by Calculated Risk on 4/16/2014 08:30:00 AM

Wednesday, April 16, 2014

Housing Starts at 946 Thousand Annual Rate in March

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 946,000. This is 2.8 percent above the revised February estimate of 920,000, but is 5.9 percent below the March 2013 rate of 1,005,000.

Single-family housing starts in March were at a rate of 635,000; this is 6.0 percent above the revised February figure of 599,000. The March rate for units in buildings with five units or more was 292,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 990,000. This is 2.4 percent below the revised February rate of 1,014,000, but is 11.2 percent above the March 2013 estimate of 890,000.

Single-family authorizations in March were at a rate of 592,000; this is 0.5 percent above the revised February figure of 589,000. Authorizations of units in buildings with five units or more were at a rate of 370,000 in March.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in March (Multi-family is volatile month-to-month).

Single-family starts (blue) increased in March.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was below expectations of 965 thousand starts in March. Note: Starts for February were revised up to 920 thousand from 907 thousand. I'll have more later.

MBA: Mortgage Applications Increase

by Calculated Risk on 4/16/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 11, 2014. ...

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.47 percent from 4.56 percent, with points decreasing to 0.32 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 18% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, April 15, 2014

Wednesday: Housing Starts, Industrial Production, Yellen Speech, Beige Book

by Calculated Risk on 4/15/2014 08:04:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" in a few months, but not quite yet).

In March 2013, starts were at a 1.005 million seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.206 million SAAR in March (not likely). For NDD to win, starts would have to fall to 905 thousand SAAR (possible). NDD could also "win" if permits fall to 790 thousand SAAR from 890 thousand SAAR in March 2013 (not likely).

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for March. Total housing starts were at 907 thousand (SAAR) in February. Single family starts were at 583 thousand SAAR in February. The consensus is for total housing starts to increase to 965 thousand (SAAR) in March.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 78.8%.

• At 12:25 PM, Speech by Fed Chair Janet Yellen, Monetary Policy and the Economic Recovery, At the Economic Club of New York, New York, New York

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/15/2014 04:39:00 PM

From housing economist Tom Lawler:

Based on realtor association/board/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.64 million in March, up 0.9% from February’s preliminary pace, but down 6.5% from last March’s seasonally adjusted pace. If my estimate is correct, then first-quarter existing home sales this year would be down 6.3% from the comparable quarter of 2013. Depending on the area of the country, weather, lower distressed sales, lower investor purchases, and weak demand from primary-residence purchases (especially from first-time buyers), the latter partly reflecting lower inventories of affordably-priced homes (even though overall inventories of homes for sale were higher), contributed to the “surprisingly” weak pace of sales last quarter.

On the inventory front, I estimate (based on realtor/MLS reports, as well as reports from entities tracking listings) that the inventory of existing homes for sale as measured by the NAR increased by 4.0% from February to March to 2.080 million, which would be up 7.8% from last March’s level.

Finally, my “best guess” based on realtor reports is that the NAR’s estimate of the median existing SF home sales price in March will be up 8.7% from last March.

CR Note: The NAR is scheduled to report March existing home sales on Tuesday, April 22nd. Based on Lawler's estimates, months-of-supply increased to around 5.4 months in March - the highest level since mid-2012.

DataQuick on SoCal: March Home Sales down 14% Year-over-year, Conventional (Equity) Sales increase

by Calculated Risk on 4/15/2014 02:59:00 PM

From DataQuick: Southland Home Sales Stuck at 6-year Low; Median Price Rises to 6-Year High

Southern California home sales quickened last month compared with February, as they normally do, but remained far below average and at the lowest level for a March in six years. ... A total of 17,638 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 25.7 percent from 14,027 sales in February, and down 14.3 percent from 20,581 sales in March last year, according to San Diego-based DataQuick.Generally both distressed sales and investor buying is declining - and this is dragging down overall sales (plus inventory is still very low). And even though total sales are down year-over-year, normal equity transactions are up 9% year-over-year.

...

Sales during the month of March have ranged from a low of 12,808 in 2008 to a high of 37,030 in 2004. Last month’s sales were 26.9 percent below the average number of sales – 24,115 – for March since 1988. Sales haven’t been above average for any month in more than seven years.

“Southland home buying got off to a very slow start this year, with last month’s sales coming in at the second-lowest level for a March in nearly two decades. We see multiple reasons for this: The inventory of homes for sale remains thin in many markets. Investor purchases have fallen. The jump in home prices and mortgage rates over the past year has priced some people out of the market, while other would-be buyers struggle with credit hurdles. Also, some potential move-up buyers are holding back while they weigh whether to abandon a phenomenally low interest rate on their current mortgage in order to buy a different home,” said DataQuick analyst Andrew LePage.

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.4 percent of the Southland resale market in March. That was down from a revised 6.7 percent the prior month and down from 13.8 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 7.7 percent of Southland resales last month. That was down from a revised 9.3 percent the prior month and down from 18.7 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 27.4 percent of the homes sold last month, down from 28.9 percent in February and down from 31.2 percent a year earlier.

emphasis added

It is important to recognize that declining existing home sales is NOT a negative indicator for the housing recovery. The reason for the decline in overall existing home sales is fewer distressed sales and less investor buying. Those are positive trends!

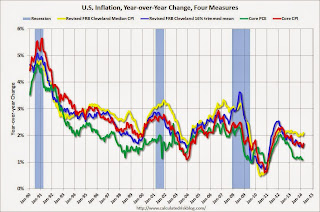

Key Inflation Measures Shows Slight Increase, but still Low in March

by Calculated Risk on 4/15/2014 11:15:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.6% annualized rate) in March. The 16% trimmed-mean Consumer Price Index also increased 0.2% (2.4% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for March here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.4% annualized rate) in March. The CPI less food and energy increased 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.7%. Core PCE is for February and increased just 1.1% year-over-year.

On a monthly basis, median CPI was at 2.6% annualized, trimmed-mean CPI was at 2.4% annualized, and core CPI increased 2.5% annualized.

These measures suggest inflation remains below the Fed's target.

NAHB: Builder Confidence increased slightly in April to 47

by Calculated Risk on 4/15/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 47 in April, up from 46 in March. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Holds Steady in April

Builder confidence in the market for newly built, single-family homes rose one point to 47 in April from a downwardly revised March reading of 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

...

“Job growth is proceeding at a solid pace, mortgage interest rates remain historically low and home prices are affordable,” said NAHB Chief Economist David Crowe. “While these factors point to a gradual improvement in housing demand, headwinds that are holding up a more robust recovery include ongoing tight credit conditions for home buyers and the fact that builders in many markets are facing a limited availability of lots and labor.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions in April held steady at 51 while the component gauging traffic of prospective buyers was also unchanged at 32. The component measuring expectations for future sales rose four points to 57.

The HMI three-month moving average was down in all four regions. The West fell nine points to 51 and the Midwest posted a four-point decline to 49 while the Northeast and South each dropped two points to 33 and 47, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the third consecutive reading below 50.

NY Fed: Empire State Manufacturing Survey indicates "business activity was flat" in April

by Calculated Risk on 4/15/2014 08:36:00 AM

Note: The BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment.I'll have more on inflation later.

...

The index for all items less food and energy also rose 0.2 percent in March.

From the NY Fed: Empire State Manufacturing Survey

The April 2014 Empire State Manufacturing Survey indicates that business activity was flat for New York manufacturers. The headline general business conditions index slipped four points to 1.3. The new orders index fell below zero to -2.8, pointing to a slight decline in orders, and the shipments index was little changed at 3.2. ...This is the first of the regional surveys for April. The general business conditions index was below the consensus forecast of a reading of 7.5, and indicates slower expansion in April than in March.

Employment indexes suggested modest improvement in labor market conditions. The index for number of employees inched up to 8.2, indicating a small increase in employment levels, and the average workweek index fell three points to 2.0, pointing to a slight increase in hours worked.

Indexes for the six-month outlook continued to convey a fair amount of optimism about future business conditions. The index for expected general business conditions advanced five points to 38.2. The index for future new orders fell for a second consecutive month, though it remained at a fairly high level of 32.7.

emphasis added

Monday, April 14, 2014

Tuesday: CPI, NY Fed Mfg Survey, NAHB Homebuilder Confidence

by Calculated Risk on 4/14/2014 09:05:00 PM

The retail sales report released this morning was solid, but some of the strength was probably some bounce-back from the severe winter weather. Still the economy will probably be stronger in 2014 than in 2013.

From the LA Times: Surging retail sales signal an economy on the upswing

"We are inclined to view March strength as part of a normalization from a very weak winter, particularly December and January," Credit Suisse analysts wrote in a note to clients Monday.Tuesday:

...

"It's a bit early to put too much weight on the retail sales number," [Standard & Poor's analyst Diya Iyer] said. "We're hearing from a lot of companies that same-store sales aren't great."

...

Economists had also braced for retail sales to take more of a hit from a calendar shift that pushed Easter into April this year after helping to pad sales in March 2013.

• At 8:30 AM ET, the Consumer Price Index for March. The consensus is for a 0.1% increase in CPI in February and for core CPI to increase 0.1%.

• Also at 8:30 AM, the NY Fed Empire State Manufacturing Survey for April. The consensus is for a reading of 7.5, up from 5.6 in March (above zero is expansion).

• At 8:45 AM, Speech by Fed Chair Janet Yellen, Opening Remarks, At the Federal Reserve Bank of Atlanta Conference: 2014 Financial Markets Conference, Stone Mountain, Georgia.

• At 10:00 AM, the April NAHB homebuilder survey. The consensus is for a reading of 50, up from 47 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

Sacramento Housing in March: Total Sales down 12% Year-over-year, Equity (Conventional) Sales up 16%, Active Inventory increases 71%

by Calculated Risk on 4/14/2014 05:42:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In March 2014, 16.3% of all resales (single family homes) were distressed sales. This was down from 19.1% last month, and down from 37.5% in March 2013.

The percentage of REOs was at 7.8%, and the percentage of short sales was 8.5%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2 years (blue).

Active Listing Inventory for single family homes increased 71.2% year-over-year in February.

Cash buyers accounted for 22.5% of all sales, down from 36.4% in March 2013, and down from 26.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 12.4% from March 2013, but conventional sales were up 16.4% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas.