12 months.

The DOL reports:

In the week ending May 10, the advance figure for seasonally adjusted initial claims was 297,000, a decrease of 24,000 from the previous week's revised level. This is the lowest level for initial claims since May 12, 2007 when they were 297,000. The previous week's level was revised up by 2,000 from 319,000 to 321,000. The 4-week moving average was 323,250, a decrease of 2,000 from the previous week's revised average. The previous week's average was revised up by 500 from 324,750 to 325,250.The previous week was revised up from 319,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 323,250.

This was below the consensus forecast of 317,000. The 4-week average is close to normal levels for an expansion.

Wednesday, May 14, 2014

Thursday: CPI, Unemployment Claims, Industrial Production, Yellen and Much More; Plus San Diego Fire Photo

by Calculated Risk on 5/14/2014 07:17:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 317 thousand from 319 thousand.

• Also at 8:30 AM, the Consumer Price Index for April. The consensus is for a 0.3% increase in CPI in April and for core CPI to increase 0.1%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for May. The consensus is for a reading of 5.0, up from 1.3 in April (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for April. The consensus is for no change in Industrial Production, and for Capacity Utilization to decrease to 79.1%.

• At 10:00 AM, the May NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in April. Any number below 50 indicates that more builders view sales conditions as poor than good.

• Also at 10:00 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 12.5, down from 16.6 last month (above zero indicates expansion).

• Also at 10:00 AM, the Mortgage Bankers Association (MBA) Q1 2014 National Delinquency Survey (NDS).

• At 6:10 PM, Speech by Fed Chair Janet Yellen, Small Businesses and the Economy, National Small Business Week 2014, Washington, D.C

Click on photo for larger image.

Click on photo for larger image.

The San Diego fire today from Color Spot's nursery in Fallbrook.

Photo from a friend at Color Spot Nurseries.

Lawler on RealtyTrac and Cash Buyers

by Calculated Risk on 5/14/2014 04:29:00 PM

From housing economist Tom Lawler:

In a report that got a huge amount of media coverage, RealtyTrac alleged that the all-cash share of home purchases hit a record 42.7% last quarter, up from 19.1% in the first quarter of 2013. This increase was “shockingly” large, and occurred despite a decline in the institutional investor share of home purchases. If correct, it is not surprising that this would be “big news.” In reality, however, they are not ...

Here is a chart from RealtyTrac. The blue line is the All-Cash Share.

According to RealtyTrac’s tabulations, the all-cash share of home purchases surged in the third quarter of 2013, and has continued to increase, and last quarter it was more than double the year-earlier share.

Data from other sources, in contrast, strongly indicate that the all-cash share of home purchases has been declining over the last year – not just MLS-based reports (such as the one’s I track, but from another entity (CoreLogic) that uses property and mortgage records.

The RealtyTrac data from 2011 through the second quarter of 2013 show a MASSIVELY lower all-cash share of home purchases than does CoreLogic, or that local MLS data would suggest. CoreLogic, e.g., estimated that the all-cash share of home purchases in the first quarter of 2013 was a tad over 40%, compared to RealtyTrac’s estimate of 19.1%. While I don’t have CoreLogic’s estimates for Q1 2014 yet, I’m pretty sure it will show a drop from the first quarter of 2013 of at least five percentage points. (I’m hoping CoreLogic will send me their Q1/2014 estimates soon.)

Below are some all-cash shares of home purchases for various areas – most based on MLS data, but some based on property records tabulated by Dataquick – for March of this year vs. March 2013.

In looking at both these data and the CoreLogic estimates, how can it POSSIBLY be true that the all-cash share of home sales in the first quarter of 2013 was just 19.1%, or that the all-cash share of home sales in the first quarter of 2014 was more than double that of 2013?

The simple answer is ...it can’t.

| All-Cash Share | ||||||||

|---|---|---|---|---|---|---|---|---|

| Mar-14 | Mar-13 | |||||||

| Las Vegas | 43.1% | 57.5% | ||||||

| Seattle* | 22.8% | 23.9% | ||||||

| Phoenix | 33.1% | 41.5% | ||||||

| Sacramento | 22.5% | 36.5% | ||||||

| Miami* | 62.5% | 66.6% | ||||||

| Mid-Atlantic | 19.9% | 20.6% | ||||||

| Orlando | 44.6% | 55.6% | ||||||

| Bay Area CA* | 25.0% | 31.0% | ||||||

| So. California* | 29.1% | 35.1% | ||||||

| Toledo | 40.7% | 38.9% | ||||||

| Wichita | 32.0% | 27.9% | ||||||

| Des Moines | 20.8% | 19.1% | ||||||

| Peoria | 21.3% | 21.7% | ||||||

| Florida SF | 45.5% | 48.3% | ||||||

| Florida C/TH | 70.9% | 74.9% | ||||||

| Tucson | 33.5% | 35.0% | ||||||

| Omaha | 20.3% | 22.1% | ||||||

| Georgia*** | 33.8% | NA | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

DataQuick on California Bay Area: April Home Sales down slightly Year-over-year, Non-Distressed sales up 15% Year-over-year

by Calculated Risk on 5/14/2014 02:58:00 PM

From DataQuick: Bay Area Home Prices Continue to Rise; Sales Up from March, Flat Yr/Yr

A total of 7,555 new and resale houses and condos were sold in the nine-county Bay Area last month. That was up 19.8 percent from 6,308 in March and down 0.9 percent from 7,621 in April a year ago, according to San Diego-based DataQuick.Sales declined 0.9% year-over-year in April compared to a 12.9% year-over-year decline in March.

Bay Area sales generally increase from March to April, but the 19.8 percent increase this year was high. The average increase is 4.8 percent. ...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 3.6 percent of resales in April, down from a revised 4.3 percent the month before, and down from 8.4 percent a year ago. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is 9.9 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 3.8 percent of Bay Area resales last month. That was down from an estimated 4.6 percent in March and down from 11.8 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 20.2 percent of all Bay Area homes. That was down from March’s 20.7 percent and down from 24.2 percent for April a year ago.

emphasis added

And even though total sales were still down slightly year-over-year, the percent of non-distressed sales is up almost 15%. There were 7,555 total sales this year in April, and 7.4% were distressed. In April 2013, there were 7,621 total sales, and 20.1% were distressed. A big positive change.

Flashback to March 2009

by Calculated Risk on 5/14/2014 12:13:00 PM

For fun: This morning Barry Ritholtz reminded me of an article by Charlie Gasparino from March 2009: Is the Worst Yet to Come?

[T]hey can’t believe what they are witnessing: an economic agenda that is contradictory at best, and possibly reckless in its extreme. Policies that will certainly make a very bad situation even worse ...Gasparino basically called the market bottom! (Ritholtz wrote yesterday: The Parasites of Finance)

Not to pick on Gasparino - we all make bad calls - but here is what I wrote at the same time: What is a depression?

It seems like the "D" word is everywhere. And that raises a question: what is a depression? Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.This was one of a series of my more positive posts in 2009 (after being very negative for several years). Not perfect, but clearly my outlook was changing.

...

I still think a depression is very unlikely. More likely the economy will bottom later this year or at least the rate of economic decline will slow sharply. I also still believe that the eventual recovery will be very sluggish, and it will take some time to return to normal growth.

...

It is possible - see Looking for the Sun - that new home sales and housing starts will bottom in 2009, but any recovery in housing will probably be sluggish.

That leaves Personal Consumption Expenditures (PCE) - and as households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

Note:

1) The recession ended in June 2009 according to NBER.

2) Housing starts bottomed in 2009, but new home sales didn't bottom until 2010-2011. Note: I predicted house prices would continue to decline, and finally called the bottom for house prices in Feb 2012.

3) The recovery has been sluggish - for housing, PCE, and the overall economy.

Sometimes it is fun to look back. I remember watching CNBC at that time, and it seemed every talking head was bearish - and many were predicting a depression. Gasparino wasn't alone, and those of us looking for the economy to bottom were definitely in the minority.

Closing a Loophole in California's Prop 13 (Property Taxes)

by Calculated Risk on 5/14/2014 09:25:00 AM

From Melanie Mason at the LA Times: Howard Jarvis group won't oppose bill to close Prop. 13 loophole

The legislation would eliminate the ability of businesses to elude higher property taxes by carving up ownership in commercial property purchases so no one has a majority stake. The tactic averts a reassessment of the property that can increase its taxes.This has been going on for years, and there lower properties taxes on existing commercial properties tends to discourage some new construction (hard to compete). This is a positive step and is supported by just about everyone.

The 2006 sale of Santa Monica's Fairmont Miramar Hotel to computer magnate Michael Dell cast one of the brightest lights on that loophole. Dell divided ownership shares among his wife and two business partners, with no one taking on more than 49% of the property.

The move saved him about $1 million a year in property taxes.