by Calculated Risk on 3/30/2014 09:05:00 PM

Sunday, March 30, 2014

Monday: Chicago PMI, Dallas Fed Mfg Survey, Yellen

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for March. The consensus is for a decrease to 58.5, down from 59.8 in February.

• At 9:55 AM, Speech, Fed Chair Janet Yellen, Strengthening Communities, At the 2014 National Interagency Community Reinvestment Conference, Chicago, Ill.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

Weekend:

• Schedule for Week of March 30th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 8 and DOW futures are up 65 (fair value).

Oil prices are up with WTI futures at $101.46 per barrel and Brent at $107.95 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.53 per gallon (up over the last two months, but still down from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Merrill and Nomura on March Employment Report

by Calculated Risk on 3/30/2014 11:28:00 AM

Here are some excepts from two research reports ... first, from Ethan Harris at Merrill Lynch:

We expect a solid jobs report in March with payroll growth of 230,000, reflecting a weather-induced snapback. We saw a modest recovery in job growth in February, with acceleration to 175,000 from 129,000 in January and 84,000 in December. The gain in February occurred despite still-harsh winter weather, implying pent-up activity. The survey week in February had poor conditions with snowstorms across the East coast. In contrast, the survey week in March was notably warmer, allowing for greater economic activity, particularly construction and manufacturing. ... Given the noise in the data, we advise smoothing through the recent swings and focus on a six month moving average, which is trending between 180-190K, revealing decent job growth. As the economy builds momentum, as we expect, we should see this trend move above 200K.And from Nomura:

We look for the unemployment rate to hold steady at 6.7%. The household survey has been quite strong, with job growth averaging 445,000 over the prior four months. The series is typically mean-reverting, suggesting there is a risk of weakening in March. We also think the labor force participation rate will inch higher as confidence about labor market prospects continues to improve, assuggested by the conference board survey (the labor differential in March weakened slightly, but has been on an upward trend).

Also of interest will be average hourly earnings and the work week. Average hourly earnings surged 0.4% mom to bring the yoy rate up to 2.2%. We do not expect such strong gains to continue and look for a slowdown to 0.2% mom which still translates to a 2.3% yoy increase. The risk, however, is to the upside. We think the workweek will rebound to 34.3 after falling to 34.2 in February, which we believe was largely due to weather conditions given the spike in the percent of workers who said they couldn’t report to work due to harsh weather.

[W]e are forecasting a 190k increase in private payrolls with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 195k. Furthermore, given the weaker labor market indicators within regional manufacturing surveys, we expect manufacturing employment to remain unchanged in March. Lastly, we expect the household survey to show that the unemployment rate fell 0.1pp to 6.6% in March.The consensus is for an increase of 206,000 non-farm payroll jobs in March, up from the 175,000 non-farm payroll jobs added in February.

Average weekly hours worked for private industries fell below trend in the past three months, most likely a result of the inclement weather which likely shortened the workweek at some businesses. However, given that the weather was better in March, we expect average weekly hours to rebound to 34.4 from 34.2 in February.

The consensus is for the unemployment rate to decline to 6.6% in March.

I'll write an employment report preview later this week after more data for March is released.

Saturday, March 29, 2014

Unofficial Problem Bank list declines to 538 Institutions, Q1 2014 Transition Matrix

by Calculated Risk on 3/29/2014 04:03:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 28, 2014.

Changes and comments from surferdude808:

The FDIC released its enforcement action activity through February 2014 today as anticipated. In that month, the FDIC was very busy terminating enforcement actions. For the week, there were 14 removals that leave the list at 538 institutions with assets of $174.3 billion. A year ago, the list held 791 institutions with assets of $290.0 billion. During March 2014, the list declined by 28 institutions and $8.0 billion in assets after 23 action terminations, four mergers, and one voluntary liquidation.

Removals included 12 action terminations against the following: Florida Bank, Tampa, FL ($536 million); Foundation Bank, Bellevue, WA ($364 million); First Bank of Dalton, Dalton, GA ($188 million); Proficio Bank, Cottonwood Heights, UT ($169 million); Regal Bank & Trust, Owings Mills, MD ($143 million); Bank of George, Las Vegas, NV ($112 million); RiverBank, Spokane, WA ($103 million); Security State Bank, Iron River, WI ($81 million); Bank of Bozeman, Bozeman, MT ($59 million); OmniBank, Bay Springs, MS ($47 million); Key Community Bank, Inver Grove Heights, MN ($42 million); and Cowboy State Bank, Ranchester, WY ($41 million). Hartford Savings Bank, Hartford, WI ($175 million) exited through a voluntary liquidation and Great Northern Bank, Saint Michael, MN ($71 million) through an unassisted merger.

We have updated the Unofficial Problem Bank List transition matrix through the first quarter of 2014. Full details are available in the accompanying table and a visual of the trends may be found in accompanying chart. Since the Unofficial Problem Bank List appeared in August 2009, 1,665 institutions have graced the list with only 32.3% or 538 remaining on the list. Removals total 1,127 with 555 coming through action termination. Another 375 have failed, 183 found a merger partner, and 14 exited through a voluntary liquidation. In the first quarter of 2014, action terminations accelerated to their fastest pace as 9.7 percent or 60 of the 595 institutions at the start of the quarter had their action terminated.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 129 | (43,313,416) | |

| Unassisted Merger | 31 | (6,663,407) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 153 | (184,209,338) | |

| Asset Change | (11,291,149) | ||

| Still on List at 3/31/2014 | 72 | 20,252,005 | |

| Additions after 8/7/2009 | 466 | 154,056,606 | |

| End (3/31/2014) | 538 | 174,308,611 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 426 | 187,850,337 | |

| Unassisted Merger | 152 | 70,216,490 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 222 | 110,834,945 | |

| Total | 810 | 371,225,914 | |

| 1Institution not on 8/7/2009 or 3/31/2014 list but appeared on a weekly list. | |||

Schedule for Week of March 30th

by Calculated Risk on 3/29/2014 08:52:00 AM

This will be a busy week for economic data with several key reports including the March employment report on Friday.

Other key reports include the ISM manufacturing index on Tuesday, February vehicle sales on Tuesday, the ISM service index on Thursday, and the February trade deficit report on Thursday.

Also, Reis is scheduled to release their Q1 surveys of rents and vacancy rates for apartments, offices and malls.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a decrease to 58.5, down from 59.8 in February.

9:55 AM: Speech, Fed Chair Janet Yellen, Strengthening Communities, At the 2014 National Interagency Community Reinvestment Conference, Chicago, Ill.

10:30 AM: Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

Early: Reis Q1 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

9:00 AM ET: The Markit US PMI Manufacturing Index for March.

10:00 AM ET: ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.

10:00 AM ET: ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in February at 53.2%. The employment index was at 52.3%, and the new orders index was at 54.5%.

10:00 AM: Construction Spending for February. The consensus is for a 0.1% increase in construction spending.

Early: Reis Q1 2014 Apartment Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in March, up from 139,000 in February.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 0.8% increase in February orders.

Early: Reis Q1 2014 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 311 thousand.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. Imports and exports increased in January.

The consensus is for the U.S. trade deficit to decrease to $38.5 billion in February from $39.1 billion in January.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a reading of 53.5, up from 51.6 in February. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: Employment Report for March. The consensus is for an increase of 206,000 non-farm payroll jobs in March, up from the 175,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to decline to 6.6% in March.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.The economy has added 8.7 million private sector jobs since employment bottomed in February 2010 (8.0 million total jobs added including all the public sector layoffs).

There are still almost 129 thousand fewer private sector jobs now than when the recession started in 2007. Private sector employment at a new high will probably be a headline for the March report.

Friday, March 28, 2014

Headline for Next Friday: "U.S. Private Employment at All Time High"

by Calculated Risk on 3/28/2014 07:13:00 PM

Just a quick note, private U.S. employment is currently 129 thousand below the pre-recession peak. With the release of the March employment report next Friday, private employment will probably be at an all time high.

However total employment is still 666 thousand below the pre-recession peak due to all the government layoffs. Total employment will probably be at a new high sometime this summer.

I guess I'm going to have to retire the following graph soon ... (once call the "THE SCARIEST JOBS CHART EVER").

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.

This is total non-farm payrolls, so I'll be posting this for a few more months.

Of course this doesn't include growth of the labor force ...

Housing: The increase in inventory in the West

by Calculated Risk on 3/28/2014 03:36:00 PM

Housing Tracker (Department of Numbers) has inventory for a number of cities. Right now we are seeing inventories up sharply year-over-year in several cities in the West.

Note: Housing Tracker is reporting total inventory is up slightly year-over-year in Las Vegas. However, non-contingent inventory has doubled year-over-year according to GLVAR. Contingent inventory includes short sales that make remain contingent for a significant period awaiting lender approval.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change in several cities in the West.

Inventory is up 88% in Sacramento, up 57% in Phoenix, up 40% in Riverside, and up 33% in Orange County.

However inventory is only up 3% in San Francisco and 9% in San Diego (Las Vegas total inventory is up 3%, but non-contingent inventory has doubled).

With more inventory, price increases should slow.

BLS: State unemployment rates were "little changed" in February

by Calculated Risk on 3/28/2014 10:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in February. Twenty-nine states had unemployment rate decreases from January, 10 states had increases, and 11 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island continued to have the highest unemployment rate among the states in February, 9.0 percent. North Dakota again had the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, South Carolina, Nevada and Florida have seen the largest declines and many other states have seen significant declines.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at 9% in only one state: Rhode Island. Illinois is at 8.7%, Nevada at 8.5%, and California at 8.0%.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate above 11% (red).Currently one state has an unemployment rate at or above 9% (purple), four states at or above 8% (light blue), and 13 states at or above 7% (blue).

Final March Consumer Sentiment at 80.0

by Calculated Risk on 3/28/2014 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for March decreased to 80.0 from the February reading of 81.6, and was up slightly from the preliminary March reading of 79.9.

This was below the consensus forecast of 80.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Personal Income increased 0.3% in February, Spending increased 0.3%

by Calculated Risk on 3/28/2014 08:44:00 AM

The BEA released the Personal Income and Outlays report for February:

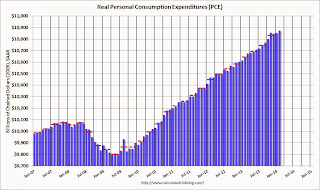

Personal income increased $47.7 billion, or 0.3 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $30.8 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in February, compared with an increase of 0.1 percent in January. ... The price index for PCE increased 0.1 percent in February, the same increase as in January. The PCE price index, excluding food and energy, increased 0.1 percent in February, the same increase as in January.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q1 PCE growth (first two months of the quarter), PCE was increasing at a 1.3% annual rate in Q1 2014 (using mid-month method, PCE was increasing less than 1.0%). This suggests weak PCE growth in Q1, but I expect PCE to increase faster in March.

Thursday, March 27, 2014

Friday: February Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 3/27/2014 07:27:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 80.5, up from the preliminary reading of 79.9, but down from the February reading of 81.6.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for February 2014.

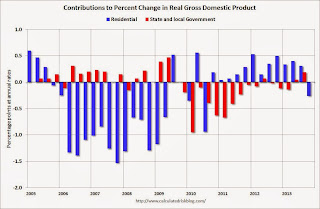

Here is an update based on the third estimate of Q4 GDP release today. The following graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments (red) appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local government contribution was zero in Q4 after revisions.

I expect state and local governments to make a small positive contribution to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.