by Calculated Risk on 4/15/2014 08:36:00 AM

Tuesday, April 15, 2014

NY Fed: Empire State Manufacturing Survey indicates "business activity was flat" in April

Note: The BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.5 percent before seasonal adjustment.I'll have more on inflation later.

...

The index for all items less food and energy also rose 0.2 percent in March.

From the NY Fed: Empire State Manufacturing Survey

The April 2014 Empire State Manufacturing Survey indicates that business activity was flat for New York manufacturers. The headline general business conditions index slipped four points to 1.3. The new orders index fell below zero to -2.8, pointing to a slight decline in orders, and the shipments index was little changed at 3.2. ...This is the first of the regional surveys for April. The general business conditions index was below the consensus forecast of a reading of 7.5, and indicates slower expansion in April than in March.

Employment indexes suggested modest improvement in labor market conditions. The index for number of employees inched up to 8.2, indicating a small increase in employment levels, and the average workweek index fell three points to 2.0, pointing to a slight increase in hours worked.

Indexes for the six-month outlook continued to convey a fair amount of optimism about future business conditions. The index for expected general business conditions advanced five points to 38.2. The index for future new orders fell for a second consecutive month, though it remained at a fairly high level of 32.7.

emphasis added

Monday, April 14, 2014

Tuesday: CPI, NY Fed Mfg Survey, NAHB Homebuilder Confidence

by Calculated Risk on 4/14/2014 09:05:00 PM

The retail sales report released this morning was solid, but some of the strength was probably some bounce-back from the severe winter weather. Still the economy will probably be stronger in 2014 than in 2013.

From the LA Times: Surging retail sales signal an economy on the upswing

"We are inclined to view March strength as part of a normalization from a very weak winter, particularly December and January," Credit Suisse analysts wrote in a note to clients Monday.Tuesday:

...

"It's a bit early to put too much weight on the retail sales number," [Standard & Poor's analyst Diya Iyer] said. "We're hearing from a lot of companies that same-store sales aren't great."

...

Economists had also braced for retail sales to take more of a hit from a calendar shift that pushed Easter into April this year after helping to pad sales in March 2013.

• At 8:30 AM ET, the Consumer Price Index for March. The consensus is for a 0.1% increase in CPI in February and for core CPI to increase 0.1%.

• Also at 8:30 AM, the NY Fed Empire State Manufacturing Survey for April. The consensus is for a reading of 7.5, up from 5.6 in March (above zero is expansion).

• At 8:45 AM, Speech by Fed Chair Janet Yellen, Opening Remarks, At the Federal Reserve Bank of Atlanta Conference: 2014 Financial Markets Conference, Stone Mountain, Georgia.

• At 10:00 AM, the April NAHB homebuilder survey. The consensus is for a reading of 50, up from 47 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

Sacramento Housing in March: Total Sales down 12% Year-over-year, Equity (Conventional) Sales up 16%, Active Inventory increases 71%

by Calculated Risk on 4/14/2014 05:42:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In March 2014, 16.3% of all resales (single family homes) were distressed sales. This was down from 19.1% last month, and down from 37.5% in March 2013.

The percentage of REOs was at 7.8%, and the percentage of short sales was 8.5%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2 years (blue).

Active Listing Inventory for single family homes increased 71.2% year-over-year in February.

Cash buyers accounted for 22.5% of all sales, down from 36.4% in March 2013, and down from 26.5% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 12.4% from March 2013, but conventional sales were up 16.4% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas.

Weekly Update: Housing Tracker Existing Home Inventory up 7.8% year-over-year on April 14th

by Calculated Risk on 4/14/2014 03:33:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY.

Inventory in 2014 (Red) is now 7.8% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

CBO Projection: Budget Deficit to be Smaller than Previous Forecast

by Calculated Risk on 4/14/2014 11:00:00 AM

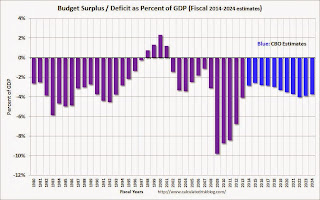

The Congressional Budget Office (CBO) released their new Updated Budget Projections: 2014 to 2024. The projected budget deficits have been reduced for each of the next ten years, and the projected deficit for 2014 has been revised down from 3.0% to 2.8%.

From the CBO:

As it usually does each spring, CBO has updated the baseline budget projections that it released earlier in the year. CBO now estimates that if the current laws that govern federal taxes and spending do not change, the budget deficit in fiscal year 2014 will be $492 billion. Relative to the size of the economy, that deficit—at 2.8 percent of gross domestic product (GDP)—will be nearly a third less than the $680 billion shortfall in fiscal year 2013, which was equal to 4.1 percent of GDP. This will be the fifth consecutive year in which the deficit has declined as a share of GDP since peaking at 9.8 percent in 2009.The CBO projects the deficit will decline further in 2015, and be below 3% of GDP through fiscal 2018. Then the deficit will slowly increase.

...

CBO’s estimate of the deficit for this year is $23 billion less than its February estimate, mostly because the agency now anticipates lower outlays for discretionary programs and net interest payments. The projected cumulative deficit from 2015 through 2024 is $286 billion less than it was in February.

...

But if current laws do not change, the period of shrinking deficits will soon come to an end. Between 2015 and 2024, annual budget shortfalls are projected to rise substantially—from a low of $469 billion in 2015 to about $1 trillion from 2022 through 2024—mainly because of the aging population, rising health care costs, an expansion of federal subsidies for health insurance, and growing interest payments on federal debt.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

After 2015, the deficit will start to increase again according to the CBO.

Retail Sales increased 1.1% in March

by Calculated Risk on 4/14/2014 08:48:00 AM

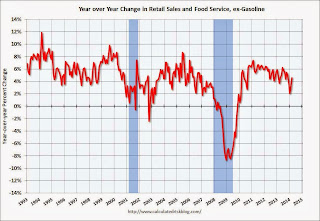

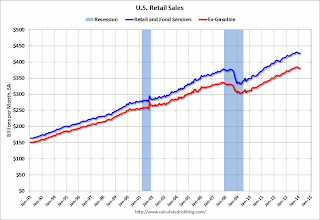

On a monthly basis, retail sales increased 1.1% from February to March (seasonally adjusted), and sales were up 3.8% from March 2013. Sales in February were revised up from a 0.3% increase to a 0.7% increase. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $433.9 billion, an increase of 1.1 percent from the previous month, and 3.8 percent above March 2013. ... The January 2014 to February 2014 percent change was revised from +0.3 percent to +0.7 percent

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos increased 0.7%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.6% on a YoY basis (3.8% for all retail sales).

Retail sales ex-gasoline increased by 4.6% on a YoY basis (3.8% for all retail sales).The increase in March was above consensus expectations and this was a strong report.

Sunday, April 13, 2014

Monday: Retail Sales, CBO Budget Projections

by Calculated Risk on 4/13/2014 08:38:00 PM

Monday:

• At 8:30 AM ET, Retail sales for March will be released. The consensus is for retail sales to increase 0.8% in March, and to increase 0.4% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.5% increase in inventories.

• At 11:00 AM, CBO will release its updated 10-year baseline projections of federal spending, revenues, and budget deficits.

Weekend:

• Schedule for Week of April 13th

• Q1 Review: Ten Economic Questions for 2014

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices are up with WTI futures at $104.05 per barrel and Brent at $107.33 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.60 per gallon, up sharply from earlier this year and more than 5 cents higher than last year at this time. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Q1 Review: Ten Economic Questions for 2014

by Calculated Risk on 4/13/2014 11:51:00 AM

At the end of last year, I posted Ten Economic Questions for 2014. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2014 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand why I was wrong).

By request, here is a Q1 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2014: Downside Risks

Happily, looking forward, it seems the downside risks have diminished significantly. China remains a key risk ... There are always potential geopolitical risks (war with Iran, North Korea, or turmoil in some oil producing country). Right now those risks appear small, although it is always hard to tell. ...China remains a downside risk, and the situation in Russia and Ukraine is serious, but overall it appears that downside risks have diminished.

When I look around, I see few obvious downside risks for the U.S. economy in 2014. No need to borrow trouble - diminished downside risks are a reason for cheer.

9) Question #9 for 2014: How much will housing inventory increase in 2014?

Right now my guess is active inventory will increase 10% to 15% in 2014 (inventory will decline seasonally in December and January, but I expect to see inventory up 10% to 15% year-over-year toward the end of 2014). This will put active inventory close to 6 months supply this summer. If correct, this will slow house price increases in 2014.Right now, through April 7th, inventory is up 7.7% compared to last year according to Housing Tracker. The NAR reported inventory was up 5.3% year-over-year in February. So far a 10% to 15% increase this year looks about right.

8) Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

Bottom line: I expect lending standards to loosen a bit in 2014 from the tight level of the last few years. It will be difficult to measure, but I'll be watching what Mel Watt says, what private lenders say, comments from mortgage brokers, and MEW.It is early in the year, but so far there is little evidence of looser mortgage lending standards.

7) Question #7 for 2014: What will happen with house prices in 2014?

In 2014, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. This suggests more house price increases in 2014, but probably at a slow pace.We only have Case-Shiller data for January - and price increases might be slowing, but it is too early to tell.

As Khater noted, some of the "bounce back" in certain areas is probably over, also suggesting slower price increases going forward. And investor buying appears to have slowed. A positive for the market will probably be a little looser mortgage credit.

All of these factors suggest further prices increases in 2014, but at a slower rate than in 2013. There tends to be some momentum for house prices, and I expect we will see prices up mid-to-high single digits (percentage) in 2014 as measured by Case-Shiller.

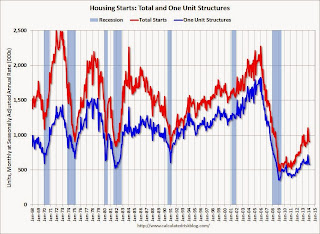

6) Question #6 for 2014: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in some judicial foreclosure states in 2014. However, unlike last year when I reported that some builders were land constrained (not enough finished lots in the pipeline), land should be less of an issue this year. Even with the foreclosures, I expect another solid year of growth for new home sales.Through February, new home sales were unchanged from 2013, and housing starts were actually down 1% year-over-year (permits were up 5%). This is a slow start to 2014, and I don't blame all of the recent weakness on the weather (probably just a small factor). There are also higher mortgage rates, higher prices and probably supply constraints in some areas. But I still think fundamentals support a higher level of starts, and I expect starts and new home sales to pick up solidly again this year.

... I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013. That would still make 2014 the tenth weakest year on record for housing starts (behind 2008 through 2012 and few other recession lows).

5) Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

[E]ven though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.So far right on schedule.

4) Question #4 for 2014: Will too much inflation be a concern in 2014?

[C]urrently I think inflation (year-over-year) will increase a little in 2014 as growth picks up, but too much inflation will not be a concern in 2014.It is early, but inflation was still low through February.

3) Question #3 for 2014: What will the unemployment rate be in December 2014?

My guess is the participation rate will stabilize or only decline slightly in 2014 (less than in 2012 and 2013) ... it appears the unemployment rate will decline to the low-to-mid 6% range by December 2014.The unemployment rate was 6.7% in March, unchanged from December.

2) Question #2 for 2014: How many payroll jobs will be added in 2014?

Both state and local government and construction hiring should improve further in 2014. Federal layoffs will be a negative, but most sectors should be solid. So my forecast is somewhat above the previous three years, and I expect gains of about 200,000 to 225,000 payroll jobs per month in 2014.Through March 2014, the economy has added 533,000 thousand jobs; 178,000 per month. Employment was clearly impacted by the poor weather, and I still expect employment gains to average 200,000 to 225,000 per month in 2014.

1) Question #1 for 2014: How much will the economy grow in 2014?

I expect PCE to pick up again into the 3% to 4% range, and this will give a boost to GDP. This increase in consumer spending should provide an incentive for business investment. Add in the ongoing housing recovery, some increase in state and local government spending, and 2014 should be the best year of the recovery with GDP growth at or above 3%The first quarter will be disappointing (most early estimates are around 1% growth in Q1), but I expect economic activity to pick up in the last three quarters of the year.

Overall activity in 2014 is a somewhat lower than I expected. However my outlook for the year remains about the same.

Saturday, April 12, 2014

Unofficial Problem Bank list declines to 530 Institutions

by Calculated Risk on 4/12/2014 01:15:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 11, 2014.

Changes and comments from surferdude808:

There were three removals this week from the Unofficial Problem Bank List. After removal, the list holds 530 institutions with assets of $170.8 billion. A year ago, the list held 786 institutions with assets of $289.4 billion.

Actions were terminated against Riverview Community Bank, Vancouver, WA ($803 million); The National Bank of Cambridge, Cambridge, MD ($190 million); and Pikes Peak National Bank, Colorado Springs, CO ($80 million).

The Federal Reserve issued a Prompt Corrective Action order against NBRS Financial, Rising Sun, MD ($207 million), which has been operating under a Written Agreement since February 2010.

Next Friday, we anticipate the OCC will release its enforcement action activity through Mid-March 2014.

Schedule for Week of April 13th

by Calculated Risk on 4/12/2014 09:31:00 AM

The key reports this week are March retail sales on Monday and March housing starts on Wednesday.

For manufacturing, the March Industrial Production and Capacity Utilization report, and the April NY Fed (Empire State) and Philly Fed surveys, will be released this week.

For prices, CPI will be released on Tuesday.

Fed Chair Janet Yellen speaks on Wednesday "Monetary Policy and the Economic Recovery".

8:30 AM ET: Retail sales for March will be released.

8:30 AM ET: Retail sales for March will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.3% from January to February (seasonally adjusted), and sales were up year-over-year 1.5% from February 2013.

The consensus is for retail sales to increase 0.8% in March, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.5% increase in inventories.

11:00 AM: CBO will release its updated 10-year baseline projections of federal spending, revenues, and budget deficits.

8:30 AM ET: Consumer Price Index for March. The consensus is for a 0.1% increase in CPI in February and for core CPI to increase 0.1%.

8:30 AM: NY Fed Empire Manufacturing Survey for April. The consensus is for a reading of 7.5, up from 5.6 in March (above zero is expansion).

8:45 AM: Speech by Fed Chair Janet Yellen, Opening Remarks, At the Federal Reserve Bank of Atlanta Conference: 2014 Financial Markets Conference, Stone Mountain, Georgia

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 50, up from 47 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for March.

8:30 AM: Housing Starts for March. Total housing starts were at 907 thousand (SAAR) in February. Single family starts were at 583 thousand SAAR in February.

The consensus is for total housing starts to increase to 965 thousand (SAAR) in March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 78.8%.

12:25 PM: Speech by Fed Chair Janet Yellen, Monetary Policy and the Economic Recovery, At the Economic Club of New York, New York, New York

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 300 thousand.

10:00 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 9.1, up from 9.0 last month (above zero indicates expansion).

All US markets will be closed in observance of Good Friday.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for March 2014.