by Calculated Risk on 5/09/2014 03:10:00 PM

Friday, May 09, 2014

The Projected Improvement in Life Expectancy

Here is something different, but it is important when looking at demographics ...

The following data is from the CDC United States Life Tables, 2009 by Elizabeth Arias released earlier this year.

The most frequently used life table statistic is life expectancy (ex), which is the average number of years of life remaining for persons who have attained a given age (x). ... Another way of assessing the longevity of the period life table cohort is by determining the proportion that survives to specified ages. ... To illustrate, 56,572 persons out of the original 2009 hypothetical life table cohort of 100,000 (or 56.6%) were alive at exact age 80. In other words, the probability that a person will survive from birth to age 80, given 2009 age-specific mortality, is 56.6%.Instead of look at life expectancy, here is a graph of survivors out of 100,000 born alive, by age for three groups: those born in 1900-1902, born in 1949-1951 (baby boomers), and born in 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.There was a dramatic change between those born in 1900 (blue) and those born mid-century (orange). The risk of infant and early childhood deaths dropped sharply, and the risk of death in the prime working years also declined significantly.

The CDC is projecting further improvement for childhood and prime working age for those born in 2009, but they are also projecting that people will live longer.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.

The second graph uses the same data but looks at the number of people who die before a certain age, but after the previous age. As an example, for those born in 1900 (blue), 12,448 of the 100,000 born alive died before age 1, and another 5,748 died between age 1 and age 5.The peak age for deaths didn't change much for those born in 1900 and 1950 (between 76 and 80, but many more people born in 1950 will make it).

Now the CDC is projection the peak age for deaths - for those born in 2009 - will increase to 86 to 90! Using these stats - for those born in 2014 - about half will make it to the next century.

Also the number of deaths for those younger than 20 will be very small (down to mostly accidents, guns, and drugs). Self-driving cars might reduce the accident components of young deaths.

An amazing statistic: for those born in 1900, about 13 out of 100,000 made it to 100. For those born in 1950, 199 are projected to make to 100 - an significant increase. Now the CDC is projecting that 2,056 out of 100,000 born in 2009 will make it to 100. Stunning!

Some people look at this data and worry about supporting all the old people. To me, this is all great news - the vast majority of people can look forward to a long life - with fewer people dying in childhood or during their prime working years. Awesome!

Hotels: On track for Strongest Year since 2000

by Calculated Risk on 5/09/2014 12:03:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 3 May

In year-over-year measurements, the industry’s occupancy increased 7.5 percent to 67.4 percent. Average daily rate increased 5.6 percent to finish the week at US$116.41. Revenue per available room for the week was up 13.6 percent to finish at US$78.42.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

emphasis added

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at the highest level since 2000.

The following graph shows the seasonal pattern for the hotel occupancy rate for the last 15 years using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels. Note: 2001 was briefly worse than 2009 in September.

Year 2000 was the best year for hotel occupancy until late in the year when 2005 had the highest occupancy rate (due to hurricane Katrina).

Right now it looks like 2014 will be the best year since 2000 for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

BLS: Jobs Openings at 4.0 million in March

by Calculated Risk on 5/09/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.0 million job openings on the last business day of March, little changed from 4.1 million in February, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in March for total nonfarm and total private. The quits level was little changed in government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 4.014 million from 4.125 million in February.

The number of job openings (yellow) are up 3.5% year-over-year compared to March 2013.

Quits increased in March and are up sharply year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are over 4 million for the second consecutive month, and that quits are increasing.

Thursday, May 08, 2014

Friday: Job Openings

by Calculated Risk on 5/08/2014 08:01:00 PM

Q1 GDP looks worse. Q2 GDP looks better. A couple of short excerpts ...

From the WSJ on Q1: Trade Data Indicate Economy Contracted

J.P. Morgan Chase economists now estimate GDP contracted at a 0.8% pace in the first three months of 2014. Macroeconomic Advisers pegged the decline at 0.6%. Even some of the more optimistic estimates point to slight output shrinkage in the first quarter. Barclays Capital economists see a 0.2% decline and BNP Paribas put the GDP drop at a 0.1% pace.And on Q2 from the WSJ: Economists See Growth Rebound

According to The Wall Street Journal's May survey of 48 economists, the consensus forecast is for annualized real growth in gross domestic product of 3.3%, better than the 3% pace projected in the April survey. ... Nine in the Journal's survey are forecasting second-quarter growth of 4% or better.Q2 should be solid.

Friday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for March from the BLS. In February, the number of job openings were up 4% year-over-year compared to February 2013, and Quits were up about 5% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.5% increase in inventories.

Will Mortgage Rates be down year-over-year in late June?

by Calculated Risk on 5/08/2014 05:48:00 PM

It is fun to try to guess future headlines, and it looks like we might see "Mortgage Rates down year-over-year" in late June.

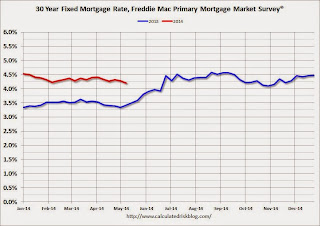

From Freddie Mac: 30-Year Fixed-Rate Mortgage Hits Low for the Year

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down further and following the decline in Treasury yields as the economic growth for the first quarter came in well below market expectations. At 4.21 percent, the 30-year fixed-rate mortgage is at its lowest since the week of November 7, 2013.

30-year fixed-rate mortgage (FRM) averaged 4.21 percent with an average 0.6 point for the week ending May 8, 2014, down from last week when it averaged 4.29 percent. A year ago at this time, the 30-year FRM averaged 3.42 percent.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the PMMS - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.21%).

Las Vegas Real Estate in April: Year-over-year Non-contingent Inventory Doubles, Median Price declines

by Calculated Risk on 5/08/2014 03:31:00 PM

Note: Usually I ignore the median price because it can be skewed by the mix of homes sold. I mention the median in this post because I'm looking for price increases to flatten out in Las Vegas because of the rapid increase in inventory - and the median might be an early indicator.

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports slight dip in Southern Nevada home prices

GLVAR reported the median price of existing single-family homes sold in Southern Nevada during April was $192,000, down 1.5 percent from $195,000 in March, but still up 15.0 percent from $167,000 in April of 2013.There are several key trends that we've been following:

...

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in April was 3,215, up from 3,094 in March, but down from 3,789 one year ago.

GLVAR said 41.4 percent of all existing local homes sold in April were purchased with cash. That’s down from 43.1 percent in March, and well short of the February 2013 peak of 59.5 percent.

...

GLVAR continued to track the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. In April, 12.4 percent of all existing local home sales were short sales, down from 12.9 percent in March. Another 11.4 percent of all April sales were bank-owned properties, down from 11.9 in March.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in April was 13,833. That’s down 0.8 percent from 13,944 in March and down 0.3 percent from one year ago. GLVAR reported a total of 3,697 condos and townhomes listed for sale on its MLS in April, down 0.1 percent from 3,701 listed in March, but up 6.1 percent from one year ago.

By the end of April, GLVAR reported 6,420 single-family homes listed without any sort of offer. That’s down 0.8 percent from 6,470 such homes listed in March, but a 103.1 percent jump from one year ago. For condos and townhomes, the 2,264 properties listed without offers in April represented a 1.4 percent decrease from 2,295 such properties listed in March, but a 79.5 percent increase from one year ago.

emphasis added

1) Overall sales were down about 15% year-over-year.

2) Conventional (equity, not distressed) sales were up 12% year-over-year. In April 2013, only 57.5% of all sales were conventional. This year, in April 2014, 76.2% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) Non-contingent inventory (year-over-year) continues to increase, but the year-over-year rate of increase is slowing. Non-contingent inventory is up 103.1% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014), and this might be showing up in the median price.

Trulia: Asking House Prices up 9.0% year-over-year in April, "smallest year-over-year increase in 11 months"

by Calculated Risk on 5/08/2014 02:21:00 PM

From Trulia chief economist Jed Kolko: Yearly Price Gain Smallest in 11 Months, Despite Steady Monthly Rise

Nationally, asking prices rose 0.8% month-over-month and 2.8% quarter-over-quarter in April, seasonally adjusted. Those gains are in line with March increases and show that home prices continue to rapidly climb.In November 2013, year-over-year asking prices were up 12.2%. In December, the year-over-year increase in asking home prices slowed slightly to 11.9%. In January, the year-over-year increase was 11.4%, in February, the increase was 10.4%, in March the increase was 10.0%, and now 9.0%.

However, asking prices rose 9.0% year-over-year, which is the smallest year-over-year increase in 11 months. Why are year-over-year price increases slipping despite month-over-month and quarter-over-quarter increases holding steady? One reason is that the biggest price spike during the housing recovery happened between February and April 2013, and the year-over-year change in April 2014 no longer includes those months.

...

Nationally, rents have increased 4.5% year-over-year and are up more than 10% in San Francisco, Oakland, and Denver.

emphasis added

This suggests prices are still increasing, but at a slightly slower pace.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.

Note: in the linked article, Kolko also has an interesting discussion on why "construction still lags in housing markets with biggest price rebounds".

NAHB: Builder Confidence improves year-over-year in the 55+ Housing Market in Q1

by Calculated Risk on 5/08/2014 11:41:00 AM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low. Note that this index is Not Seasonally Adjusted (NSA)

From the NAHB: Single-family 55+ HMI Rises to Highest First Quarter Reading Since 2008

Builder confidence in the single-family 55+ housing market for the first quarter of 2014 is up year over year, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. Compared to the first quarter of 2013, the single-family index increased 4 points to a level of 50, which is the highest first-quarter reading since the inception of the index in 2008 and the 10th consecutive quarter of year over year improvements.

...

Two of the components of the 55+ single-family HMI posted increases from a year ago: present sales rose six points to 52 and expected sales for the next six months climbed nine points to 62. Meanwhile, traffic of prospective buyers held steady at a reading of 41.

...

“The 55+ segment of the housing market is stronger now than it was a year ago,” said NAHB Chief Economist David Crowe, “helped by factors like rising house prices, which has increased owners’ equity and allowed them to buy in a 55+ community. But there are still some headwinds hampering a stronger recovery, as builders in many markets are facing tight credit conditions and a lack of lots and labor.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q1 2014. The index was unchanged in Q1 at 50 - however the index is up year-over-year. This indicates that about the same numbers builders view conditions as good than as poor.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Fannie and Freddie Results in Q1: REO inventory declines, "Lower demand for foreclosed properties"

by Calculated Risk on 5/08/2014 09:15:00 AM

• Fannie Mae reported net income of $5.3 billion, the company’s ninth consecutive quarterly profit, and comprehensive income of $5.7 billion for the first quarter of 2014.

• Fannie Mae’s financial results for the first quarter of 2014 included $4.1 billion in revenue from legal settlements relating to private-label securities lawsuits.

• Fannie Mae expects to pay Treasury $5.7 billion in dividends in June 2014. With the expected June dividend payment, Fannie Mae will have paid a total of $126.8 billion in dividends to Treasury in comparison to $116.1 billion in draw requests since 2008. Dividend payments do not offset prior Treasury draws.

...

The continued decrease in the number of our seriously delinquent single-family loans, as well as the slower pace of completed foreclosures we are experiencing due to lengthy foreclosure timelines in a number of states, have resulted in a reduction in the number of REO acquisitions, while the lower demand for foreclosed properties has resulted in fewer REO dispositions in the first quarter of 2014 as compared with the first quarter of 2013.

emphasis added

From Freddie Mac:

• First quarter 2014 net income was $4.0 billion – the company’s tenth consecutive quarter of positive earnings, compared to $8.6 billion in the fourth quarter of 2013

• First quarter 2014 comprehensive income was $4.5 billion, compared to $9.8 billion in the fourth quarter of 2013

...

• Recent level of earnings is not sustainable over the long term, and earnings may be volatile from period to period

Treasury Draws and Dividend Payments at March 31, 2014

• Based on March 31, 2014 net worth of $6.9 billion, the company’s June 2014 dividend obligation will be $4.5 billion, bringing total cash dividends paid to Treasury to $86.3 billion

• Senior preferred stock held by Treasury remains $72.3 billion, as dividend payments do not reduce prior Treasury draws

...

In 1Q14, REO inventory declined primarily due to lower single-family foreclosure activity as a result of Freddie Mac’s loss mitigation efforts and a declining amount of delinquent loans.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie REO.

REO inventory decreased in Q1 for both Fannie and Freddie.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Fannie noted there was less demand for foreclosed properties.

Weekly Initial Unemployment Claims decrease to 319,000

by Calculated Risk on 5/08/2014 08:30:00 AM

The DOL reports:

In the week ending May 3, the advance figure for seasonally adjusted initial claims was 319,000, a decrease of 26,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 344,000 to 345,000. The 4-week moving average was 324,750, an increase of 4,500 from the previous week's revised average. The previous week's average was revised up by 250 from 320,000 to 320,250.The previous week was revised up from 344,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 324,750.

This was below the consensus forecast of 330,000. The 4-week average is close to normal levels for an expansion.