by Calculated Risk on 3/24/2014 08:42:00 AM

Monday, March 24, 2014

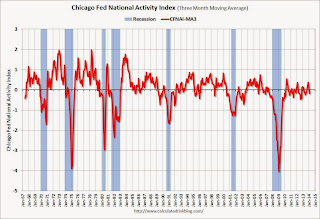

Chicago Fed: "Economic activity increased in February"

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth increased in February

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.14 in February from –0.45 in January. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.18 in February from +0.02 in January, marking its first reading below zero in six months. February’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in February (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, March 23, 2014

Sunday Night Futures

by Calculated Risk on 3/23/2014 08:33:00 PM

Jon Hilesenrath at the WSJ points out that even if the Fed starts raising rates a little earlier than expected, rates are expected to be below normal for a long time: Inside Fed Statement Lurks Hint on Rates

The Fed, in its official policy statement, said it planned to keep short-term rates below what it sees as appropriate for a normal economy even after the unemployment rate and inflation revert to typical levels.Monday:

In 2016, for example, the Fed projects the jobless rate will reach 5.4%, economic output will be growing at a rate near 3% and inflation will be just below 2%. That level of unemployment would be lower than the average over the past 50 years.

Yet officials see the Fed's target short-term interest rate at just over 2% at the end of 2016, well below the 4% they consider appropriate for an economy running on all cylinders.

• At 8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

• Early, Black Knight (formerly LPS) will release their monthly "First Look" at February mortgage performance data.

Weekend:

• Schedule for Week of March 23rd

• The Favorable Demographics for Apartments

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices are mixed with WTI futures at $99.21 per barrel and Brent at $106.92 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.51 per gallon (up sharply over the last month, but still down from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

The Favorable Demographics for Apartments

by Calculated Risk on 3/23/2014 02:57:00 PM

For several years I've been pointing out that demographics are favorable for apartments. This is because a large cohort has been moving into the 20 to 34 year old age group (a key age group for renters).

Also ... in 2015, based on Census Bureau projections, the two largest 5 year cohorts will be 20 to 24 years old, and 25 to 29 years old (the largest cohorts will no longer be the "boomers").

Here are two graphs showing the population in the 25 to 34 year age group, and the 20 to 34 year old age group from 1985 to 2035 (1990 was the previous peak for 25 to 34, 1985 was the previous peak for 20 to 34).

This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

Click on graph for larger image.

Click on graph for larger image.

For the 25 to 34 year old age group, the population is just getting back to the previous peak, and will continue to increase significantly over the next 5 years.

After 2020, the increase in population for this key age group will slow.

The second graph is for the 20 to 34 year old age group.

The second graph is for the 20 to 34 year old age group.

This favorable demographics is a key reason I've been positive on the apartment sector for the last several years - and I expect new apartment construction to stay strong for several more years.

Hamilton: Graphs of key economic trends

by Calculated Risk on 3/23/2014 10:36:00 AM

Professor Hamilton discusses several interesting graphs at econbrowser: Graphs of key economic trends.

As an example, Hamilton (via Martin Neil Baily and Barry Bosworth) presents a graph that shows while "U.S. manufacturing output has grown at the same pace as the rest of the economy, U.S. manufacturing employment has not."

And there are couple of interesting graphs on oil. Enjoy!

Saturday, March 22, 2014

Schedule for Week of March 23rd

by Calculated Risk on 3/22/2014 01:11:00 PM

The key reports this week are the third estimate of Q4 GDP on Thursday, February New Home sales on Tuesday, February Personal Income and Outlays on Friday, and January Case-Shiller house prices, on Tuesday.

For manufacturing, the March Richmond and Kansas City Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through December 2013 (the Composite 20 was started in January 2000).

The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for January. The Zillow forecast is for the Composite 20 to increase 13.0% year-over-year, and for prices to increase 0.5% month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for January 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for a decrease in sales to 440 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 468 thousand in January.

10:00 AM: Conference Board's consumer confidence index for March. The consensus is for the index to increase to 78.6 from 78.1.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 320 thousand.

8:30 AM: Q4 GDP (third estimate). This is the third estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.7% annualized in Q4, revised up from the second estimate of 2.4%.

10:00 AM ET: Pending Home Sales Index for February. The consensus is for a 0.8% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 80.5, up from the preliminary reading of 79.9, but down from the February reading of 81.6.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for February 2014.

Unofficial Problem Bank list declines to 552 Institutions

by Calculated Risk on 3/22/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 21, 2014.

Changes and comments from surferdude808:

The OCC provided an update on its enforcement action activities today as anticipated. The release contributed to the majority of the seven removals this week, with six being action terminations. After the removals, the Unofficial Problem Bank List includes 552 institutions with assets of $176.4 billion. A year ago, the list held 797 institutions with $294.3 billion in assets.

The Bank of the Lakes, National Association, Owasso, OK ($169 million) found its way off the list through an unassisted acquisition. Actions were terminated by the OCC against Putnam Bank, Putnam, CT ($453 million Ticker: PSBH); The First National Bank of Ottawa, Ottawa, IL ($271 million Ticker: FOTB); First National Bank of Central Alabama, Aliceville, AL ($230 million); The Oculina Bank, Fort Pierce, FL ($162 million); First National Bank of Pasco, Dade City, FL ($145 million); and First National Bank of Southern California, Riverside, CA ($141 million).

Next week, the FDIC should provide an update in its enforcement action activity through the end of February 2014. With also being the calendar quarter-end, we will update the transition matrix. Enjoy the weekend and hopefully your bracket is still intact for the $1 billion grand prize.

Friday, March 21, 2014

DOT: Vehicle Miles Driven decreased 1.3% year-over-year in January

by Calculated Risk on 3/21/2014 06:04:00 PM

This monthly decline appears weather related since miles driven were down 4.6% in the Northeast, and 4.0% in the Northwest. Miles driven were up 2.9% in the West.

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -1.3% (-2.9 billion vehicle miles) for January 2014 as compared with January 2013.The following graph shows the rolling 12 month total vehicle miles driven.

...

Travel for the month is estimated to be 224.0 billion vehicle miles.

The rolling 12 month total is still mostly moving sideways but has started to increase a little recently.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 74 months - 6+ years - and still counting. Currently miles driven (rolling 12 months) are about 2.3% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In January 2014, gasoline averaged of $3.39 per gallon according to the EIA. that was unchanged from January 2013 when prices also averaged $3.39 per gallon.

In January 2014, gasoline averaged of $3.39 per gallon according to the EIA. that was unchanged from January 2013 when prices also averaged $3.39 per gallon.As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 6 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it appears miles driven might be gradually increasing again.

Lawler on Lennar: Orders up 10.1% YoY; Prices, Margins Up Sharply; Saw “Volumes Returning,” But Not from First-Time Buyers

by Calculated Risk on 3/21/2014 03:01:00 PM

From housing economist Tom Lawler:

Lennar Corporation, the third largest US home builder, reported that net home orders in the quarter ended February 28, 2014 totaled 4,465, up 10.1% from the comparable quarter of 2013. The company’s community count was up 13% YOY. Home deliveries last quarter totaled 3,609, up 13.3% from the comparable quarter of 2013, at an average sales price of $316,000, up 17.5% from a year ago. The company’s order backlog at the end of February was 5,662, up 15.0% from last February.

In its conference call, a Lennar official noted that while in the previous quarter the company had seen evidence of weaker sales, more recently there were “clear signs that volume is returning to the market.” The official said that net orders “improved sequentially” during the quarter, but when asked for more information the official said that this “sequential increase” was “normal” for the time of year. An official said that the company had seen a “bit of a slowdown” in home price increases in “most” (though not all) markets. In response to a question on competitors, an official said that competition “has heated up a bit” and some competitors have been a bit more aggressive in offering sales incentives to increase sales, but that so far such competitive pressure was “not significant.”

In a Q&A on first-time buyers, an official said that the company’s land/lot acquisitions had prepared the company to meet increased first-time buyer demand “should that market return,” implying that demand from first-time buyers remained very weak.

Lennar was extremely aggressively acquiring land/lots over the last two years – Lennar owned or controlled 153,776 lots at the end of last November, up about 20% from November 2012 and up 38% from November 2011. An official said that the company’s land/lot inventory was sufficient to meet planned home deliveries in both 2014 and 2015.

Here is a summary of net home orders for the three-month period ending in February for three large home builders.

| Net Home Orders | |||

|---|---|---|---|

| 3-mo period ending: | 2/28/2014 | 2/28/2013 | % Change |

| Lennar | 4,465 | 4,055 | 10.1% |

| KB Home | 1,765 | 1,671 | 5.6% |

| Hovnanian | 1,402 | 1,581 | -11.3% |

| Total | 7,632 | 7,307 | 4.4% |

So far builder results have been “mixed,” and while most are optimistic, most also say it is too early to gauge the “success” of the “spring” home selling season (which actually begins well before spring.) There appears to be a consensus, however, that demand from first-time buyers remains very low.

Update: Predicting the Next Recession

by Calculated Risk on 3/21/2014 11:11:00 AM

The following is a repeat of a post I wrote in January 2013. This still seems correct - and I've added a few updates in italics.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR Update: this was written over a year ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

[CR Update: 2013 was a little better than I expect, but still sluggish. Even with the weak start, I think growth in 2014 will be better than in 2013.]

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR Update: Most of the poor policy choices in the U.S. are behind us. Austerity hurt the recovery, but austerity appears over at the state and local level and diminished at the Federal level.]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR Update: This still seems correct - no recession this year or next from Fed tightening.]

ATA Trucking Index increased in February

by Calculated Risk on 3/21/2014 09:24:00 AM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Jumped 2.8% in February

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.8% in February, after plunging 4.5% the previous month. January’s drop was slightly more than the 4.3% reported on February 19, 2014. In February, the index equaled 127.6 (2000=100) versus 124.1 in January. The all-time high was in November 2013 (131.0).

Compared with February 2013, the SA index increased 3.6%.

...

“It is pretty clear that winter weather had a negative impact on truck tonnage during February,” said ATA Chief Economist Bob Costello. “However, the impact wasn’t as bad as in January because of the backlog in freight due to the number of storms that hit over the January and February period.”

“The fundamentals for truck freight continue to look good,” he said. “Several other economic indicators also snapped back in February. We have a hole to dig out of from such a bad January, but I feel like we are moving in the right direction again. I remain optimistic for 2014.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index rebounded in February after the sharp decline in January.