by Calculated Risk on 3/20/2014 09:04:00 PM

Thursday, March 20, 2014

Fed: Large Banks "collectively better positioned" to cope with "an extremely severe economic downturn"

Note: I was strong early supporter of bank stress tests, and I'm glad the Fed has continued testing banks on an annual basis. Hopefully this will continue ...

From the Federal Reserve: Press Release

According to the summary results of bank stress tests announced by the Federal Reserve on Thursday, the largest banking institutions in the United States are collectively better positioned to continue to lend to households and businesses and to meet their financial commitments in an extremely severe economic downturn than they were five years ago. This result reflects continued broad improvement in their capital positions since the financial crisis.From the WSJ: Fed 'Stress Test' Results: 29 of 30 Big Banks Could Weather Big Shock

Reflecting the severity of the most extreme stress scenario--which features a deep recession with a sharp rise in the unemployment rate, a drop in equity prices of nearly 50 percent, and a decline in house prices to levels last seen in 2001--projected loan losses at the 30 bank holding companies in the latest stress tests would total $366 billion during the nine quarters of the hypothetical stress scenario. The aggregate tier 1 common capital ratio, which compares high-quality capital to risk-weighted assets, would fall from an actual 11.5 percent in the third quarter of 2013 to the minimum level of 7.6 percent in the hypothetical stress scenario. That minimum post-stress number is significantly higher than the 30 firms' actual tier 1 common ratio of 5.5 percent measured in the beginning of 2009.

The Fed said 29 of the 30 largest institutions have enough capital to continue lending even when faced with a hypothetical jolt to the U.S. economy lasting into 2015, including a severe drop in housing prices and a spike in the unemployment rate.

The results will factor into the Fed's decision next week to approve or deny individual banks' plans for returning billions of dollars to shareholders through dividends or share buybacks. The Fed's annual "stress tests" are designed to ensure large banks can withstand severe losses without needing a government rescue.

Fed: Q4 Household Debt Service Ratio near 30 year low

by Calculated Risk on 3/20/2014 04:51:00 PM

Here is an update of the Fed's Household Debt Service ratio through Q4 2013 Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased slightly in Q4, and is near a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than a few years ago.

Earlier: Philly Fed Manufacturing Survey indicated Expansion in March

by Calculated Risk on 3/20/2014 02:27:00 PM

From the Philly Fed: March Manufacturing Survey

Manufacturing activity rebounded in March, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, and shipments increased and recorded positive readings this month, suggesting a return to growth following weather‐related weakness in February. Firms’ employment levels were reported near steady, but responses reflected optimism about adding to payrolls over the next six months. The surveyʹs indicators of future activity reflected optimism about continued growth over the next six months.This was above the consensus forecast of a reading of 4.0 for March.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of ‐6.3 in February to 9.0 this month, nearing its reading in January.

The employment index remained positive for the ninth consecutive month but edged 3 points lower, suggesting near‐steady employment.

emphasis added

Click on graph for larger image.

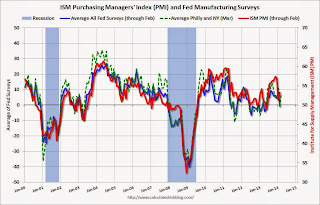

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys was negative in February (probably weather related), and turned positive again in March. This suggests stronger expansion in the ISM report for March.

Comments on Existing Home Sales

by Calculated Risk on 3/20/2014 11:59:00 AM

The NAR reported this morning that inventory was up 5.3% year-over-year in February.

A few points:

• Inventory is the KEY number in the NAR release.

• The NAR inventory data is "noisy" (and difficult to forecast based on other data), however it appears inventory bottomed in early 2013.

• The headline NAR inventory number is NOT seasonally adjusted (and there is a clear seasonal pattern).

• Inventory is still very low, and with the low level of inventory, there is still upward pressure on prices.

• I expect inventory to increase in 2014, and I expect the year-over-year increase to be in the 10% to 15% range by the end of 2014.

• However, if inventory doesn't increase, prices will probably increase a little faster than expected (a key reason to watch inventory right now).

Click on graph for larger image.

Click on graph for larger image.

The NAR does not seasonally adjust inventory, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory (see graph of NAR reported and seasonally adjusted).

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 6.8% from the bottom. On a seasonally adjusted basis, inventory was mostly unchanged in February compared to January.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 7.1% from February 2013, but normal equity sales were probably up from February 2013, and distressed sales down. The NAR reported that 16% of sales were distressed in February (from a survey that isn't perfect):

Distressed homes – foreclosures and short sales – accounted for 16 percent of February sales, compared with 15 percent in January and 25 percent in February 2013.Last year the NAR reported that 25% of sales were distressed sales.

A rough estimate: Sales in February 2013 were reported at 4.95 million SAAR with 25% distressed. That gives 1.24 million distressed (annual rate), and 3.71 million conventional. In February 2014, sales were 4.60 million SAAR, with 16% distressed. That gives 0.74 million distressed, and 3.86 million conventional. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up. A positive sign!

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in February (red column) were above the sales for 2008 through 2011, and below sales for the last two year.

Overall this report was as expected (fewer distressed sales pulling down overall sales), and inventory needs to be watched closely.

Earlier:

• Existing Home Sales in February: 4.60 million SAAR, Inventory up 5.3% Year-over-year

Existing Home Sales in February: 4.60 million SAAR, Inventory up 5.3% Year-over-year

by Calculated Risk on 3/20/2014 10:00:00 AM

The NAR reports: February Existing-Home Sales Remain Subdued

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 0.4 percent to a seasonally adjusted annual rate of 4.60 million in February from 4.62 million in January, and 7.1 percent below the 4.95 million-unit level in February 2013. February’s pace of sales was the lowest since July 2012, when it stood at 4.59 million.

...

Total housing inventory at the end of February rose 6.4 percent to 2.00 million existing homes available for sale, which represents a 5.2-month supply at the current sales pace, up from 4.9 months in January. Unsold inventory is 5.3 percent above a year ago, when there was a 4.6-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (4.60 million SAAR) were slightly lower than last month, and were 7.1% below the February 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.00 million in February from 1.88 million in January. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.00 million in February from 1.88 million in January. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 5.3% year-over-year in February compared to February 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.

Inventory increased 5.3% year-over-year in February compared to February 2013. This year-over-year increase in inventory suggests inventory bottomed early last year.Months of supply was at 5.2 months in February.

This was slightly below expectations of sales of 4.64 million. For existing home sales, the key number is inventory - and the key story is inventory is still low, but up year-over-year. I'll have more later ...

Weekly Initial Unemployment Claims at 320,000

by Calculated Risk on 3/20/2014 08:30:00 AM

The DOL reports:

In the week ending March 15, the advance figure for seasonally adjusted initial claims was 320,000, an increase of 5,000 from the previous week's unrevised figure of 315,000. The 4-week moving average was 327,000, a decrease of 3,500 from the previous week's unrevised average of 330,500.The previous week was unrevised at 315,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 327,000.

This was below the consensus forecast of 325,000. The 4-week average is moving down slightly and is close to normal levels during an expansion.

Wednesday, March 19, 2014

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 3/19/2014 08:10:00 PM

On Fed Chair Janet Yellen's press conference ...

From Jon Hilsenrath and Victoria McGrane at the WSJ: Yellen Debut Rattles Markets

In a press conference after the meeting, Ms. Yellen suggested that interest-rate increases might come about six months after the bond-buying program ends—a conclusion that could come this fall. She offered that projection with many caveats, but some investors took it as a sign that the Fed could start raising interest rates sooner than expected.As I noted earlier, I don't think QE3 will not end until January 2015 (that is the current path of a $10 billion reduction per meeting). That puts the first rate hike mid-year 2015 - if all goes well.

And from Binymin Appelbaum at the NY Times: Fed Cuts Bond Purchases by Another $10 Billion

The Federal Reserve further curtailed its economic stimulus campaign on Wednesday, announcing as expected that it would further reduce its monthly bond purchases because of the progress of the economic recovery.With the unemployment rate at 6.7%, the 6.5% wording was no longer useful. Now the Fed will watch a number of employment and inflation indicators. According to the FOMC statement:

The Fed ... policy-making committee said in a statement released after a two-day meeting that rates would remain at the current level, near zero, “for a considerable time” after it stops adding to its bond holdings, particularly if inflation remains sluggish.

...

The loose guidance about short-term rates replaced the Fed’s specific assertion ... that it would keep rates near zero at least as long as the official unemployment rate remained above 6.5 percent. ... “The purpose of this change is simply to provide more information than we have in the past, even though it is qualitative information, as the unemployment rate declines below 6.5 percent,” Janet L. Yellen, the Fed’s new chairwoman, said ...

In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments.Using several indicators keeps the options open.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 315 thousand.

• At 10:00 AM, the Existing Home Sales report for February from the National Association of Realtors (NAR). The consensus is for sales of 4.64 million on seasonally adjusted annual rate (SAAR) basis. Sales in January were at a 4.62 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.60 million SAAR. As always, a key will be inventory of homes for sale.

• Also at 10:00 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 4.0, up from -6.3 last month (above zero indicates expansion).

What does Yellen's "around six months" mean?

by Calculated Risk on 3/19/2014 04:40:00 PM

During the Q&A today, Fed Chair Janet Yellen said:

"[T]he language that we used in the statement is considerable period. So I, you know, this is the kind of term it’s hard to define. But, you know, probably means something on the order of around six months, that type of thing.”She was referring to the sentence in the FOMC statement:

The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.This raises several questions:

emphasis added

1) When does six months end?

2) Is this data dependent?

3) Is this new news?

Here is a table of actual and projected FOMC tapering (Note: this is not preset, but it would take a substantial change in the forecast to deviate from this schedule):

| Meeting | Taper to | Effective |

|---|---|---|

| 12/18/13 | $75 billion | Jan-14 |

| 1/29/14 | $65 billion | Feb-14 |

| 3/19/14 | $55 billion | Apr-14 |

| 4/30/14 | $45 billion1 | May-14 |

| 6/18/14 | $35 billion1 | Jul-14 |

| 7/30/14 | $25 billion1 | Aug-14 |

| 9/17/14 | $15 billion1 | Oct-14 |

| 10/29/14 | $5 billion1 | Nov-14 |

| 12/17/14 | 01 | Jan-15 |

| 1Current Forecast | ||

Based on this schedule, the FOMC will conclude tapering as of January 1, 2015. So six months would be around July 1, 2015.

And to question #2, of course this is data dependent - on both employment and inflation.

And on question #3, is this new news?

Here is the chart today from the FOMC projections showing when participants expect the first rate hike (this was mostly unchanged from the December meeting). Thirteen of sixteen participants expect a rate hike in 2015. So saying "around six months" or mid-year isn't much "new" news (maybe a few months earlier than some expect).

Here is the chart today from the FOMC projections showing when participants expect the first rate hike (this was mostly unchanged from the December meeting). Thirteen of sixteen participants expect a rate hike in 2015. So saying "around six months" or mid-year isn't much "new" news (maybe a few months earlier than some expect).Maybe it surprise some participants, but Yellen's comment fit previously released projections, so it really shouldn't be too shocking.

My guess is, if the first rate hike happens in mid-year 2015, it will be perceived as good news.

FOMC Projections and Press Conference

by Calculated Risk on 3/19/2014 02:15:00 PM

The key sentence in the announcement was: "The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

Rates will be low for a long long time ...

As far as the "Appropriate timing of policy firming", participant views were mostly unchanged (almost all participants expect the first rate increase in 2015).

Yellen press conference here.

On the projections, GDP was revised down slightly, the unemployment rate was revised down again, and inflation projections were mostly unchanged.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 |

| Mar 2014 Meeting Projections | 2.8 to 3.0 | 3.0 to 3.2 | 2.5 to 3.0 |

| Dec 2013 Meeting Projections | 2.8 to 3.2 | 3.0 to 3.4 | 2.5 to 3.2 |

The unemployment rate was at 6.7% in February.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 |

| Mar 2014 Meeting Projections | 6.1 to 6.3 | 5.6 to 5.9 | 5.2 to 5.6 |

| Dec 2013 Meeting Projections | 6.3 to 6.6 | 5.8 to 6.1 | 5.3 to 5.8 |

As of January, PCE inflation was up 1.2% from January 2012, and core inflation was up 1.1%. The FOMC expects inflation to increase in 2014, but remain below their 2% target (Note: the FOMC target is symmetrical around 2%, so this is about the same miss as 2.9% inflation).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 |

| Mar 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

| Dec 2013 Meeting Projections | 1.4 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 |

| Mar 2014 Meeting Projections | 1.4 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

| Dec 2013 Meeting Projections | 1.4 to 1.6 | 1.6 to 2.0 | 1.8 to 2.0 |

FOMC Statement: More Taper, Forward Guidance Changed

by Calculated Risk on 3/19/2014 02:00:00 PM

Information received since the Federal Open Market Committee met in January indicates that growth in economic activity slowed during the winter months, in part reflecting adverse weather conditions. Labor market indicators were mixed but on balance showed further improvement. The unemployment rate, however, remains elevated. Household spending and business fixed investment continued to advance, while the recovery in the housing sector remained slow. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace and labor market conditions will continue to improve gradually, moving toward those the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for the economy and the labor market as nearly balanced. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

The Committee currently judges that there is sufficient underlying strength in the broader economy to support ongoing improvement in labor market conditions. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions since the inception of the current asset purchase program, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in April, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $25 billion per month rather than $30 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $30 billion per month rather than $35 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy remains appropriate. In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

With the unemployment rate nearing 6-1/2 percent, the Committee has updated its forward guidance. The change in the Committee's guidance does not indicate any change in the Committee's policy intentions as set forth in its recent statements.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Richard W. Fisher; Sandra Pianalto; Charles I. Plosser; Jerome H. Powell; Jeremy C. Stein; and Daniel K. Tarullo.

Voting against the action was Narayana Kocherlakota, who supported the sixth paragraph, but believed the fifth paragraph weakens the credibility of the Committee's commitment to return inflation to the 2 percent target from below and fosters policy uncertainty that hinders economic activity.

emphasis added