by Calculated Risk on 3/12/2014 09:07:00 PM

Wednesday, March 12, 2014

Thursday: Retail Sales, Unemployment Claims

Some more interesting analysis from Atif Mian and Amir Sufi: Weakening Economy or Just Bad Winter?

Retail spending by households in January 2014 was a major disappointment, coming in well below expectations. January 2014 was also one of the coldest months in memory in many parts of the country. Was the extreme cold weather to blame for weak retail spending? Or is the economy weakening? These questions are especially pressing given the release of data tomorrow on February 2014 retail spending–February again was a very cold month.Bottom line: Blame the weakness on the snow!

We use state-level data on new auto purchases to attack this question. Here is the basic idea. Not all states experienced a horrible January 2014 — in fact, much of the western part of the country actually was warmer than normal. We can use this variation across the country in January weather to see if national auto sales were brought down by states that experienced abnormally cold temperatures.

...

The evidence is pretty clear. New auto purchases in January 2014 were more than 5% down in states that were more than 7 degrees below their normal January temperature. New auto purchases were down slightly in states that were between -7 and -4 degrees below normal. In the rest of the country where temperatures were closer to normal, new auto purchases were quite strong.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand.

• Also at 8:30 AM, Retail sales for February will be released. The consensus is for retail sales to increase 0.2% in February, and to increase 0.1% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.4% increase in inventories.

Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/12/2014 04:06:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports I have seen across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.60 million in February, down 0.4% from January’s seasonally adjusted pace. There is little doubt that severe weather in many parts of the country contributed to last month’s weak sales, as was the case in many areas in January.

Some of the biggest YOY declines in sales, however, were not in areas with “bad” weather, but where (1) there were big YOY declines in “distressed” sales, (2) big YOY declines in “investor” purchases; (3) big rebounds in home prices over the past year+; and (4) no growth, or in several area declines in primary-residence home purchases.

CR Note: Based on Lawler's estimate, sales will be down about 7% from the February 2013 sales rate of 4.95 million. Some of this weakness is weather related, but there are other factors (as Lawler noted there are fewer distressed sales, less investor buying, and higher prices).

Sacramento Housing in February: Total Sales down 17% Year-over-year, Equity (Conventional) Sales up 18%, Active Inventory increases 88%

by Calculated Risk on 3/12/2014 02:25:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In February 2014, 19.1% of all resales (single family homes) were distressed sales. This was down from 19.5% last month, and down from 43.8% in February 2013.

The percentage of REOs was at 6.6%, and the percentage of short sales was 12.5%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales over the last 2 years (blue).

Active Listing Inventory for single family homes increased 87.8% year-over-year in February.

Cash buyers accounted for 26.5% of all sales, down from 26.6% last month (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 17.2% from February 2013, but conventional sales were up 17.8% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Weekly Update: Housing Tracker Existing Home Inventory up 5.8% year-over-year on March 10th

by Calculated Risk on 3/12/2014 11:33:00 AM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.8% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Las Vegas Real Estate in February: Year-over-year Non-contingent Inventory Doubles

by Calculated Risk on 3/12/2014 09:24:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports increasing home prices, slower sales

GLVAR said the total number of existing local homes, condominiums and townhomes sold in February was 2,518, down from 2,565 in January and down from 3,232 one year ago.There are several key trends that we've been following:

...

GLVAR continued to chart the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. For instance, in February, 14 percent of all existing local home sales were short sales, down from 17 percent in January. Another 12 percent of all February sales were bank-owned properties, up from 11 percent in January.

GLVAR said 46.8 percent of all existing local homes sold in February were purchased with cash. That’s unchanged from January, but down from a peak of 59.5 percent set in February 2013.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service in February was 13,624. That’s up 0.6 percent from 13,537 single-family homes listed for sale at the end of January, but down 3.5 percent from 14,120 homes one year ago. ...

By the end of February, GLVAR reported 6,316 single-family homes listed without any sort of offer. That’s down 3.4 percent from 6,541 such homes listed in January, but still a 107.3 percent jump from one year ago.

emphasis added

1) Overall sales were down about 22% year-over-year.

2) Conventional sales are up 11% year-over-year. In February 2013, only 51.9% of all sales were conventional. This year, in February 2014, 74% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 107.3% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014).

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/12/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 7, 2014. ...

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.52 percent from 4.47 percent, with points increasing to 0.29 from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 4.41 percent from 4.37 percent, with points unchanged at 0.20 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 70% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 18% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Note: Jumbo rates are still below conforming rates.

Tuesday, March 11, 2014

Phoenix ARMLS: Total Sales down 17.4% year-over-year in February, Distressed Sales down 61%, Inventory up 37%

by Calculated Risk on 3/11/2014 07:11:00 PM

Another "bubble" area that has seen rapid price appreciation over the last two years. Now sales are declining and inventory is increasing.

The Arizona Regional Multiple Listing Service reported Statistics for February

• Total Sales are down 17.4% year-over-year.

• Distressed sales are down 60.7% year-over-year.

• Active inventory is up 36.6% year-over-year.

Inventory has clearly bottomed in Phoenix (A major theme for housing last year). And fewer distressed sales - probably less investor buying - and more inventory means price increases will slow.

There is commentary in the release from Tom Ruff. Excerpt:

In MLS, 5,474 total homes were sold in February, 14.1% higher than 4,797 in January 2014. As the monthly sales volume comparison is clearly seasonal, one must look at the year-over-year comparisons to get a clear view of sales activity. The February 2014 sales total was 17.4% lower than the total in February 2013 of 6,630. The last time we saw a lower sales volume in February was 2008 where only 3,448 sales were reported. Last year at this tie total inventory numbers were dropping, this year they continue to climb, up 4.2% to 29,661.

...

The imbalance we are seeing between supply and demand will exert downward pressure on pricing which will likely appear later this year.

CBO: Federal Deficit through February $148 billion less this year than it was in fiscal year 2013 (adjusted for timing)

by Calculated Risk on 3/11/2014 02:30:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for February 2014

The federal government ran a budget deficit of $379 billion for the first five months of fiscal year 2014, CBO estimates, $115 billion less than the shortfall recorded in the same span last year. Revenues are higher and outlays are lower than they were at this time a year ago. Without shifts in the timing of certain payments (which otherwise would have fallen on a weekend), the deficit for the five-month period would have been $148 billion less this year than it was in fiscal year 2013.And for February 2014:

The federal government incurred a deficit of $195 billion in February 2014, CBO estimates—$9 billion less than the $204 billion deficit incurred in February 2013. Because March 1 and February 1 both fell on a weekend in 2014, certain payments that ordinarily would have been made in March this year were made in February, and certain payments that would have been made in February were made in January. Without those shifts in the timing of payments, the deficit in February 2014 would have been $1 billion larger than it was.The consensus was the deficit for February would be around $218 billion, and it appears the deficit for fiscal 2014 will be smaller than the CBO currently expects (less than 3.0% of GDP).

CBO estimates that receipts in February totaled $144 billion—$21 billion (or 17 percent) more than those in the same month last year ... Total spending in February 2014 was $338 billion, CBO estimates, $12 billion more than outlays in the same month in 2013.

emphasis added

BLS: 4 Million Jobs Openings in January

by Calculated Risk on 3/11/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

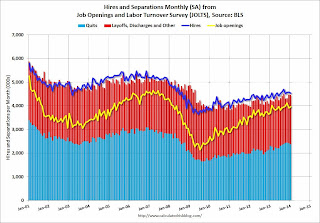

There were 4.0 million job openings on the last business day of January, little changed from December, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in January for total nonfarm, total private, and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased slightly in January to 3.974 million from 3.914 million in December.

The number of job openings (yellow) is up 7.6% year-over-year compared to January 2013.

Quits decreased in January and are up about 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are close to 4.0 million and are at 2005 levels.

NFIB: Small Business Optimism Index declines in February

by Calculated Risk on 3/11/2014 09:10:00 AM

From the National Federation of Independent Business (NFIB): February optimism takes a tumble

Small business optimism continues its winter hibernation with the latest Index dropping 2.7 points to 91.4 ... NFIB owners increased employment by an average of 0.11 workers per firm in February (seasonally adjusted), virtually unchanged from January.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 92.7 in February from 94.1 in January.