by Calculated Risk on 4/03/2014 08:54:00 AM

Thursday, April 03, 2014

Trade Deficit increased in February to $42.3 Billion

The Department of Commerce reported this morning:

[T]otal February exports of $190.4 billion and imports of $232.7 billion resulted in a goods and services deficit of $42.3 billion, up from $39.3 billion in January, revised. February exports were $2.0 billion less than January exports of $192.5 billion. February imports were $1.0 billion more than January imports of $231.7 billion.The trade deficit was above the consensus forecast of $39.1 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2014.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in February.

Exports are 15% above the pre-recession peak and up 2% compared to February 2013; imports are at the pre-recession peak, and up about 1% compared to February 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $91.53 in February, up from $90.21 in January, and down from $95.96 in February 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China declined to $20.86 billion in February, from $23.41 billion in February 2013. About half of the trade deficit is related to China.

Overall it appears trade is picking up slightly.

Weekly Initial Unemployment Claims increase to 326,000

by Calculated Risk on 4/03/2014 08:30:00 AM

The DOL reports:

In the week ending March 29, the advance figure for seasonally adjusted initial claims was 326,000, an increase of 16,000 from the previous week's revised figure of 310,000. The 4-week moving average was 319,500, an increase of 250 from the previous week's revised average of 319,250.The previous week was revised down from 311,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 319,500.

This was above the consensus forecast of 320,000. The 4-week average is close to normal levels during an expansion.

Wednesday, April 02, 2014

Thursday: Trade Deficit, Unemployment Claims, ISM Non-Manufacturing, Q1 Mall Vacancy Survey

by Calculated Risk on 4/02/2014 08:25:00 PM

Thursday:

• Early: Reis Q1 2014 Mall Survey of rents and vacancy rates.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 311 thousand.

• Also at 8:30 AM, the Trade Balance report for February from the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $38.5 billion in February from $39.1 billion in January.

• At 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for a reading of 53.5, up from 51.6 in February. Note: Above 50 indicates expansion, below 50 contraction.

Survey: Small Businesses add more Jobs in March

by Calculated Risk on 4/02/2014 05:15:00 PM

From NFIB: Small Business Job Creation Better Than February But...

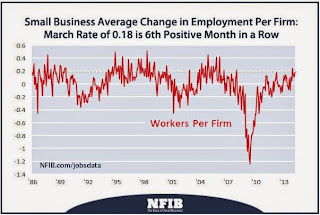

“NFIB owners increased employment by an average of 0.18 workers per firm in March (seasonally adjusted), an improvement over February’s 0.11 reading and the sixth positive month in a row. Seasonally adjusted, 11 percent of the owners (down 1 point) reported adding an average of 2.6 workers per firm over the past few months. Offsetting that, 12 percent reduced employment (up 2 points) an average of 2.1 workers, producing the seasonally adjusted net gain of 0.18 workers per firm overall. While there could still be lingering winter effects in the data, some of the best job producing areas, the Southwest, West and Florida, did not have weather problems and still delivered mediocre growth ratings.

Click on graph for larger image.

Click on graph for larger image.This graph from NFIB shows the change in number of employees per firm.

Small businesses have a larger percentage of real estate and retail related companies than the overall economy. With the high percentage of real estate (including small construction companies), I expect small business hiring to be slow to recover in this cycle.

Research: "The Overhang of Structures before and since the Great Recession"

by Calculated Risk on 4/02/2014 03:24:00 PM

From Margaret Jacobson and Filippo Occhino at the Cleveland Fed: The Overhang of Structures before and since the Great Recession

The economic recovery in the US has been atypically weak, and one reason for this weakness is the failure of investment to rebound as strongly as it has in previous recoveries. We are four and a half years into the recovery, and yet the real level of investment spending by businesses, households, and nonprofits on structures, equipment, and software is still below its pre-recession peak.CR Note: I think most of the "overhang" has been absorbed for residential, although there is still an overhang for office and retail (vacancy rates are still high).

In turn, the current low level of investment is mainly the result of an exceptionally large and persistent drop in one of its key components, investment in structures. Structures include both residential buildings, such as homes and apartment buildings, and nonresidential buildings, such as factories, office buildings, stores, and hospitals. After peaking in early 2006, investment in residential and nonresidential structures dropped by an unprecedented 45 percent, and it began to recover late, two years after the official beginning of the recovery. Currently, it is still 29 percent below its pre-recession peak. By comparison, investment in equipment dropped by 31 percent during the recession, but it began to pick up right when the recovery started and is now above its previous peak ...

Why is investment in structures so low? One reason that is often cited is overhang, the idea that the excess, or overhang, of structures that have been built in the past is now holding investment down. Using a new indicator of the optimal level of structures—the level that would be warranted by economic conditions—we measure the level of overhang before, during, and since the recession. We find evidence that investment in structures was too high in the years leading up to the recession and that an overhang of structures has held down investment growth during the recovery.

...

According to our measure, structure overhang in the private sector increased in the first half of the 2000s, peaking at 21 percent in 2006. It remained elevated throughout 2009, and then declined rapidly during the recovery, reaching 11 percent in 2012. This suggests that overhang built up because of excessive investment before the crisis, rather than resulting from the unanticipated drop in economic activity during the Great Recession.

Reis: Apartment Vacancy Rate declined to 4.0% in Q1 2014

by Calculated Risk on 4/02/2014 10:11:00 AM

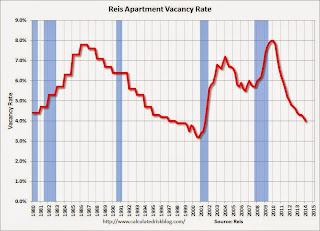

Reis reported that the apartment vacancy rate declined in Q1 to 4.0% from 4.2% in Q4 2013. In Q1 2013 (a year ago) the vacancy rate was at 4.4%, and the rate peaked at 8.0% at the end of 2009.

Some data and comments from Reis Senior Economist Ryan Severino:

Vacancy declined by 20 basis points during first quarter to 4.0%, a slight improvement over last quarter’s 10 basis point decline. Over the last twelve months the national vacancy rate has declined by 40 basis points, more or less the same pace as the last few quarters. Demand for apartments remains strong four years after the recovery began while inclement weather had a negative impact on construction activity. The national vacancy rate now stands 400 basis points below the cyclical peak of 8.0% observed right after the recession concluded in late 2009.

Resilient demand continued to shrug off seasonal weakness with a strong showing in the first quarter. The sector absorbed 41,570 units, down slightly versus last quarter’s 48,546 but nonetheless the largest figure for a first quarter since 2011. Moreover, the market is displaying incredible strength, continuing to absorb this many units four years after the advent of the recovery. Meanwhile, completions during the first quarter totaled 25,135 units. This is a pullback from last quarter’s 45,073, though inclement weather surely had some impact on this. As we have been warning, construction is clearly on an upswing, and bad weather is only likely to delay, not cancel projects. For 2014, we still expect roughly 162,000 units to be delivered so we should expect significant completions figures during the subsequent quarters of 2014.

Asking and effective rents grew by 0.5% and 0.6%, respectively, during the first quarter. This is a minor decrease from the fourth quarter and the lowest figure since the first quarter of 2013. Rent growth remains relatively weak given the fact that the apartment market is at a miniscule 4.0% vacancy rate. Normally at such a low vacancy rate, rent growth is at least 100 basis points above current growth rates on an annual basis. Rent growth is being held back by the fact that rents (on a nominal basis) are at record‐high levels and the labor market is still relatively weak, generating little compensation increases for many workers. The marriage of these two factors is making it difficult for landlords in many markets to increase rents at a faster pace.

...

Demand for apartments is seemingly insatiable. Although the labor market got off to sluggish start in 2014, we still expect the recovery to accelerate which should support ongoing demand for apartment units. However, the slight pullback in construction this quarter was due to seasonal factors and construction remains on pace for roughly 162,000 new units to be completed this year. This is above the long‐term historical average of roughly 125,000 units/year and this will make it difficult for demand to keep exceeding completions. Therefore, we anticipate that for the first time since 2009 the national vacancy rate will not fall in 2014. We anticipate that vacancy will be more or less flat this year. However, our general position on 2014 has not been altered ‐ still low vacancy, an improving economy and labor market, and lots of newly completed Class A properties coming online with rents higher than the market average will all conspire to push asking and effective rents up by roughly 3.3% next year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

Apartment vacancy data courtesy of Reis.

ADP: Private Employment increased 191,000 in March

by Calculated Risk on 4/02/2014 08:21:00 AM

Private sector employment increased by 191,000 jobs from February to March according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was at the consensus forecast for 190,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market is coming out from its deep winter slumber. Job gains are consistent with the pace prior to the brutal winter. The gains are broad based across industries and business size classes. Even better numbers are likely in coming months as the weather warms.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for March will be released on Friday.

MBA: Mortgage Purchase Applications Increase, Refinance Applications Decrease

by Calculated Risk on 4/02/2014 07:01:00 AM

From the MBA: Mortgage Purchase Applications Increase in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 28, 2014. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) was unchanged at 4.56 percent, with points increasing to 0.31 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Tuesday, April 01, 2014

Wednesday: ADP Employment, Q1 Apartment Vacancy Survey

by Calculated Risk on 4/01/2014 08:07:00 PM

There has been a debate about whether the recent economic weakness was weather related or something more serious. Readers of Atif Mian and Amir Sufi's House of Debt were fairly confident much of the weakness was weather related.

In mid-March, Mian and Sufi wrote: Weakening Economy or Just Bad Winter?

We use state-level data on new auto purchases to attack this question. Here is the basic idea. Not all states experienced a horrible January 2014 — in fact, much of the western part of the country actually was warmer than normal. We can use this variation across the country in January weather to see if national auto sales were brought down by states that experienced abnormally cold temperatures.Bottom line: the weather had a significant impact on auto sales. And their follow-up today (following the strong auto sales report): Auto Sales and Weather

...

The evidence is pretty clear. New auto purchases in January 2014 were more than 5% down in states that were more than 7 degrees below their normal January temperature. New auto purchases were down slightly in states that were between -7 and -4 degrees below normal. In the rest of the country where temperatures were closer to normal, new auto purchases were quite strong.

Our post three weeks ago on the weather and auto sales argued that bad winter weather was responsible for the slowdown in consumer spending. ... We concluded: “When it comes to durable goods such as cars, it is likely that purchases will increase sharply when the weather improves in the states that had extremely cold winters.”Wednesday:

We now have an out-of-sample test of our conclusion: March estimates of new auto sales are out, and they are higher than at any other point since 2007.

• Early: Reis Q1 2014 Apartment Survey of rents and vacancy rates.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in March, up from 139,000 in February.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 0.8% increase in February orders.

CoreLogic: House Prices up 12.2% Year-over-year in February

by Calculated Risk on 4/01/2014 05:45:00 PM

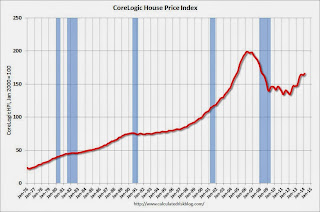

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 12.2 Percent Year Over Year in February

Home prices nationwide, including distressed sales, increased 12.2 percent in February 2014 compared to February 2013. This change represents 24 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 0.8 percent in February 2014 compared to January 2014.

Excluding distressed sales, home prices nationally increased 10.7 percent in February 2014 compared to February 2013 and 0.9 percent month over month compared to January 2014.

... the forecast indicates that home prices, including distressed sales, are expected to increase 10.5 percent year over year from March 2013 to March 2014.

“As the spring home-buying season kicks off, house price appreciation continues to be strong,” said Dr. Mark Fleming, chief economist for CoreLogic. “Although prices should remain strong in the near term due to a short supply of homes on the market, price increases should moderate over the next year as home equity releases pent-up supply.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.8% in January, and is up 12.2% over the last year. This index is not seasonally adjusted, so this was a strong month-to-month gain during the "weak" season.

The index is off 16.9% from the peak - and is up 23.5% from the post-bubble low set in February 2012.

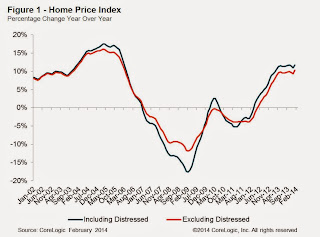

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty four consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty four consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).I expect the year-over-year increases to slow - and it may show up soon since CoreLogic is forecasting a smaller year-over-year increase for March index.