by Calculated Risk on 4/02/2014 10:11:00 AM

Wednesday, April 02, 2014

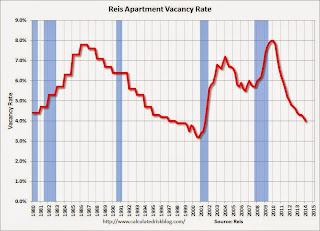

Reis: Apartment Vacancy Rate declined to 4.0% in Q1 2014

Reis reported that the apartment vacancy rate declined in Q1 to 4.0% from 4.2% in Q4 2013. In Q1 2013 (a year ago) the vacancy rate was at 4.4%, and the rate peaked at 8.0% at the end of 2009.

Some data and comments from Reis Senior Economist Ryan Severino:

Vacancy declined by 20 basis points during first quarter to 4.0%, a slight improvement over last quarter’s 10 basis point decline. Over the last twelve months the national vacancy rate has declined by 40 basis points, more or less the same pace as the last few quarters. Demand for apartments remains strong four years after the recovery began while inclement weather had a negative impact on construction activity. The national vacancy rate now stands 400 basis points below the cyclical peak of 8.0% observed right after the recession concluded in late 2009.

Resilient demand continued to shrug off seasonal weakness with a strong showing in the first quarter. The sector absorbed 41,570 units, down slightly versus last quarter’s 48,546 but nonetheless the largest figure for a first quarter since 2011. Moreover, the market is displaying incredible strength, continuing to absorb this many units four years after the advent of the recovery. Meanwhile, completions during the first quarter totaled 25,135 units. This is a pullback from last quarter’s 45,073, though inclement weather surely had some impact on this. As we have been warning, construction is clearly on an upswing, and bad weather is only likely to delay, not cancel projects. For 2014, we still expect roughly 162,000 units to be delivered so we should expect significant completions figures during the subsequent quarters of 2014.

Asking and effective rents grew by 0.5% and 0.6%, respectively, during the first quarter. This is a minor decrease from the fourth quarter and the lowest figure since the first quarter of 2013. Rent growth remains relatively weak given the fact that the apartment market is at a miniscule 4.0% vacancy rate. Normally at such a low vacancy rate, rent growth is at least 100 basis points above current growth rates on an annual basis. Rent growth is being held back by the fact that rents (on a nominal basis) are at record‐high levels and the labor market is still relatively weak, generating little compensation increases for many workers. The marriage of these two factors is making it difficult for landlords in many markets to increase rents at a faster pace.

...

Demand for apartments is seemingly insatiable. Although the labor market got off to sluggish start in 2014, we still expect the recovery to accelerate which should support ongoing demand for apartment units. However, the slight pullback in construction this quarter was due to seasonal factors and construction remains on pace for roughly 162,000 new units to be completed this year. This is above the long‐term historical average of roughly 125,000 units/year and this will make it difficult for demand to keep exceeding completions. Therefore, we anticipate that for the first time since 2009 the national vacancy rate will not fall in 2014. We anticipate that vacancy will be more or less flat this year. However, our general position on 2014 has not been altered ‐ still low vacancy, an improving economy and labor market, and lots of newly completed Class A properties coming online with rents higher than the market average will all conspire to push asking and effective rents up by roughly 3.3% next year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

Apartment vacancy data courtesy of Reis.