by Calculated Risk on 3/28/2014 09:55:00 AM

Friday, March 28, 2014

Final March Consumer Sentiment at 80.0

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for March decreased to 80.0 from the February reading of 81.6, and was up slightly from the preliminary March reading of 79.9.

This was below the consensus forecast of 80.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Personal Income increased 0.3% in February, Spending increased 0.3%

by Calculated Risk on 3/28/2014 08:44:00 AM

The BEA released the Personal Income and Outlays report for February:

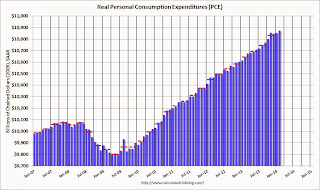

Personal income increased $47.7 billion, or 0.3 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $30.8 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in February, compared with an increase of 0.1 percent in January. ... The price index for PCE increased 0.1 percent in February, the same increase as in January. The PCE price index, excluding food and energy, increased 0.1 percent in February, the same increase as in January.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q1 PCE growth (first two months of the quarter), PCE was increasing at a 1.3% annual rate in Q1 2014 (using mid-month method, PCE was increasing less than 1.0%). This suggests weak PCE growth in Q1, but I expect PCE to increase faster in March.

Thursday, March 27, 2014

Friday: February Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 3/27/2014 07:27:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 80.5, up from the preliminary reading of 79.9, but down from the February reading of 81.6.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for February 2014.

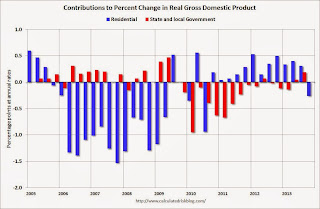

Here is an update based on the third estimate of Q4 GDP release today. The following graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments (red) appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local government contribution was zero in Q4 after revisions.

I expect state and local governments to make a small positive contribution to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.

House Prices and Lagged Data

by Calculated Risk on 3/27/2014 02:55:00 PM

Two years ago I wrote a post titled House Prices and Lagged Data. In early 2012, I had just called the bottom for house prices (see: The Housing Bottom is Here), and in the "lagged data" post I was pointing out that the Case-Shiller house price index has a serious data lag - and that we had to wait several months to see if prices had actually bottomed (the call was correct).

Now I'm looking for price increases to slow, and once again we have to remember that the Case-Shiller data has a serious lag. (Note: the following is updated from the post two years ago)

All data is lagged, but some data is lagged more than others.

In times of economic stress, I tend to watch the high frequency data closely: initial weekly unemployment claims, monthly manufacturing surveys, and consumer sentiment. The “high frequency” data is lagged, but the lag is usually just a week or two.

Most of the time I focus on the monthly employment report, quarterly GDP, housing starts, new home sales and retail sales. The lag for most of this data is several weeks. As an example, the BLS reference period contains the 12th of the month, so the report is lagged a few weeks by the time it is released. The housing starts and new home sales data released recently were for February, so the lag is also a few weeks after the end of the month. The advance estimate of quarterly GDP is released several weeks after the end of the quarter.

But sometimes the lag can be much longer. Two days ago, the January Case-Shiller house price index was released. This is actually a three month average for house sales closed in November, December and January.

But remember that the purchase agreement for a house that closed in November was probably signed in September or early October. So some portion of the Case-Shiller index will be for contract prices 6 to 7 months ago!

Other house price indexes have less of a lag. CoreLogic uses a weighted 3 month average with the most recent month weighted the most, the Black Knight house price index is for just one month (not an average).

But, if price increases have slowed - as Jed Kolko argues using asking prices - then the key point is that the Case-Shiller index will not show the slowdown for some time. Just something to remember ...

Kansas City Fed: Regional Manufacturing increased in March

by Calculated Risk on 3/27/2014 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Increased

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity increased, and producers’ expectations were mostly stable at solid levels.The last regional Fed manufacturing survey for March will be released on Monday, March 31st (Dallas Fed). In general - with the exception of the Richmond survey - the regional surveys have been positive in March and suggest improvement in the ISM manufacturing index.

“We saw acceleration in regional factory activity in March, to the fastest pace in over two years”, said Wilkerson. “However, several respondents noted the stronger growth was in part making up for weather-related softness in previous months.”

The month-over-month composite index was 10 in March, up from 4 in February and 5 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity increased at both durable and non-durable goods-producing plants, particularly for plastic and machinery products. Other month-over-month indexes also improved. The production index jumped from 3 to 22, its highest level in 3 years, and the shipments and new orders indexes also climbed higher. The order backlog index edged up from -4 to -1, and the new orders for exports index also increased slightly. The employment index moderated from 3 to 0, and both inventory indexes eased somewhat.

emphasis added

NAR: Pending Home Sales Index down 10.5% year-over-year in February

by Calculated Risk on 3/27/2014 10:00:00 AM

From the NAR: February Pending Home Sales Continue Slide

The Pending Home Sales Index, a forward-looking indicator based on contract signings, dipped 0.8 percent to 93.9 from a downwardly revised 94.7 in January, and is 10.5 percent below February 2013 when it was 104.9. The February reading was the lowest since October 2011, when it was 92.2.A few comments:

...

The PHSI in the Northeast declined 2.4 percent to 77.1 in February, and is 7.4 percent below a year ago. In the Midwest the index rose 2.8 percent to 95.3 in February, but is 8.5 percent lower than February 2013. Pending home sales in the South fell 4.0 percent to an index of 106.3 in February, and are 9.3 percent below a year ago. The index in the West increased 2.3 percent in February to 86.1, but is 16.5 percent below February 2013.

• Mr. Yun once gain blamed some of the weakness on the weather (the weather was unusually bad again in February), but the index remained weak in the South too (down 9.3% year-over-year and probably not weather), and in the West (down 16.5% year-over-year partially related to low inventories).

• My view is there were several reasons for the decline in this index: weather in some areas, fewer distressed sales, less investor buying, fewer "pending" short sales, and low inventories. I think fewer distressed sales, fewer "pending" short sales, and less investor buying are all signs of a healthier market - even if overall sales decline.

• Mr Yun's forecast for 2014 is 5.0 million existing home sales, down from his earlier forecast of 5.1 million existing home sales this year. I'll take the under on his current forecast, and I think it would be a positive sign if sales were under 5 million in 2014 as long as distressed sales continue to decline and conventional sales increase.

• Of course, with housing, what really matters for the economy and employment is new home sales and housing starts, not existing home sales.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

Q4 GDP Revised up to 2.6%, Weekly Initial Unemployment Claims decline to 311,000

by Calculated Risk on 3/27/2014 08:30:00 AM

From the BEA: Gross Domestic Product, 4th quarter and annual 2013 (third estimate); Corporate Profits, 4th quarter and annual 2013

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.6 percent in the fourth quarter of 2013 (that is, from the third quarter to the fourth quarter), according to the "third" estimate released by the Bureau of Economic Analysis. ...Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 2.6% to 3.3%. Private investment was revised down.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.4 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains largely the same; personal consumption expenditures (PCE) was larger than previously estimated, while private investment in inventories and in intellectual property products were smaller than previously estimated ...

The DOL reports:

In the week ending March 22, the advance figure for seasonally adjusted initial claims was 311,000, a decrease of 10,000 from the previous week's revised figure of 321,000. The 4-week moving average was 317,750, a decrease of 9,500 from the previous week's revised average of 327,250.The previous week was revised up from 320,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 317,750.

This was below the consensus forecast of 325,000. The 4-week average is moving down and is close to normal levels during an expansion.

Wednesday, March 26, 2014

Thursday: Q4 GDP (3rd Estimate), Unemployment Claims, Pending Home Sales

by Calculated Risk on 3/26/2014 06:55:00 PM

From the Federal Reserve: Comprehensive Capital Analysis and Review

The Federal Reserve on Wednesday announced it has approved the capital plans of 25 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR). The Federal Reserve objected to the plans of the other five participating firms--four based on qualitative concerns and one because it did not meet a minimum post-stress capital requirement.Thursday:

...

When considering an institution's capital plan, the Federal Reserve considers both qualitative and quantitative factors. These include a firm's capital ratios under severe economic and financial market stress and the strength of the firm's capital planning process. After the Federal Reserve objects to a capital plan, the institution may only make capital distributions with prior written approval from the Federal Reserve.

...

Based on qualitative concerns, the Federal Reserve objected to the capital plans of Citigroup Inc.; HSBC North America Holdings Inc.; RBS Citizens Financial Group, Inc.; and Santander Holdings USA, Inc. The Federal Reserve objected to the capital plan of Zions Bancorporation because the firm did not meet the minimum, post-stress tier-1 common ratio of 5 percent.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 320 thousand.

• Also at 8:30 AM, The third estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.7% annualized in Q4, revised up from the second estimate of 2.4%.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 0.8% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

Vehicle Sales Forecasts: March Rebound

by Calculated Risk on 3/26/2014 03:30:00 PM

Auto sales were clearly impacted by the harsh winter weather in January and February. For an excellent article on weather and auto sales, see Weakening Economy or Just Bad Winter? by Atif Mian and Amir Sufi. Now we will see if sales rebound ...

Note: The automakers will report March vehicle sales on Tuesday, April 1st. Sales in February were at a 15.3 million seasonally adjusted annual rate (SAAR), and it appears there will be a solid increase in March.

Here are a couple of forecasts:

From Kelley Blue Book: New-Car Sales Expected To Rise 2 Percent In March, Fall 0.3 Percent In First Quarter 2014

New-vehicle sales are expected to rise 2 percent year-over-year to a total of 1.48 million units, and an estimated 15.7 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ... A 15.7 million SAAR would mark the seventeenth consecutive month above 15 million and the greatest March since 2007.Note: In March 2014, there was one less selling day than in March 2013 (26 days vs. 27 last year).

"Following two months of weaker-than-expected sales, the industry should start to bounce back in March," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Although we aren't expected to hit 16 million SAAR, indications show that consumers are returning to showrooms in spring. The momentum built in March should set the market up for a big month in April.

From J.D. Power: Auto Sales Recovering After Slow Start to 2014

Cold and snowy weather may have depressed new-vehicle sales in January and February of 2014, but customers are returning to dealership showrooms in March, according to a new sales forecast jointly issued by J.D. Power and LMC Automotive. According to the latest forecast, retail sales are expected to demonstrate a 7% increase over March 2013, with 1,148,338 new cars, trucks, SUVs, and minivans rolling into American driveways.J.D. Power didn't provide a fleet forecast or SAAR forecast, but this suggests a significant increase over the February rate.

Additionally, the average transaction price for those new vehicles remains above $29,300, the highest ever for the month of March and $700 higher than in March 2013, reflecting continued economic strength and improved consumer confidence.

"The severe weather had an impact on retail sales in January and February, but as the weather has improved, so have sales," said John Humphrey, senior vice president of the global automotive practice at J.D. Power. "Additionally, stronger pricing coupled with lower reliance on fleet continues to bode well for the overall health of the sector."

At the start of March 2014, automakers had stockpiled an 80-day supply of new vehicles, while a 60-day supply is considered ideal. LMC Automotive isn't concerned, though, and expects a faster selling rate to reduce inventories to normal levels.

Chemical Activity Barometer for March Suggests "continued modest growth"

by Calculated Risk on 3/26/2014 12:37:00 PM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Equity Prices Drive Chemical Activity Barometer Growth Despite Continued Adverse Weather

While winter weather extremes continue to impact economic reporting, strengthening chemical equity prices drove solid gains in the American Chemistry Council’s (ACC) monthly Chemical Activity Barometer (CAB), released today. March’s reading featured a gain of 0.3% over February on a three-month moving average basis (3MMA), rebounding past the average 0.2% gain in late 2013, and pointing to modest but continued growth in the U.S. economy through the fourth quarter of 2014. Strengthening chemical equity prices in February and March are a positive signal and a major factor in this month’s CAB reading. The economic indicator, shown to lead U.S. business cycles by an average of eight months at cycle peaks, is up 2.5 percent over a year ago, at an improved year-earlier pace. The CAB reading for February was revised upwards slightly from earlier reports.

“Winter weather extremes have carried into March and continue to impact many of the economic readings, but all signs point to an expanding U.S. economy through 2014,” said Kevin Swift, chief economist at the American Chemistry Council. “Strengthening chemical equity prices, combined with the expansion of sales in intermediate goods, which constitute roughly 85% of overall chemical sales, are encouraging signs for the continued health of the U.S. economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests that continued growth.