by Calculated Risk on 4/08/2014 03:57:00 PM

Tuesday, April 08, 2014

When will total payroll employment exceed the pre-recession peak?

Total payroll employment is getting close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow and is now 2.2 million higher than in January 2008). Since January 2008, the Civilian noninstitutional population1 has increased by 12.8 million people, although the prime working-age population (25 to 54) has actually declined by 1.5 million.

Still reaching a new high in employment will be a significant milestone in the recovery.

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

Click on graph for larger image.

Click on graph for larger image.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.927 million total non-farm payroll jobs, or 436 thousand fewer than the pre-recession peak.

It is possible that total non-farm payroll will be at a new high in May.

The pre-recession peak for private payroll employment was 115.977 million. As we discussed last week, currently there are 116.087 million private payroll jobs, or 110 thousand above the pre-recession peak.

1 From the BLS: "Civilian noninstitutional population (Current Population Survey) Included are persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces."

Las Vegas Real Estate in March: Year-over-year Non-contingent Inventory up 128%

by Calculated Risk on 4/08/2014 12:14:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports rising home prices and more homes available for sale

GLVAR said the total number of existing local homes, condominiums and townhomes sold in March was 3,094, up from 2,518 in February, but down from 3,642 one year ago.There are several key trends that we've been following:

...

GLVAR continued to track the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. In March, 12.9 percent of all existing local home sales were short sales, down from 14 percent in February. Another 11.7 percent of all March sales were bank-owned properties, down from 12 percent in February.

GLVAR said 43.1 percent of all existing local homes sold in March were purchased with cash. That’s down from 46.8 percent the previous month, and well short of the February 2013 peak of 59.5 percent.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in March was 13,944. That’s up 2.3 percent from 13,624 listed in February and up 1.8 percent from 13,693 listed one year ago. GLVAR reported a total of 3,701 condos and townhomes listed for sale on its MLS in March, up 3.9 percent from 3,561 listed in February and up 7.2 percent from one year ago. ...

By the end of March, GLVAR reported 6,470 single-family homes listed without any sort of offer. That’s up 2.4 percent from 6,316 such homes listed in February, and a 127.9 percent jump from one year ago.

emphasis added

1) Overall sales were down about 15% year-over-year.

2) Conventional sales were up 16% year-over-year. In March 2013, only 55.5% of all sales were conventional. This year, in March 2014, 75.4% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 127.9% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014).

BLS: Jobs Openings increase to 4.2 million in February

by Calculated Risk on 4/08/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

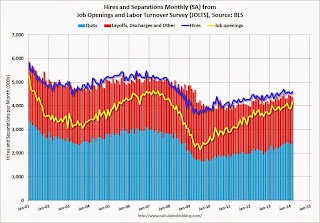

There were 4.2 million job openings on the last business day of February, up from January, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in February for total nonfarm, total private, and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 4.173 million from 3.874 million in January.

The number of job openings (yellow) is up 4% year-over-year compared to February 2013.

Quits increased in February and are up about 5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are over 4 million and at the highest level since January 2008.

NFIB: Small Business Optimism Index increases in March

by Calculated Risk on 4/08/2014 08:29:00 AM

From the National Federation of Independent Business (NFIB): Small Business Rollercoaster Continues

The latest Small Business Optimism Index rose 2 points to 93.4, mostly reversing the February decline ... NFIB owners increased employment by an average of 0.18 workers per firm in March (seasonally adjusted), an improvement over February’s 0.11 reading and the sixth positive month in a row.

Click on graph for larger image.

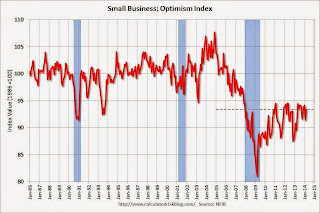

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 93.4 in March from 91.4 in February.

Monday, April 07, 2014

Tuesday: Small Business Confidence, Job Openings

by Calculated Risk on 4/07/2014 09:32:00 PM

At the end of each day, I always check the Alphaville Closer.

A couple of interesting links:

• Introducing the new St Louis FRED blog (CR Note: Added FRED blog to right sidebar)

• And from Business Insider: Wall Street's Brightest Minds Reveal THE MOST IMPORTANT CHARTS IN THE WORLD

Tuesday:

• 7:30 AM ET, NFIB Small Business Optimism Index for March.

• 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS. The number of job openings (yellow) were up 7.6% year-over-year compared to January 2013, and Quits decreased in January and were up about 3% year-over-year.

CBO: Federal Deficit through March $187 billion less this year than it was in fiscal year 2013

by Calculated Risk on 4/07/2014 06:56:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for March 2014

The federal government ran a budget deficit of $413 billion for the first six months of fiscal year 2014, CBO estimates—$187 billion less than the shortfall recorded in the same span last year. Revenues were about 10 percent higher; and outlays, about 4 percent lower. ...And for March 2014:

The federal government incurred a deficit of $36 billion in March 2014, CBO estimates—$71 billion less than the $107 billion deficit incurred in March 2013. Because March 1 fell on a weekend in 2014, certain payments that ordinarily would have been made in March this year were made in February. Without those shifts in the timing of payments, and prepayments of deposit insurance premiums that lowered collections in fiscal year 2013, the deficit in March 2014 would have been $34 billion smaller than it was in the same month last year.The consensus was the deficit for March would be around $133 billion, and it appears the deficit for fiscal 2014 will be smaller than the CBO currently expects (less than 3.0% of GDP).

emphasis added

Of course there will be a solid surplus in April.

Weekly Update: Housing Tracker Existing Home Inventory up 7.7% year-over-year on April 7th

by Calculated Risk on 4/07/2014 04:14:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY.

Inventory in 2014 (Red) is now 7.7% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Lawler: Phoenix "listings are way up and sales are way down"

by Calculated Risk on 4/07/2014 02:59:00 PM

From housing economist Tom Lawler:

ARMLS reported that residential home sales by realtors in the Greater Phoenix, Arizona area totaled 6,712 in March, down 17.7% from last March’s pace. Lender-owned properties were 6.9% of last month’s sales, down from 11.6% last March, while last month’s short-sales share was 5.1%, down from 15.1% a year ago. All-cash transactions were 33.1% of last month’s sales, down from 41.5% last March. Active listings in March totaled 29,939, up 0.9% from February and up 44.4% from a year ago. The median home sales price last month was $187,000, up 11.6% from last March. Last month’s sales were the lowest for a March since 2008.

| Residential Home Sales, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Mar-11 | Mar-12 | Mar-13 | Mar-14 | |

| Number of Sales by Type | ||||

| Lender owned | 4,589 | 1,872 | 948 | 462 |

| Short sales | 1,889 | 2,275 | 1,233 | 339 |

| "Non-distressed" sales | 3,455 | 4,722 | 5,972 | 5,911 |

| Total sales | 9,933 | 8,869 | 8,153 | 6,712 |

| Share of Sales by Type (and All-Cash Share) | ||||

| Lender owned | 46.2% | 21.1% | 11.6% | 6.9% |

| Short sales | 19.0% | 25.7% | 15.1% | 5.1% |

| Non-distressed | 34.8% | 53.2% | 73.2% | 88.1% |

| All-cash | 49.8% | 47.6% | 41.5% | 33.1% |

Click on graph for larger image.

Click on graph for larger image.This graph from Tom Lawler shows the active inventory in the Phoenix area. As Tom noted, listings are way up - but also way below the "bust" years.

Employment Diffusion Indexes

by Calculated Risk on 4/07/2014 12:12:00 PM

Here is something I like to look at every month.

These diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.The BLS diffusion index for total private employment was at 58.5 in March, down from 59.1 in February.

For manufacturing, the diffusion index decreased to 50.0, down from 51.9 in March.

Job growth was fairly widespread for private employment in March.

Mortgage Monitor: Delinquencies are below 6% for the first time since 2008, "Little Sign of Easing" in Credit Standards

by Calculated Risk on 4/07/2014 08:29:00 AM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for February today. According to LPS, 5.97% of mortgages were delinquent in February, down from 6.27% in January. BKFS reports that 2.22% of mortgages were in the foreclosure process, down from 3.38% in February 2013.

This gives a total of 8.17% delinquent or in foreclosure. It breaks down as:

• 1,749,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,242,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,115,000 loans in foreclosure process.

For a total of 4,106,000 loans delinquent or in foreclosure in February. This is down from 5,104,000 in February 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years. BKFS reports: "Delinquencies are below 6% for the first time since ‘08; foreclosures down 34% in the last year"

The second graph from BKFS shows the credit score distribution for all mortgage originations. From Herb Blecher, senior vice president of Black Knight’s Data and Analytics division:

The second graph from BKFS shows the credit score distribution for all mortgage originations. From Herb Blecher, senior vice president of Black Knight’s Data and Analytics division:

“Credit standards have shown little sign of easing -- only about 30 percent of 2013 loans went to borrowers with credit scores below 720 -- which indicates that significant opportunity to expand mortgage origination activity is available, if risk appetites allow."There is much more in the mortgage monitor.

emphasis added