by Calculated Risk on 4/09/2014 08:16:00 PM

Wednesday, April 09, 2014

Thursday: Weekly Unemployment Claims

An interesting post on the stock market from Joshua Brown: The Most Important Difference Between 2007 and 2014

Of course, in 2007, it was clear the country was headed into recession and that house prices would decline much further. Now there is no recession in sight ... and in addition to corporate balance sheets being in much better shape (as Brown notes), household balance sheets are much stronger too.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 320 thousand from 326 thousand.

• Early, the Trulia Price Rent Monitors for March. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 2:00 PM, the Monthly Treasury Budget Statement for March.

Lawler: Number of Home Owners Lower than 2006!

by Calculated Risk on 4/09/2014 05:16:00 PM

From housing economist Tom Lawler:

Below are my “best guess” estimates of the number of US households – total and by tenure – from 2006 to 2013. The numbers for 2000 and 2010 are the “official” decennial Census numbers, while the numbers for other years from 2006 to 2012 are yearly averages derived from ACS data, adjusted (1) to reflect differences between ACS and decennial Census results; and (2) to reflect updated population estimates (total and by age group) for each year. Numbers for 2013 are “guesstimates” based on population estimates and headship/homeownership rates.

Also shown are homeownership rates. These homeownership rates are lower than the ones shown in the more widely followed Housing Vacancy Survey, as the HVS homeownership rates, both total and by age group, were “way off” from Decennial Census results for 2010.

| US Household Estimates (000's) | ||||

|---|---|---|---|---|

| Owners | Renters | Total | Homeownership Rate | |

| 2000 (Census) | 69,816 | 35,664 | 105,480 | 66.2% |

| 2006 | 76,126 | 37,356 | 113,482 | 67.1% |

| 2007 | 76,706 | 37,799 | 114,505 | 67.0% |

| 2008 | 76,656 | 38,748 | 115,404 | 66.4% |

| 2009 | 76,409 | 39,811 | 116,220 | 65.7% |

| 2010 (Census) | 75,986 | 40,730 | 116,716 | 65.1% |

| 2011 | 75,600 | 41,843 | 117,443 | 64.4% |

| 2012 | 75,481 | 43,006 | 118,487 | 63.7% |

| 2013 | 75,683 | 43,814 | 119,497 | 63.3% |

One of the most striking statistics is the number of US home owners: There were fewer US home owners in 2013 than there were in 2006, despite a 7% increase in the 15+ year old population!

While the number of SF (detached and attached) homes occupied by owners in 2013 appears to be about the same as in 2006, the number occupied by renters appears to have increased by about 3 1/2 million.

FOMC Minutes: SEP changes need "not be viewed as signifying a less accommodative reaction function"

by Calculated Risk on 4/09/2014 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, March 18-19, 2014 . Excerpt:

In their discussion of monetary policy going forward, participants focused primarily on possible changes to the Committee's forward guidance for the federal funds rate. Almost all participants agreed that it was appropriate at this meeting to update the forward guidance, in part because the unemployment rate was seen as likely to fall below its 6-1/2 percent threshold value before long. Most participants preferred replacing the numerical thresholds with a qualitative description of the factors that would influence the Committee's decision to begin raising the federal funds rate. One participant, however, favored retaining the existing threshold language on the grounds that removing it before the unemployment rate reached 6-1/2 percent could be misinterpreted as a signal that the path of policy going forward would be less accommodative. Another participant favored introducing new quantitative thresholds of 5-1/2 percent for the unemployment rate and 2-1/4 percent for projected inflation. A few participants proposed adding new language in which the Committee would indicate its willingness to keep rates low if projected inflation remained persistently below the Committee's 2 percent longer-run objective; these participants suggested that the inclusion of this quantitative element in the forward guidance would demonstrate the Committee's commitment to defend its inflation objective from below as well as from above. Other participants, however, judged that it was already well understood that the Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance. Most participants therefore did not favor adding new quantitative language, preferring to shift to qualitative language that would describe the Committee's likely reaction to the state of the economy.Rates will be low for a long time. Note: SEP: "Summary of Economic Projections"

Most participants also believed that, as part of the process of clarifying the Committee's future policy intentions, it would be appropriate at this time for the Committee to provide additional guidance in its postmeeting statement regarding the likely behavior of the federal funds rate after its first increase. For example, the statement could indicate that the Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run. Participants observed that a number of factors were likely to have contributed to a persistent decline in the level of interest rates consistent with attaining and maintaining the Committee's objectives. In particular, participants cited higher precautionary savings by U.S. households following the financial crisis, higher global levels of savings, demographic changes, slower growth in potential output, and continued restraint on the availability of credit. A few participants suggested that new language along these lines could instead be introduced when the first increase in the federal funds rate had drawn closer or after the Committee had further discussed the reasons for anticipating a relatively low federal funds rate during the period of policy firming. A number of participants noted the overall upward shift since December in participants' projections of the federal funds rate included in the March SEP, with some expressing concern that this component of the SEP could be misconstrued as indicating a move by the Committee to a less accommodative reaction function. However, several participants noted that the increase in the median projection overstated the shift in the projections. In addition, a number of participants observed that an upward shift was arguably warranted by the improvement in participants' outlooks for the labor market since December and therefore need not be viewed as signifying a less accommodative reaction function. Most participants favored providing an explicit indication in the statement that the new forward guidance, taken as a whole, did not imply a change in the Committee's policy intentions, on the grounds that such an indication could help forestall misinterpretation of the new forward guidance.

emphasis added

Goldman's Hatzius: "Rays of Light"

by Calculated Risk on 4/09/2014 11:09:00 AM

A couple of excerpts from a research note by Goldman chief economist Jan Hatzius: "Rays of Light on the Supply Side"

First, on the outlook:

US economic growth is accelerating as the economy bounces back from the inventory and weather-related weakness of the first quarter. Our current activity indicator (CAI) is up a preliminary 3.6% in March, well above the 2% pace of the prior three months and consistent with our forecast for a rebound into the 3%-3.5% range for real GDP growth in the remainder of 2014.And on the labor force participation rate:

[T]he labor force participation rate has risen by 0.39 percentage points since December, the biggest increase over a three-month period since 2007. The main reason for the increase has been a significant pickup in the gross flow of individuals from inactivity to employment (and to a lesser degree unemployment). We view this as a potentially promising sign that labor demand is picking up sufficiently to pull discouraged workers back into the labor force.CR Note: My expectation at the beginning of the year was the participation rate would mostly hold steady (returning workers would offset demographics in 2014). So far (just three months) that looks about right. I also expect a pick up in GDP after Q1.

The increase in labor force participation is especially encouraging because the expiration of emergency unemployment benefits at the end of December should have acted to reduce participation. We have received questions whether the impact might have gone the other way. Some argue that the loss of benefits might have forced some workers to seek employment, and that this could have increased participation. But this assumes that prior to year-end there were a significant number of individuals who told the unemployment benefit office that they were actively seeking work but said the opposite in the household survey. We find this hard to believe; most people would probably be reluctant to tell "the government" that they are not actually seeking work when doing so is a prerequisite for drawing benefits.

MBA: Mortgage Purchase Applications Increase, Refinance Applications Decrease

by Calculated Risk on 4/09/2014 07:01:00 AM

From the MBA: Mortgage Purchase Applications Increase in Latest MBA Weekly Survey

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 4, 2014. ...

The Refinance Index decreased 5 percent from the previous week and is at its lowest level since the end of 2013. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained constant at 4.56 percent, with points increasing to 0.33 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

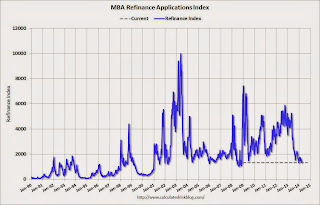

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Tuesday, April 08, 2014

Wednesday: FOMC Minutes

by Calculated Risk on 4/08/2014 08:59:00 PM

On Sunday I listed a few possible reasons for the decline in the labor force participation rate for prime-working age men. One of the reasons I suggested was more men were being "Mr. Mom". I looked for some research on this, and sure enough the percent of stay-at-home father families has increased from 0.7% in the 1968 to 1979 period, to 2.5% in the 2000 to 2012 period (percent of married families).

Meanwhile the prime-working age men participation rate fell from an average of 95.0% (1968 to 1979) to 90.3% (2000 - 2012). Clearly "Mr. Mom" has been a factor.

From Karen Z. and Amit Kramer at the University of Illinois at Urbana-Champaign The Rise of Stay-at-Home Father Families in the U.S.: The Role of Gendered Expectations, Human Capital, and Economic Downturns

Stay-at-home father families in which the mother is the sole- or primary-earner of income (Chesley 2011) represent a small but growing percentage of two-parent families in the United States. These families, in which the mother is the sole income earner, are estimated to make up three to four percent of two-parent households in the United States (Fields 2002; Kramer, Kelly, and McCulloch forthcoming). The higher participation rates of women in the labor force, as well as the impact of the 2009 Great Recession, which have affected men’s employment more than women’s (Harrington, Van Deusen, and Ladge 2010), combined with greater projected growth rates in occupations that are dominated by women, such as health and education (Boushey 2009), suggest that the proportion of stay-at-home father families in the U.S. is likely to increase.The other factors too as I noted in the post on Sunday.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

• At 2:00 PM, the FOMC Minutes for the Meeting of March 18-19, 2014.

"A Closer Look at Post-2007 Labor Force Participation Trends"

by Calculated Risk on 4/08/2014 06:42:00 PM

This is an excellent overview of many of the labor force participation trends.

From Melinda Pitts, John Robertson, and Ellyn Terry at Marcoblog: A Closer Look at Post-2007 Labor Force Participation Trends

And the promise of another post using micro data:

[A]n important assumption in the BLS projection is that the post-2007 decline in prime-age participation will not persist. Indeed, the data for the first quarter of 2014 does suggest that some stabilization has occurred.

But separating what is trend from what is cyclical is challenging. The rapid pace of the decline in participation among the prime-age population between 2007 and 2013 is somewhat puzzling. Could this decline reflect a temporary cyclical effect or something more permanent? A follow-up blog will explore this question in more detail using the micro data from the Current Population Survey.

When will total payroll employment exceed the pre-recession peak?

by Calculated Risk on 4/08/2014 03:57:00 PM

Total payroll employment is getting close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow and is now 2.2 million higher than in January 2008). Since January 2008, the Civilian noninstitutional population1 has increased by 12.8 million people, although the prime working-age population (25 to 54) has actually declined by 1.5 million.

Still reaching a new high in employment will be a significant milestone in the recovery.

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

Click on graph for larger image.

Click on graph for larger image.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.927 million total non-farm payroll jobs, or 436 thousand fewer than the pre-recession peak.

It is possible that total non-farm payroll will be at a new high in May.

The pre-recession peak for private payroll employment was 115.977 million. As we discussed last week, currently there are 116.087 million private payroll jobs, or 110 thousand above the pre-recession peak.

1 From the BLS: "Civilian noninstitutional population (Current Population Survey) Included are persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces."

Las Vegas Real Estate in March: Year-over-year Non-contingent Inventory up 128%

by Calculated Risk on 4/08/2014 12:14:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports rising home prices and more homes available for sale

GLVAR said the total number of existing local homes, condominiums and townhomes sold in March was 3,094, up from 2,518 in February, but down from 3,642 one year ago.There are several key trends that we've been following:

...

GLVAR continued to track the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. In March, 12.9 percent of all existing local home sales were short sales, down from 14 percent in February. Another 11.7 percent of all March sales were bank-owned properties, down from 12 percent in February.

GLVAR said 43.1 percent of all existing local homes sold in March were purchased with cash. That’s down from 46.8 percent the previous month, and well short of the February 2013 peak of 59.5 percent.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in March was 13,944. That’s up 2.3 percent from 13,624 listed in February and up 1.8 percent from 13,693 listed one year ago. GLVAR reported a total of 3,701 condos and townhomes listed for sale on its MLS in March, up 3.9 percent from 3,561 listed in February and up 7.2 percent from one year ago. ...

By the end of March, GLVAR reported 6,470 single-family homes listed without any sort of offer. That’s up 2.4 percent from 6,316 such homes listed in February, and a 127.9 percent jump from one year ago.

emphasis added

1) Overall sales were down about 15% year-over-year.

2) Conventional sales were up 16% year-over-year. In March 2013, only 55.5% of all sales were conventional. This year, in March 2014, 75.4% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 127.9% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014).

BLS: Jobs Openings increase to 4.2 million in February

by Calculated Risk on 4/08/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

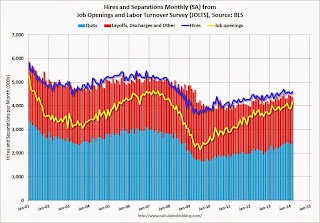

There were 4.2 million job openings on the last business day of February, up from January, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in February for total nonfarm, total private, and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 4.173 million from 3.874 million in January.

The number of job openings (yellow) is up 4% year-over-year compared to February 2013.

Quits increased in February and are up about 5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are over 4 million and at the highest level since January 2008.